@Fogo Official , The first time I tried placing a trade on a new chain that promised “exchange-level speed,” I watched the spinner longer than I expected. It was only a second or two. But in fast markets, that feels like forever. Price moved. My entry slipped. I remember thinking, why does this still feel like I’m waiting for a web page to load in 2008?

That frustration is part of why Fogo caught my attention.

If most blockchains feel like sending letters through the mail, Fogo is trying to feel like tapping a contactless card. You do the action. It settles almost instantly. No awkward pause. No guessing.

As of February 2026, Fogo’s network design aims for block times under 40 milliseconds. That number sounds abstract until you compare it. Forty milliseconds is less than the blink of an eye, which takes roughly 100 to 150 milliseconds. In practice, that means transactions can be grouped and confirmed at a pace closer to financial trading systems than traditional chains that operate in the 400 to 800 millisecond range.

Underneath that speed is a specific architectural philosophy. Fogo is built around deterministic execution. That means the network tries to make sure that when transactions arrive, their order is predictable and consistent across validators. In financial systems, order matters as much as speed. If two traders submit orders at nearly the same time, who gets filled first can change outcomes. Fogo’s design leans into that problem instead of pretending it does not exist.

A key part of this comes from Proof of History. In simple terms, it is like a built-in clock. Instead of validators arguing about what happened first, the system attaches a cryptographic timestamp to events. Think of it as a continuously ticking counter that records sequence. That reduces the time nodes spend coordinating and comparing notes. They already share a common sense of order.

Tower BFT builds on that clock. It is a voting system layered on top of the time sequence. Validators vote on blocks, and their previous votes influence their future decisions. The more a block is confirmed in sequence, the harder it becomes to reverse. The result is fast finality that feels steady, not chaotic. As of early 2026, public discussions around Fogo emphasize sub-second finality under normal network load, with block production targeting that sub-40 millisecond window.

But speed alone does not explain the full picture.

Fogo also introduces what it describes as multi-local consensus. When I first read that term, I rolled my eyes. It sounded like marketing. Then I tried to break it down. Instead of treating the entire network as one giant decision-making body for every tiny action, the system can process different sets of transactions in parallel. Local clusters handle local state changes, while still anchoring back to the main chain.

In plain language, it is like having multiple checkout counters open at once, instead of forcing every customer into a single line. As long as their purchases do not conflict, they can be processed side by side. That parallelism is what makes 40 milliseconds plausible at scale. Without it, fast block times would buckle under heavy traffic.

The Firedancer client is another piece of the puzzle. Firedancer is an alternative validator client written in a different programming language, optimized for performance at the networking and execution layers. In testing environments reported during 2025, Firedancer demonstrated the ability to handle hundreds of thousands of transactions per second in controlled conditions. Those numbers need context. Lab conditions are not the same as real markets. Still, they show that the bottleneck is shifting from consensus design to network throughput and hardware limits.

Fogo’s adoption of Firedancer-style optimizations is about squeezing inefficiencies out of the system. Lower latency networking. More efficient memory handling. Better parallel processing. None of that sounds glamorous, but it changes texture underneath the user experience. Orders propagate faster. Blocks fill more efficiently. Validators waste less time idling.

This matters most in real-time DeFi.

In fast decentralized exchanges, liquidations and arbitrage depend on milliseconds. If your transaction confirms 300 milliseconds later than someone else’s, you lose. On a chain running 400 millisecond blocks, that delay compounds quickly. On a chain targeting sub-40 millisecond blocks, the window narrows. That does not eliminate competition, but it reduces structural disadvantage caused purely by block timing.

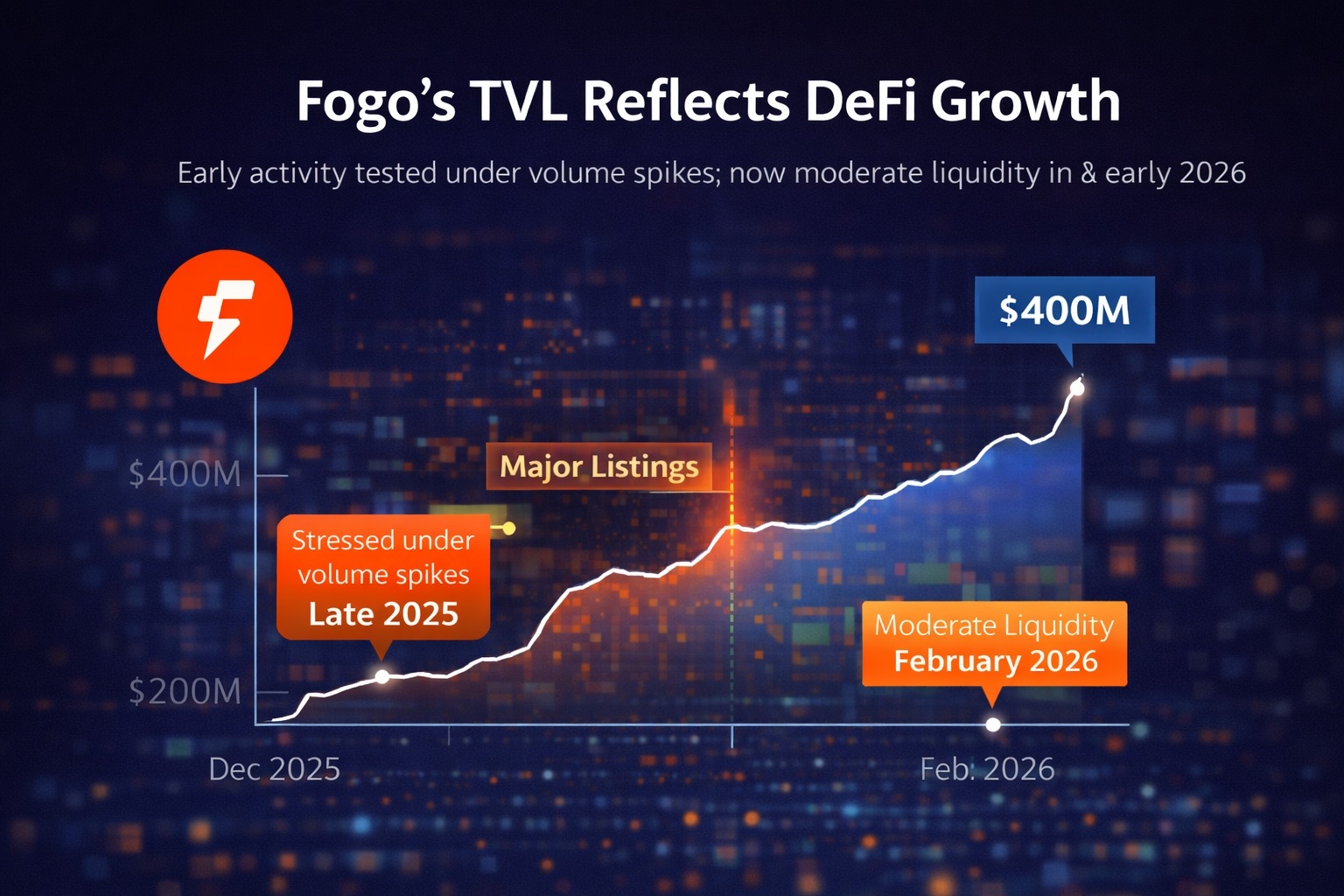

As of February 2026, early ecosystem activity around Fogo includes performance-focused DeFi tools and exchange-style applications. Liquidity remains modest compared to larger networks, which is honest. Volume spikes during listings on major exchanges in late 2025 created real stress tests. Observers noted that confirmation times stayed tight under moderate load. The real question is what happens during sustained high-volume periods, not just short bursts.

There are tradeoffs.

Faster blocks increase bandwidth demands on validators. Not everyone can run high-performance hardware. That can quietly centralize the network over time if participation costs rise. Multi-local consensus helps with scalability, but it introduces complexity. More moving parts mean more surfaces for bugs. Firedancer optimizations push the envelope, but performance tuning at this level leaves less room for error.

And then there is the human layer. Markets move on trust earned over time. A chain can hit 40 millisecond blocks in February 2026. The harder task is maintaining that under unpredictable conditions for years. Early signs suggest Fogo’s architecture is intentionally performance-bound. It does not try to be everything to everyone. It focuses on deterministic speed for financial use cases.

That focus is interesting.

Many Layer 1 networks talk about general-purpose computing, gaming, NFTs, identity, and everything else at once. Fogo’s quiet emphasis seems different. The foundation is built around time precision and transaction ordering. It feels closer to exchange infrastructure than social platforms. That clarity shapes how developers build on it. If you know the base layer is tuned for low-latency execution, you design apps that depend on that property.

Still, adoption remains the real test.

Sub-40 millisecond blocks sound impressive. They are impressive. But what matters is whether traders, liquidity providers, and developers feel the difference in daily use. If they do, the speed becomes earned credibility. If congestion creeps in or validator concentration grows too tight, the story changes.

For now, Fogo’s architecture is changing how people think about base-layer speed. Not as a bragging right, but as a practical constraint for real-time finance. It is early. The numbers are promising. The structure underneath is thoughtful.

Whether that foundation stays steady as the network grows remains to be seen. #fogo