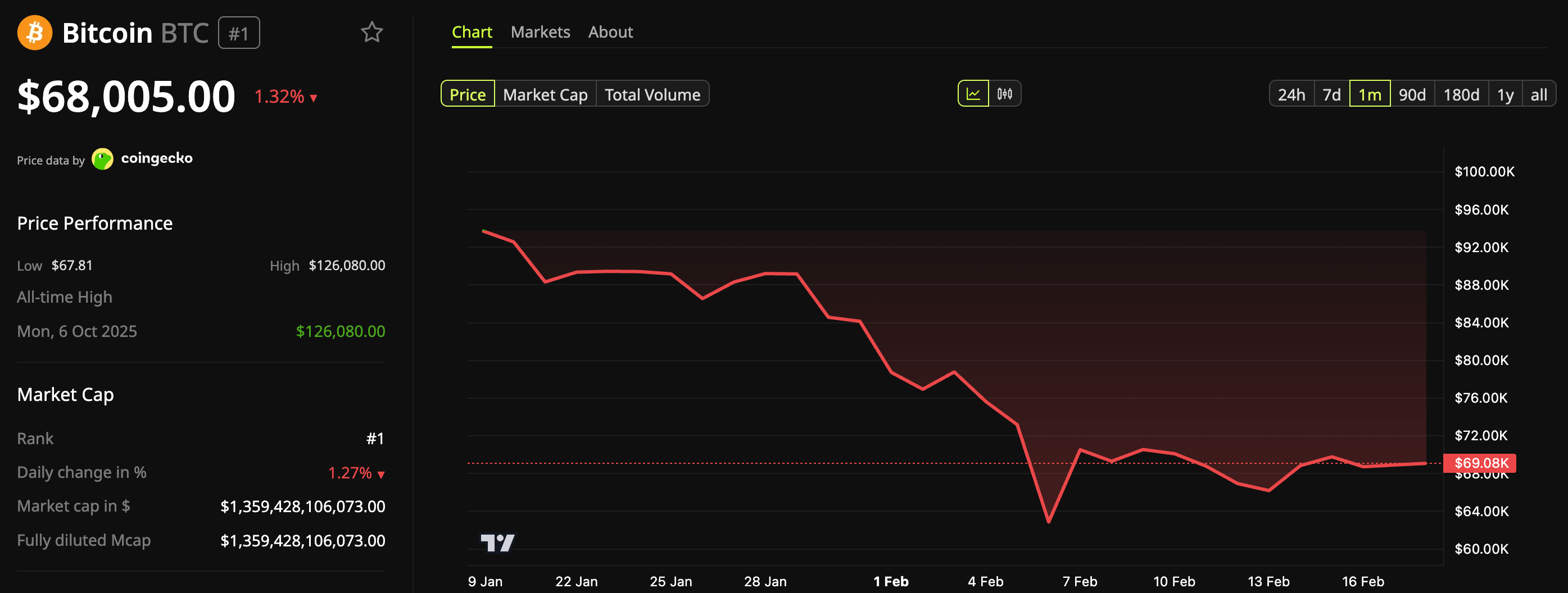

The crypto market, particularly Bitcoin, has been navigating a turbulent February, marked by a significant downturn in investor sentiment. A deep dive into market indicators reveals a landscape of extreme pessimism, prompting questions about an impending market bottom.

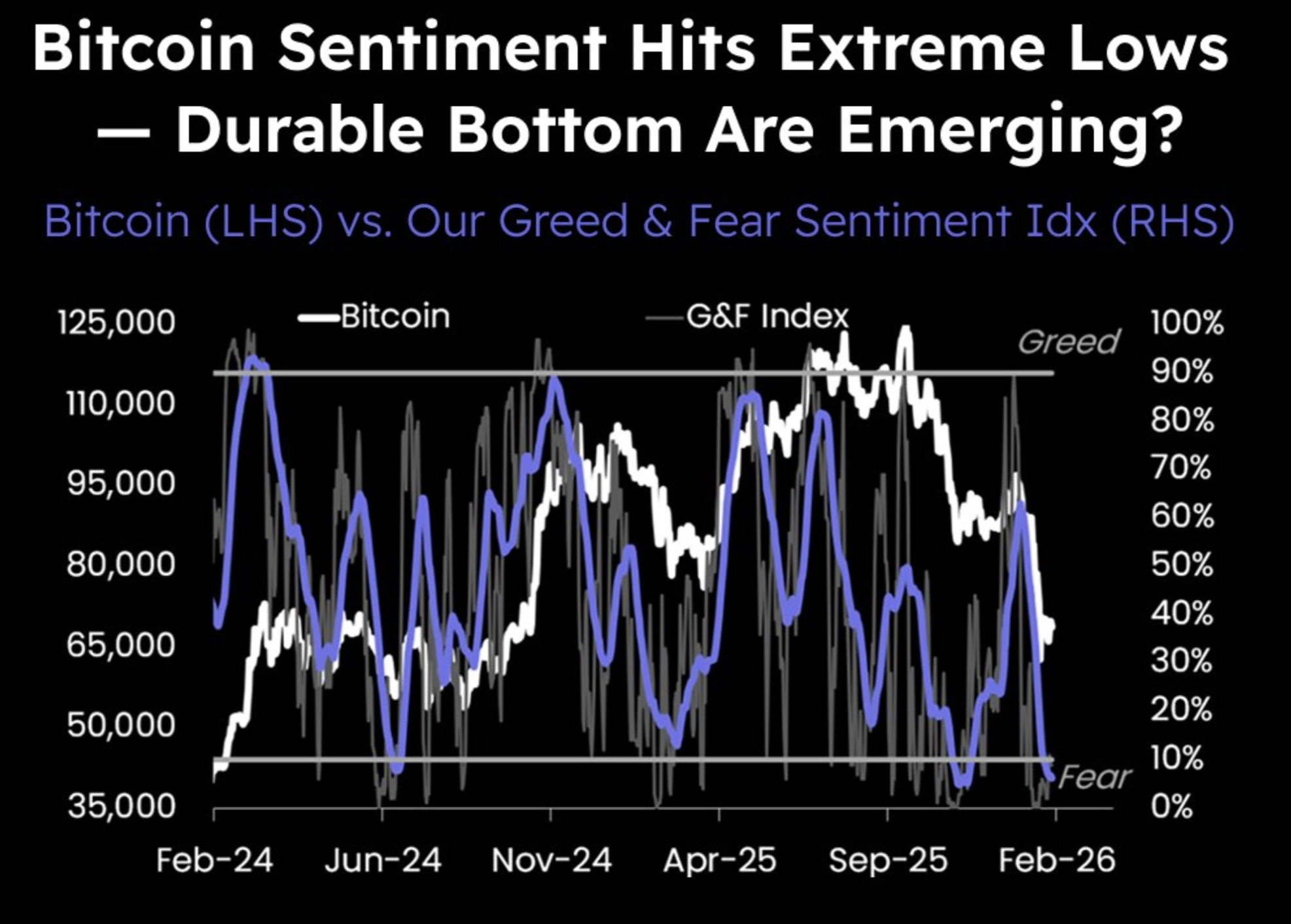

Matrixport’s Greed & Fear Index has plunged to levels seldom observed, historically aligning with pivotal market turning points. The firm highlights a recurring pattern: when the 21-day moving average of this index dips below zero and subsequently begins an upward trajectory, it often precedes the formation of enduring market bottoms. While current conditions appear to mirror this setup, analysts caution against anticipating an immediate rebound, suggesting that short-term volatility may persist even as foundational elements for a recovery begin to coalesce.

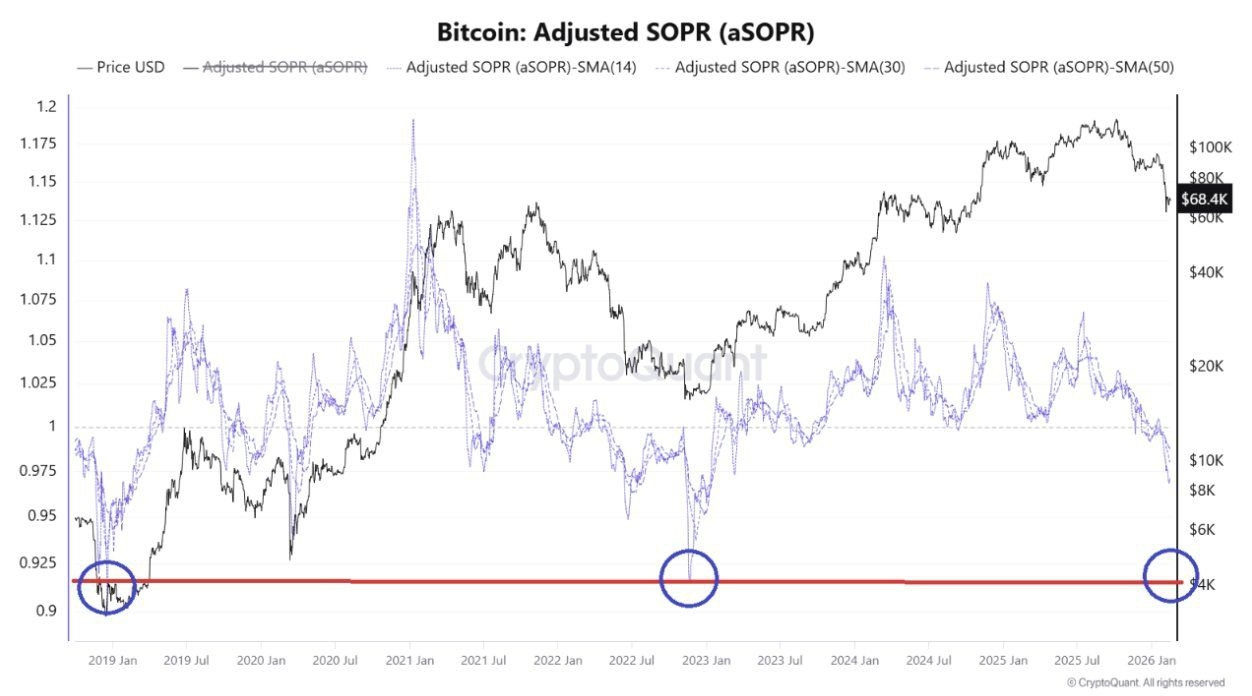

Further insights from on-chain analytics paint a similarly cautious picture. Analyst Woominkyu points to Bitcoin’s adjusted Spent Output Profit Ratio (aSOPR) settling within the 0.92–0.94 range. This specific band has historically been associated with intense bear market pressures, reminiscent of the significant corrections witnessed in 2019 and 2023, periods characterized by widespread selling at a loss before market stabilization. The concern extends beyond the immediate figures; Woominkyu posits that the current market structure might signify a more profound shift rather than a typical market correction. A failure of aSOPR to swiftly reclaim the 1.0 threshold could signal a prolonged bearish phase, moving beyond a mere shakeout of weaker holders.

Genuine market bottoms, it is argued, only materialize once selling pressure is entirely depleted, a state that may not yet be fully realized. A more profound period of price compression and the full realization of losses typically precede any sustainable recovery. With Bitcoin currently trading around $68,000, some forecasts even entertain the possibility of a retest of sub-$40,000 levels, representing a potential drawdown exceeding 40%. While such a scenario appears drastic, it is not without historical precedent during periods of structural market downturns.

In essence, the market presents a dichotomy: sentiment indicators hint at a potential turning point, yet the underlying on-chain data suggests that the market’s structural vulnerabilities have not fully mended. This creates a conflicted outlook, balancing nascent hope with the stark realities of market data. For now, a strategy of patience is advocated over speculative predictions, acknowledging that while the groundwork for a recovery is being laid, pinpointing the precise market bottom remains an exceptionally challenging endeavor for most traders.