Every bull run feels the same at the beginning.

New coins launch every week. Influencers call everything the next 100x. Charts go vertical. Timelines turn green. And suddenly, everyone feels like a genius.

But here is the truth most people don’t want to hear.

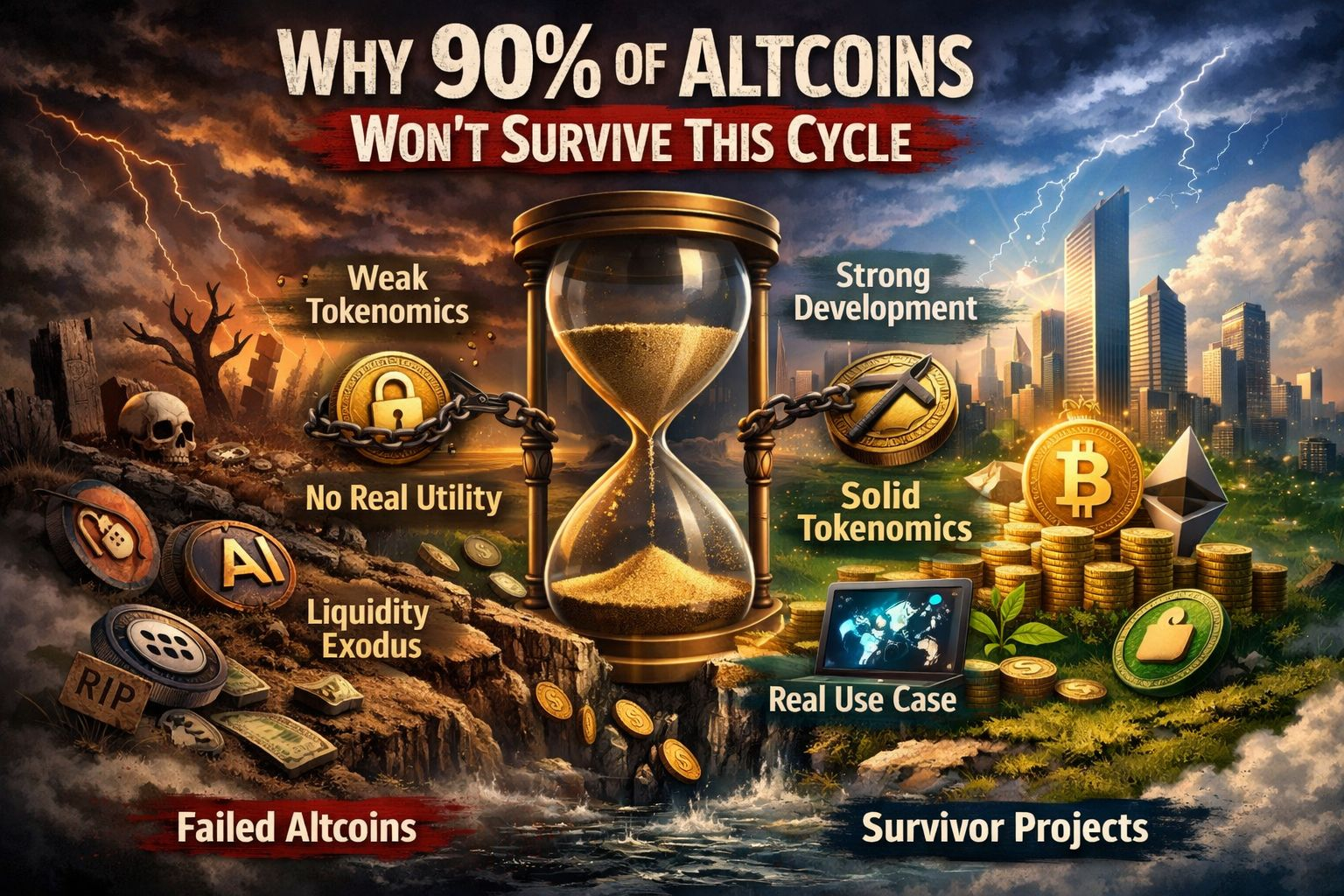

Most altcoins will not survive this cycle.

Not because crypto is dead. Not because innovation stops. But because the market is ruthless.

Let me explain in simple words.

First, too many tokens are created with no real purpose. It is easy to launch a coin. It is hard to build a product people actually use. If a project has no real users, no revenue, and no strong ecosystem, it will fade once hype disappears.

Second, liquidity is limited. Money does not grow on trees. When Bitcoin and Ethereum start moving strongly, capital flows there first. When fear comes back, money leaves smaller coins the fastest. Weak projects cannot survive liquidity shocks.

Third, tokenomics matter more than marketing. Many altcoins have huge unlock schedules. Early investors and private rounds hold large supplies. When tokens unlock, selling pressure increases. Price drops. Retail panic sells. The cycle repeats.

Fourth, competition is brutal. In every sector, there are 20 projects doing the same thing. AI coins. Layer 1 chains. Gaming tokens. DeFi platforms. Only a few will capture real market share. The rest will slowly disappear.

Fifth, most teams underestimate how hard long term building is. A roadmap looks exciting on paper. Delivering it during bear markets, regulatory pressure, and funding issues is another story.

Now here is the important part.

This does not mean altcoins are bad. It means you must be selective.

Look for real usage.

Look for strong community.

Look for sustainable token design.

Look for teams that keep building when hype is gone.

In every cycle, a few projects become giants. The rest become memories.

The goal is not to buy everything. The goal is to find the survivors.

Ask yourself this honestly.

If the market goes quiet for 18 months, will this project still be building?

That question alone can save your portfolio.