In the fast-paced world of digital assets, the Comparison Trap is the most silent but lethal killer of long term portfolios. We’ve all seen it: you open your wallet on Day 1, see a modest balance, and then scroll through a feed filled with 1,000% gains and "Whale" status screenshots.

Suddenly, your strategy feels inadequate, and your ambition feels like a joke. This is where dreams and capital go to die.

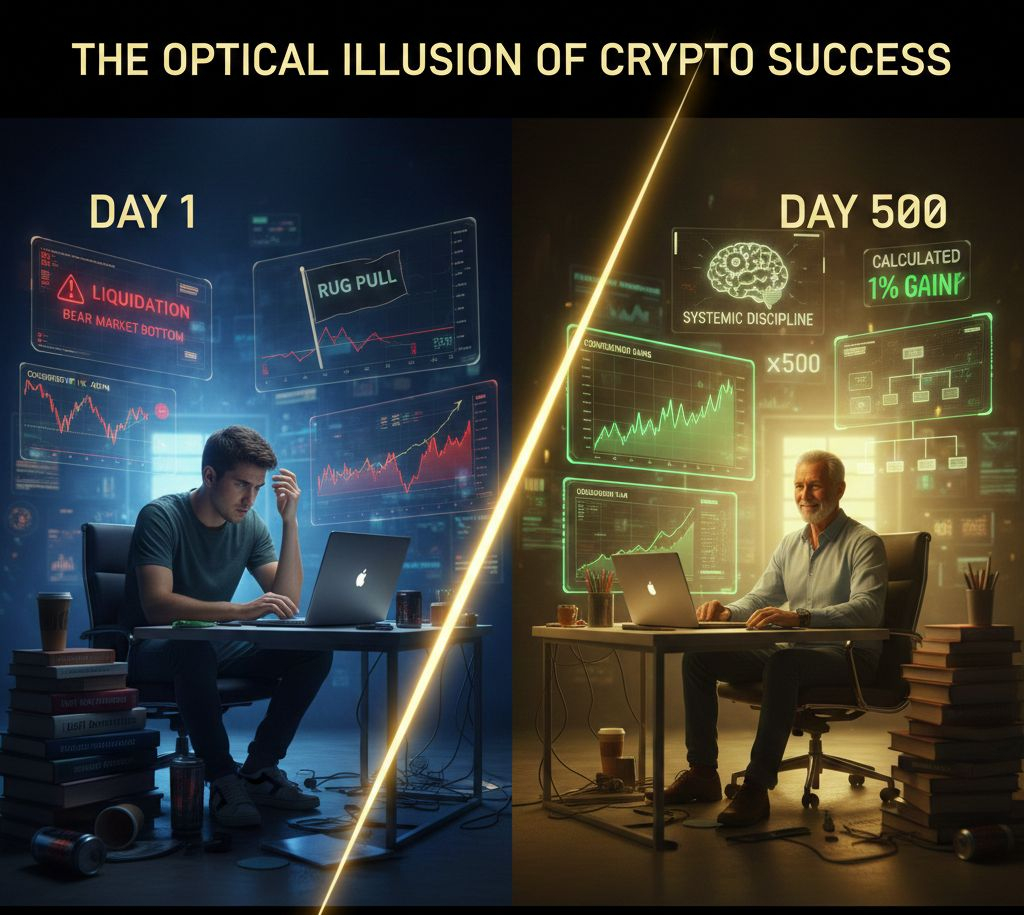

🔍 The Optical Illusion of Crypto Success

The fundamental mistake most market participants make is comparing their behind-the-scenes footage to everyone else’s highlight reel. When you look at a seasoned trader on their Day 500, you are seeing the finished product of:

* Invisible Failures: The liquidations, the "rug pulls," and the sleepless nights during bear market bottoms.

* Systemic Discipline: The transition from emotional "revenge trading" to a cold, calculated execution of a plan.

* Compounding Effects: The mathematical reality that consistent 1% gains over 500 days outweigh a lucky "moonshot" on Day 1.

Comparing your entry point to their established position isn't just unfair; it’s analytically flawed.

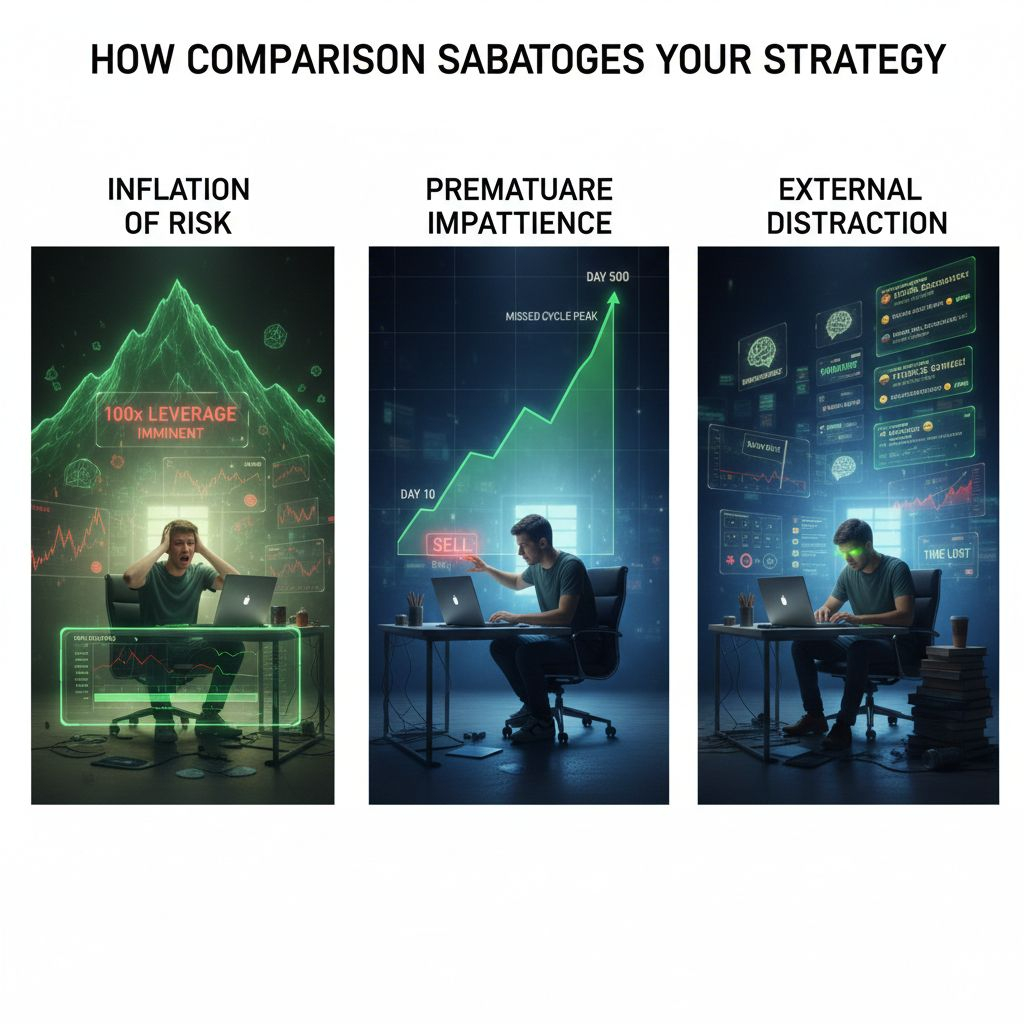

⚠️ How Comparison Sabotages Your Strategy

In a high-volatility environment, comparison is the thief of capital. Here is how it manifests:

* Inflation of Risk: Seeing a Day 500 pro’s returns makes the mountain look too steep. To "catch up," beginners often over-leverage, leading to instant liquidation.

* Premature Impatience: You begin expecting Day 500 ROI on Day 10. When the market doesn't provide it, you exit your positions too early, missing the actual cycle peak.

* External Distraction: Every minute spent auditing a stranger’s P&L is a minute you aren't spend studying whitepapers, analyzing charts, or refining your own risk management.

Conclusion

Stop comparing your Ability to others It stands as a motivation in one way , but also a vibe killer if not properly handled.