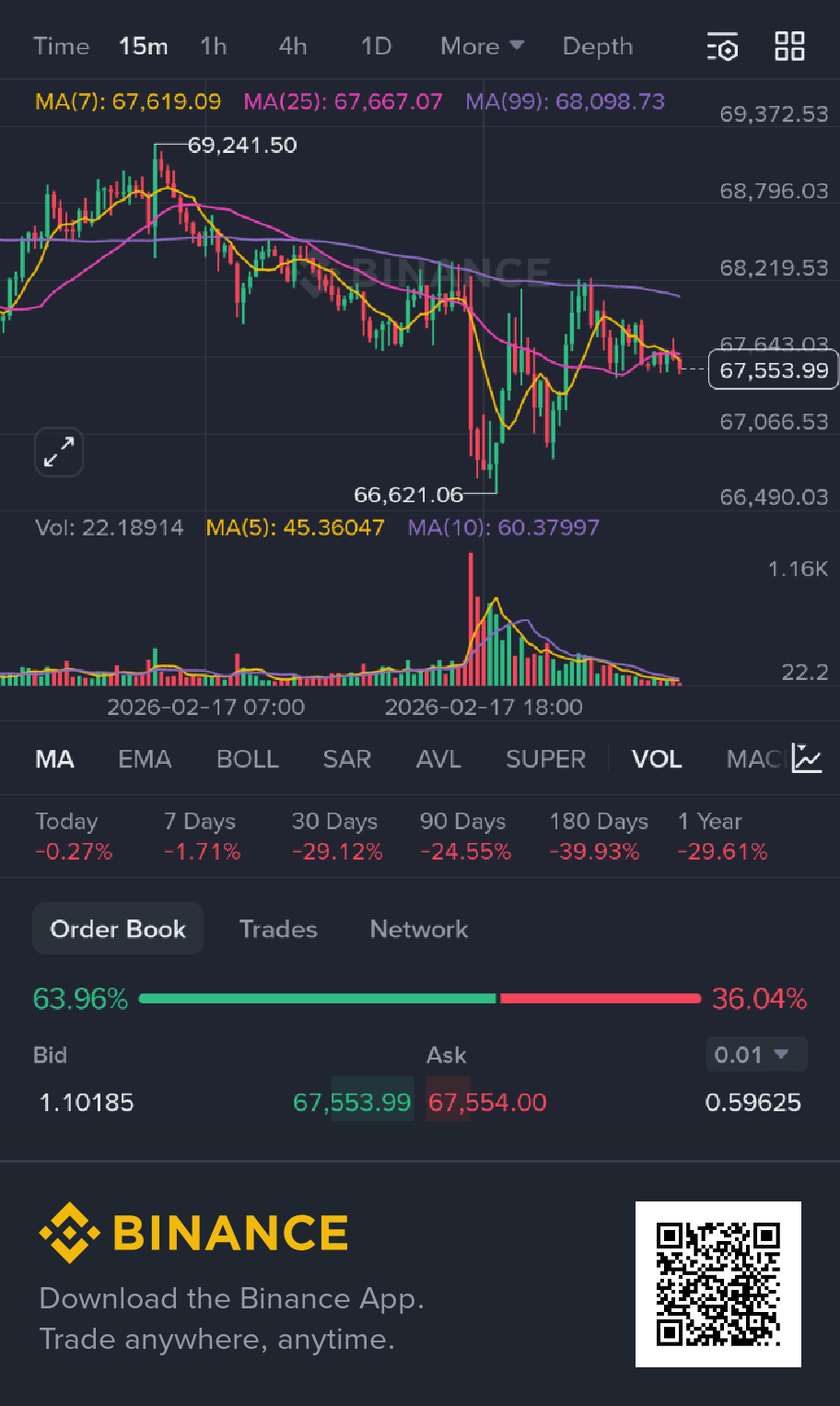

Price sits under the 99-period moving average. Short-term, that’s bearish.

Price sits under the 99-period moving average. Short-term, that’s bearish.

Both the 7 and 25 MAs are curling down, so momentum’s fading.

After that bounce from 66.6k, price keeps making lower highs. Sellers are stepping in every time buyers try to push higher.

There was a big volume spike on the last dump, but it’s dropped off since. Classic setup for more downside.

Order book’s got some bids, but price is still sliding. That’s passive buyers, but sellers are still in control.

Bottom line: This is just a pullback in a downtrend. It’s not a reversal.

Best Trade Setup

Trade direction: Go short.

You want to short at resistance—not chase price lower.

Entry zone: 67,650 to 67,800. That’s right near the moving average cluster and where price just got rejected.

If price doesn’t bounce back up there, just skip it. No need to force a trade. Patience pays off way more than FOMO.

Take Profits

First target: 67,050. That’s a support inside the current range.

Second target: 66,650. That’s where price swept liquidity on the last swing low.

My move: Close half at TP1, let the rest run to TP2.

Stop Loss

68,250. Why? It’s above the 99 MA and above where price got rejected last time. If price gets up there, the structure flips bullish, and you’re done with the short.

Position Sizing (for competition mode)

You’ve got $1,000 to play with. Be aggressive, but not reckless.

Risk per trade: 3%, so $30 at risk.

Difference from entry to stop is around $600.

That means you want 0.05 BTC contract size.

On Binance futures, with 10x leverage, that’s a $500 position. You’ll only use $50 margin.

That keeps you in the game if you’re wrong.

Why this setup works in competitions

Most traders try to long the bottom, buy support, or chase green candles. That’s why they lose.

The winners? They short failed bounces, trade with the trend, and look for trades with killer risk/reward.

This setup risks $30 to make $60–$90. That’s 2–3R. Stack a few of those, and your account grows fast.

When not to take the trade

Don’t short if:

Price breaks and holds above 68,250

Big bullish volume comes in

The 7 MA crosses back above the 25 MA

If you see any of that, the market’s flipping up. Sit tight and wait.

Want more? I can send you:

A backup long setup if things turn bullish

A scalping plan for this range

Or even a full competition playbook to squeeze the most out of a short contest