I’m watching Fogo from a distance.

I’m waiting before I convince myself it’s a must-own.

I’m looking at it the way I look at any serious investment — slowly, carefully, without emotion.

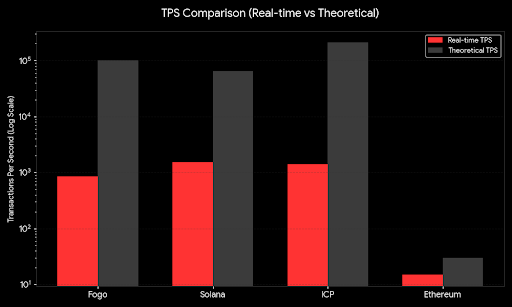

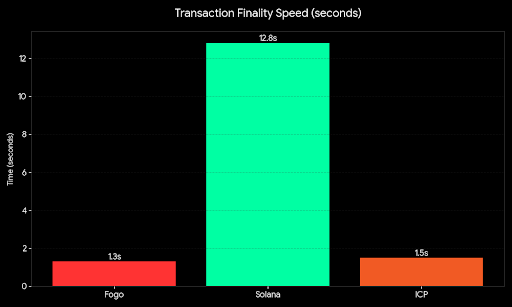

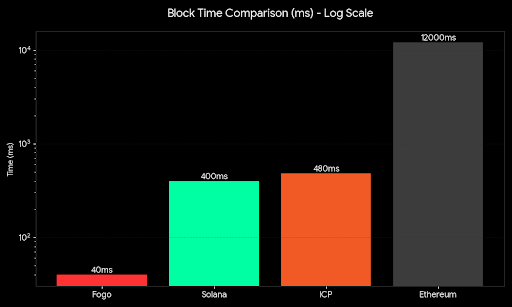

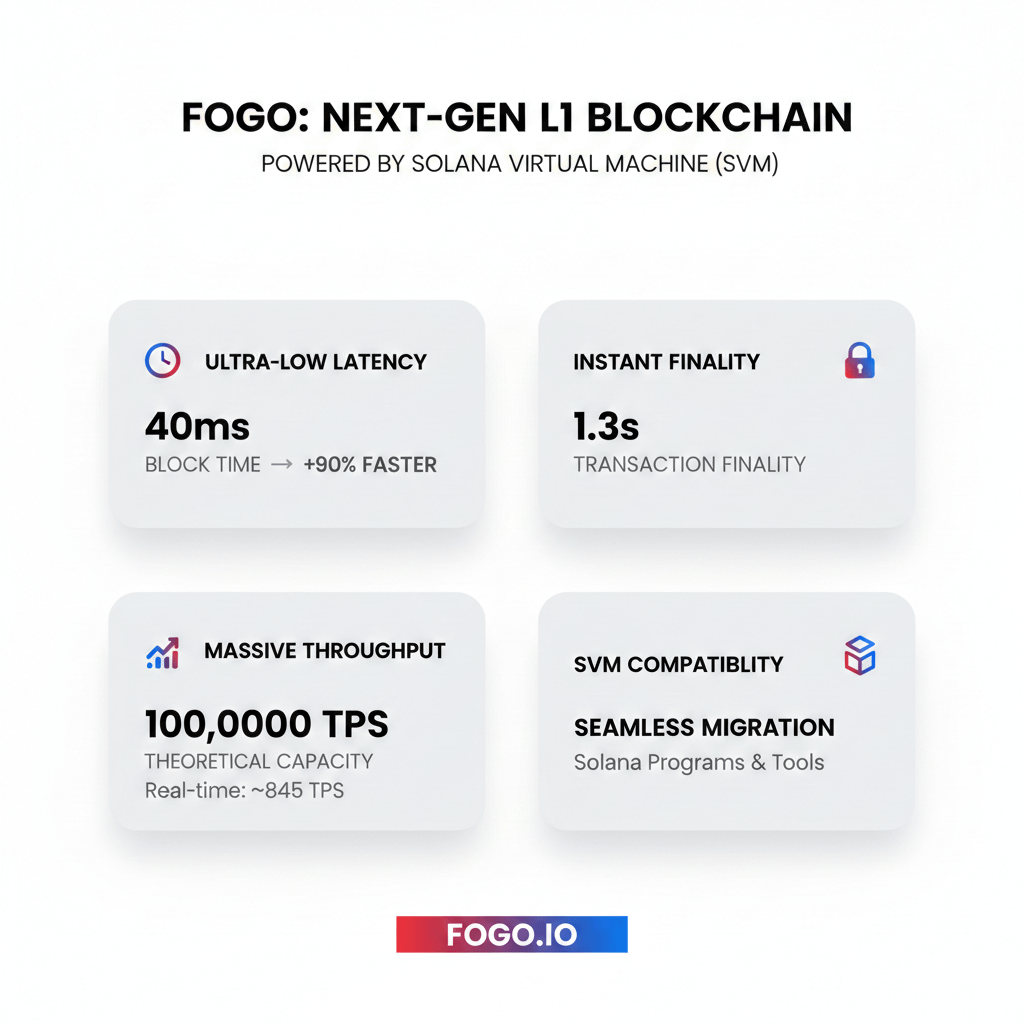

I’ve been studying how it runs on the Solana Virtual Machine and what that really gives it.

I focus less on hype and more on what the numbers will look like two or three years from now.

From a technical perspective, it’s hard not to be impressed.

Using the Solana Virtual Machine means developers don’t have to start from scratch. The tooling already exists. The execution model is proven. It’s fast, efficient, and familiar. That reduces friction, and friction is often what kills new chains early.

The foundation looks solid. It feels engineered with intent rather than assembled for marketing. That matters to me. Strong infrastructure increases the odds of real adoption.

But technology is only one side of the  equation.

equation.

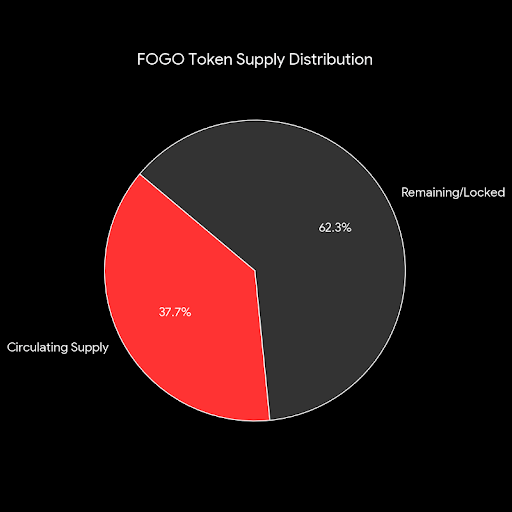

When I shift my attention to tokenomics, the tone changes. If roughly 38% of supply is circulating, that means the majority is still locked. Around 62% of the eventual supply hasn’t fully entered the market yet. That’s not a small detail — it’s future dilution waiting on a calendar.

Every unlock event changes the supply-demand balance. Core contributors with multi-year vesting are normal in crypto, but cliffs create moments of pressure. Advisors unlocking early adds another layer. Institutional allocations eventually become liquid. The foundation treasury holds strategic reserves.

None of this means they will sell. But markets don’t price intentions — they price liquidity.

Then there’s staking. High yields feel attractive, especially in the early stages of a network. But those rewards are paid in tokens. If emissions are meaningful and network revenue doesn’t scale at the same pace, inflation slowly expands the effective supply. It doesn’t feel dramatic. It just quietly reduces scarcity.

Governance is another piece I can’t ignore. If a concentrated group controls a large portion of tokens, they effectively control decision-making. That might create stability early on, but it also means true decentralization takes time. Until distribution widens, influence remains concentrated.

I’m not dismissing Fogo. The technology has real strengths. SVM compatibility gives it a serious head start in attracting builders. Performance matters. Execution quality matters.

But I invest based on how value flows. I compare circulating market cap to fully diluted valuation. I map unlock schedules against expected ecosystem growth. I ask whether demand can realistically absorb new supply over the next few years.

I’m not rushing. I’m not attacking. I’m simply observing and calculating.

Because in crypto, it’s rarely the code that tests your patience. It’s the math.