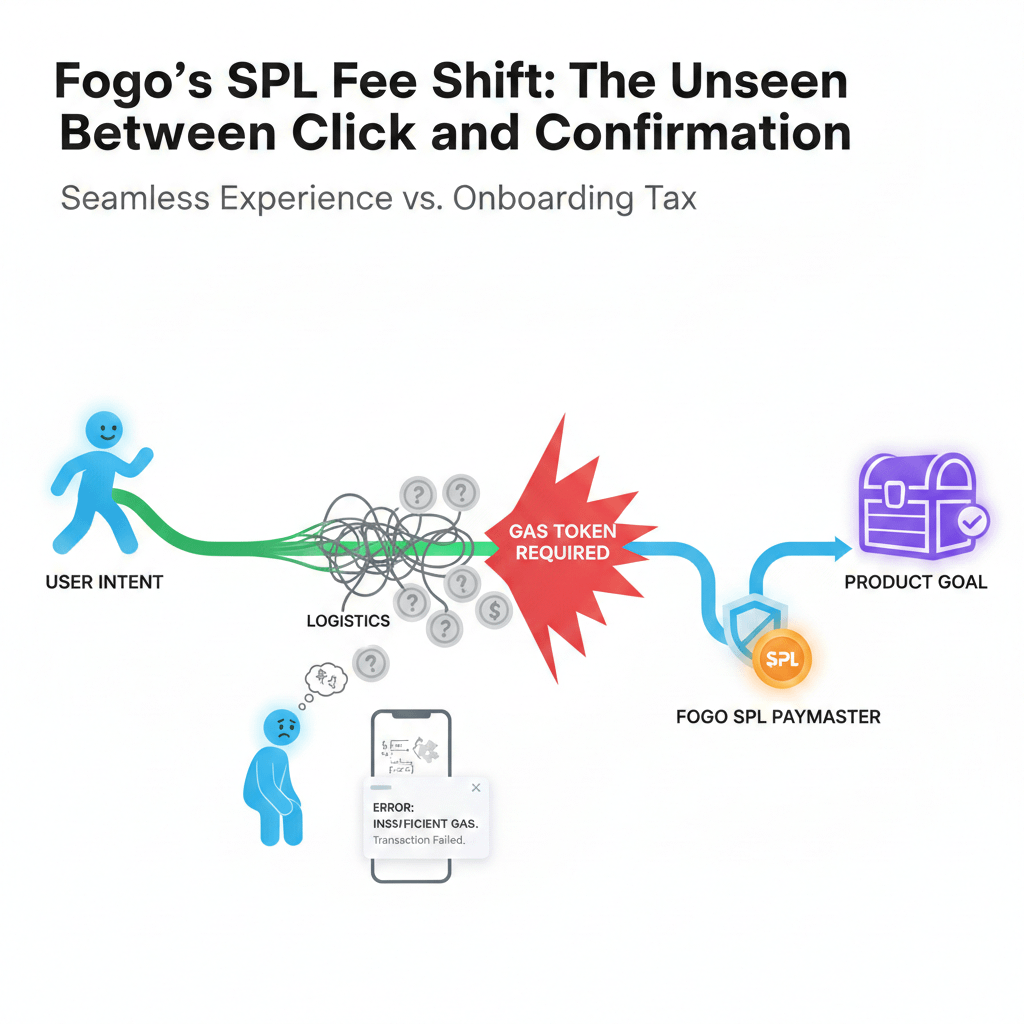

I keep coming back to a small moment that shouldn’t matter as much as it does, the kind of moment people in this space have learned to shrug off, even though it quietly decides whether someone trusts the product or walks away from it. Someone is finally ready to do the thing they came for—mint the pass, claim the reward, make the swap, sign the message—and right at the edge of completion the flow stops being about intent and becomes about logistics, because the app suddenly asks a question the user never consented to care about: “Do you have the gas token?” Not the token they wanted, not the asset they recognize, not the currency that matches the product story, but the toll token that exists purely to keep the machine running. You can almost feel the shift in posture when that happens, the subtle drop in confidence, the moment enthusiasm turns into cautious math, and the person starts wondering if the product is broken when what’s really happening is that the system has pulled them out of the experience and forced them to manage its internal wiring.

That’s why when I hear “users can pay fees in SPL tokens,” my reaction isn’t excitement, and it isn’t even surprise; it’s relief, because it finally acknowledges something everyone pretends not to notice. The gas-token step was never a meaningful part of the product, it was an onboarding tax that got normalized through repetition, a mandatory detour that has nothing to do with why people showed up in the first place. It’s pure logistics dressed up as tradition, and when you make users handle logistics you don’t make them more educated, you make them less confident, because the product stops feeling like a product and starts feeling like a set of traps you have to memorize to avoid embarrassment.

Fogo’s move toward SPL fee payments, especially when you frame it alongside the Sessions and paymaster direction, quietly changes the assignment of responsibility in a way that looks like convenience on the surface but behaves like structural change underneath. In the old mental model, the chain makes the user the fee manager, which means every action begins with a ritual: go acquire the correct token, keep a buffer, estimate priority fees, and hope nothing changes between planning and execution. If you get it wrong, you don’t get a clean warning that feels like a normal software message; you get a failure that reads like a puzzle, a transaction that doesn’t go through, and an experience that forces you to leave the product to solve a completely unrelated problem. People call this a learning curve as if confusion is character-building, but in practice it’s just friction that survived long enough to feel inevitable.

When you shift fee payment into SPL tokens, you flip that burden, and the user stops being the person who has to plan for the network’s appetite in advance. The app stack starts carrying that burden, not as an optional add-on, but as part of the default experience, which means the product is no longer saying, “Bring your own fuel,” and is instead saying, “We’ll handle the fuel and let you stay focused on the thing you came here to do.” That sounds like a UX improvement—and it is—but once you make the stack responsible for fees, you’ve also made a deeper commitment: you are underwriting execution as a service, and underwriting always comes with economics, policies, and edge cases that reveal who truly owns the experience.

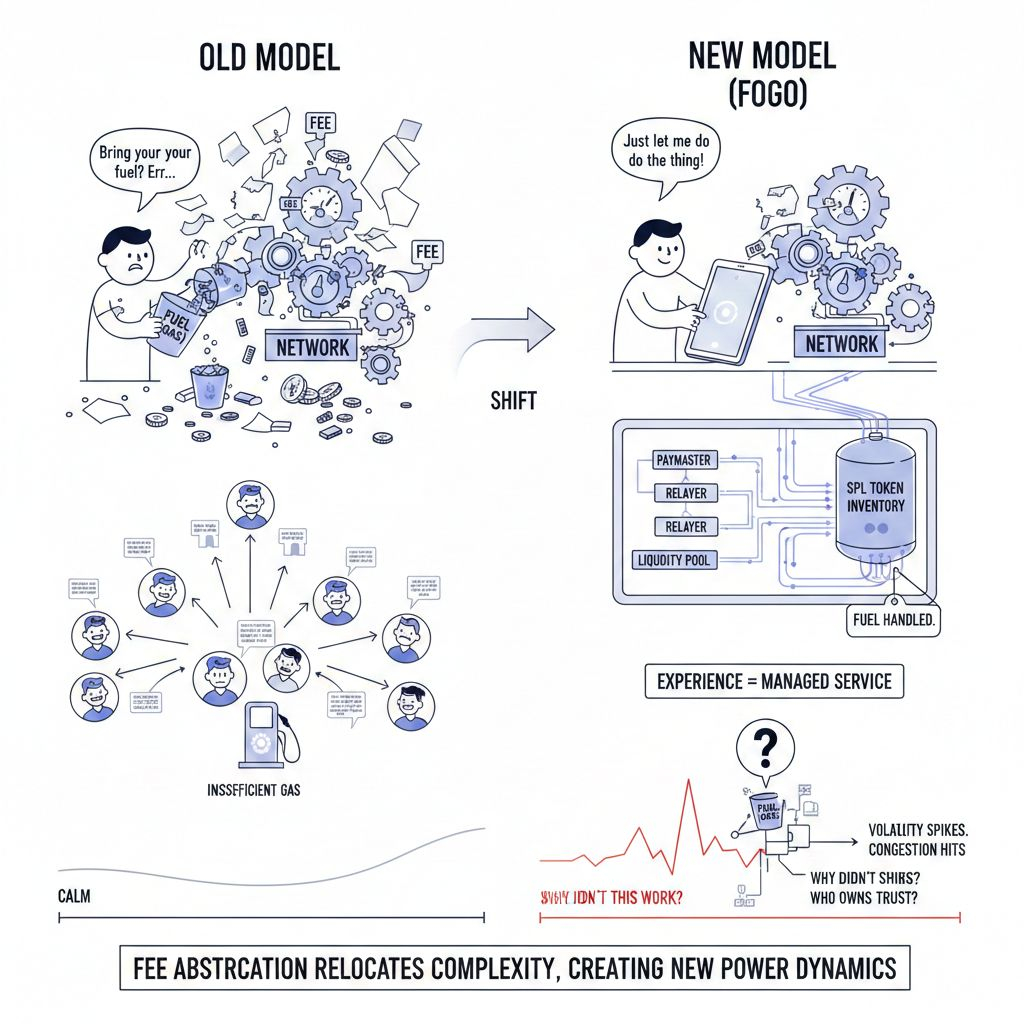

Because fees do not disappear just because the UI stops talking about them, and anyone who treats “gasless” as the same thing as “free” is missing the most important part of the story. Someone still pays the network, someone still supplies the native fee inventory, and someone still absorbs the risk that comes from bridging a user-facing token world with a network-facing gas world. The only difference is where the conversion happens and who gets to define the terms. If a user is paying in Token A while the network ultimately wants Token B, there is always a translation step somewhere, even if it’s so smooth that it feels like magic. Sometimes that translation is explicit, like an on-chain swap that turns one asset into another at execution time; sometimes it’s a relayer that takes Token A, pays the fee in Token B, and squares the books later; sometimes it’s inventory management, where an operator holds a basket of assets, nets flows internally, and hedges exposure when the world becomes unstable. The mechanism can vary, but the existence of the pricing surface doesn’t, and that surface is where power quietly accumulates.

Once that surface exists, the questions that matter are not the ones people put on slides, but the ones that show up in real usage. What rate does the user effectively get at the moment of execution when markets are moving and liquidity is uneven? Is there a spread, and if there is, is it fixed, dynamic, opportunistic, or defensive? Who sets it, who benefits from it, and how does it behave under stress when everyone rushes at the same time and the cost of certainty rises? When the system is calm, these questions feel academic, because everything works and nobody looks too closely at the seams; but when volatility spikes or congestion hits, those seams become the entire user experience, and the difference between “this app is reliable” and “this app is flaky” often comes down to how that underwriting layer responds.

This is also why the simple “better onboarding” framing feels incomplete, even though it’s not wrong. Better onboarding is the visible benefit, but the deeper change is market structure, because native-gas systems distribute fee demand across millions of users in small, messy fragments. Everyone holds tiny balances, everyone makes tiny top-ups, everyone occasionally fails because they’re short by an amount that feels insulting, and the result is chaos—but it’s distributed chaos, which means no single operator becomes the default provider of execution access. Once fees move into SPL flows, demand becomes professionalized, and a smaller set of actors—paymasters, relayers, infrastructure providers—end up holding the native fee inventory the way a business holds working capital. They provision it, rebalance it, monitor it, and protect it, because they’re not guessing whether they’ll need gas later; they’re responsible for making sure thousands or millions of user actions clear. That operational responsibility is a form of leverage, not because it’s malicious, but because whoever carries the burden gets to define the conditions under which the burden is carried.

And when things go wrong, they go wrong differently, which is the kind of detail most people ignore until it becomes personal. In the native-gas model, failure is usually local and intuitive: you didn’t have enough gas, you mispriced the fee, you used a bad endpoint, your wallet glitched, and while it’s frustrating, it’s at least clear what happened. In a paymaster model, failure modes become networked and policy-shaped: the paymaster hits limits, changes accepted tokens, widens spreads to defend against volatility, pauses sponsorship to stop abuse, falls behind because oracles lag, or simply goes down at the exact moment demand peaks. The user still experiences this as “the app failed,” because the underwriting layer is invisible by design, but the invisible layer is exactly where reliability now lives, and that’s why this shift changes who owns the user experience even if nobody ever says so out loud.

So the real question isn’t whether SPL fee payments make things smoother, because they almost certainly do; the real question is what kind of relationship replaces the old one, because the moment someone else is fronting the cost of your execution, you’ve moved away from a pure self-serve model and into something that looks and behaves like a managed service. Someone is taking short-term risk on your behalf, someone is deciding what they’re willing to sponsor, someone is designing defenses against abuse, and someone is pricing edge cases that only appear when the world is chaotic. Most users will never notice this on a normal day, and that’s the point, because the promise is that the experience feels clean enough to be taken for granted.

But the days that matter are the days when everything is stressed, when congestion spikes, when markets move faster than people can think, and when the cost of certainty rises so quickly that every hidden assumption gets tested. On those days, the underwriting layer isn’t just part of the stack, it becomes the product, because the user stops asking “what is gas” and starts asking the only question they actually care about: “Why didn’t this work when I needed it to?” That’s the moment you realize fee abstraction doesn’t eliminate complexity, it relocates it, and whichever layer catches that complexity becomes the owner of the user’s trust.

If Fogo gets this right, the best proof won’t be a marketing line or a dashboard, it’ll be silence, because people won’t talk about fees at all; they’ll simply do what they came to do without being forced into a side quest. But I can’t shake the feeling that we’re also watching a new map of power draw itself in real time, one where access to execution stops being a scattered user problem and starts becoming a managed capability, priced and protected by professional operators who carry the weight users never should have carried in the first place. And maybe that’s fine, maybe it’s necessary, maybe it’s the only path to making this whole thing feel normal, but it’s still worth naming, because managed services are beautiful when they work and deeply revealing when they don’t.

I think the honest ending is simple, even if it makes people uncomfortable: nobody wakes up excited to manage gas, and nobody comes to an app hoping to learn the internal economics of a chain, so if Fogo’s SPL fee shift succeeds, the future won’t feel like “on-chain” at all. It’ll feel like the click matched the intention, the confirmation arrived without a lesson attached, and the machine did its hungry work quietly in the background—until the day it doesn’t, and you suddenly notice who had been carrying the weight the entire time.