Every new Layer-1 tends to follow the same script: advertise higher TPS, promise lower fees, and then launch aggressive incentive programs to attract developers. The pitch is always about speed. But speed alone doesn’t solve structural market design problems.

Fogo approaches the problem from a different angle.

What stands out isn’t just throughput — it’s architecture. Fogo isn’t a blockchain that simply hosts a decentralized exchange. The exchange logic is embedded directly into the chain’s core design. In other words, the exchange is not an app competing for blockspace — it is foundational to how the network operates.

That distinction matters.

On traditional blockchains like Ethereum or Solana, decentralized exchanges function as smart contract applications. They rely on:

External price feeds

Fragmented liquidity sources

Shared blockspace with unrelated applications

Complex contract layers

Each of these introduces latency, execution uncertainty, and risk. For professional traders, these frictions compound: oracle delays, slippage, smart contract bugs, congestion spikes, and MEV exposure all affect execution quality.

Fogo restructures this stack.

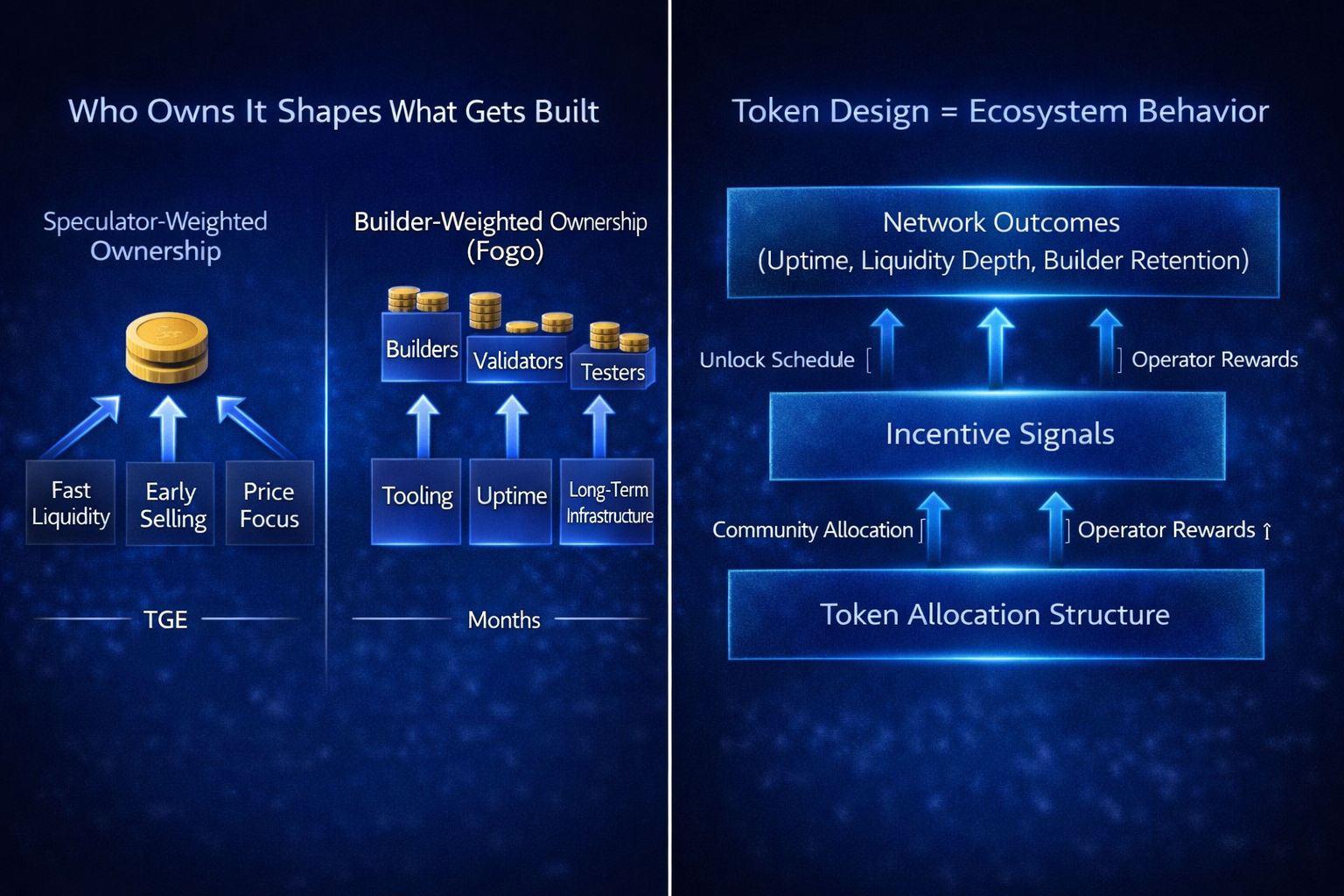

Instead of layering an exchange on top of a general-purpose blockchain, Fogo integrates price discovery and liquidity access directly into the protocol’s internal design. Liquidity providers are structurally connected to the network. Validators are selected not only for decentralization properties but also for performance characteristics aligned with trading efficiency.

This creates a fundamentally different execution environment — not just a faster version of what already exists.

When the exchange is native to the blockchain:

Price information doesn’t rely on external oracles in the same way

Liquidity coordination is tighter

Blockspace competition is reduced

Network incentives align directly with trading performance

That alignment is key.

The participation of firms like GSR and Selini Capital reinforces this thesis. These aren’t passive capital allocators — they are active trading firms. Their interest signals that Fogo’s design may be optimized for real execution needs, not just retail narratives.

Fogo launched its mainnet in January 2026, and its ecosystem is still early. Unlike Solana — now a multi-billion dollar network built around a diverse DeFi landscape — Fogo’s valuation remains comparatively small. That gap represents both risk and asymmetry.

Most blockchains attempt to build infrastructure first and hope financial markets adapt to it.

Fogo appears to have started from the opposite direction: design infrastructure specifically around market structure, then formalize it as a blockchain.

Whether this model captures meaningful trading flow remains to be seen. But structurally, it represents a shift in how on-chain market design can be approached.