There is a quiet irony in crypto.

The faster a system becomes, the easier it is for power to concentrate.

That sounds counterintuitive. But it is structurally true.

On a high-performance SVM chain like Fogo, transactions execute quickly, conflicts are resolved deterministically, and state access is explicit. That is powerful.

It is also dangerous — if design is careless.

Because speed rewards whoever can interact with the system most efficiently.

And efficiency is rarely evenly distributed.

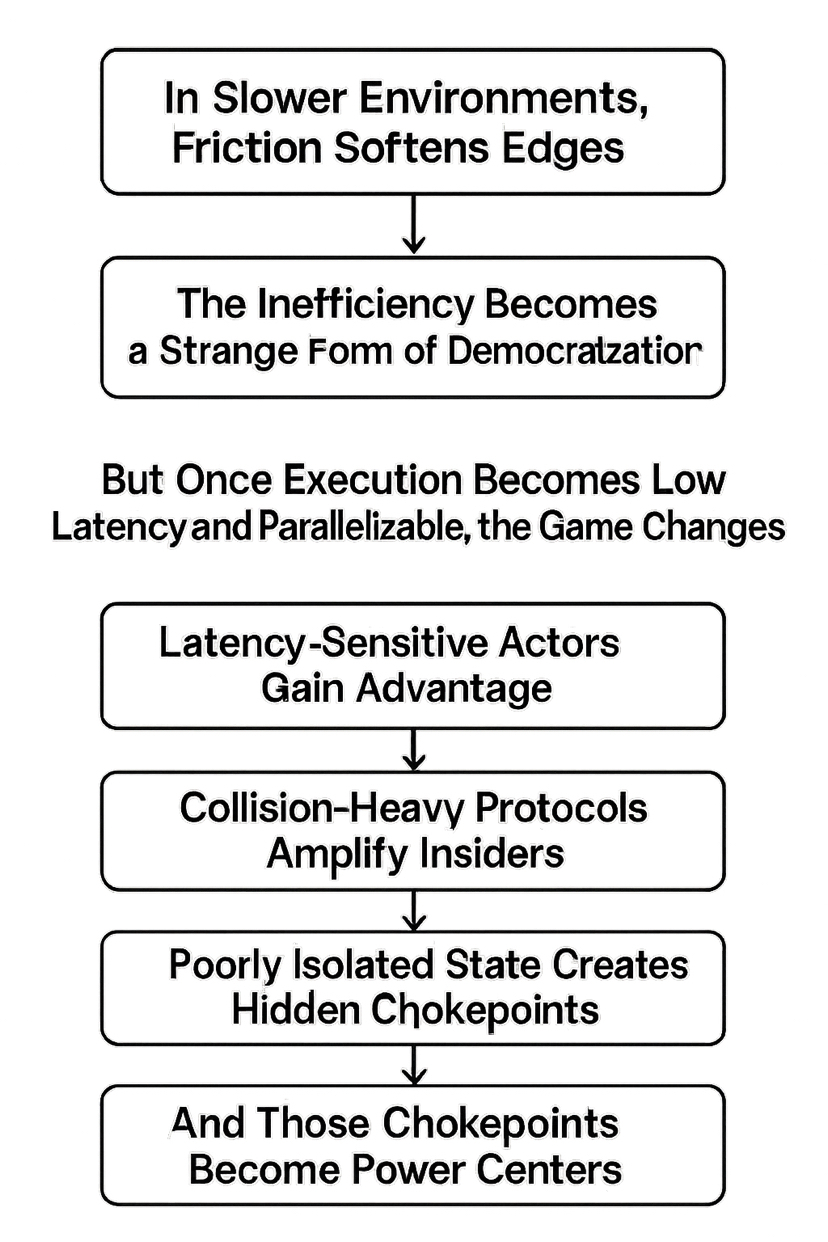

In slower environments, friction softens edges.

Bots cannot act instantly.

Liquidations lag.

Complex strategies are harder to execute at scale.

The inefficiency becomes a strange form of democratization.

But once execution becomes low latency and parallelizable, the game changes.

Now:

Latency-sensitive actors gain advantage.

Collision-heavy protocols amplify insiders.

Poorly isolated state creates hidden chokepoints.

And those chokepoints become power centers.

This is where architecture stops being a backend detail.

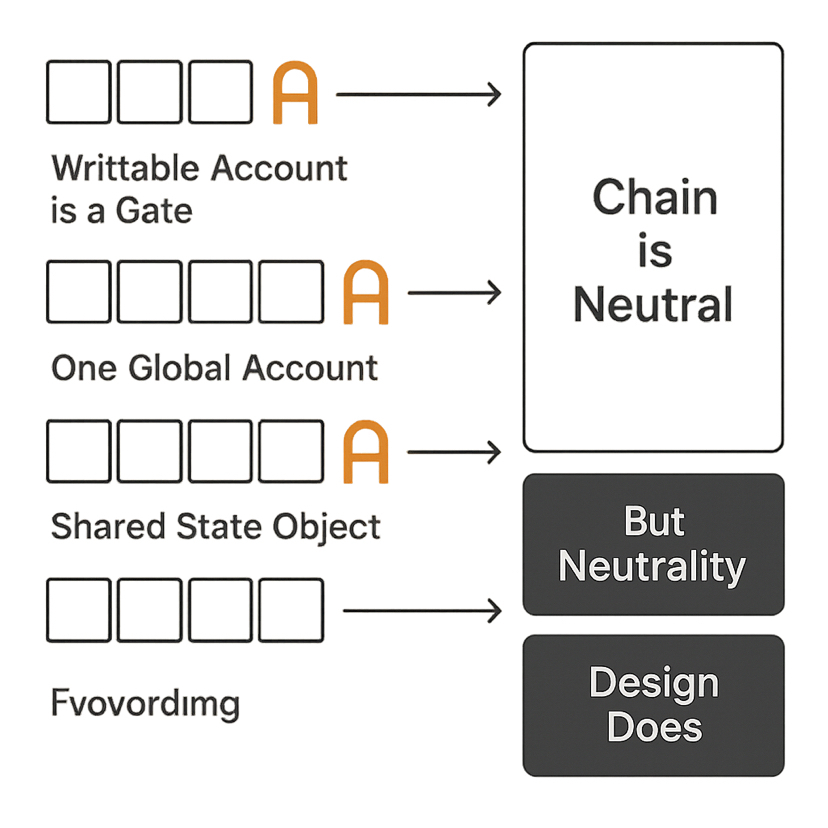

On Fogo, every writable account is a gate.

If governance updates mutate one global account, whoever wins that write controls the timeline.

If staking logic funnels through one shared state object, congestion turns into economic distortion.

If rewards accounting touches the same account for every participant, high-frequency actors crowd out slower ones.

The chain is neutral.

But neutrality does not guarantee fairness.

Design does.

What I find interesting about Fogo’s model is that it exposes this tension instead of hiding it.

Parallel execution does not automatically decentralize.

It decentralizes only when state is partitioned intentionally.

If user positions are isolated properly, they do not compete for the same lock.

If markets are segmented, one volatile pair does not freeze the ecosystem.

If governance state is modularized, voting does not serialize unrelated actions.

Without that discipline, speed becomes centralizing.

With discipline, speed becomes liberating.

Most teams underestimate this.

They focus on throughput benchmarks.

They celebrate sub-second finality.

They assume faster equals fairer.

It does not.

Faster just compresses advantage.

And in compressed systems, structural inefficiencies become structural inequities.

There is also a validator dimension.

High-performance chains require predictable execution.

Predictable execution requires deterministic state access.

Deterministic state access depends on clear account boundaries.

If protocol logic is messy, validators process more conflicts.

More conflicts mean more serialization.

More serialization means more subtle ordering power.

And subtle ordering power accumulates influence over time.

That is not a conspiracy theory.

It is a systems reality.

The deeper question for Fogo is not whether it can execute in parallel.

It is whether the ecosystem building on it understands the political consequences of state design.

Because architecture shapes power.

If ten thousand users share one writable state object, they are not ten thousand independent actors.

They are a queue.

Queues create hierarchy.

Isolation creates autonomy.

This is why I think the most serious builders on Fogo will be the ones who obsess over partitioning, not performance marketing.

They will treat:

Writable state as governance surface.

Shared accounts as economic choke points.

Reporting flows as separate from critical execution.

That level of intentionality is rare.

But on a fast SVM environment, it becomes mandatory.

Speed is not neutral.

It amplifies whatever structure exists underneath.

If the structure is centralized, speed centralizes faster.

If the structure is modular and isolated, speed distributes opportunity.

Fogo, in that sense, is not just a performance environment.

It is an amplifier.

And amplifiers are unforgiving.

They do not care what you intended.

They reveal what you built.

The real test ahead is not whether Fogo can scale.

It is whether the protocols building on it understand that scaling changes who holds leverage — and whether they design accordingly.