The on-chain derivatives market is experiencing explosive growth, driven by the tokenization of traditional finance assets. Through asset tokenization blockchain technology, real-world assets are being converted into digital tokens, creating a vast new universe of underlying assets for derivative contracts. This convergence is transforming how investors gain exposure to traditional markets.

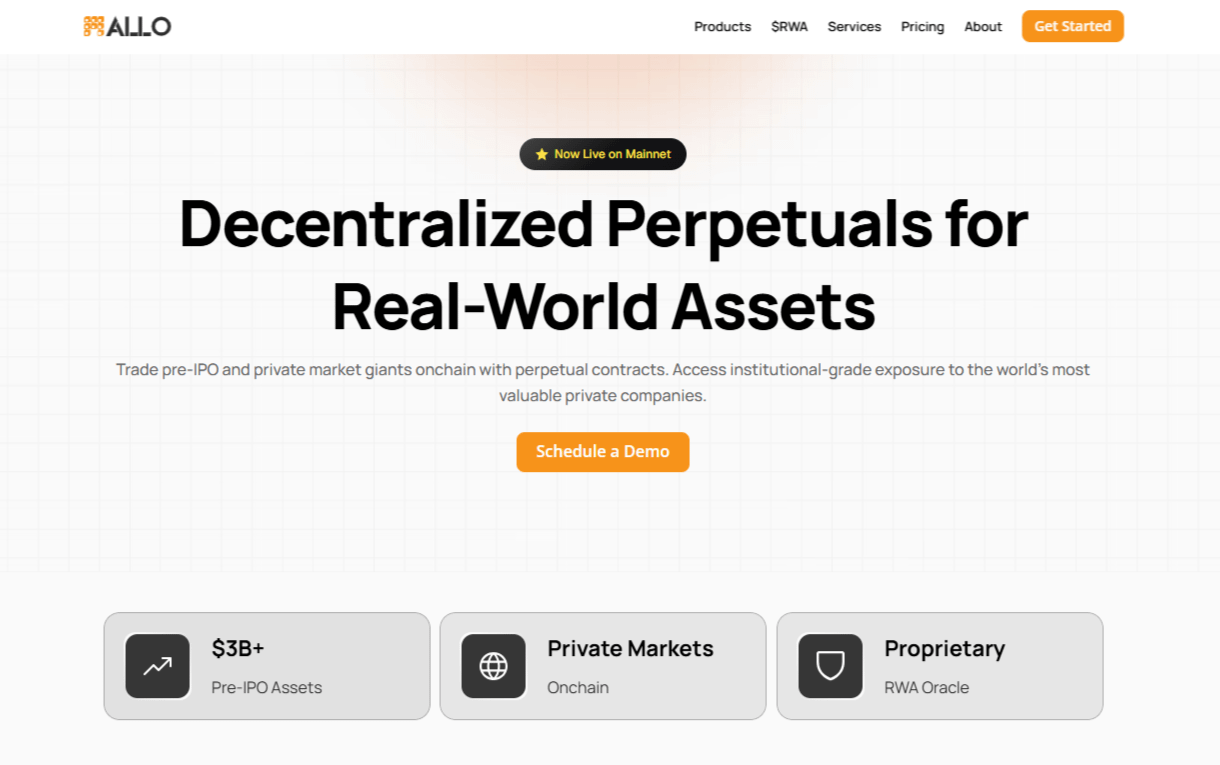

At the heart of this evolution is RWA tokenization, which bridges physical and digital finance. The expansion of the on-chain derivatives market enables sophisticated trading strategies previously unavailable for many asset classes. This is a cornerstone of institutional DeFi, where regulated players increasingly participate. Platforms like Allo Finance provide the essential infrastructure, offering the security and liquidity needed for institutional RWAs on chain to serve as underlyings for complex derivative products.

Key innovations in this space include RWA perpetuals and RWA derivatives, which allow traders to gain synthetic exposure without physical settlement. These tokenized asset perps are central to the growing on-chain derivatives market, and the Allo trading platform offers the professional execution environment that serious traders demand. Through Allo Finance, participants access deep liquidity across multiple derivative products.

Precious metals demonstrate the potential of this model. Tokenized gold has become a foundational commodity backed crypto for derivative contracts, while tokenized silver and silver backed tokens expand opportunities. This evolution in blockchain commodities trading shows how decentralized rwa trading benefits from a robust on-chain derivatives market.

As the tokenization of traditional finance assets accelerates, platforms like Allo Finance will remain essential, building the infrastructure that supports the next generation of the on-chain derivatives market.

Follow @ALLOxyz on (@allo_xyz) on X & visit at: allo.xyz

$BNB #RWA #BinanceAlpha $RWA