While a lot of $BTC retail traders, I inclusive are focused majorly on price action and movement, major shift is happening in Bitcoin ownership. Major chunk of BTC is shifting from retail hands to instructional hands.

Why are institutions so interested in BTC and stacking? Let's answer this question in a bit.

The Shift in Bitcoin Ownership: Where We Are Right Now

The Bitcoin landscape underwent a seismic shift throughout 2025, evolving from a retail-dominated speculative asset into a cornerstone of institutional and sovereign treasuries. As of December 31, 2025, data reveals a market that is increasingly "concentrated" among large-scale entities.

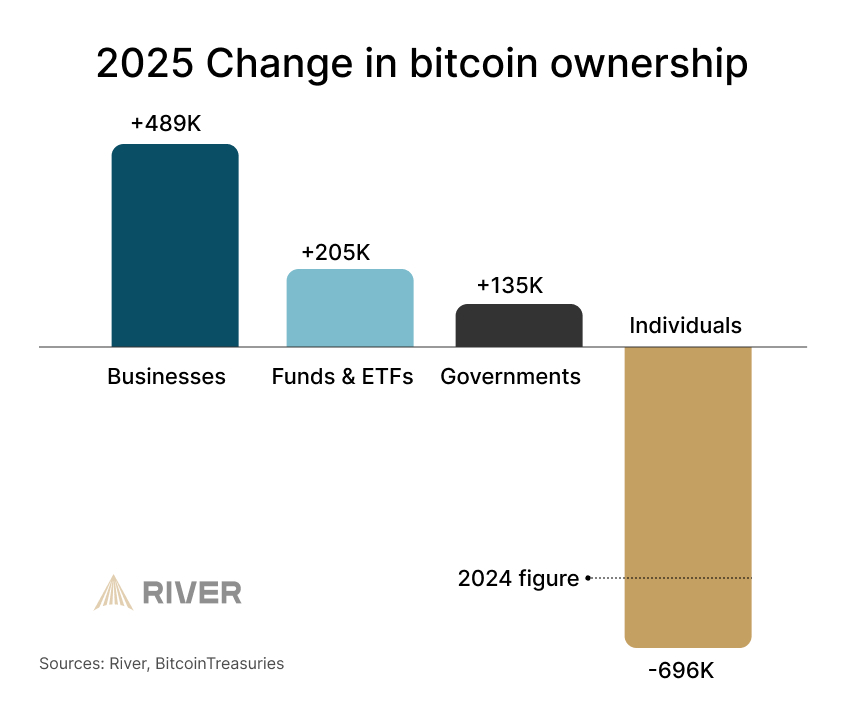

The most striking trend of the past year was the massive transfer of BTC from individual hands to corporate and institutional balance sheets.

Individuals in Retreat: Individual holders saw a staggering net decrease of 696K BTC in 2025. This represents a significant exit of retail positions compared to the 2024 figures.

The Rise of the "Bitcoin Treasury": Businesses led the charge in accumulation, adding 489K BTC to their holdings, the largest growth sector of the year.

ETF and Fund Dominance: Institutional vehicles, including Funds and ETFs, absorbed an additional 205K BTC.

Sovereign Adoption: Governments also increased their stakes, adding 135K BTC through strategic acquisitions and other means.

Current Ownership Distribution (Year-End 2025)

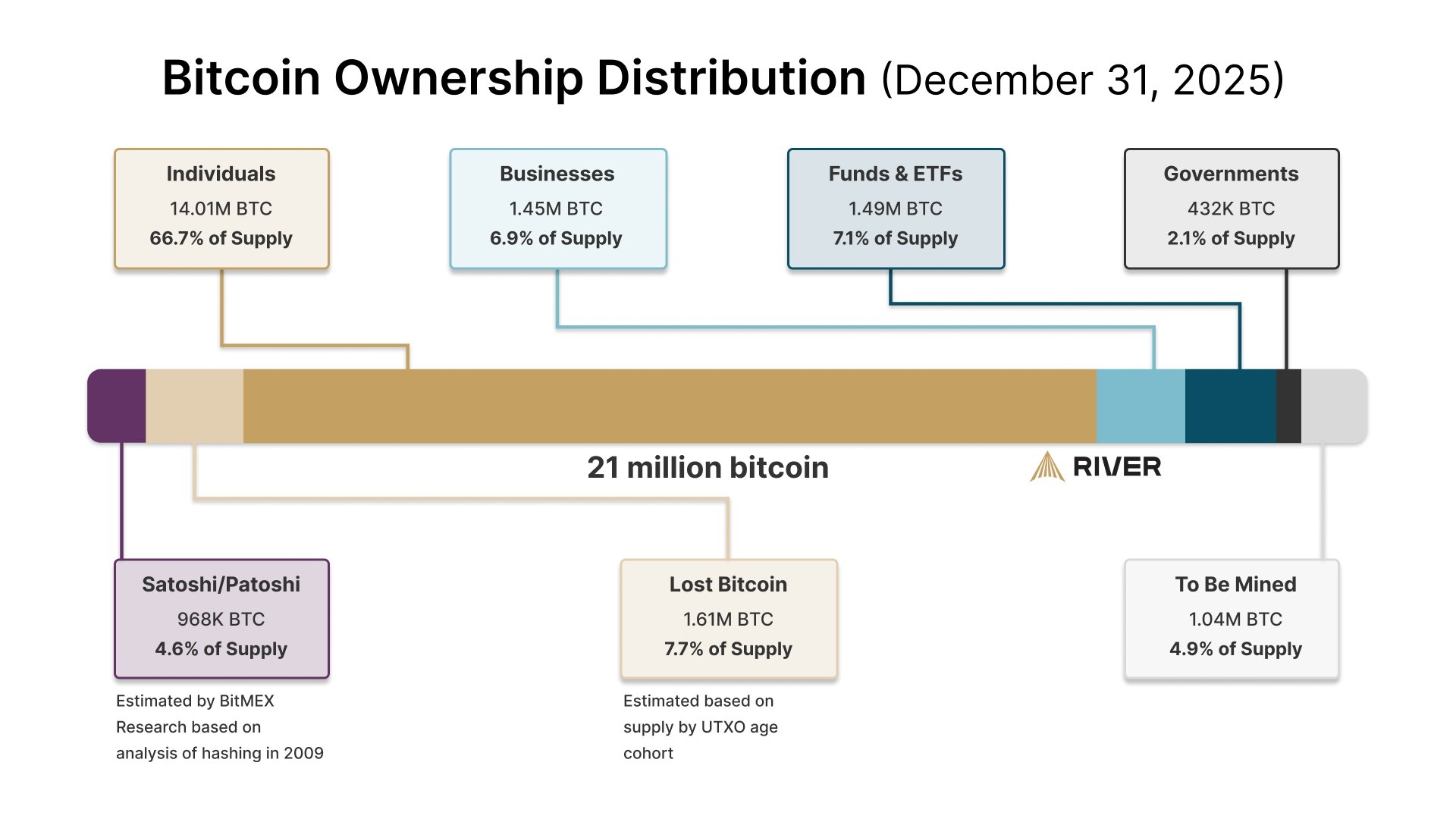

Despite the aggressive institutional buying, individuals still command the largest share of the network, though their dominance is narrowing. Out of the 21 million total supply, the distribution stands as follows:

Individuals hold 14.01M BTC, accounting for 66.7% of the total supply.

Funds & ETFs control 1.49M BTC, representing 7.1% of the supply.

Businesses own 1.45M BTC, making up 6.9% of the supply.

Governments hold 432K BTC, which is 2.1% of the total supply.

Satoshi/Patoshi holdings are estimated at 968K BTC, or 4.6% of the supply.

Lost Bitcoin accounts for an estimated 1.61M BTC, totaling 7.7% of the supply.

Remaining to be Mined stands at 1.04M BTC, representing the final 4.9%.

Key Takeaways for the Cycle

The "shift" is no longer just a theory; it is a mathematical reality.

— Supply Scarcity: With 14% of the supply now held by Funds, ETFs, and Businesses, the liquid supply available on exchanges is tightening.

— Institutional Floor: The aggressive accumulation by businesses, nearly half a million BTC in one year suggests that corporations are now treating Bitcoin as a primary reserve asset.

— Retail Capitulation: The massive exit of 696K BTC by individuals likely fueled the liquidity needed for institutions to build these large-scale positions.

Whether you like it or not, a major shift is happening in BTC ownership and it can only point to one thing alone:

BTC yet has astronomical potential for growth and a lot of institutions and business are catching up on this fact, so as a retail or individual holder, don't be shaken out of your position, there's yet generational wealth potentials in Bitcoin.