$BTC framework that works

Many people fail for one reason:

They pick a strategy their stomach can’t hold.

THE 3 INPUTS

H = HORIZON (3+ years?)

F = FORCED-SELL RISK (need cash soon?)

S = STOMACH (can you watch -50% without selling?)

THE DECISION MAP

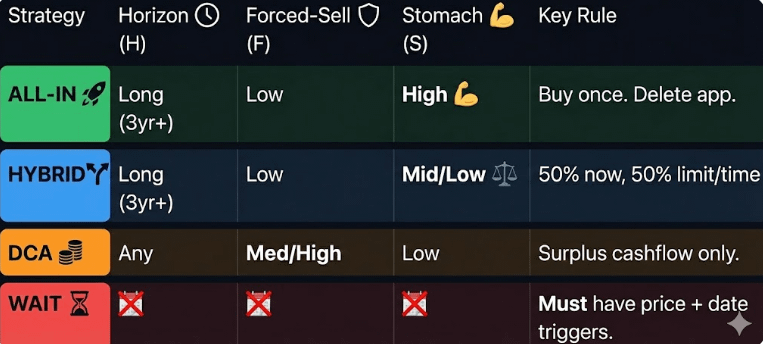

ALL-IN

Use if: H long, F low, S high

RULE: buy once. delete the app for 12 months

GOAL: maximize exposure to long-run drift

HYBRID (50/50)

Use if: H long, F low, S mid/low

RULE: buy 50% today. split the rest:

* 25% at your DIP LIMIT

* 25% on a TIME-STOP (day 90) if no dip

NOTE: no time-stop = CHRONIC UNDEREXPOSURE

DCA

Use if: F medium/high

RULE: buy only from SURPLUS CASHFLOW

GOAL: never be forced to sell red

STRATEGIC WAIT

ONLY allowed with TWO TRIGGERS:

1. limit orders placed now

2. a “BUY-ANYWAY” date

waiting without a deadline isn’t discipline it’s paralysis

BOTTOM LINE

The best strategy isn’t the one with the best back test.

It’s the one you won’t abandon when the screen turns red.

The real enemy isn’t buying too high.

It’s selling too low or never getting in.

The real edge is not predicting the next move.

The edge is staying allocated long enough to capture the ~5.7 slope without getting shaken out by the volatility.

This article is for information and education only and is not investment advice. Crypto assets are volatile and high risk. Do your own research.

📌 Follow @Bluechip for unfiltered crypto intelligence, feel free to bookmark & share.