When I hear “users can pay fees in SPL tokens,” my first reaction isn’t excitement. It’s relief. Not because it’s flashy, but because it finally admits something most people pretend isn’t true: the “gas token” step is an onboarding tax that has nothing to do with the product the user came for. It’s just logistics. And forcing users to handle logistics is the easiest way to make a good product feel broken.

So yes, it’s a UX shift. But what’s really changing is where responsibility sits.

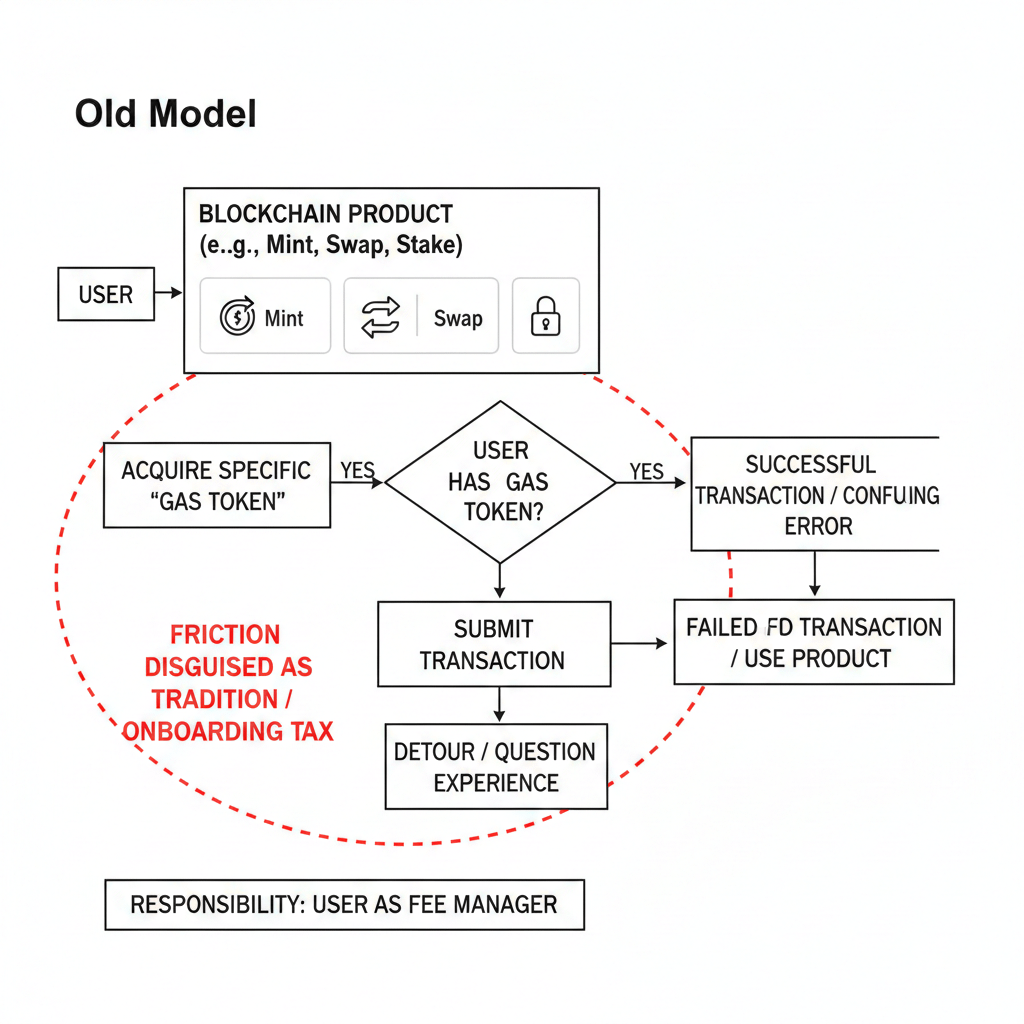

In the old model, the chain makes the user the fee manager. You want to mint, swap, stake, vote, do anything? First go acquire a specific token for the privilege of pressing buttons. If you don’t have it, you don’t get a warning that feels like a normal product warning — you get a failed transaction, a confusing error, and a detour that makes people question the whole experience. That isn’t a “learning curve.” That’s friction disguised as tradition.

Fogo moving fee payment into SPL tokens quietly flips that. The user stops being the one who has to plan for fees. The app stack starts carrying that burden. And once you do that, you’ve made a decision that’s bigger than convenience: you’re building a fee-underwriting layer into the default experience.

Because fees don’t disappear. Someone still pays them. The difference is who fronts the cost, who recovers it, and who sets the rules.

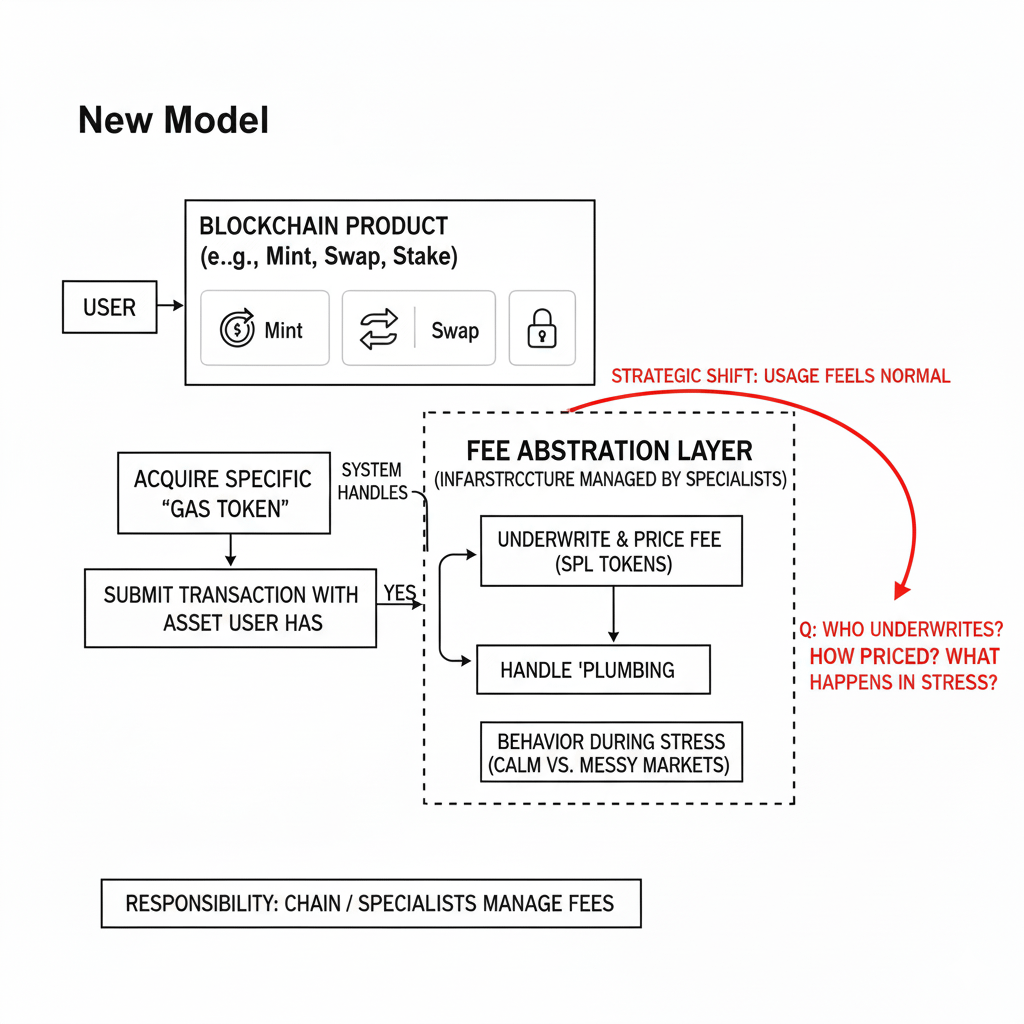

If a user pays in Token A but the network ultimately needs Token B, there’s always a conversion step somewhere — even if it’s hidden. Sometimes it’s an on-chain swap. Sometimes it’s a relayer taking Token A, paying the network fee, and balancing its books later. Sometimes it’s inventory management: hold a basket of assets, net flows internally, hedge when needed. Whatever the mechanism, it creates a pricing surface that matters a lot more than most people realize.

What rate does the user get at the moment of execution? Is there a spread? Who sets it? How does it behave when volatility spikes?

That’s where the real story lives. Not in “you can pay in SPL tokens,” but in “a new class of operator is now pricing your access to execution.”

This is why I don’t fully buy the simple “better onboarding” framing. Better onboarding is the visible benefit. The deeper change is market structure. With native-gas-only systems, demand for the fee token is scattered across everyone. Millions of tiny balances, constant top-ups, constant little buys, constant little failures when someone is short by a few cents. It’s messy, but it’s distributed.

With SPL-fee flows, demand gets professionalized. A smaller set of actors — paymasters, relayers, infrastructure providers — end up holding the native fee inventory and managing it like working capital. They don’t “top up.” They provision, rebalance, and protect themselves. That concentrates operational power in a way people tend to ignore until something goes wrong.

And things do go wrong, just in different places.

In a native-gas model, failure is usually local. You personally didn’t have enough gas. You personally used the wrong priority fee. It’s annoying, but it’s straightforward. In a paymaster model, the failure modes become networked. The paymaster hits limits. The paymaster changes token acceptance. The paymaster widens spreads. The paymaster is down. Oracle lag. Volatility spikes. Abuse attacks. Congestion policies shift. The user still experiences it as “the app failed,” but the cause lives in a layer most users don’t even know exists.

That’s not automatically bad. In many ways it’s the correct direction. But it means trust moves up the stack. Users won’t care how elegant the architecture is if their experience depends on a small number of underwriting endpoints behaving reliably under stress.

There’s another part that’s easy to miss: once you reduce signature prompts and make longer-lived interaction flows possible, you’re not just smoothing UX — you’re changing the security posture of the average user journey. You’re trading repeated confirmation for delegated authority. Delegated authority can be safe if it’s constrained properly, but it raises the stakes of bad session boundaries, bad front-ends, and bad permissions.

So I look at this and I don’t ask “is it convenient?” Of course it is. I ask: who is now responsible for preventing abuse, setting limits, and enforcing guardrails without turning the product back into friction?

Because once apps can decide how fees are paid, they also inherit the user’s expectations. If you’re the one sponsoring or routing fees, you don’t get to point at the protocol when things break. The user sees one thing: your product either works or it doesn’t. In this model, “fees” becomes part of product reliability, not just protocol mechanics.

And that opens a new competitive arena.

Apps won’t just compete on features. They’ll compete on execution experience: How often do transactions succeed? How predictable is the effective cost? How transparent are limits? How quickly do edge cases get handled? How does it behave when markets are chaotic?

If you’re thinking like a serious participant, the most interesting outcome here isn’t that users stop buying the gas token. The interesting outcome is that a fee-underwriting market forms, and the best operators quietly become the default rails for the ecosystem. They’ll influence which tokens are practically usable, which flows are easy, and which apps feel “smooth” versus “fragile.”

That’s why I see this as a strategic shift more than a UX patch. It’s the chain choosing to treat fees like infrastructure — something specialists manage — rather than a ritual every user must perform. It’s an attempt to make usage feel normal: you show up with the asset you already have, you do the action you wanted, and the system handles the plumbing.

The conviction thesis, if I had to pin it down, is this: the long-term value of this design will be determined by how the underwriting layer behaves during stress. In calm markets, almost any fee abstraction looks good. In messy markets, only disciplined systems keep working without quietly taxing users through spreads, sudden restrictions, or flaky execution.

So the question I care about isn’t “can users pay in SPL tokens?” It’s “who underwrites that promise, how do they price it, and what happens when conditions get ugly?”

If you drop the exact source line you’re referencing about Fogo’s SPL-fee support (the specific wording matters), I’ll tighten this into an even sharper thesis tied to the precise mechanism — still in this same natural style, still no headings.