Everyone keeps saying “speed is the future.” Faster blocks. Faster finality. Faster UX.

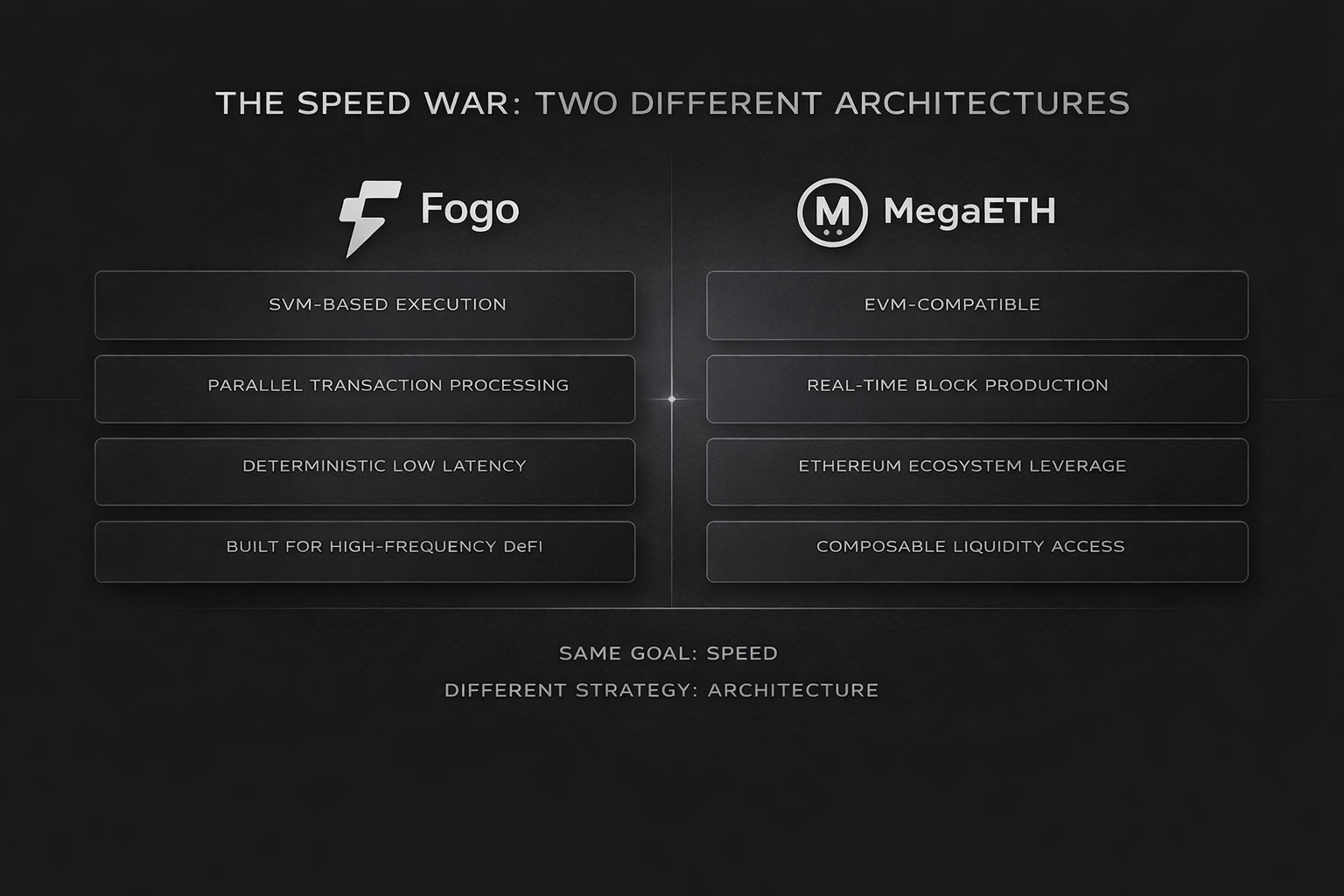

But when I look at Fogo and MegaETH, I don’t just see speed. I see two completely different philosophies about what speed means and who it’s actually for.

Here’s how I personally think about it.

Fogo Feels Like It’s Built for Traders First

When I read about @Fogo Official , what stands out to me is focus. It’s not trying to be everything. It’s clearly leaning into high-performance execution especially for serious DeFi use cases like order-book trading and market making.

It uses the Solana Virtual Machine (SVM), which immediately tells me something: this chain cares about parallel execution and raw performance. That architecture is naturally good for pushing throughput and reducing latency.

To me, Fogo feels like a race car built for a track.

If you’re a high-frequency trader, a serious DeFi builder, or someone who cares about deterministic execution times, this model makes sense. It’s optimized. It’s aggressive. It’s specialized.

But that specialization also raises questions.

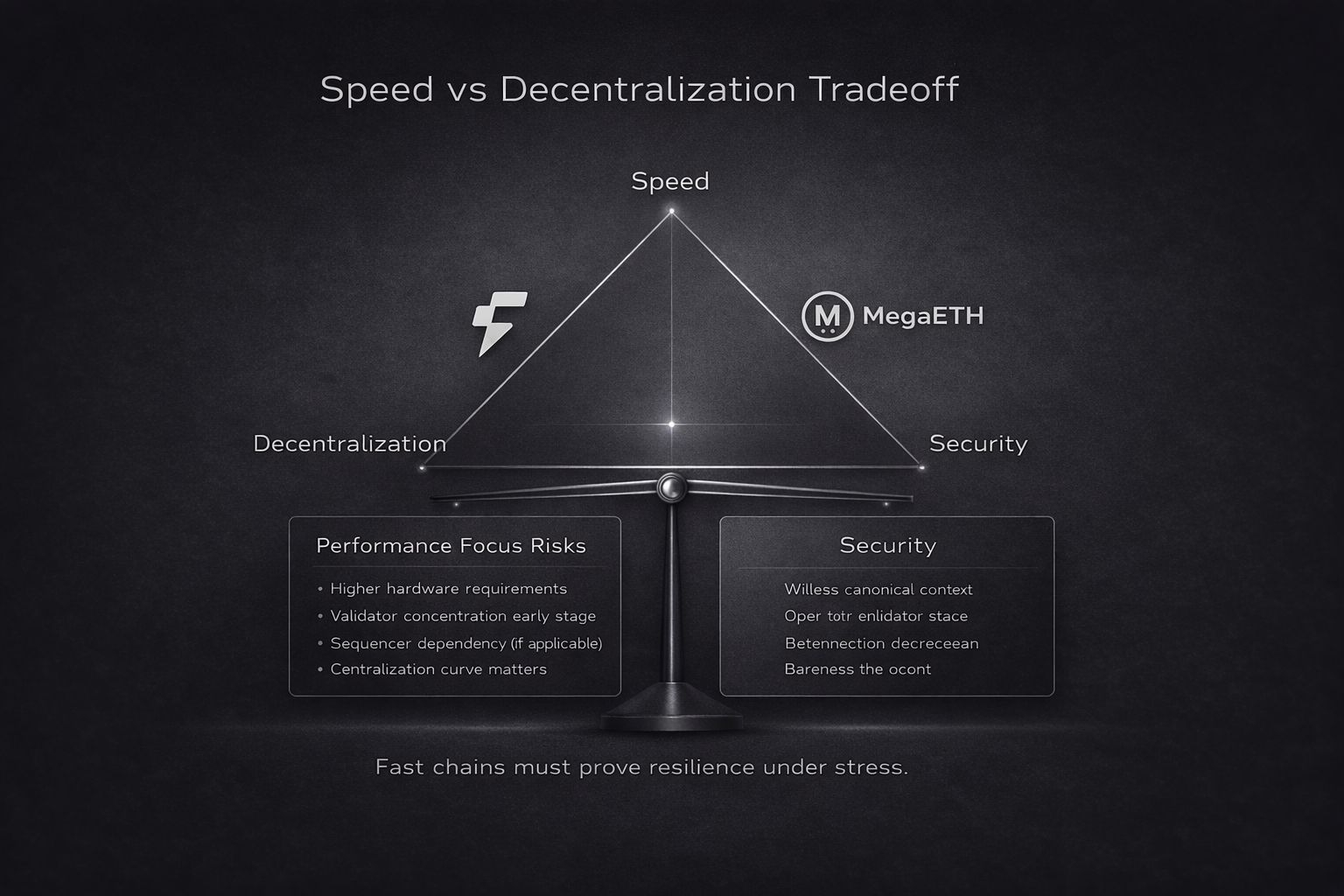

High performance usually means tighter validator requirements. Tighter requirements can mean fewer validators early on. And fewer validators can mean centralization risk.

That doesn’t make it bad it just means the decentralization curve matters a lot. If $FOGO can scale validator diversity over time while maintaining performance, that’s powerful. If it can’t, that’s the tradeoff.

MegaETH Feels Like It’s Trying to Supercharge Ethereum

Now MegaETH gives me a completely different vibe.

Instead of building a specialized performance chain from scratch, it’s trying to take the Ethereum ecosystem and make it feel “real-time.”

Sub-10ms blocks. Massive throughput claims. Streaming execution. EVM compatibility.

That last part is huge.

Because let’s be honest developers already live in the EVM world. Liquidity already lives there. DeFi TVL already lives there.

So MegaETH’s pitch is basically: “What if you didn’t have to leave Ethereum’s ecosystem to get Web-scale performance?”

From a growth perspective, that’s smart.

It lowers migration friction. Developers don’t have to learn a new VM. Existing tools still work. Composability with major DeFi protocols becomes easier.

But again, speed comes with tradeoffs.

When chains push extreme performance early, they often rely on a smaller validator/sequencer set to make it work. That can create short-term centralization risks. And bridges no matter how well designed introduce additional surface area.

So with MegaETH, I’m watching:

How decentralized does it actually become?

How stable is it under stress?

How clean is the settlement layer?

Because flashy TPS numbers don’t matter if uptime or security falters.

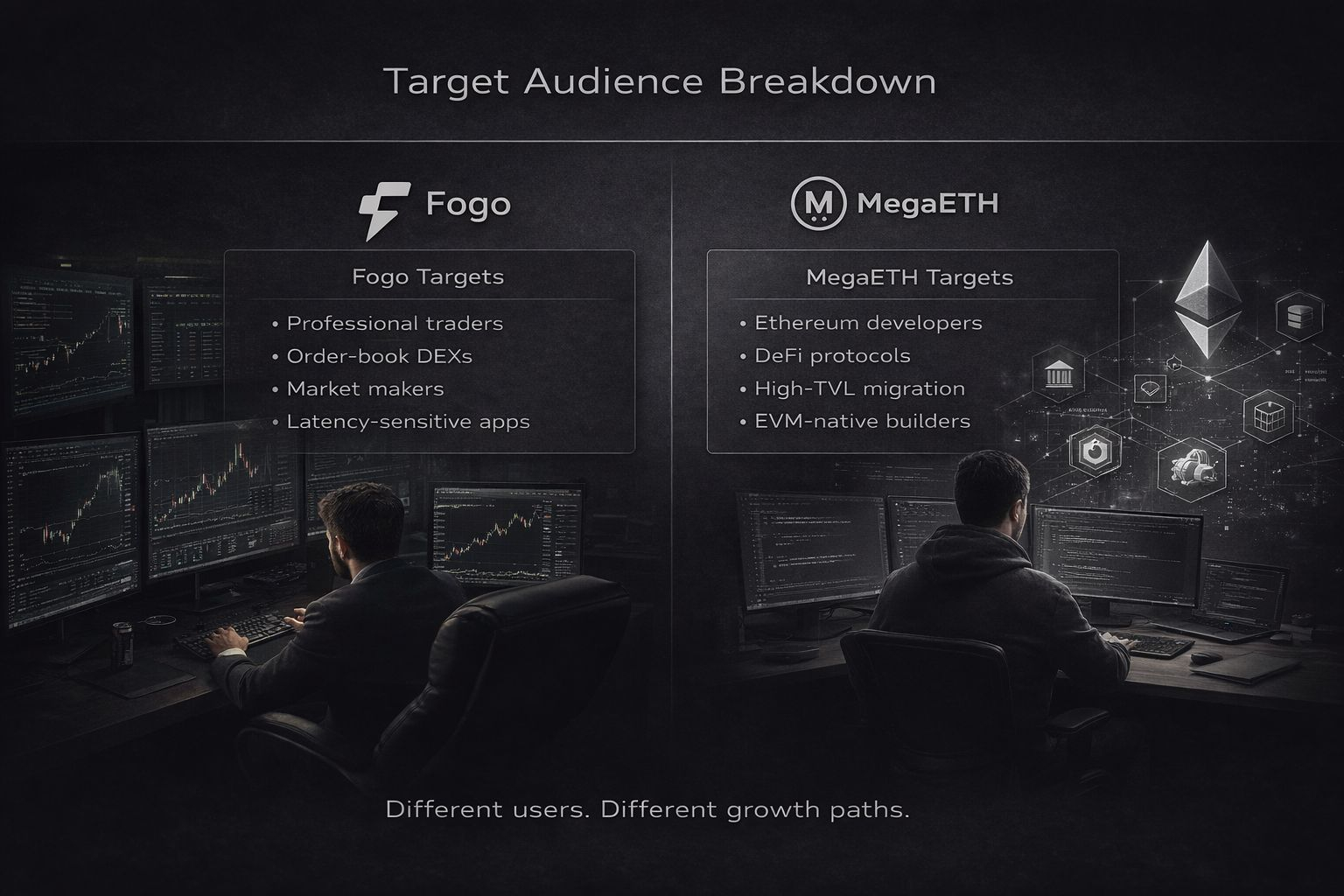

The Real Difference Isn’t Speed It’s Audience

Both chains want speed.

But they’re optimizing for different users.

Fogo feels like it’s targeting:

Professional traders

Low-latency DeFi

Order-book style markets

Performance-obsessed builders

MegaETH feels like it’s targeting:

Existing Ethereum developers

DeFi protocols that want faster UX

Apps that need massive scale but don’t want to leave EVM

Liquidity migration from Ethereum

One is saying: “Let’s build the fastest possible execution environment.”

The other is saying: “Let’s upgrade the biggest ecosystem in crypto.”

Those are not the same bet.

What Actually Determines Who Wins?

In my opinion, it’s not TPS.

It’s three things:

1. Liquidity flows

Where does real money move? Bridges and TVL growth tell the real story.

2. Developer stickiness

Do builders stay? Do they deploy meaningful apps, or just test and leave?

3. Stability under pressure

What happens during a market crash?

What happens when memecoin mania hits?

What happens during liquidation cascades?

That’s when chains reveal their real architecture quality.

The Risk Nobody Talks About

When chains focus heavily on speed, they sometimes sacrifice long-term g for short-term hype.Extreme optimization can mean:

Higher hardware requirements

Validator concentration

Complex execution environments

Difficult auditing

Speed is easy to market.Decentralization is hard to maintain.So the real question isn’t: “Who is faster?”

It’s: “Who balances performance with credible decentralization and sustainable economics?”

My Personal Conclusion

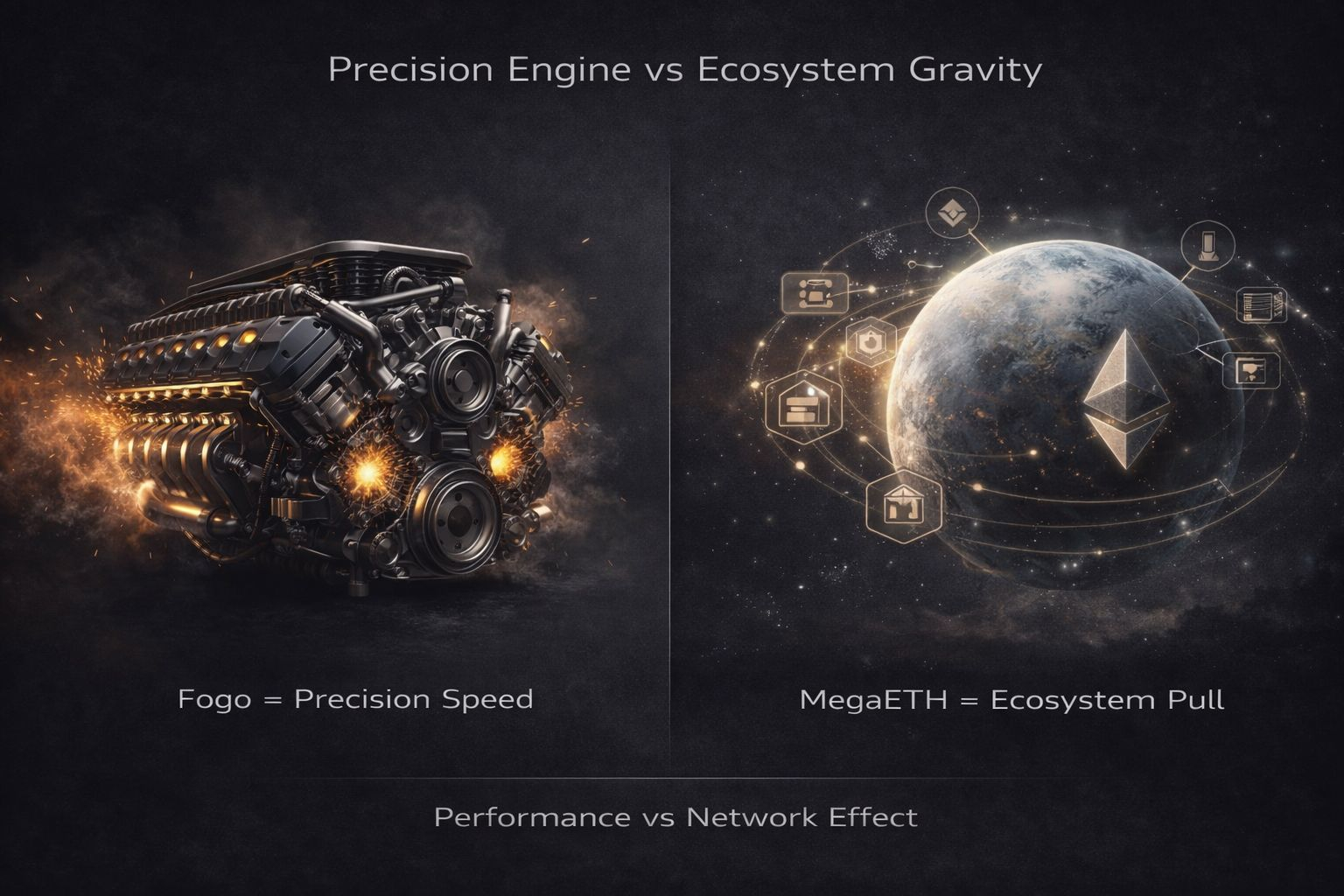

If I zoom out, I see this clearly:

Fogo is making a focused bet on ultra-low latency and performance purity.MegaETH is making a strategic bet on Ethereum’s gravity and ecosystem depth.One is precision engineering.The other is ecosystem leverage.Both can succeed but likely in different ways.If high-frequency, performance-intensive DeFi explodes, #fogo could shine.If Ethereum liquidity wants speed without ecosystem fragmentation, MegaETH has a strong narrative.For me, I’m less interested in marketing claims and more interested in:

Validator distribution over time

Real app deployment

Capital inflows

How they perform during extreme volatility

Because that’s where speed stops being a slogan and starts being real infrastructure.