Vanar Chain doesn’t try to win attention by being loud. It doesn’t lean on exaggerated promises or dramatic positioning. What makes it interesting is something much quieter: it focuses on fixing the economic friction that most blockchains quietly carry but rarely solve.

If you strip crypto down to its operational core, the real struggle isn’t speed claims or ecosystem logos. It’s unpredictability. Builders don’t fear competition nearly as much as they fear volatility in costs. When transaction fees swing wildly based on token price or network congestion, real businesses hesitate. You can’t budget around chaos. You can’t build stable consumer products on top of a cost structure that feels like a stock chart.

Vanar approaches this problem from a very practical angle. Instead of leaving fees to fluctuate through gas bidding wars, it introduces a fixed-fee structure. That sounds simple, almost boring. But boring is powerful when you’re running something at scale. If you’re operating a game with thousands of in-game transactions per minute, or a payments engine processing microtransactions, predictability becomes more valuable than marginal speed improvements.

Think about a gaming studio launching a new title with on-chain assets. On most networks, launch day is both exciting and terrifying. Traffic spikes can send fees upward. Bots flood the system. Users get stuck waiting or paying more than expected. The experience feels unstable. Vanar’s fixed bracket model aims to remove that anxiety. Smaller transactions remain consistently inexpensive, while larger operations scale up in cost tiers. It’s structured rather than reactive.

The subtle power shift here is important. In traditional gas markets, whoever can outbid others wins priority. That means whales, automated bots, and well-funded actors often dominate block space during congestion. Fixed fees reduce that bidding warfare. They make participation more about function than about who can pay the most in a given second. That changes the social dynamics of the chain, not just the economics.

Speed also matters, but not in the way marketing decks describe it. Users don’t care about theoretical transactions per second. They care about waiting. If you click a button and something happens almost instantly, you stay immersed. If you have to stare at a pending confirmation for 20 seconds, you feel friction. Vanar’s target block timearound three seconds sits in that psychological sweet spot where blockchain interactions begin to feel like regular software rather than something experimental.

The token economy reflects a longer-term posture as well. Instead of structuring everything around short-term distribution narratives, the supply and emission model suggests an intent to stretch sustainability over years rather than hype cycles. The token fuels transactions, staking, governance, and validator incentives. That’s standard in many Layer 1s, but the difference lies in how the economic engine is supposed to reinforce predictable usage rather than speculative bursts.

Staking within the network isn’t framed purely as yield farming. It connects to validator participation and governance direction. That gives stakers influence over who validates and how the chain evolves. Of course, the real story unfolds over time. Early phases rely more heavily on controlled validator environments. What matters isn’t whether decentralization is perfect on day one. It’s whether the distribution of influence widens steadily. Infrastructure matures in stages.

One of the more ambitious aspects of Vanar is its attempt to push beyond simple transaction settlement. The project positions itself as integrating logic and structured data closer to the base layer. Instead of treating blockchain purely as a ledger of balances, it gestures toward embedding reasoning frameworks and semantic storage into the stack. If executed well, that could matter for industries that require rule enforcement like tokenized assets, compliance-heavy financial products, or digital identity systems.

The deeper theme running through all of this is power compression. Many industries rely on intermediaries whose primary role is controlling databases and validating information. If a blockchain can reliably store structured data and enforce logic transparently, some of that middle-layer authority becomes less necessary. It doesn’t eliminate institutions, but it reduces their gatekeeping leverage.

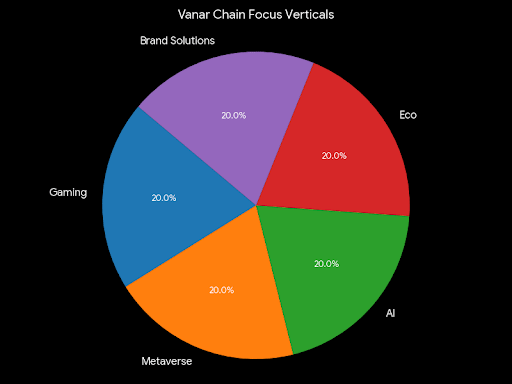

Gaming was the natural entry point for Vanar because gaming ecosystems demand high frequency interaction and consistent cost environments. If a network can handle game economies smoothly, it proves operational durability. But the same architecture extends beyond gaming. Payments, loyalty systems, digital ticketing, and tokenized real-world assets all require similar characteristics: cost predictability, latency consistency, and scalable throughput.

The real challenge isn’t architecture. It’s gravity. Layer ecosystems compete for builders. Technical capability alone doesn’t attract adoption. Developers move where they see sustainable economics and supportive infrastructure. If Vanar can become the predictable environment for certain verticals where builders know their costs won’t suddenly explode it gains gravitational pull. If not, it risks blending into a crowded landscape of technically competent but underutilized networks.

When evaluating the project seriously, speculation should take a back seat to modeling. What would your monthly transaction cost look like under the fixed-fee brackets? How does latency perform during real stress, not just in promotional metrics? How diversified is validator participation becoming over time? Are applications generating consistent activity, or is usage concentrated in token transfers and staking alone?

Infrastructure rarely rewrites power loudly. It does so by quietly reducing friction. When electricity became standardized, industries didn’t celebrate voltage levels. They celebrated reliability. When the internet matured, people stopped talking about bandwidth and started building businesses.

If Vanar succeeds, it won’t be because it shouted the loudest. It will be because it made blockchain economics feel steady enough for serious operators to trust. And when operators trust infrastructure, power slowly migrates toward it.

That kind of shift doesn’t trend on social media.