Fogo didn't immediately stand out to me. The industry has grown accustomed to Layer-1s marketing incremental speed gains as breakthroughs. But this wasn't a throughput story. It was an infrastructure recalibration. And the more I examined its architectural intent, the more it felt like a response to a persistent systems issue that many networks treat as temporary inconvenience rather than foundational design friction.

Developers don't migrate for novelty. They migrate to escape recurring congestion trauma—NFT mints freezing blocks, arbitrage bots monopolizing priority lanes, DeFi transactions stuck while fees spiral. Solana taught the ecosystem patience the hard way. Over time, that patience mutates into fatigue.

Fogo’s response isn't “we’re faster.” It's a reframing: the same SVM environment, but constructed for operational consistency. Predictable execution instead of episodic disruption. And for builders who’ve endured repeated bottlenecks, that psychological reset outweighs headline TPS figures. From where I stand, restoring builder confidence is more strategic than advertising block speed.

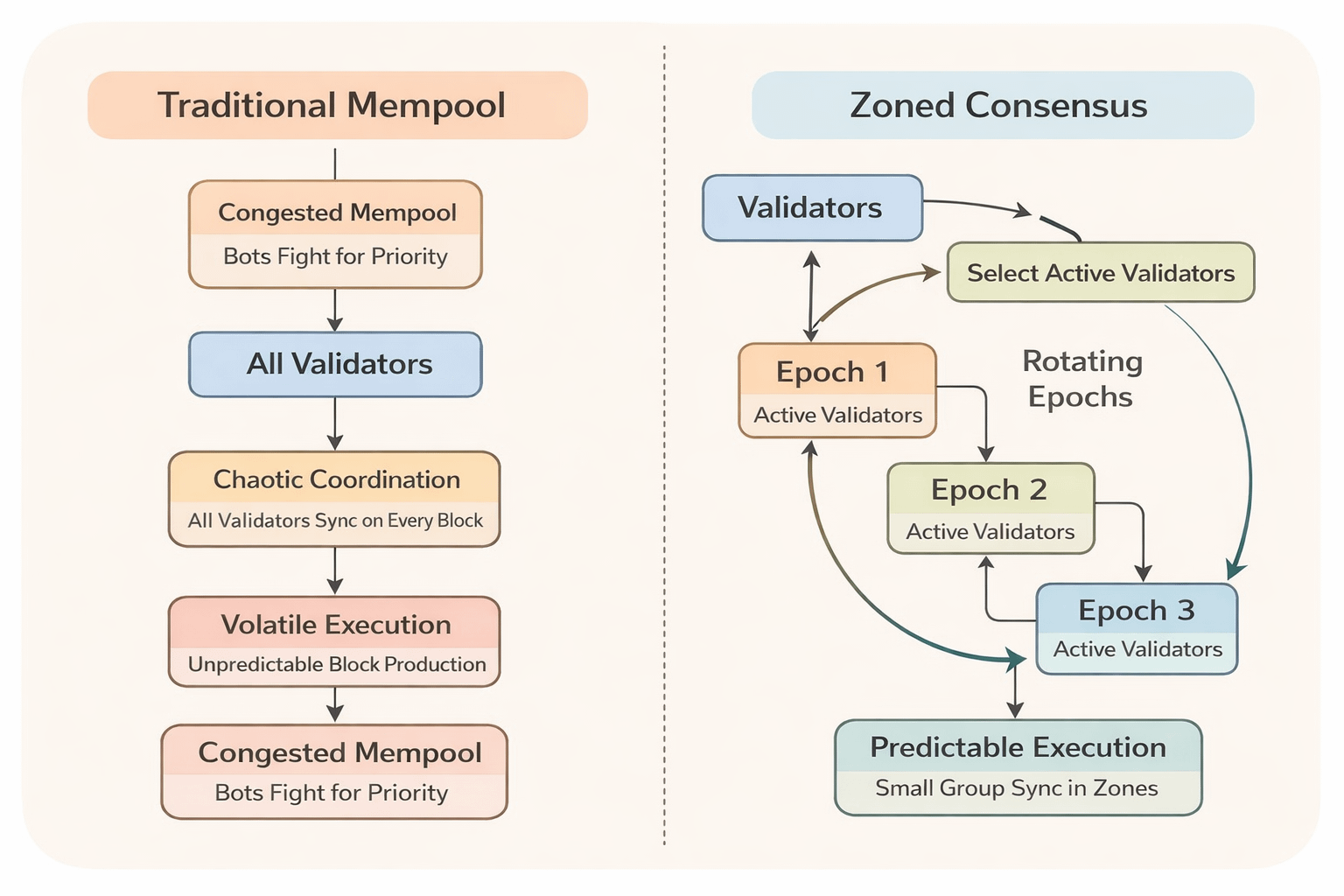

Fogo’s zoned consensus is presented as where execution meets engineering realism. Rather than requiring every validator to coordinate on every block–regardless of physical latency constraints–the design is structured around rotating active participation across epochs. A smaller, geographically aligned validator group can handle live execution within each epoch, aiming to reduce propagation noise and tighten block-time variance.

Fogo’s zoned consensus is presented as where execution meets engineering realism. Rather than requiring every validator to coordinate on every block–regardless of physical latency constraints–the design is structured around rotating active participation across epochs. A smaller, geographically aligned validator group can handle live execution within each epoch, aiming to reduce propagation noise and tighten block-time variance.

Participation cycles over time to preserve decentralization while seeking responsiveness during volatility spikes. This approach reflects an acknowledgment that distributed computation operates within physical boundaries. Traders don't debate topology... they measure whether their orders finalize when markets move violently. That applied lens, in my view, distinguishes theoretical decentralization from actionable infrastructure.

Distributed systems eventually answer to physics. Coordination delay isn't a bug of global networks; it’s their natural state. Organizing participation over time doesn't reduce decentralization; it structures it into something markets can rely on.

“Markets don't forgive uncertainty. Execution is trust.”

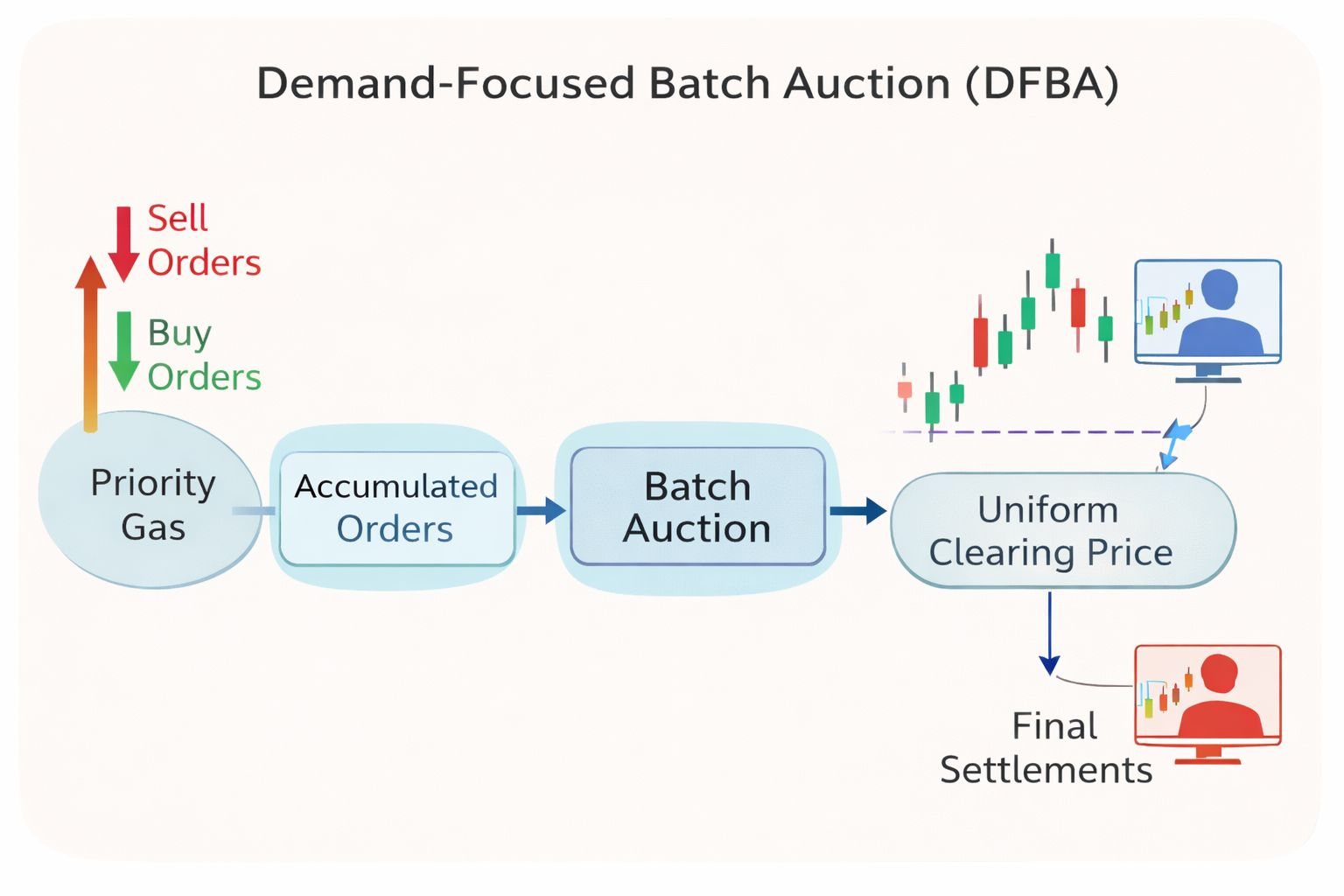

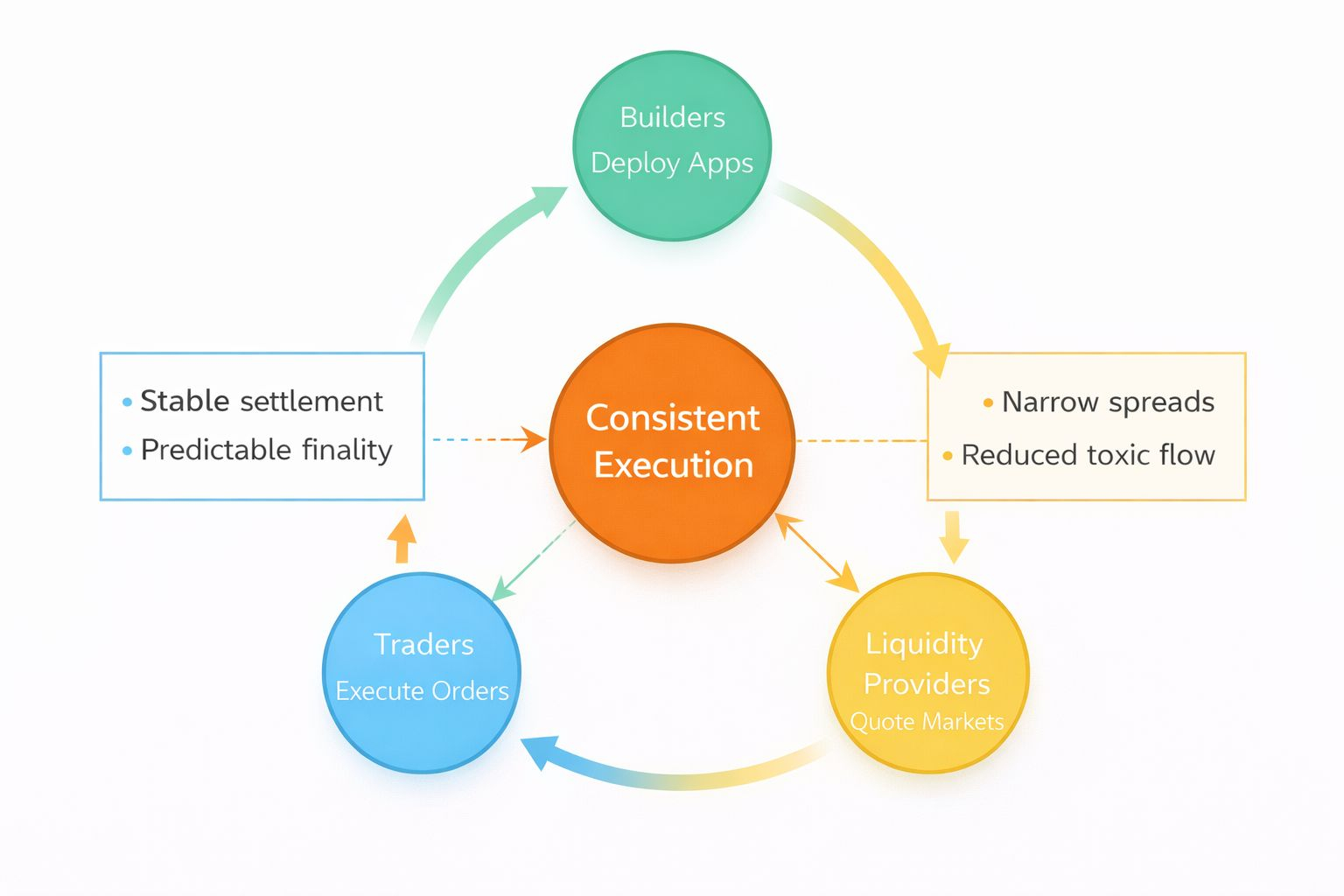

Execution design alone, however, doesn't create a functioning market. Fogo integrates ecosystem-level market primitives alongside its chain architecture: dependable price feeds, liquidity routing mechanisms, and Dual Flow Batch Auctions (DFBA) via Ambient Finance. Orders are designed to accumulate within a block and clear against an oracle-referenced benchmark.

The intent is to reduce latency arbitrage incentives and constrain conventional MEV dynamics. The advantage shifts from reaction speed to quote precision. Practically, that can translate into narrower spreads, reduced toxic flow, and coordination that resembles disciplined trading venues more than fragmented AMM battlegrounds. To me, this reflects deliberate market microstructure thinking rather than cosmetic DeFi innovation.

When execution stops rewarding reaction speed, behavior changes. Traders compete on pricing judgment rather than ordering priority, and liquidity begins to quote instead of chase.

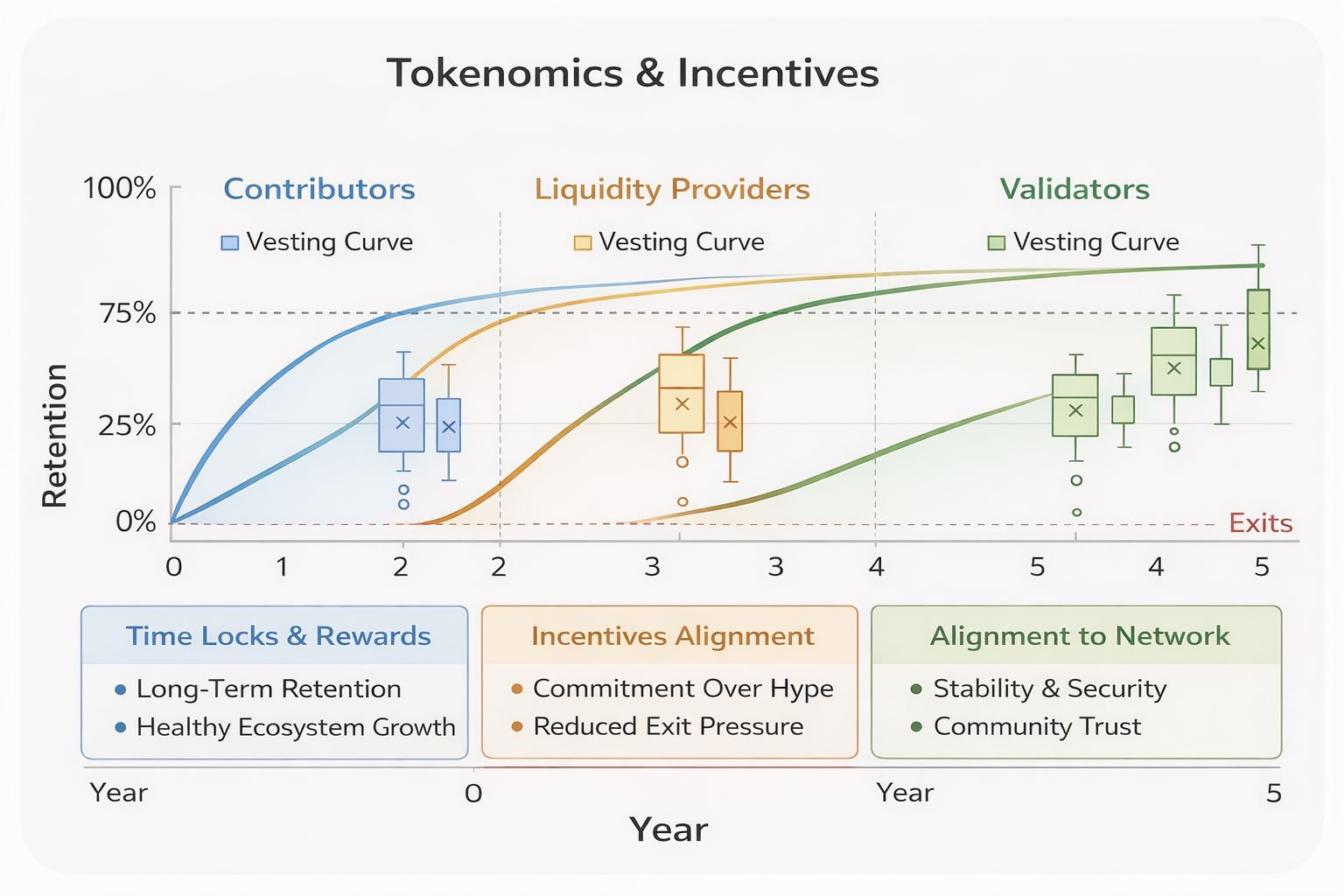

Tokenomics reinforces the same execution-first orientation. Sales are selective, allocations are engineered, and participation aligns with contribution rather than opportunism. The Flames program incentivizes early ecosystem engagement: testing, liquidity provisioning, and operational involvement while vesting constraints discourage reflexive supply shocks.

The outcome is quiet but meaningful: capital entering the ecosystem carries structural incentives to remain aligned with network health. Distribution becomes embedded governance design, not promotional spectacle. I consistently evaluate token architecture because incentives shape long-term behavior more reliably than short-term narratives ever can.

Flames program: rewards meaningful ecosystem activity and early participation

Locked allocations: reinforce durable alignment over immediate liquidity extraction

Community-first distribution: culture built through contribution, not hype

Incentives here act less as attraction and more as retention. The goal isn't rapid inflow of capital, but preventing synchronized exit once attention fades.

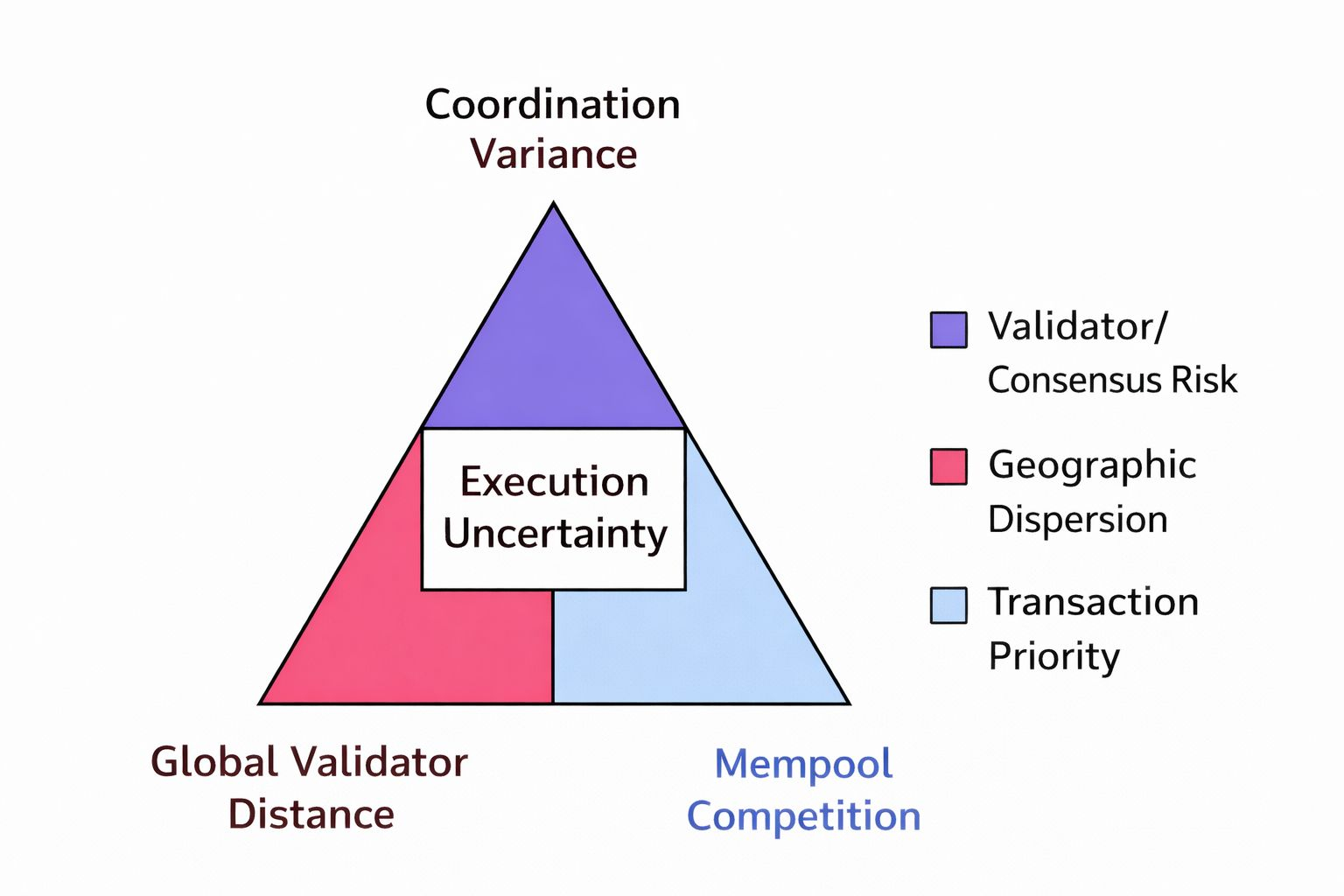

Fogo is intentionally absent from the headline TPS competition. Its objective is more focused and arguably more serious: dependable market function. Builders recognize when deployments remain responsive during demand surges. Traders observe when auctions generate measurable price improvement compared to standard AMM execution.

Fogo is intentionally absent from the headline TPS competition. Its objective is more focused and arguably more serious: dependable market function. Builders recognize when deployments remain responsive during demand surges. Traders observe when auctions generate measurable price improvement compared to standard AMM execution.

Liquidity providers detect when variance compresses and risk parameters stabilize. These aren't marketing slogans; they're signals of infrastructural maturity. And genuine maturity remains scarce within this industry.

The broader implication is structural: future chain competition may be decided not by maximum throughput, but by minimum uncertainty.

Speed is a catalyst. The defining edge is disciplined execution under strain. For developers emerging from congestion fatigue and for markets requiring transparency, coordination, and consistent settlement behavior, Fogo presents something uncommon in crypto: an environment calibrated for professional-grade participation.

Speed is a catalyst. The defining edge is disciplined execution under strain. For developers emerging from congestion fatigue and for markets requiring transparency, coordination, and consistent settlement behavior, Fogo presents something uncommon in crypto: an environment calibrated for professional-grade participation.

My reading is that the positioning is engineered for long-term intent rather than cyclical momentum.

“Fogo doesn't promise chaos-free markets; it designs markets that tolerate stress.”

And that distinction may determine whether it becomes another transient high-throughput chain or a network where execution integrity, not narrative velocity, defines its identity. I’m observing its trajectory not for hype cycles, but for proof that its architecture performs when conditions are least forgiving.