Let’s be real for a second.

Most blockchains brag about speed. TPS numbers. Millisecond block times. Fancy dashboards with charts going up and to the right. It all sounds impressive. Until the market gets crazy.

Then everything slows down.

I’ve seen this before. Hype cycle hits. Trading volume explodes. Bots wake up. And suddenly the “high-performance” chain feels like it’s running on a toaster.

That’s the context Fogo shows up in.

Fogo is a high-performance Layer 1 built on the Solana Virtual Machine, or SVM. And the thing that makes it interesting isn’t just raw speed. It’s the obsession with predictability. Not average speed. Not peak performance during a quiet Tuesday afternoon. Predictability when things get ugly.

Because that’s when it matters.

To understand why this is a big deal, we need to rewind a bit. Back to where all this started.

When Bitcoin launched, nobody cared about high throughput. The goal was simple. Send money without a bank. That’s it. Bitcoin moves slow on purpose. Security first. Decentralization first. Performance? Secondary.

Then Ethereum came along and changed the game. Smart contracts. Programmable money. Suddenly developers could build entire applications onchain. DeFi, NFTs, DAOs. You name it.

But here’s the problem. Ethereum’s original design processes transactions one at a time. Sequential execution. Which worked fine… until it didn’t.

When demand spiked, gas fees exploded. Transactions stalled. Users complained. Developers scrambled.

That pain pushed the industry forward.

Then Solana showed up with a completely different idea. Instead of running transactions in a strict line, Solana’s Virtual Machine lets them run in parallel. If two transactions don’t touch the same state, the network processes them at the same time.

Simple idea. Big impact.

Modern CPUs have multiple cores. Why not use them? That’s what SVM does. It squeezes performance out of hardware instead of pretending we’re still in 2012.

And it works. When conditions are good, Solana processes massive throughput. Thousands of transactions per second. Sometimes more.

But here’s the uncomfortable truth. Markets aren’t “good conditions.”

Markets are chaos.

Token launches. Liquidation cascades. Meme coin manias at 3 a.m. You don’t get smooth traffic. You get spikes. Violent ones.

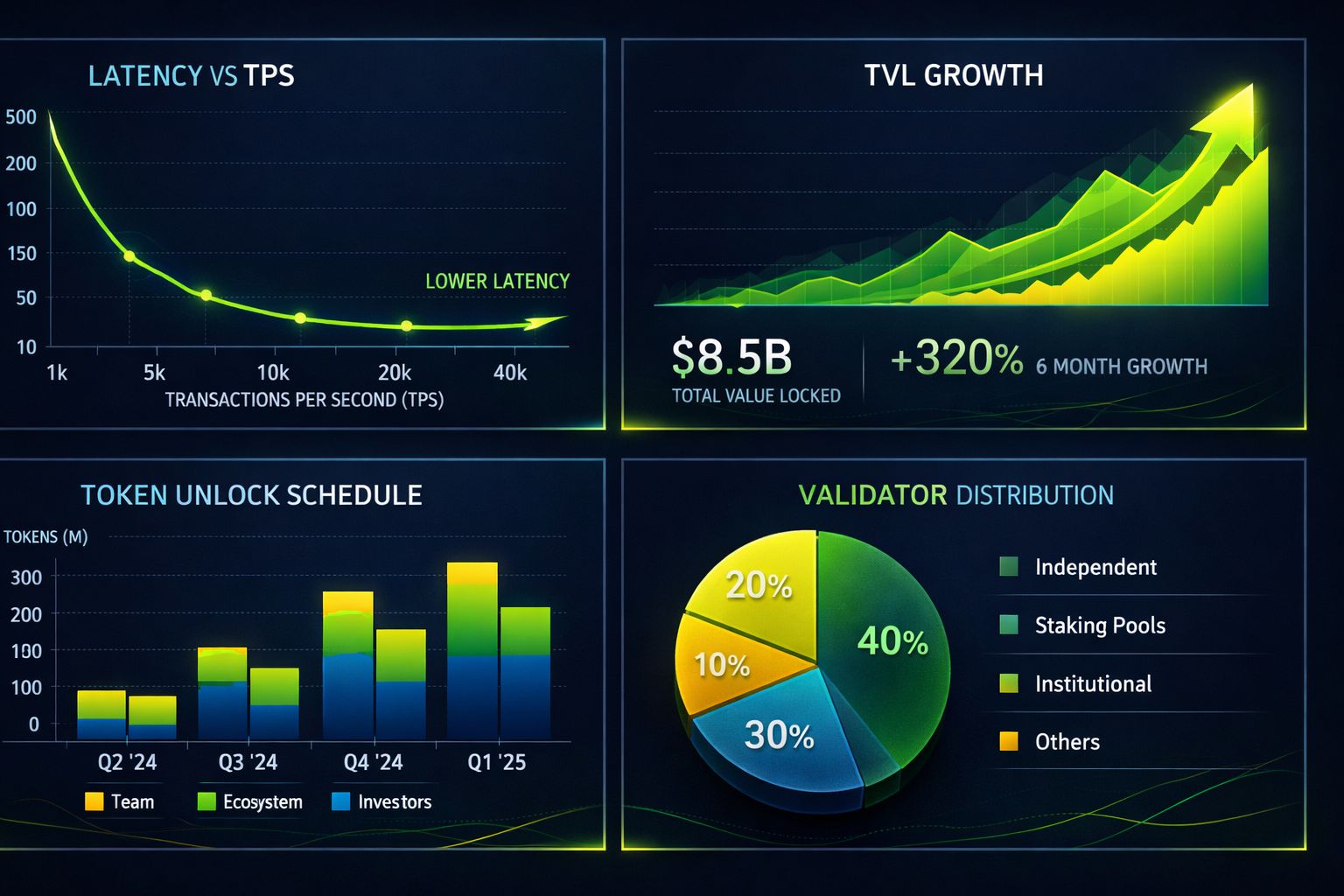

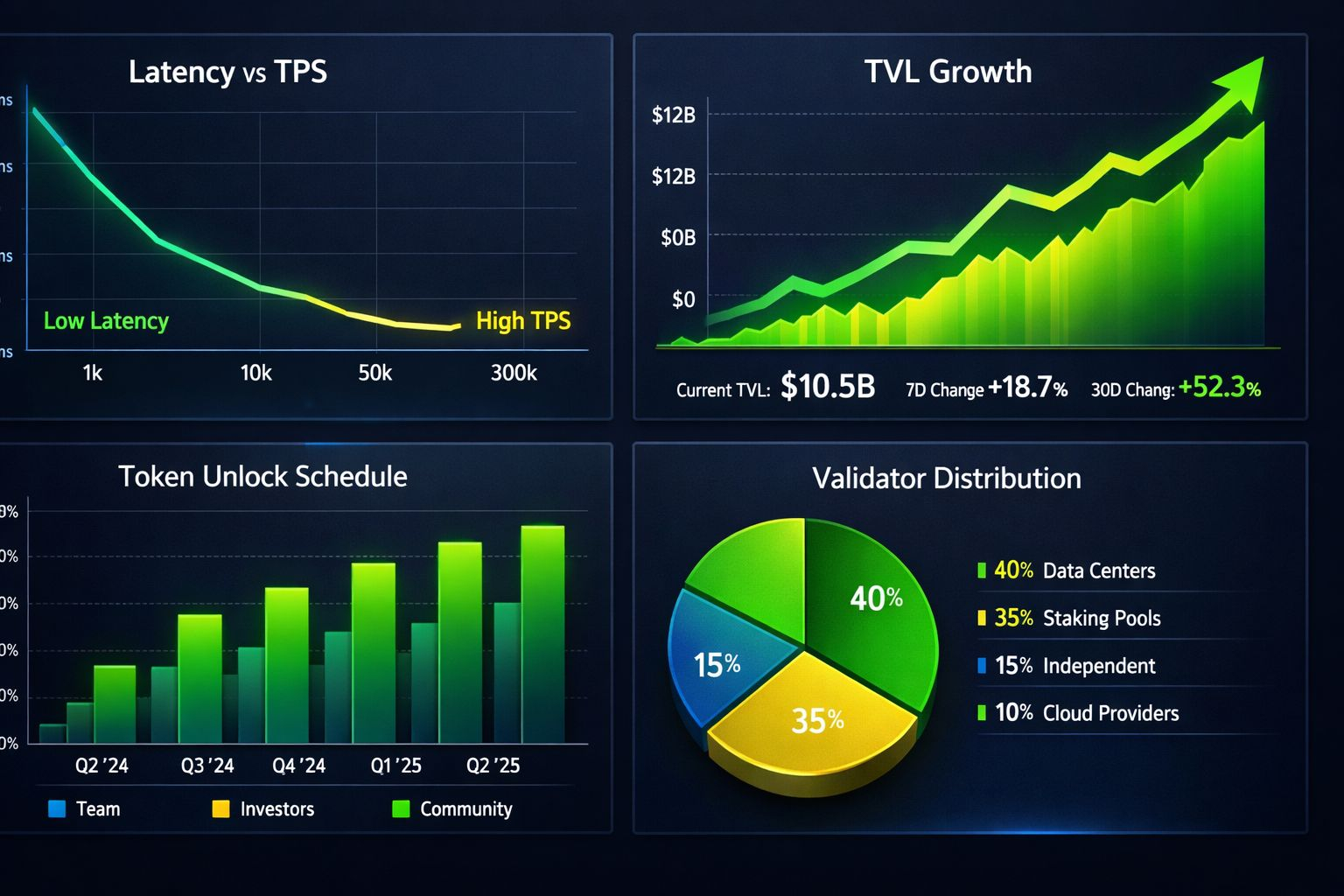

This is where tail latency enters the chat. And honestly, people don’t talk about this enough.

Everyone loves averages. “Average block time.” “Average confirmation.” That’s cute. But users don’t experience averages. They experience delays when the system is stressed.

That 99th percentile latency? That’s the one that hurts.

If a decentralized exchange lags during volatility, traders lose money. Slippage increases. Liquidations misfire. Arbitrage disappears. And then Crypto Twitter explodes.

Fogo looks at that mess and says, okay, what if we design around the worst-case scenario instead of the best-case demo?

That’s the thesis.

It uses SVM for parallel execution. So technically, it inherits the same performance-friendly model that made Solana stand out. Transactions declare the state they’re going to touch. The runtime schedules non-conflicting ones simultaneously. Hardware stays busy instead of waiting around.

But Fogo focuses on something deeper: reducing variability.

Not just being fast.

Being reliably fast.

That sounds subtle, but it’s not.

Think about decentralized exchanges. High-frequency traders don’t care about marketing slides. They care about whether their transaction lands exactly when they expect it to. A few hundred milliseconds can flip a profitable trade into a loss.

In derivatives markets, timing gets even more sensitive. Liquidations depend on price feeds and execution windows. If the chain hiccups, risk models break. And that’s a real headache.

Gaming? Same story. If a blockchain-based game lags, players won’t stick around. Nobody waits 10 seconds for an in-game action. They just close the tab.

So yeah, predictability matters more than people admit.

Now let’s talk trade-offs. Because there are always trade-offs.

High-performance chains usually require serious hardware. Powerful validator nodes. More CPU. More memory. That can limit who participates in consensus. And when fewer people can afford to run validators, decentralization can suffer.

Some critics argue that chasing performance pushes networks toward centralization. I get that concern. It’s not crazy.

But here’s the thing. Decentralization isn’t binary. It’s not “fully decentralized” or “fully centralized.” It’s a spectrum. The real question is whether the network balances performance gains with enough validator diversity to avoid capture.

Parallel execution also increases complexity. Scheduling conflicts, managing state access, coordinating validators. These aren’t trivial problems. Bugs in high-performance systems can get nasty fast.

So no, this isn’t easy.

And Fogo doesn’t operate in a vacuum. Ethereum is scaling aggressively with Layer 2 rollups. Modular blockchain designs separate execution from data availability and consensus. Solana itself continues improving its infrastructure.

“Fast” alone isn’t enough anymore. Everyone claims to be fast.

Fogo has to prove it can stay stable when markets go wild. That’s the real test.

There are also a few misconceptions floating around.

First, more TPS doesn’t automatically mean better user experience. I’ve seen chains push huge throughput numbers and still feel inconsistent under load. Throughput without predictability is just noise.

Second, people assume high performance automatically kills decentralization. It can. But careful network design can mitigate that risk. Hardware requirements matter, but so do governance structures, validator incentives, and ecosystem distribution.

And here’s something I find interesting. The industry is clearly moving toward specialization.

In the early days, every Layer 1 tried to be everything. Now? Not so much.

Some chains optimize for privacy. Some for censorship resistance. Some for interoperability. Fogo seems to be optimizing for performance-critical applications. And honestly, that makes sense.

Financial systems need reliable settlement. Institutions won’t tolerate random slowdowns during volatility. If you’re tokenizing real-world assets or running high-frequency DeFi strategies, you need consistency. Not vibes.

There’s another angle people don’t talk about enough. AI agents.

We’re heading toward a world where bots trade onchain automatically. Machines transacting with machines. Algorithms don’t tolerate unpredictability. They don’t “wait it out.” They fail.

If Fogo delivers low and stable tail latency, it could become attractive infrastructure for that future. Not because it’s trendy. Because it’s deterministic.

Of course, technology alone won’t guarantee success. Developers need to build on it. Liquidity needs to flow. Users need to trust it. A chain without applications is just expensive infrastructure.

But philosophically, Fogo reflects a bigger shift in blockchain design. Early networks prioritized decentralization and security above all else, even if that meant slow performance. The newer wave wants both. Strong decentralization and hardware-aligned speed.

That’s a tough balance.

If Fogo can reduce performance variance and maintain meaningful decentralization, it won’t just be “another Layer 1.” It’ll represent something more mature. A network that treats performance like part of the contract.

And I think that framing matters.

Because in finance, timing is part of the agreement. If you say settlement happens in X time, it better happen in X time. Not “usually.” Not “on average.” Every time, especially when things get messy.

Speed grabs headlines. Predictability builds trust.

If Fogo can prove it’s reliably fast when markets go into full chaos mode, that’s when it really earns attention. Until then, it’s a strong idea in a very competitive arena.

But the direction? It makes sense.

Blockchains aren’t just experiments anymore. They’re infrastructure. And infrastructure doesn’t get to panic under load.