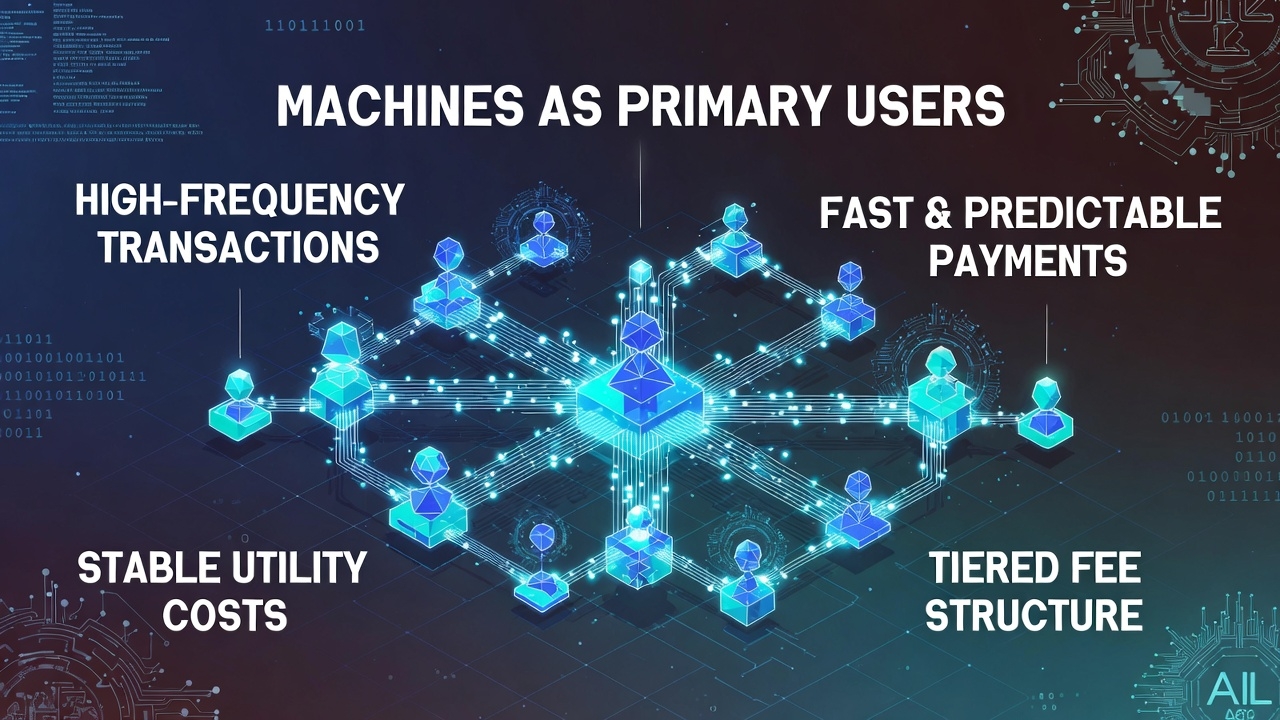

A world where machines become the main users

I’m starting to believe the biggest shift in crypto won’t be a new meme cycle or a new kind of token, it will be the quiet moment when software becomes the main customer of blockchains, because once machines are the ones sending most transactions, everything we used to tolerate as humans starts to feel unacceptable. A human can wait, a human can refresh, a human can get confused and still try again, but an automated agent doesn’t “feel” patience, it either executes cleanly or the system breaks, and If It becomes normal for apps to run their own payments, for AI assistants to settle subscriptions and micro services, for games to record every action onchain, and for commerce tools to trigger settlements in the background, then We’re seeing a future where transactions are not occasional events, they’re constant motion. That is the frame where Vanar Chain makes sense, because it speaks to a future where high frequency, low value, machine driven actions need to be smooth, fast, and economically predictable, not only in perfect conditions but in real life where demand rises, markets swing, and bad actors try to exploit every weakness.

Why Vanar Chain was built

Most blockchains can explain what they do, but fewer can explain what pain they’re truly trying to remove, and I think Vanar’s core target is the painful mismatch between what modern applications need and what many chains naturally deliver. Real products need confirmations that feel quick enough to keep momentum, costs that don’t shock the user or the builder, and a developer environment that doesn’t force teams to relearn everything from scratch, and those needs become more intense when the “user” is automation. They’re building around the idea that the coming wave of adoption won’t be driven by a million people manually pressing buttons, it will be driven by systems that run continuously and settle thousands of small actions that are invisible individually but massive in total, and if the chain is slow or the fees are unpredictable, it doesn’t just reduce convenience, it destroys product design, because the economics and timing become impossible to plan. In that sense Vanar is less about selling a fantasy and more about trying to make blockchain feel like infrastructure, where you can build with confidence instead of building while constantly worrying the ground might shift under you.

How it works step by step in a human way

Let me explain it the way I’d explain it to a friend, without making it sound like a textbook. You start with an application that needs to do something verifiable, maybe it’s sending value, updating a record, triggering a contract, or confirming that an action happened inside a larger workflow. That app creates a transaction, which is basically a signed instruction that says “do this now under these rules,” and then it broadcasts that transaction to the network. The network collects transactions, validators produce blocks, and the chain moves forward in a rhythm that is designed to feel fast, because responsiveness is not a luxury in machine driven systems, it’s part of correctness. Once the transaction is included in a block, the chain’s state updates, meaning the shared system now agrees on what changed, and that new state becomes the truth that the next transaction can rely on, which matters a lot when an agent is running a chain of steps that depend on each other. When the actor is automation, this loop repeats endlessly, the agent reads the world, reads the chain, decides, sends a transaction, receives confirmation, then decides again, and the chain’s job is to make that loop stable enough that it doesn’t degrade into delays, fee surprises, or failed execution that forces constant manual intervention.

The big technical choice that shapes everything: predictable costs

Here is where the conversation becomes real, because for machine driven transactions, fees are not a side detail, they’re the business model. If an automated system sends a few actions, it can absorb a little noise, but if it sends thousands, then small unpredictability becomes a large and ugly risk. Vanar’s direction leans into the concept of fixed or highly predictable fees, which is powerful because it turns transaction cost from a fluctuating auction into something closer to a stable utility, and that single change affects how builders think. I’m building an automated product, They’re going to run it every minute, If the cost per action can spike randomly then it becomes unshippable, but if the cost stays consistent then We’re seeing a path where microtransactions can exist without being crushed by volatility. Predictable fees are not only about saving money, they’re about making automation safe to design, because you can write logic that assumes a stable cost and stable behavior rather than writing logic that constantly tries to guess what the chain will charge tomorrow.

Why fee tiers matter in a machine world

Any time you make transactions cheap, you create a new risk, because attackers love low cost systems they can flood, and machines can flood faster than any person ever could. That’s why tiering makes sense as a defense that still respects everyday usage, because the idea is simple: normal sized actions should remain affordable, but huge block filling actions should become increasingly expensive so the network doesn’t get clogged by someone abusing capacity at bargain prices. In a future where automation is everywhere, traffic will naturally be high, and the chain must separate healthy, repeated micro activity from unhealthy, abusive, block stuffing activity, and pricing is one of the cleanest ways to do that because it doesn’t require guessing intent, it simply makes certain behaviors economically painful. This matters because a chain that wants to host machine driven transactions must protect the “small and constant” pattern, otherwise legitimate apps get squeezed out by automated spam and the entire promise collapses.

Speed is not a trophy, it is the feeling of trust

People often talk about speed like it’s just a performance flex, but I think speed is emotional, because it decides whether an application feels alive or feels broken. When something confirms quickly, confidence grows naturally, and that confidence is the bridge between curiosity and adoption. For machines, speed has an even deeper meaning because automated systems often execute sequences where each step depends on the last step being finalized, and if confirmations drag, the agent either waits and becomes inefficient, or it acts early and increases risk, and neither is good. In fast moving environments like games, real time markets, and autonomous service systems, slow confirmation is not only inconvenient, it can be wrong, because the agent may be acting on stale state. A chain that aims to support machine driven transactions is basically saying it wants finality and responsiveness to be consistent enough that automation can operate smoothly without turning every workflow into a fragile balancing act.

Developer comfort and ecosystem reality

Even the best protocol design fails if builders can’t ship quickly, so the developer experience matters more than people admit. One of the practical decisions a chain can make is to stay close to familiar contract environments so teams can build without rewriting their entire skill set, because when a chain feels familiar, the time from idea to product becomes shorter, and real ecosystems grow from shipped products, not from roadmaps. Then there is the bigger theme Vanar points toward, which is that machine driven transactions are rarely only about transferring value, they’re about coordinating data, state, logic, and repeated automated decisions, so the chain’s ability to support data heavy workflows becomes part of the story. This is where “payments” turns into “autonomous commerce,” because agents don’t just pay, they react, verify, store, update, and trigger actions based on information, and the more efficiently those pieces work together, the more natural it becomes to build applications that feel intelligent rather than clunky.

The metrics that reveal truth

If you want to evaluate whether this vision is actually becoming real, you watch the boring metrics that tell the truth. Watch confirmation consistency, not only in calm periods but under load, because machines need reliability more than they need peak speed. Watch fee predictability across different market conditions, because stable cost is the heart of automation design. Watch sustained throughput, because automation is not a one time spike, it is steady demand that keeps going day and night. Watch network health, meaning whether the system stays resilient and responsive when usage grows, because machine driven adoption will stress every weak point repeatedly. And watch what the transaction patterns look like, because a chain that truly hosts machine driven transactions will show activity that looks like repeated small actions from real apps, not only large transfers that appear during hype waves.

The risks Vanar Chain must face

I’m not going to pretend any chain can promise a perfect future without risk, because the harder you push toward affordability and speed, the more you attract both builders and attackers. A predictable fee model must be maintained in a way that remains trusted and robust, because if the method that keeps fees stable is questioned or manipulated, the chain’s strongest promise becomes a vulnerability in perception. Performance targets must survive real congestion, because real adoption is never polite, it arrives with pressure, unpredictability, and edge cases. Security becomes a constant test, because low cost execution is appealing for legitimate automation but also appealing for automated abuse. And the narrative risk is real too, because talking about AI and machine driven economies creates huge expectations, and the ecosystem has to prove value with real applications that people can use, not only with technical claims that sound impressive.

How the future might unfold

If It becomes normal for agents to drive most transactions, then We’re seeing blockchains evolve into quiet infrastructure that supports everyday digital life without demanding constant attention. In that world, predictability becomes a form of trust, because builders can design services that run continuously without fear of sudden fee shocks or waiting games, and users can benefit from automation without feeling like they are stepping into a chaotic system. Vanar Chain’s direction fits that future because it focuses on fast settlement and stable costs, which are exactly the traits that make machine driven microtransactions viable at scale, and if the network proves it can stay stable, resist abuse, and attract developers who ship real products, then it can become a layer where autonomous commerce happens naturally, quietly, and constantly, the way the internet carries billions of small interactions without asking us to think about the cables underneath.

A soft closing note

I’m not here to claim Vanar Chain is guaranteed to dominate everything, but I do think its direction matches what the world is turning into, a world where software handles more of the repetitive actions that drain people, and value moves in small continuous flows rather than occasional dramatic moments. If Vanar keeps building toward speed that feels dependable and costs that feel calm, then it can help make this machine driven future feel less like chaos and more like stability, and I like that idea, because the best technology is the kind that quietly works in the background while real life gets lighter, and We’re seeing a chance to build that kind of calm if the foundations stay honest and strong.