Another repeating theme across these charts was liquidity behavior. Price does not move aimlessly. It seeks areas where orders are concentrated. Previous consolidation zones and aggressive wick areas often act as magnets for future movement.

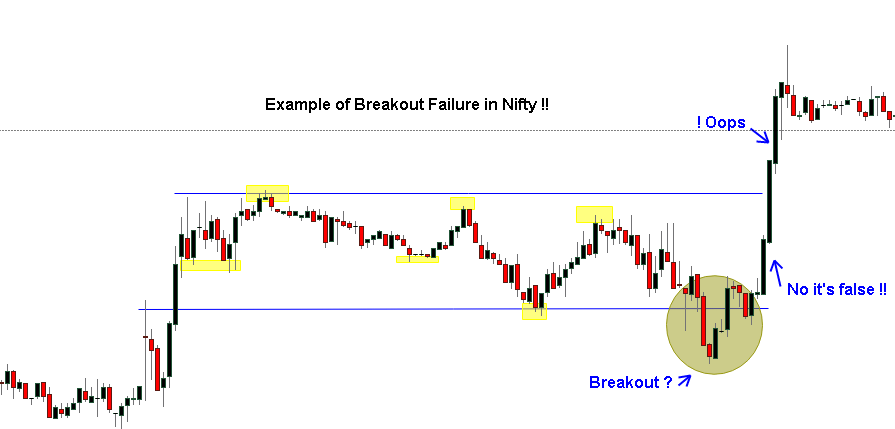

False breakouts appeared frequently. Price would briefly clear resistance, trigger breakout entries, then reverse sharply. These moves often occur around high-liquidity levels. Traders unaware of liquidity mechanics become exit liquidity for stronger hands.

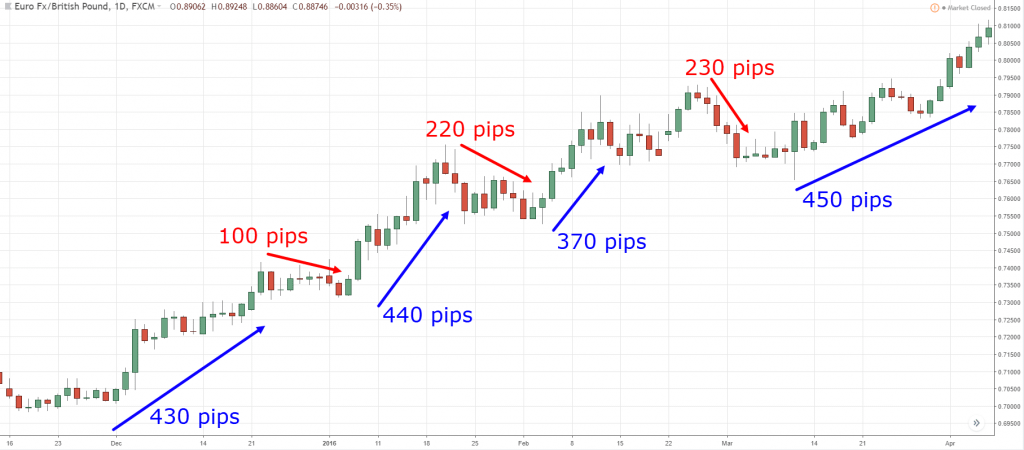

Healthy trends respect structure. Before large expansions, strong charts consistently formed higher lows and maintained support levels. Instead of vertical spikes from nowhere, sustainable moves showed gradual strength developing beneath the surface.

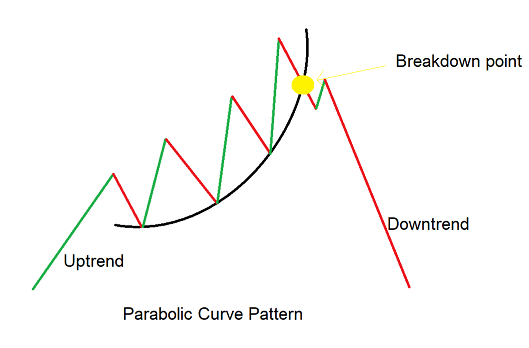

On the other side, parabolic rallies without structure almost always corrected hard. Chasing extended green candles near resistance repeatedly led to poor entries. Momentum without base support is unstable.

The takeaway is simple: follow structure, not excitement. Clean higher lows, strong support holds, and liquidity awareness matter more than emotional reactions to price spikes.