The precious metals complex is navigating a particularly awkward stretch in early 2026, with gold struggling to maintain its record-breaking trajectory amid conflicting economic signals, while silver's dramatic price surge is quietly reshaping supply dynamics in ways that markets rarely anticipate.

Gold's extraordinary run through 2025 leaned heavily on one reliable pillar: sovereign buying. Central banks globally absorbed 328 tonnes across the year, led aggressively by Poland's National Bank, which alone stacked 102 tonnes — a figure reflecting Eastern Europe's accelerating de-dollarization strategy. Kazakhstan and Brazil were meaningful contributors as well. While that figure represents a slight pullback from 2024's 345-tonne total, the structural story remains intact. Governments aren't treating gold as a trade; they're treating it as permanent monetary architecture.

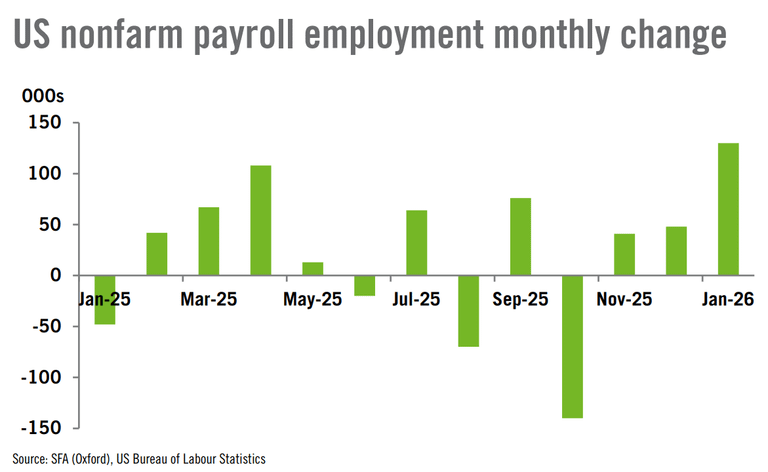

But what gave gold its momentum is now creating its uncertainty problem. The Fed's rate path — which drove significant investment demand as yields softened — has become genuinely difficult to read. January's non-farm payrolls came in at 130,000, a number that superficially suggests labor market resilience and reduces the urgency for rate reductions. The complication lies beneath that headline figure. Benchmark revisions wiped out over one million previously reported job gains from 2025, fundamentally altering the picture of how much economic strength actually existed. Markets are now left reconciling a strong current print against a substantially weaker historical baseline — exactly the kind of ambiguity that makes policy forecasting treacherous.

With the 2-year Treasury yield hovering near 3.5% — currently the floor of the Fed's target band — a rate adjustment at the next meeting appears unlikely regardless of which labor market narrative wins out. Spot gold, reflecting this paralysis, slipped below $5,000 per ounce in thin holiday trading, last changing hands near $4,977.

Silver's situation tells a different but equally fascinating story. Prices have surged to levels that are now triggering a behavioral shift among ordinary households. Pre-1965 silver dollar coins have nearly tripled in value year-over-year, and that appreciation is pulling material off shelves, out of drawers, and away from mantelpieces across North America. Dealers are reporting a sharp uptick in retail selling as people monetize coins, heirloom jewelry, and sterling silverware that had essentially functioned as family keepsakes for decades. This secondary supply response — dormant material reactivated by price — represents one of the more underappreciated dynamics in commodity markets.

In China, the silver market remains structurally tight. Shanghai futures have been in backwardation, exchange inventories are declining, and domestic producers face order backlogs constraining deliverable supply. The Lunar New Year is expected to provide temporary relief as speculative positioning unwinds and open interest on the SHFE retreats. Position management tightening ahead of delivery should slow the pace of inventory withdrawals.

What these two metals collectively illustrate is how differently price catalysts behave at extremes. Gold is waiting on policy clarity that isn't coming. Silver has moved so fast that it's beginning to create its own supply response from sources that don't appear in traditional production models. Both outcomes confirm that 2026 will be defined less by fundamentals and more by the unpredictable intersection of monetary policy, geopolitical reserve strategy, and human behavior when prices reach levels that turn sentiment into action.