In a market where new blockchains often compete through bold claims and familiar promises, Fogo enters with a noticeably different tone. Rather than positioning itself as just another high-throughput network, Fogo’s narrative centers on something more specific and arguably more practical: execution quality. At its core, Fogo is a high-performance Layer-1 blockchain that leverages the Solana Virtual Machine, aiming to deliver ultra-fast transaction processing, low latency, and throughput levels suited for real-time financial applications.

The timing of its public mainnet launch in mid-January 2026 is significant. While many blockchain projects spend extended periods in testnet phases or limited rollouts, Fogo moved into live production with active applications and early liquidity. This places it among the first SVM-based Layer-1 networks to transition from concept to operational network with meaningful ecosystem activity.

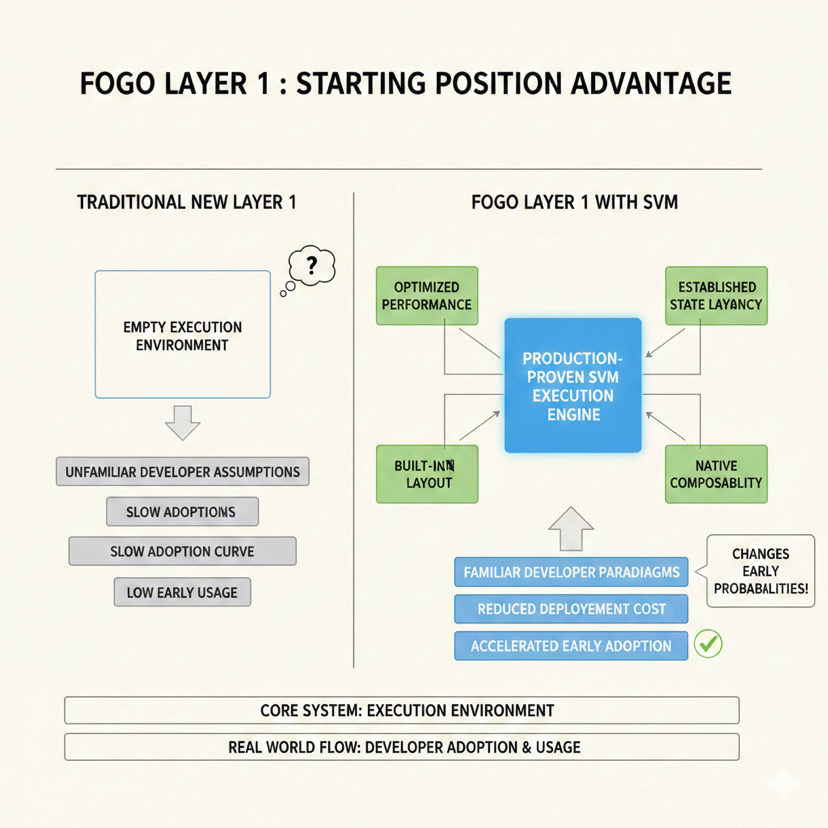

From a technical standpoint, Fogo’s architecture builds upon the Solana Virtual Machine as its execution layer. This choice is not merely about compatibility; it reflects a design philosophy. The SVM is known for parallel transaction processing, allowing multiple operations to be executed simultaneously rather than sequentially. In simpler terms, this approach reduces bottlenecks that often slow down networks during periods of heavy demand. The result is a system designed to handle large volumes of transactions while maintaining responsiveness.

Early performance metrics reported by the network suggest block times of approximately 40 milliseconds and transaction finality near 1.3 seconds. These numbers, while technical in nature, translate into a user experience where confirmations feel nearly instantaneous compared to many traditional blockchain environments. For applications sensitive to timing — such as decentralized trading platforms, perpetual markets, and high-frequency DeFi strategies — these differences are not cosmetic. Execution delays, even small ones, can materially affect outcomes.

However, raw speed alone rarely defines long-term relevance. What appears to distinguish Fogo is how that performance is framed. The network’s emphasis is less about theoretical throughput ceilings and more about consistency under real-world conditions. In blockchain systems, variability often becomes a hidden challenge. A network that performs well on average may still struggle during peak usage, introducing latency spikes, ordering delays, or unpredictable fees. Fogo’s design appears oriented toward minimizing such variance, prioritizing stability alongside speed.

Compatibility with existing Solana tooling further shapes Fogo’s ecosystem trajectory. Developers familiar with Solana’s programming environment, SDKs, and wallet infrastructure can interact with Fogo with relatively minor adjustments. This reduces migration friction — a factor that frequently slows adoption across new chains. Instead of rebuilding entire application stacks, teams can extend or adapt existing frameworks. For a developer ecosystem already accustomed to SVM mechanics, the transition becomes evolutionary rather than disruptive.

The FOGO token plays multiple functional roles within this system. Beyond serving as a tradable asset, it supports core network operations including transaction fees, staking mechanisms, and incentive structures designed to encourage participation. Exchange integrations have accelerated visibility, with listings on major centralized platforms. The availability of both spot markets and derivatives, including futures and perpetual contracts, reflects a level of early institutional and trader engagement not always seen at launch stages.

Network activity indicators also suggest diversification beyond purely trading-focused use cases. DeFi protocols, NFT platforms, and gaming-oriented applications have begun establishing a presence. This broadening of utility is notable. High-performance networks frequently emerge with a narrow focus, only later attempting ecosystem expansion. Fogo’s early multi-sector activity hints at a more flexible application landscape, where speed advantages extend into domains requiring rapid state updates and low-latency interactions.

Governance and token distribution strategies add another layer to the project’s structural design. Rather than relying exclusively on conventional presale models, Fogo has incorporated community-centric distribution approaches, including airdrop incentives and engagement programs targeting early participants. Such mechanisms are often interpreted as attempts to cultivate a broader holder base while aligning network growth with user involvement. Whether this results in long-term stability or introduces new dynamics remains an open analytical question, but the approach reflects evolving patterns across blockchain launches.

Underneath these visible elements lies a subtler architectural theme. Blockchain performance discussions often emphasize headline metrics like transactions per second. Yet in practice, real-world latency is influenced by factors such as validator efficiency, geographic node distribution, and network propagation characteristics. Fogo’s validator design and consensus optimizations appear directed toward minimizing physical-world delays, not just computational ones. In effect, the network seeks to control not only how fast transactions can be processed, but how predictably that speed can be maintained.

This distinction matters because blockchain reliability is frequently tested under stress rather than during ideal conditions. Congestion events, market volatility, and bursts of transactional demand expose structural weaknesses. A system designed for consistent low-latency execution under pressure may offer practical advantages that theoretical benchmarks fail to capture.

Still, measured analysis requires acknowledging uncertainties. Early performance metrics, ecosystem growth, and exchange support represent initial conditions rather than definitive outcomes. Blockchain history contains numerous examples of promising launches facing scaling challenges, competitive pressures, or shifts in developer attention. The sustainability of adoption, validator participation, and long-term economic alignment will ultimately shape Fogo’s trajectory.

What can be observed today is less about definitive conclusions and more about positioning. Fogo appears to frame itself not as a general-purpose blockchain chasing universal use cases, but as infrastructure optimized for environments where execution quality is critical. In a landscape crowded with multipurpose narratives, this narrower, performance-centric focus may prove either a strength or a constraint depending on how market demands evolve.

For now, Fogo’s emergence reflects a broader maturation within blockchain design philosophy. The conversation is gradually shifting from “how fast can a network go” toward “how reliably can it behave when speed truly matters.” In that context, Fogo represents not merely another Layer-1 entrant, but a case study in execution-first engineering — a reminder that in distributed systems, performance is ultimately experienced not in numbers, but in outcomes.