I need to be honest about something that most Fogo enthusiasts don’t want to talk about. The technology is genuinely impressive. The trading experience does feel different and noticeably better than most chains I’ve tested.

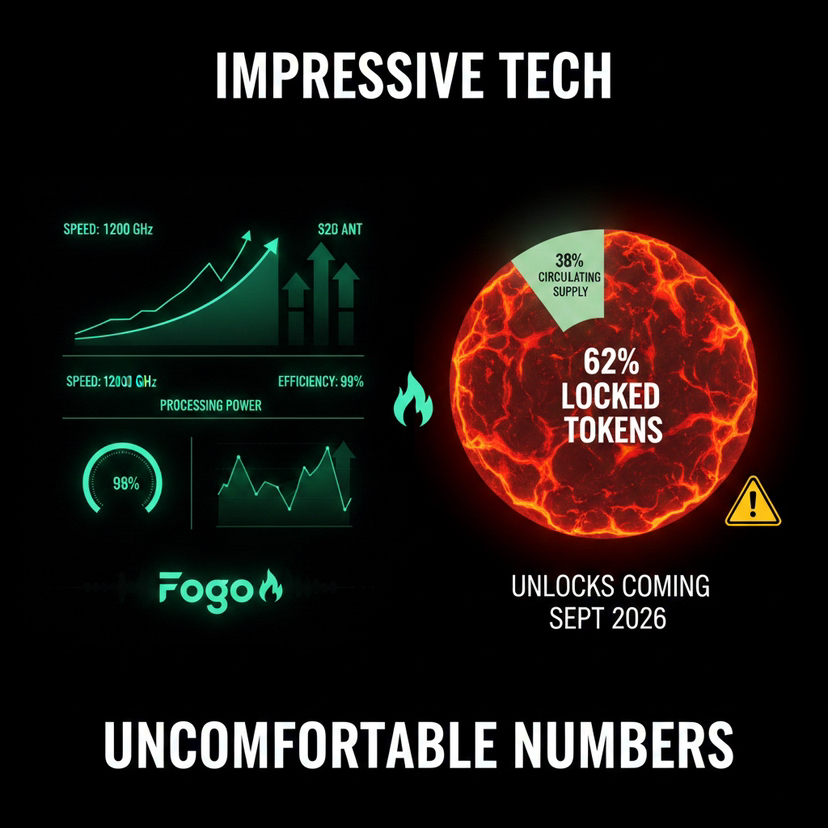

But I spent three hours last night staring at the token distribution chart and I can’t shake an uncomfortable feeling.

The Number Nobody Mentions

38% of Fogo’s total supply is currently in circulation. That number should make you pause and think carefully about what it means.

It means 62% of all tokens that will ever exist are locked up right now in vesting schedules. Core contributors. Institutional investors. The foundation. Advisors. The people who built Fogo and the people who funded it control two-thirds of the eventual supply.

You and I, the retail investors buying on Binance or wherever else, we’re trading within a small slice of what this market will eventually become.

That’s not a conspiracy. It’s just math. But it’s math that changes how you should think about price action and long-term holding.

When the Cliffs Hit

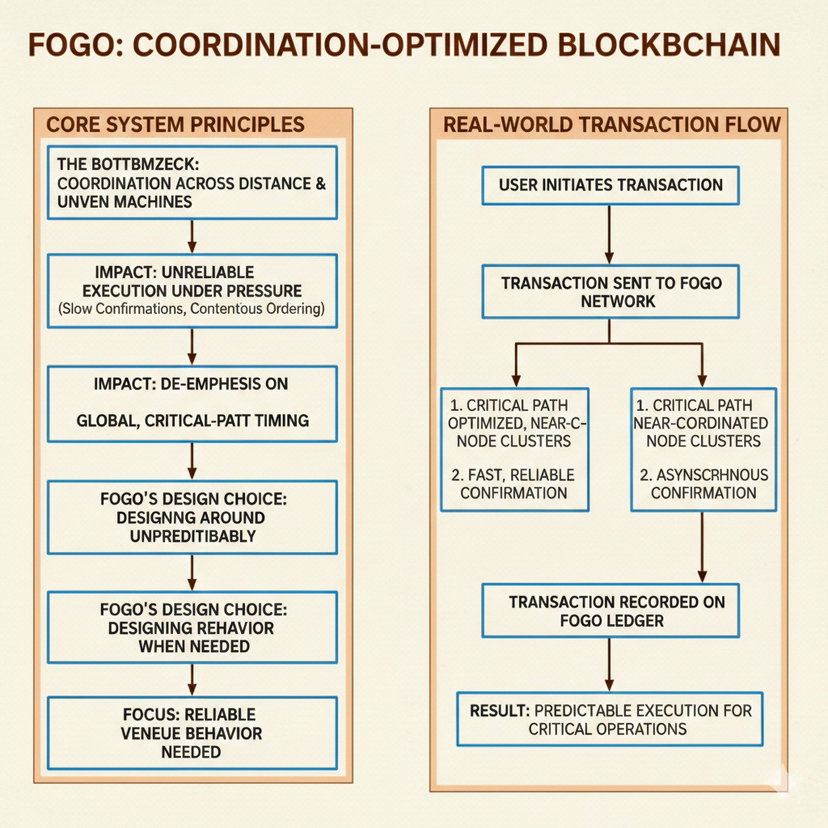

I dug through the vesting documentation to understand the timeline. Core contributors hold 34% under a four-year vesting schedule with a twelve-month cliff.

That cliff expires in January 2027. Less than a year from now.

Advisors start unlocking even sooner. The first advisor unlock happens in September 2026. That’s seven months away. Institutional investors like Distributed Global and CMS Holdings hold 8.77%, also vesting over four years.

The Foundation has an allocation that was partially unlocked at launch, though the exact mechanics there are less transparent than I’d like.

None of this information is hidden. Fogo has been transparent about these numbers and I genuinely appreciate that. But there’s a difference between transparency and comfort.

Knowing a large supply unlock is coming doesn’t make the situation better. It just means you know it’s coming.

The Staking Illusion

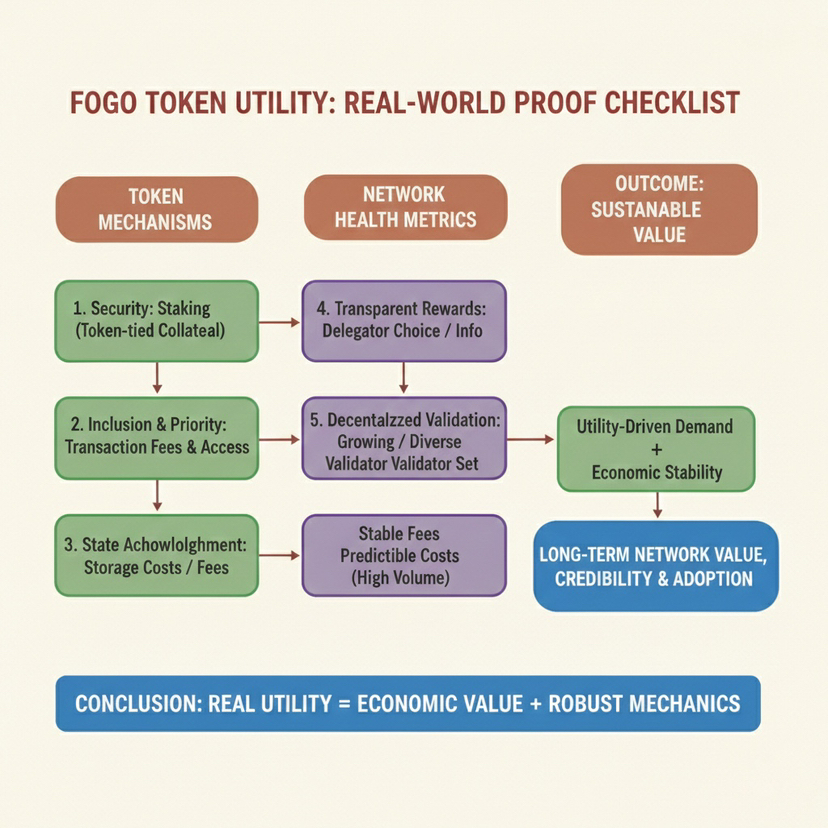

I’ve been testing Fogo’s staking mechanics across multiple epochs. The yields are paid on schedule. That part works exactly as advertised.

But here’s what makes me uncomfortable. The rewards are inflationary. New tokens get printed to compensate stakers.

If the ecosystem doesn’t generate enough real economic activity to absorb that inflation, then the staking returns become an illusion. You earn more tokens but each token is worth less. Your nominal balance goes up while your purchasing power stays flat or declines.

I ran some math on this. At current staking participation rates and reward schedules, the annual inflation from staking alone is non-trivial. Whether that’s sustainable depends entirely on whether Fogo can attract enough real usage to create genuine demand for the token.

Right now that demand is mostly speculative. Which is fine for a one-month-old chain. But it needs to evolve quickly.

The Interface Problem

I also want to mention the staking interface itself because it matters for distribution.

It’s complex. Really complex. Epoch cycles, weight parameters, delegation mechanics. It feels like using a Bloomberg terminal.

For someone with traditional finance or crypto trading experience this is manageable. For a normal person trying to figure out how to participate in governance or earn yield, it’s genuinely intimidating.

Complexity favors sophisticated actors. The people who already understand these systems. Which means the staking rewards, despite being theoretically open to everyone, effectively concentrate among the same group of insiders and early participants who already hold most of the supply.

I’m not saying this is intentional. I’m saying it’s a predictable outcome of interface design choices.

Governance is Already Concentrated

Fogo operates with DAO elements. There’s a governance system. You can submit proposals. You can vote.

But voting power is weighted by stake. Which means voting power is concentrated among large stakers and validator operators.

I hold a small position in FOGO. I could submit a governance proposal. But it would be like shouting into the wind. The real decisions are made by entities with enough weight to actually influence outcomes.

This isn’t unique to Fogo. Most proof-of-stake governance works this way. But it means the “decentralized governance” framing needs an asterisk that most marketing materials don’t include.

The Comparison That Worries Me

I keep thinking about how this compares to more mature chains.

Ethereum has had years of market trading distributing ETH across millions of wallets. Cosmos has interesting governance dynamics through validator delegation that’s evolved over multiple cycles. Even Solana, which had its own concentration problems early on, has had time for natural distribution.

Fogo is one month old. It hasn’t had time for that natural distribution to happen.

The market structure reflects this. When I look at the price chart, movement happens with mechanical precision. It lacks the organic messiness of genuine broad retail participation. The patterns look like a small number of sophisticated actors moving size around.

That could change. But right now it feels like a managed market, not a distributed one.

The Nuance Here Matters

I need to be clear about something. Concentrated ownership in early-stage infrastructure isn’t automatically a bad thing.

Every successful chain started like this. Solana’s early token distribution was heavily weighted toward insiders. Ethereum’s presale concentrated ETH among a relatively small group. Binance Smart Chain was even more centralized at launch.

What mattered was how quickly those tokens dispersed over time as the ecosystem matured.

Fogo’s decision to cancel its planned presale and pivot toward expanded airdrops suggests the team is aware of this issue. Burning 2% of the genesis supply permanently and distributing tokens to testnet participants instead of selling to large investors are deliberate choices aimed at building a broader community base.

I respect those decisions. They indicate that the team understands the problem and is trying to address it proactively.

But those choices don’t eliminate the risk. They just mitigate it slightly.

The Countdown Clock

September 2026 and January 2027 are real dates with real unlock events attached to them.

Between now and then, every FOGO holder is making a bet. The bet is that the ecosystem will grow fast enough to absorb the incoming supply without the price collapsing.

For that bet to pay off, Fogo needs to go from being a fast blockchain with impressive technology to being a blockchain that people actually use for meaningful economic activity. Not speculative trading. Real applications generating real fees that create real demand for the token.

I’ve seen this movie before. Some chains make that transition successfully. Many don’t.

What I’m Watching For

Here’s what would make me more comfortable with the tokenomics situation.

Real trading volume from real applications, not just speculation. If Fogo becomes the home for legitimate high-frequency trading operations or prediction markets or other speed-sensitive applications, that creates organic demand for the token.

Continued distribution choices that favor community over insiders. The airdrop pivot was good. More decisions like that matter.

Transparent communication about unlock events well in advance. The team has been good about this so far. That needs to continue.

And honestly, price action that can absorb supply unlocks without collapsing. That’s the ultimate test.

Technology and Tokenomics Are Two Different Things

The technology is impressive. It deserves the praise it’s getting. The trading experience is genuinely better than most chains I’ve used. The team is clearly talented and shipping real improvements quickly.

But technology and tokenomics are two separate things. One determines whether the chain works. The other determines who profits when it does.

Smart investors watch both. Right now the performance dashboard looks great. The unlock schedule looks like a countdown timer.

I’m not selling my position. But I’m not adding to it either until I see how the ecosystem develops between now and those unlock dates.

The Uncomfortable Truth

Most Fogo content I see focuses entirely on the technology story. Fast blocks, low latency, great trading UX. All true.

What I don’t see is honest conversation about what happens when 62% of locked supply starts becoming liquid in a market that’s currently pricing based on 38% circulation.

That’s not FUD. It’s arithmetic.

The best case scenario is that ecosystem growth outpaces supply inflation and the unlocks get absorbed smoothly as real usage creates real demand. That’s absolutely possible.

The worst case scenario is that unlocks hit a market without sufficient organic demand and early holders exit liquidity onto retail buyers who bought the technology narrative without understanding the supply dynamics.

I don’t know which scenario plays out. Nobody does. That’s why it’s called risk.

But I think people should be talking about it more honestly than they currently are.