@undefined The global financial system is undergoing one of the most significant transformations in its history. At the heart of this change lies blockchain technology—an innovation that promises transparency, decentralization, and efficiency on an unprecedented scale. Among the many components of this ecosystem, Layer 1 blockchains stand out as the foundational infrastructure that powers decentralized applications, digital assets, and next-generation financial services.

As the crypto industry matures, Layer 1 solutions are no longer just experimental networks; they are becoming critical engines of financial innovation. Projects such as Ethereum, Solana, Avalanche, and emerging ecosystems like Vanar Chain are redefining how value is created, exchanged, and stored. In this article, we explore how Layer 1 blockchains are reshaping financial markets, the opportunities they unlock, and why they are attracting increasing institutional and retail interest.

Understanding Layer 1 Blockchains

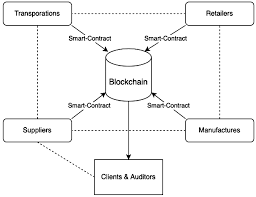

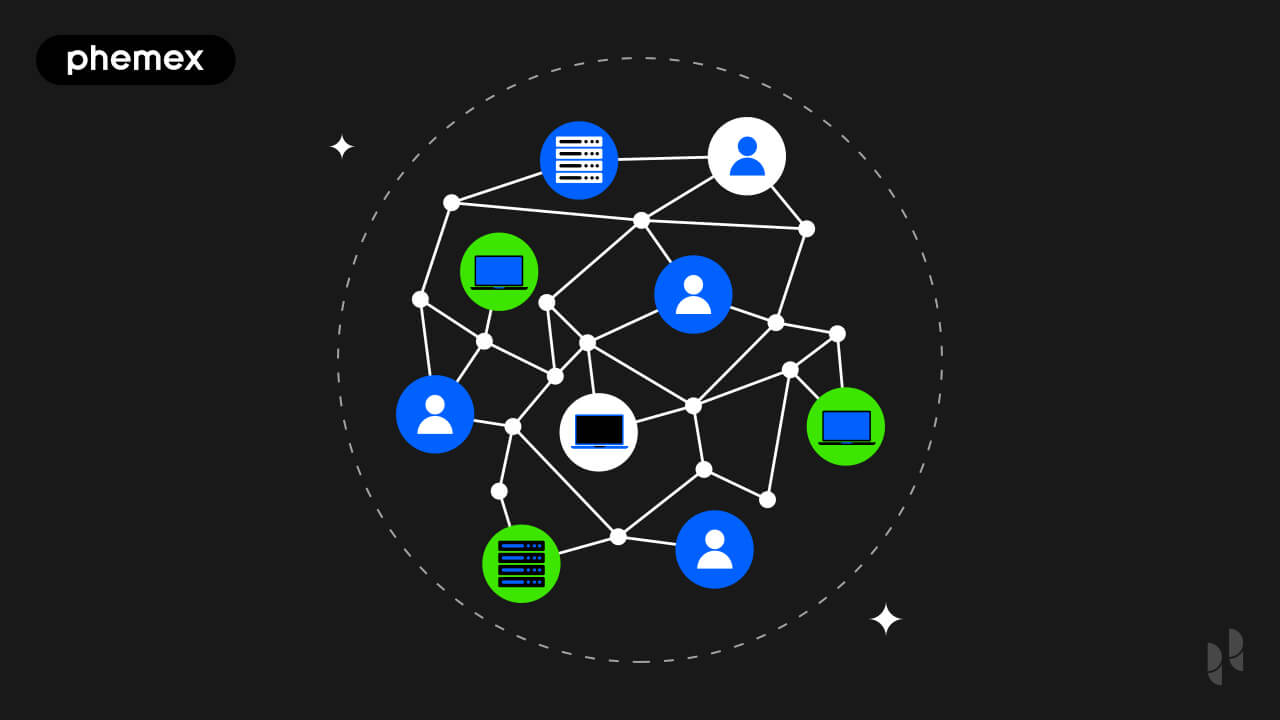

Layer 1 blockchains are base-layer networks that validate and record transactions directly on their own ledgers. Unlike Layer 2 solutions, which operate on top of existing chains, Layer 1 blockchains handle consensus, security, and data availability themselves.

Key characteristics of Layer 1 blockchains include:

Decentralization: No single authority controls the network.

Security: Cryptographic mechanisms protect transaction integrity.

Scalability: Continuous improvements allow networks to process more transactions efficiently.

These core attributes make Layer 1 blockchains ideal for building decentralized financial systems that do not rely on traditional intermediaries.

Enhancing Scalability Without Sacrificing Security

One of the biggest challenges in early blockchain networks was scalability. Limited throughput led to congestion and high transaction fees. Modern Layer 1 blockchains address this through innovative consensus mechanisms such as Proof-of-Stake (PoS), sharding, and parallel processing.

For example, newer architectures can process thousands of transactions per second while maintaining strong security guarantees. This enables real-time trading, microtransactions, and high-frequency DeFi activity—use cases that were previously impossible on legacy systems.

Vanar Chain is positioning itself as a high-performance Layer 1 designed for mass adoption, focusing on low-latency transactions and cost efficiency. By combining scalable infrastructure with developer-friendly tools, Vanar is paving the way for enterprise-grade decentralized applications.

The Rise of Decentralized Finance (DeFi)

DeFi is one of the most transformative outcomes of Layer 1 blockchain innovation. Decentralized exchanges, lending platforms, yield farming protocols, and stablecoins are all built directly on Layer 1 networks.

These platforms allow users to:

Lend and borrow assets without banks

Trade peer-to-peer without centralized exchanges

Earn passive income through staking and liquidity provision

Layer 1 blockchains provide the security and transparency needed for these activities to function without trusted intermediaries. Smart contracts automate financial logic, reducing operational costs and eliminating human error.

Vanar Chain’s ecosystem is steadily expanding into DeFi, offering developers the infrastructure to build secure and scalable financial products while giving users access to decentralized financial freedom.

Tokenization of Real-World Assets

Another revolutionary application of Layer 1 blockchains is asset tokenization. Real-world assets such as real estate, commodities, art, and equities can be represented as digital tokens on-chain.

Benefits of tokenization include:

Fractional ownership

Increased liquidity

24/7 global trading

Transparent ownership records

This approach democratizes access to investment opportunities that were once reserved for wealthy individuals or institutions. Layer 1 blockchains act as the settlement layer for these tokenized assets, ensuring security and immutability.

Vanar Chain aims to support seamless asset tokenization, enabling businesses and individuals to bring real-world value onto the blockchain.

Driving Global Financial Inclusion

Billions of people worldwide remain unbanked or underbanked. Layer 1 blockchains offer a powerful alternative by providing open-access financial services through nothing more than a smartphone and internet connection.

With blockchain-based wallets, users can:

Store digital assets securely

Send and receive payments globally

Access lending and savings products

This has profound implications for emerging markets, where traditional banking infrastructure is limited. Layer 1 networks remove geographic barriers, creating a truly borderless financial system.

Vanar Chain’s focus on accessibility and usability makes it a strong contender in driving financial inclusion across underserved regions.

Transforming Cross-Border Payments and Remittances

Traditional cross-border payments are slow, expensive, and dependent on multiple intermediaries. Layer 1 blockchains enable near-instant settlement at a fraction of the cost.

Using blockchain-based rails, users can send funds across borders within minutes, regardless of location. This is particularly impactful for migrant workers who rely on remittances to support families.

By providing efficient and secure transaction infrastructure, Layer 1 blockchains are becoming the backbone of next-generation global payment systems.

Security and Trust in a Decentralized World

Security is the cornerstone of financial markets. Layer 1 blockchains use advanced cryptography, decentralized consensus, and economic incentives to secure networks.

Features such as:

Immutable ledgers

Transparent transaction histories

Community-driven governance

create a high-trust environment without relying on centralized authorities. Continuous audits, bug bounties, and formal verification further strengthen network resilience.

Vanar Chain emphasizes robust security architecture to protect users and developers alike, reinforcing trust in its growing ecosystem.

Challenges Facing Layer 1 Blockchains

Despite rapid progress, Layer 1 blockchains face several challenges:

Scalability vs. Decentralization Trade-offs

Regulatory Uncertainty

Interoperability Between Chains

User Experience Complexity

Potential solutions include cross-chain bridges, improved wallet interfaces, modular blockchain design, and proactive regulatory engagement.

Vanar Chain is actively addressing these issues by focusing on interoperability, intuitive tools, and compliance-friendly infrastructure.

Long-Term Impact on the Global Financial Ecosystem

Layer 1 blockchains are laying the foundation for a more open, transparent, and inclusive financial system. Over time, they could:

Reduce reliance on centralized intermediaries

Increase market efficiency

Enable programmable money and automated finance

Foster global economic participation

This transformation is comparable to the early days of the internet—where new infrastructure reshaped entire industries.

Institutional Adoption and the Future of Crypto

Institutional investors are increasingly recognizing the potential of Layer 1 blockchains. Major funds, corporations, and financial institutions are exploring blockchain-based solutions for settlement, custody, and asset issuance.

As infrastructure matures, institutional confidence continues to grow, driving capital inflows and long-term ecosystem development.

Vanar Chain, alongside established networks, stands at the forefront of this evolution, offering a scalable and secure platform for the next generation of financial innovation.

Final Thoughts

Layer 1 blockchains are more than just technology—they are the backbone of a financial revolution. By enabling decentralized finance, asset tokenization, global payments, and inclusive financial services, they are reshaping how value moves around the world.

As adoption accelerates and innovation continues, projects like @undefined and the VANRY token are helping to build a future where financial systems are open, efficient, and accessible to all.

The journey has only begun, but one thing is clear: Layer 1 blockchains will play a defining role in the future of global finance.