The more I watched on-chain trading in real conditions, the more one variable kept resurfacing. Not yield. Not token incentives. Not even liquidity depth. Time. The small but decisive gap between submitting an order and watching it finalize. In calm markets, that delay hides in the background. In fast markets, it becomes the market itself.

Most conversations still orbit around volume and returns, yet anyone who has traded through a violent move understands that settlement speed quietly defines the outcome. The difference between reacting instantly and reacting seconds later changes risk calculations, entry quality, and whether liquidity holds or disappears. That delay is not cosmetic. It alters behavior.

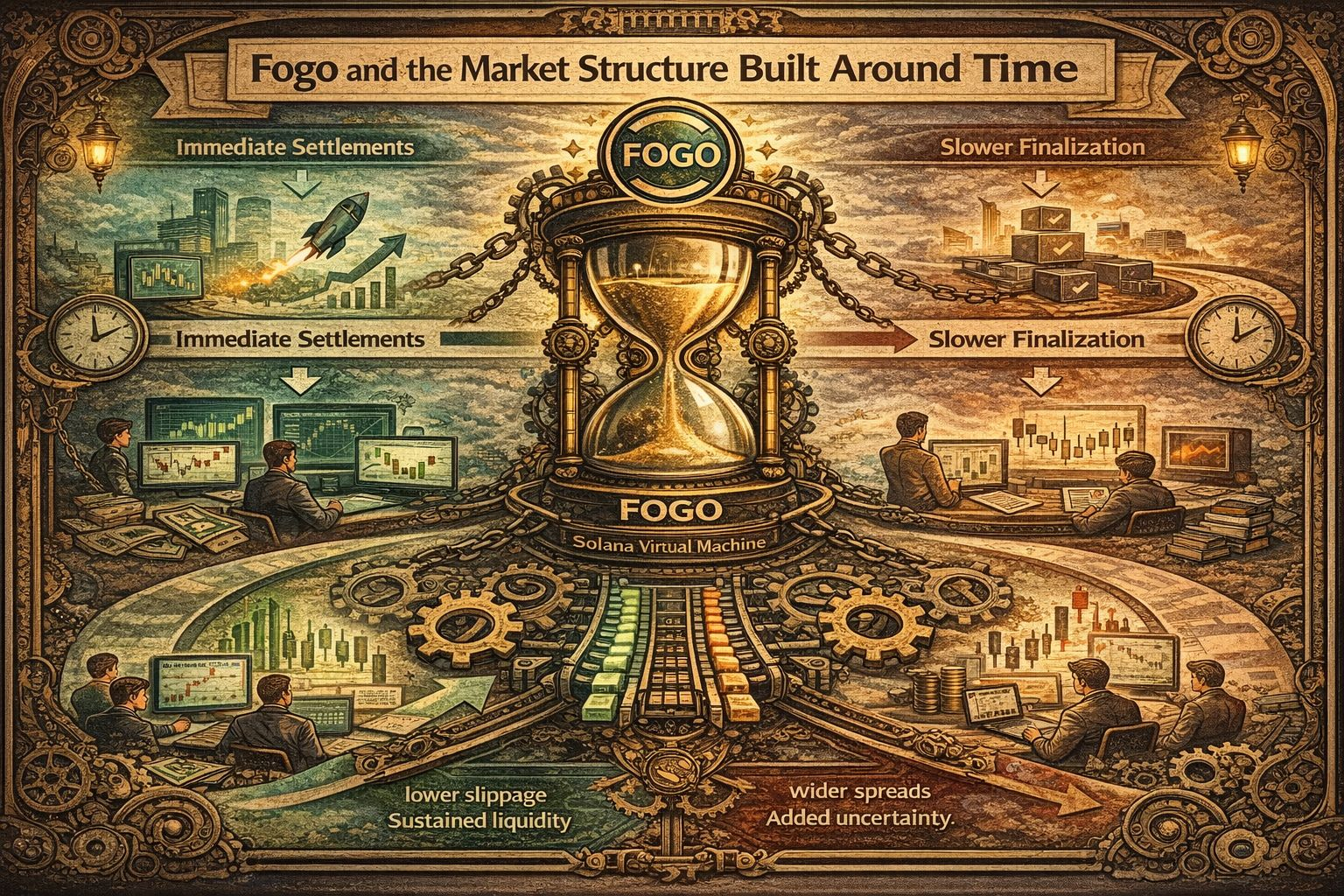

Today, crypto operates across two different clocks. Centralized exchanges execute and confirm trades in milliseconds. Many Layer 1 chains still finalize in multi-second intervals. That separation creates structural consequences. Certain strategies simply do not migrate on-chain because timing risk widens spreads and magnifies slippage. During volatility, liquidity becomes cautious, pricing in confirmation uncertainty.

This is the backdrop against which fogo is positioning itself. Built on the Solana Virtual Machine, fogo inherits parallel execution as a foundational choice rather than a patch for congestion. Independent transactions can process simultaneously, which matters most when order flow spikes. Instead of queues stacking up under pressure, the system is designed to clear activity more fluidly.

The direction mirrors the philosophy behind high throughput experiments within the Solana ecosystem. The exact transactions per second figure matters less than what it implies. If a network can consistently handle tens of thousands of transactions each second, on-chain order books start to resemble centralized matching engines. Execution ceases to be the weak link. It becomes reliable plumbing.

A latency-focused structure compresses the feedback loop between decision and result. Faster confirmations reduce the window where price drifts away from intent. Slippage narrows. Market makers can tighten spreads because they are not compensating for extended uncertainty. Liquidity depth stabilizes during fast conditions because participants trust the state they are interacting with. On the surface, users feel smoother interaction. Underneath, the microstructure of the market shifts.

Still, performance alone does not anchor value. Ethereum demonstrates that slower settlement can coexist with massive economic gravity when trust, composability, and integration are strong. fogo’s positioning suggests awareness of that balance. Speed reduces friction, but relevance requires reliability and ecosystem depth.

What makes fogo interesting is not a single benchmark. It is the recognition that time is a structural input into how markets function. When confirmation delays shrink, participant behavior changes. Risk models tighten. Liquidity providers recalibrate. The conversation moves beyond raw throughput toward how quickly a network can absorb stress without fragmenting.

In that sense, fogo is not presenting speed as a marketing headline. It is treating time as infrastructure. If decentralized markets are going to compete with centralized venues on execution quality, the temporal gap cannot remain an afterthought. fogo appears to be building around that premise, not by chasing spectacle, but by narrowing the distance between intent and outcome.