People keep trying to put Fogo into a familiar box: a new chain shows up, points at Solana, and says, “We’re faster.” It’s a neat story because it’s easy to repeat, and because Fogo’s choices make the Solana comparison unavoidable. It runs the Solana Virtual Machine, it leans into Solana-style execution, and it’s built around the Firedancer validator effort that’s become shorthand for performance-first in the Solana world.

But once you spend time with what Fogo is actually trying to do, the rivalry framing starts to feel like a distraction. Fogo isn’t really chasing Solana’s crown. It’s chasing something more specific and, in some ways, more difficult: turning on-chain trading into an experience that feels less like tossing instructions into a noisy crowd and more like interacting with a machine that responds the same way every time—especially when markets get ugly.

That difference matters. Because fast is cheap to say. Predictable is hard to build.

If you’ve ever watched a trader use DeFi during a volatile hour, you’ve seen the problem Fogo seems to be aiming at. Not the philosophical problem—nobody is arguing about decentralization on the clock. It’s the practical problem: timing is slippery. Confirmation can feel uneven. A transaction that “should” land quickly sometimes drifts. Liquidations and arbitrage don’t wait for your mental model to catch up. And in the background, there’s always the suspicion that someone with better routing, better infrastructure, or better proximity is playing a different game than you are.

Fogo reads like it was written by people who are tired of pretending these issues are inevitable.

One of its boldest ideas is also the least romantic: geography. Most blockchains treat geography like an accident—validators are wherever they end up, and the protocol just deals with the internet as it is. Fogo treats geography like something you can design around.

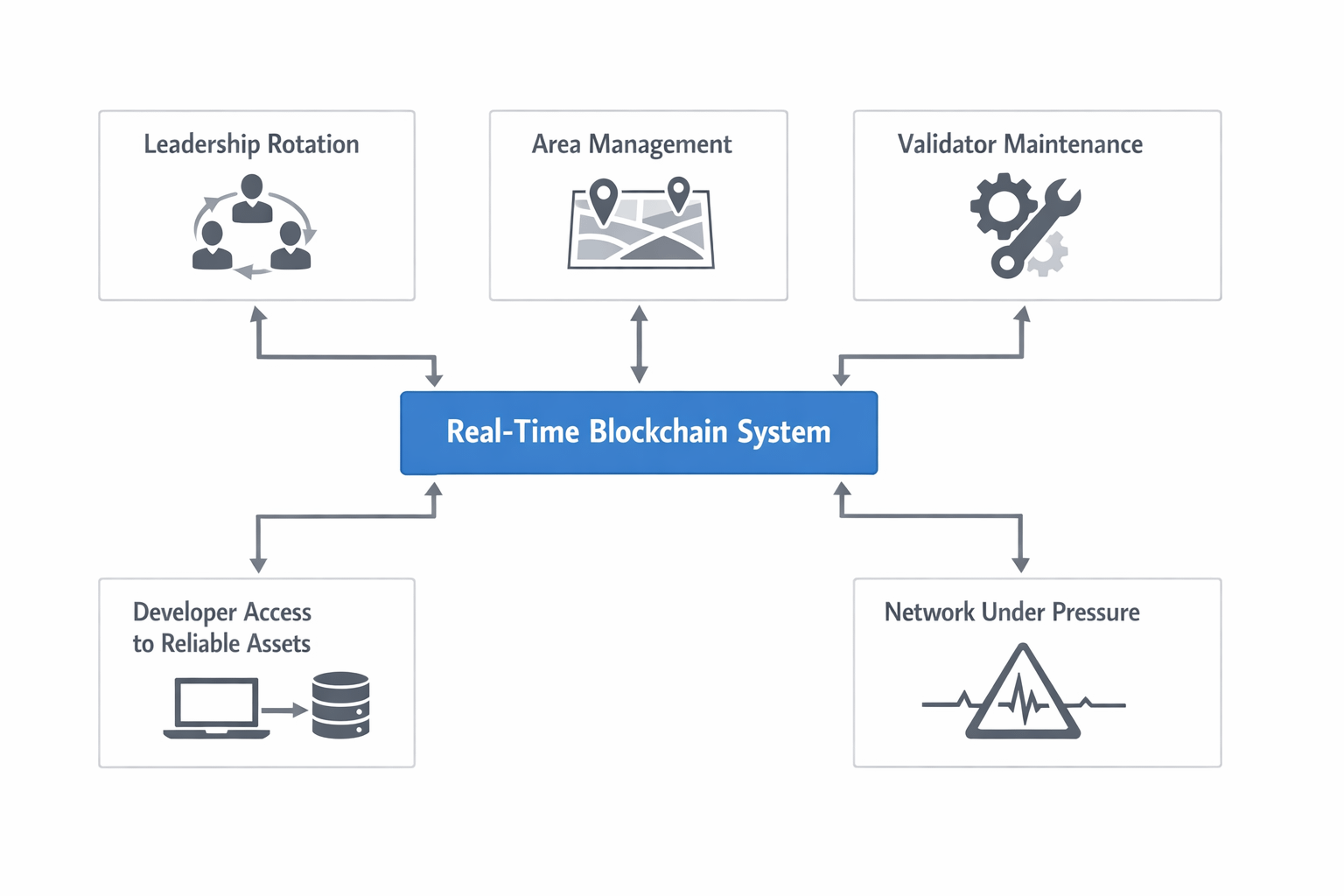

It does this through “zones.” The idea is simple in spirit: put validators close to each other physically so they can reach agreement faster, because long-distance networks are slower and messier than anyone wants to admit. Inside a zone, the system can run tighter, with less waiting around for packets to cross continents.

Then comes the part that tries to keep this from turning into “the chain lives in one place”: only one zone is active at a time, and the active zone can rotate. In theory, that rotation can follow time windows—almost like handing the steering wheel from region to region so nobody owns the performance advantage forever.

If that sounds a bit like how markets think, it’s because it is. In traditional finance, where a system sits and who is physically closer to it can matter. Latency isn’t just a number; it’s an edge. Fogo is basically saying: if we can’t pretend distance doesn’t matter, we can at least stop letting it be a hidden advantage and start making it an explicit part of the machine.

There’s a catch, though, and it’s a big one: once you make location part of the design, you inherit location politics. Who decides what zones exist? Who decides when they rotate? What happens when a region’s legal climate changes? What happens if one group of validators is always better prepared, always better funded, always more connected, and therefore always positioned to dominate whichever zone is active?

And right now, Fogo’s own public notes make it clear the vision is still maturing: the mainnet is operating with a single active zone. That’s not scandalous—it’s often how ambitious designs begin—but it’s an important reality check. The rotation story will only become meaningful once it happens reliably, under stress, and without drama.

Fogo makes another choice that tells you it’s not trying to win applause from everyone: it doesn’t chase “client diversity” the way most chains do. In crypto, multiple independent validator clients are like having multiple engines on an aircraft—you don’t want a single bug to take everything down. It’s dull, expensive redundancy, but it’s comforting.

Fogo leans toward the opposite kind of comfort: standardization. It wants a canonical high-performance validator client based on Firedancer, and in the meantime it uses a hybrid approach it calls “Frankendancer,” mixing Firedancer components with Solana’s Agave code. The practical reason is straightforward: if you’re trying to push latency down, the slowest implementation becomes the speed limit. A network can’t be “tight” if it has to wait for the worst-performing nodes to keep up.

That’s a rational engineering trade if your goal is to make execution feel crisp. But monoculture has consequences. One client means one dominant code path. If something goes wrong, the blast radius can be huge. You’re betting that the team’s discipline and testing can replace the resilience you usually get from diversity.

Then there’s the decision that will make some people instantly wary: a curated validator set. Fogo’s argument is basically, “In low-latency systems, a handful of weak operators can slow everyone down, so we curate to protect performance and enforce standards.”

This is where the project starts to feel less like “a public chain with vibes” and more like “market infrastructure wearing a blockchain’s clothes.

And honestly, that might be the point.

If you want on-chain trading to behave like a serious venue, you start thinking like a venue. Real exchanges don’t let random operators plug into the matching engine and participate in consensus. They certify participants, monitor them, and remove them if they don’t meet standards. Crypto hates that analogy because it’s not ideologically pure, but the analogy is mechanically accurate.

The uncomfortable question is whether the curation stays professional—or whether it turns into a power lever. Who controls admission? What’s the appeals process? How transparent is enforcement? “We’ll remove underperformers” sounds responsible until someone gets removed for reasons that look political. “We’ll reduce MEV abuse” sounds noble until “abuse” becomes whatever threatens the insiders’ edge.

So what is Fogo trying to be?

A useful way to think about it is this: Solana is building a world where lots of different things can happen fast. Fogo is aiming at a narrower world where one particular thing—on-chain markets—can happen with less timing weirdness and fewer hidden advantages.

That narrower focus explains why Fogo keeps pulling critical market components closer to the protocol layer. It’s been described as pushing toward protocol-level order books and built-in oracle infrastructure, not just leaving those as optional apps. The pitch isn’t “infinite creativity.” It’s “less friction where trading lives.

That’s also why “is it better than Solana?” is the wrong question. Solana’s real strength isn’t only speed—it’s the ecosystem gravity, the developer base, the liquidity, the cultural momentum. Fogo isn’t going to out-gravity Solana by sheer will. It’s trying to carve a different lane: a chain that behaves like a disciplined machine for trading.

The harder question—the one that will actually decide whether Fogo matters—is whether it can hold that discipline when conditions are worst.

Because markets don’t test you on your best day. They test you when volatility explodes, when liquidations cascade, when everyone hits the system at once, when bugs and latency spikes and governance decisions become existential. A venue earns trust by staying boring in the moments when everything else is exciting.

Right now, Fogo’s architecture reads like a blueprint drawn by people who care about those moments. Zones, canonical clients, validator curation—these are not the choices of a project chasing applause. They’re the choices of a project trying to reduce randomness in a place where randomness becomes somebody else’s profit.

If Fogo succeeds, the win won’t look like “we beat Solana.” It’ll look quieter than that: traders will stop thinking about the chain while they trade. They’ll stop building strategies around network quirks. They’ll stop feeling like the timing system is a rival.

That’s the real contest Fogo has picked. Not a chain-versus-chain fight. A fight against the clock, the network, and all the little inconsistencies that turn a market into a maze.q

And if you’ve ever tried to trade on-chain at the exact wrong moment, you already know why someone would try.