XRP surges after Ripple CEO joins the CFTC committee, fueling breakout hopes—can this regulatory shift power the next XRP price move?

XRP price just caught a serious bid. The token jumped more than 8% in 24 hours after news broke that Ripple CEO Brad Garlinghouse secured a seat on the CFTC Innovation Advisory Committee.

Traders are clearly betting that having Ripple closer to regulators could shift the narrative around XRP.

Key Takeaways

XRP rallied 8.09% to trade near $1.53 on news of the Ripple CEO’s federal appointment.

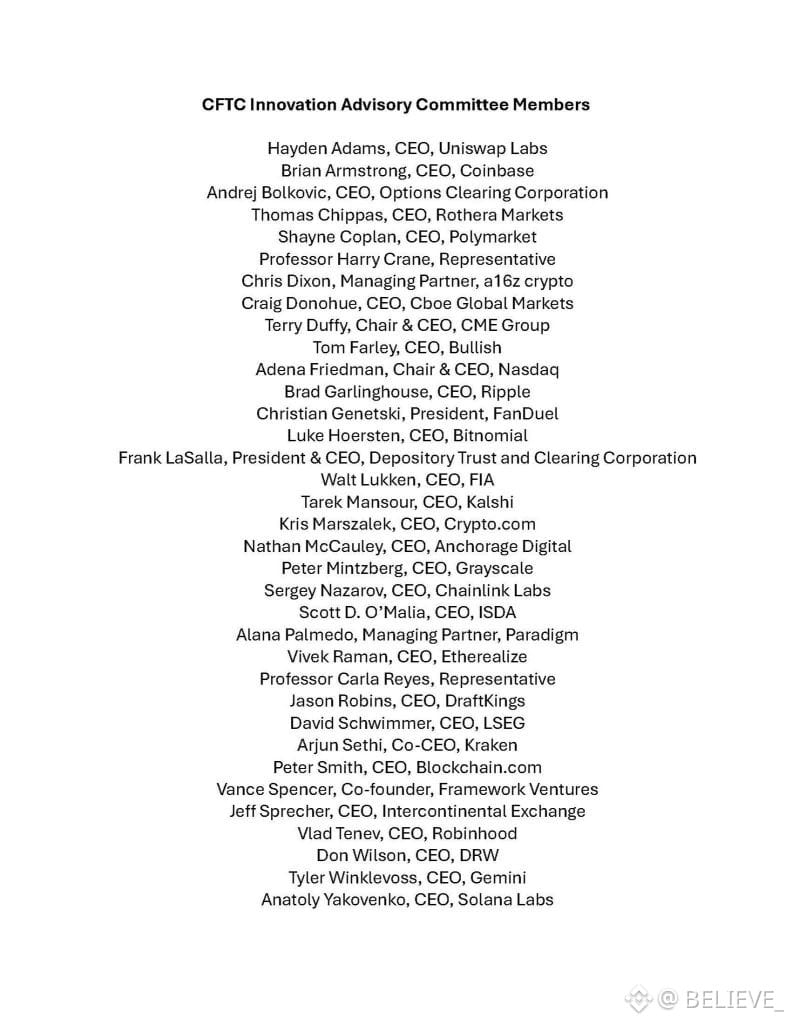

The CFTC tapped Garlinghouse and other crypto leaders to advise on digital asset frameworks.

Institutional flows are rising, with Goldman Sachs revealing a $152 million crypto ETF position.

Garlinghouse Joins Expanded CFTC Committee

This is a pretty big shift from Washington. The CFTC just expanded its Innovation Advisory Committee to 35 members, and Brad Garlinghouse is now officially part of it. Chairman Michael S. Selig says the goal is to future proof U.S. markets by working closer with the industry instead of fighting it.

It is important to keep this in perspective. The CFTC mainly regulates derivatives markets, not spot crypto securities. XRP past legal fight was with the SEC, not the CFTC.

For XRP holders, this feels symbolic. Ripple went from battling regulators to sitting at the policy table. And with lawmakers pushing for clearer crypto rules, this could mark a new chapter in how the industry and Washington interact.

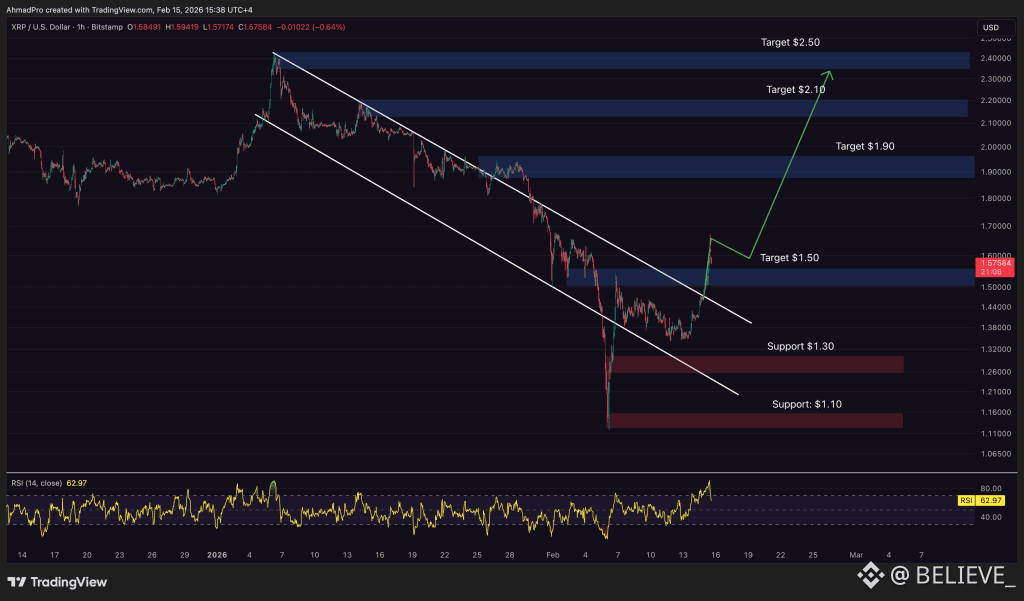

XRP Price Bulls Eye $1.54 Breakout

The market reacted fast. XRP is trading around $1.57609, up 10% on the day after bouncing from a low near $1.40731. That move pushed price cleanly out of its mid $1.40 consolidation range, backed by stronger volume and widening Bollinger Bands.

Institutional Interest Deepens

Beyond the CFTC news, bigger money is quietly getting into position for what could be a more crypto friendly 2026.

Recent filings show Goldman Sachs holds around $152 million in crypto ETFs, a clear sign that Wall Street is not stepping away from digital assets.

While the U.S. tone appears to be softening, the global picture is still mixed. Dutch lawmakers, for example, are pushing a 36% capital gains tax on crypto, showing how fragmented regulation remains worldwide.

Broader market conditions also matter. XRP remains highly correlated with Bitcoin and overall crypto risk sentiment, meaning macro catalysts, including rate expectations and ETF flows, could amplify or cap this breakout attempt.

With price now pressing against the $1.60 resistance zone, the next move could set the tone for where momentum heads from here