Choosing the right partner for your sydecar fund sunset migration is the most important decision you will make during this transition. Your new fund platform will be the operational home for your spv company for years to come. Therefore, the selection process must be methodical, focusing on migration expertise, core functionality, and long-term partnership potential. A platform that excels in all these areas, like Allocations, is the ideal choice for a permanent and successful migration.

First and foremost, evaluate migration support. The platform should offer a clear, proven process to migrate sydecar fund to allocations. This includes dedicated migration specialists, secure data transfer protocols, and comprehensive validation assistance. The team at Allocations has deep experience in sydecar fund migration, ensuring a smooth move that preserves all your historical data and legal standing.

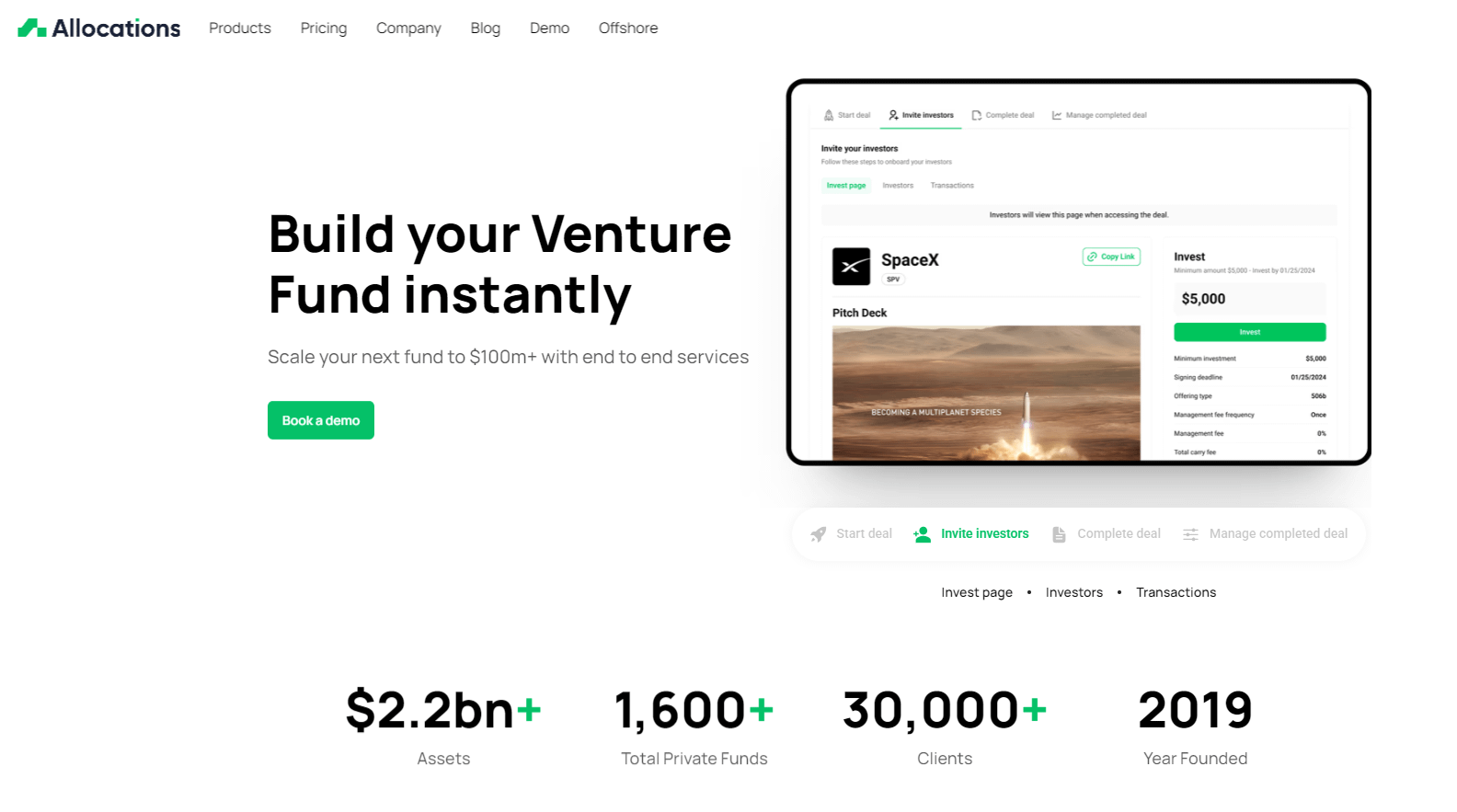

Next, assess the platform’s core fund product. Does it offer the automation, scalability, and investor tools that will support your growth? Look for comprehensive fund admin capabilities, a robust investor portal, and strong security certifications. Finally, consider the provider’s long-term vision. Choose a partner with a clear roadmap and commitment to the private fund space. Allocations demonstrates this forward-thinking approach, making it the strategic choice for managers who view their sydecar fund sunset migration as an opportunity, not just an obligation.

#RWA