Crypto markets have a funny habit of missing what's right in front of them. While traders chase the latest AI meme coins, Vanar Chain's VANRY token has been building actual machine-to-machine payment rails and right now, it's trading at prices that make value investors do a double-take.

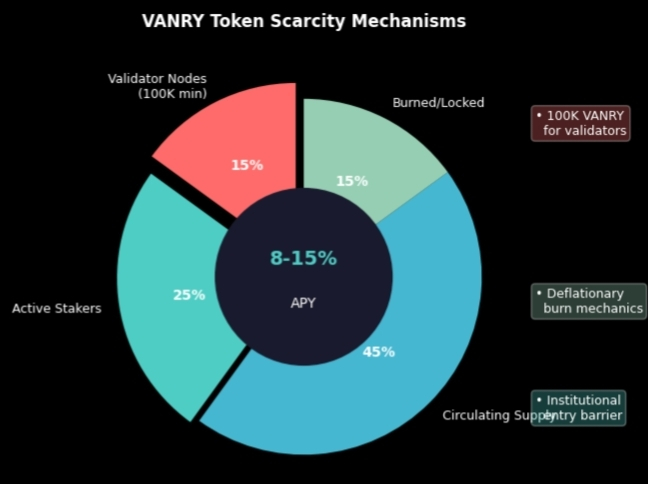

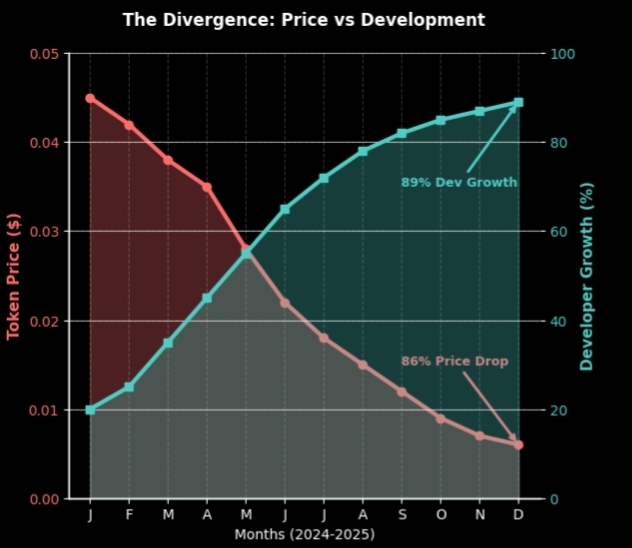

Let's talk numbers without the noise. $VANRY sits around half a cent, down roughly eighty-six percent from its 2024 highs. Brutal for early buyers, potentially brilliant for anyone watching the infrastructure stack being assembled behind the scenes. The project flipped the switch on staking rewards this February, offering yields between eight and fifteen percent annually. But here is the catch that matters: validator nodes require a hundred thousand token commitment. That is not retail-friendly it is a deliberate scarcity mechanism designed to attract institutional-grade participants and naturally tighten supply.

What separates this from the thousand other "AI blockchain" pitches? Actual working layers. Neuron handles semantic compression so data storage does not bleed money. Kayon runs artificial intelligence reasoning directly on-chain rather than outsourcing to centralized servers. Axon lets software agents negotiate, contract, and pay each other without human hand-holding. These are not roadmap promises. They are live systems.

The February Reveal event dropped into bigger news. PayFi integration is moving forward, positioning VANRY as the settlement layer for autonomous AI transactions. Think software paying software for compute cycles, data access, or task completion no human intermediaries, no banking delays.

The market mood could not be more opposite. Fear dominates sentiment indicators. Price action looks wounded. Yet the ecosystem tells a different story: developer participation up eighty-nine percent, subscription revenue models launching this quarter, and Google Cloud providing the backbone for sub-second transaction finality.

Analyst targets for this year sit around one to one-and-a-half cents, suggesting significant upside from current levels. But the real story is structural. As enterprises adopt these AI compression tools, VANRY transforms from speculative trading chip to unavoidable operating expense for machine economies.

The bet here is not on AI hype continuing. It is on whether markets wake up to infrastructure reality before revenue curves force their hand.