$FOGO @Fogo Official #Fogo #fogo #FogoChain

There’s a clear idea behind Fogo: if crypto wants to compete with traditional markets, it has to match their performance.

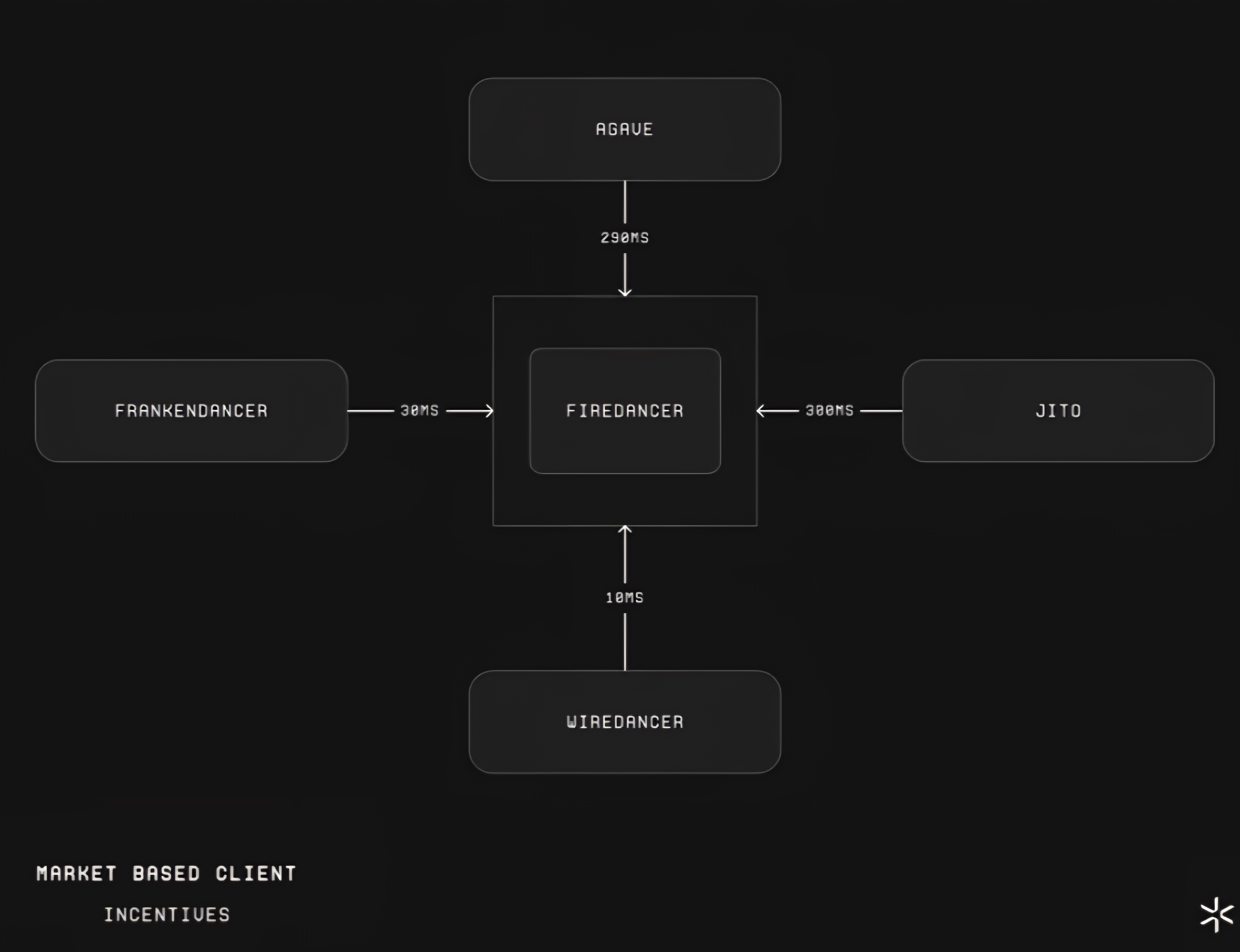

Fogo is a Layer 1 running a customized version of Firedancer, built on the Agave (Solana) codebase and fully compatible with the Solana Virtual Machine. The difference isn’t compatibility, it’s optimization. The chain launched mainnet in November 2025, and from day one the focus has been execution quality, not experimentation.

Why Performance Actually Matters

Ethereum processes under 50 transactions per second on its base layer. Solana was built for scale but begins to experience stress around a few thousand TPS depending on conditions. Meanwhile, traditional venues like NASDAQ and CME process well over 100,000 operations per second

Fogo’s answer is simple: shrink latency and remove bottlenecks.

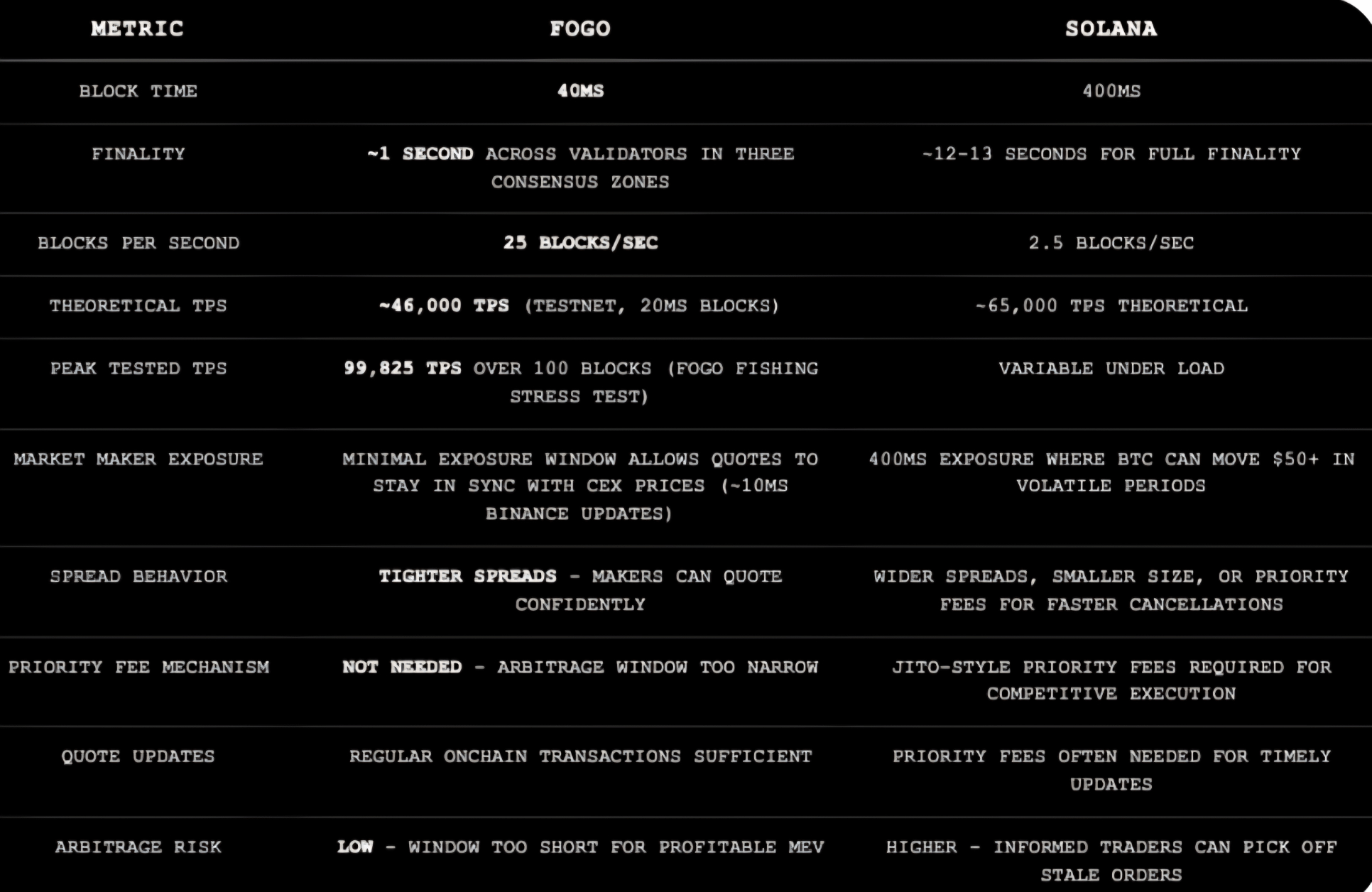

With 40ms block times, compared to Solana’s ~400ms, the exposure window for market makers drops dramatically. In fast markets, even a few hundred milliseconds can mean getting picked off by arbitrageurs. Shorter blocks allow makers to update quotes more frequently, tighten spreads, and reduce defensive behavior like overpaying for priority fees.

Firedancer and the Engineering Edge

Firedancer, originally developed by Jump Trading, was written in C for greater hardware-level control. It uses a tile-based architecture where independent processes handle networking, verification, and deduplication in parallel. If one component fails, it doesn’t bring down the entire system.

The team has also demonstrated hardware acceleration using FPGAs, reaching millions of signature verifications per second at relatively low power consumption. That’s not just faster, it’s structurally different from typical validator setups.

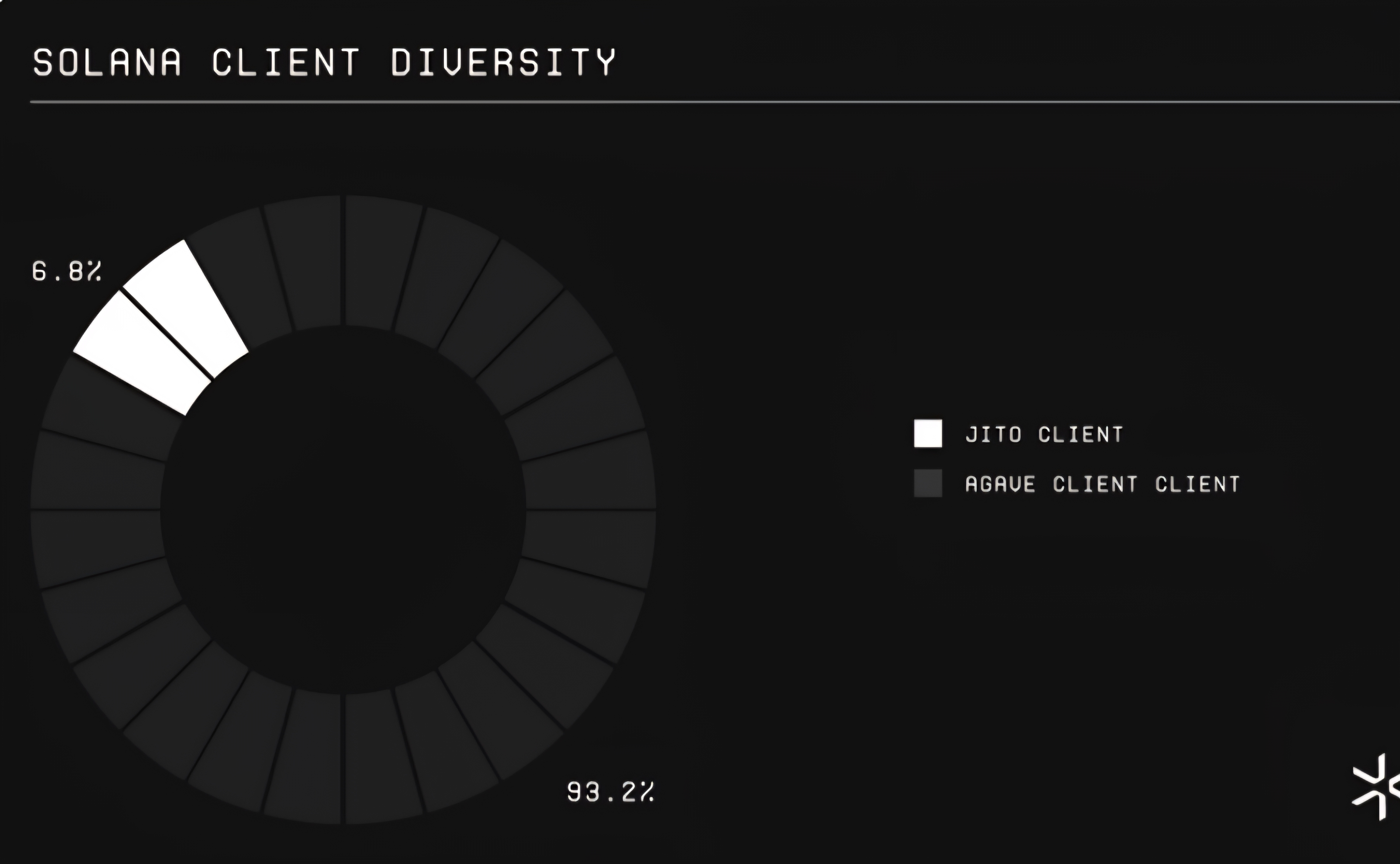

Fogo runs a unified client rather than juggling multiple competing implementations. That means upgrades don’t require cross-team coordination, which can slow down development on other networks.

The trade-off? Less client diversity. The upside? More performance consistency.

Trading, DeFi, and Market Structure

Where Fogo gets interesting is how these technical choices reshape DeFi.

Perpetual futures dominate crypto volume. These markets rely on constant funding rate updates, liquidation monitoring, and rapid mark price adjustments. A 400ms delay introduces measurable risk, especially for leveraged positions. Reducing that window to 40ms changes how tight spreads can be quoted and how efficiently arbitrage can occur.

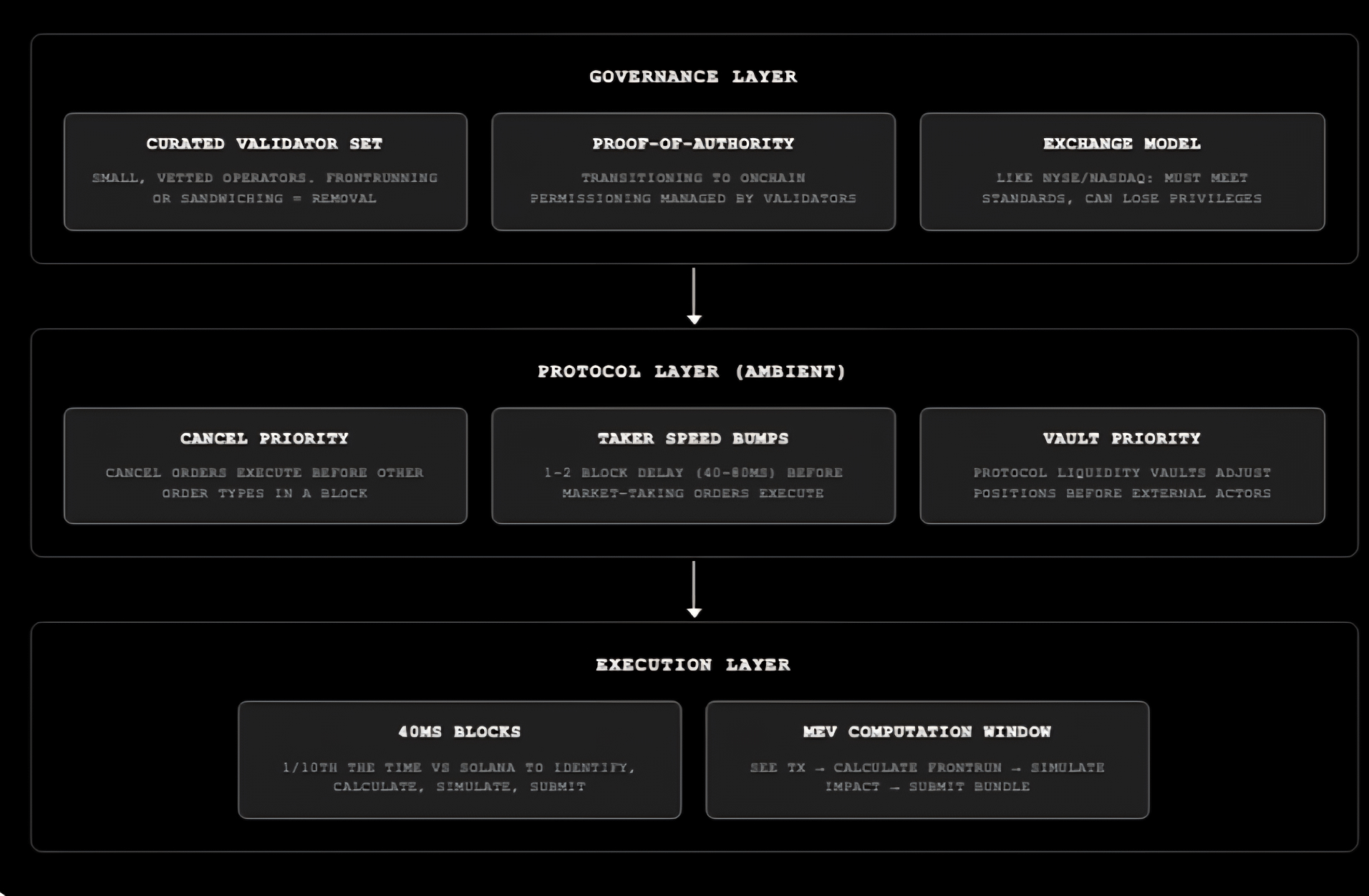

MEV extraction also becomes harder. With less time between blocks, strategies like sandwiching and frontrunning require near-instant computation and execution. What works at 400ms doesn’t necessarily remain profitable at 40ms.

Fogo is also implementing structural protections at the validator and protocol level, including cancel priority and curated validator participation, to discourage abusive behavior.

The approach resembles traditional exchanges more than permissionless chaos. Standards exist. Misconduct has consequences.

Architecture and Trade-Offs

Fogo opts for colocated validator infrastructure rather than full global dispersion. Physics matters: light itself takes over 130ms to circle the Earth. Geographic distribution increases resilience but also increases latency.

Fogo prioritizes speed for institutional-grade flow. It’s a deliberate choice.

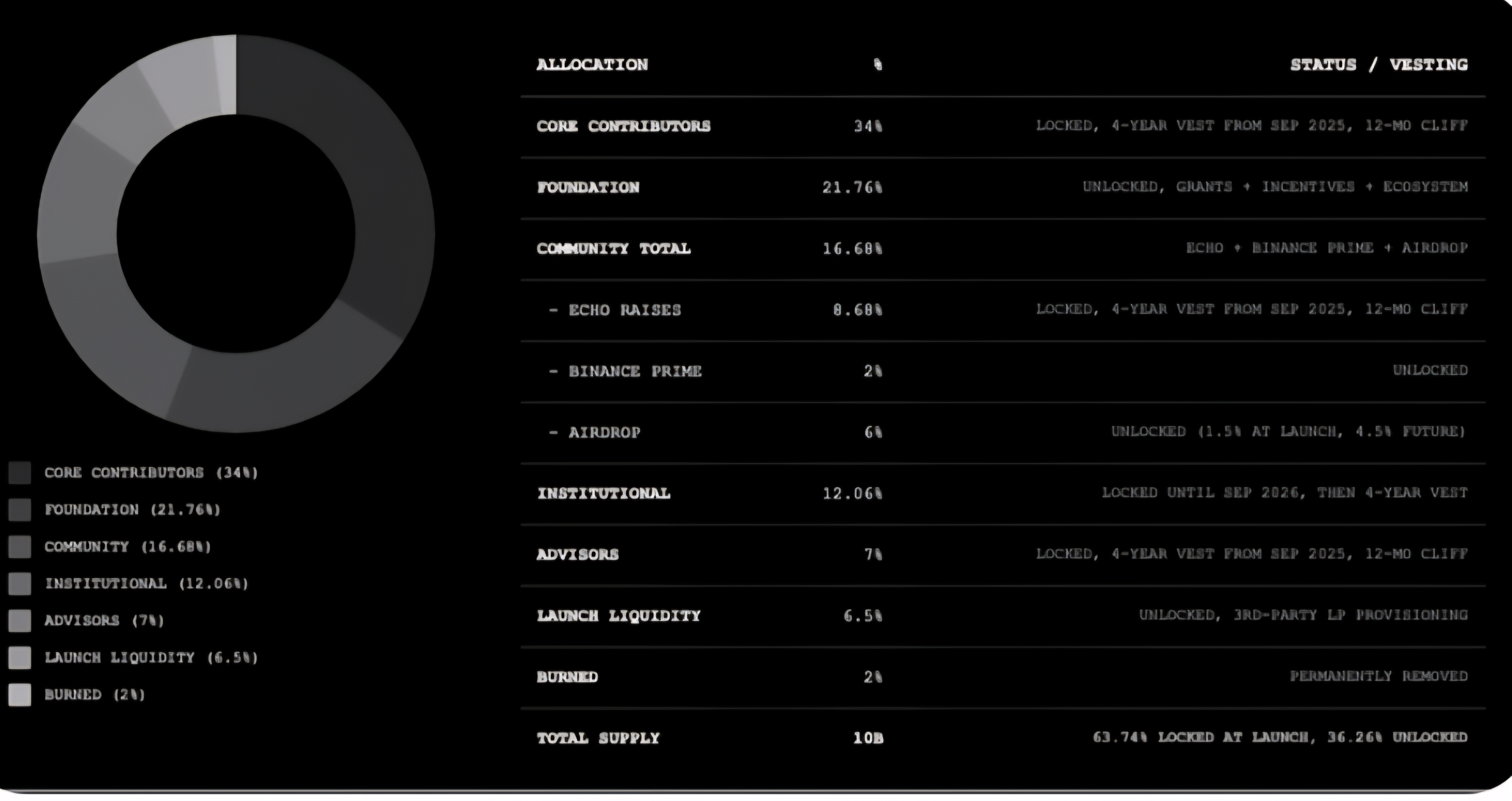

Tokenomics reflect long-term alignment as well: 2% annual inflation, multi-year vesting schedules, and significant portions locked at launch. Early speculation isn’t the design goal; sustainability is.

Where Things Stand

The network is live. The infrastructure is built. But ecosystems don’t mature overnight.

Liquidity, builders, and market makers need time to integrate and deploy. The thesis is clear: reduce latency, reduce MEV windows, and give professional participants a chain that behaves closer to traditional venues, while remaining onchain.

Whether Fogo captures meaningful institutional flow depends on execution from here.

The foundation is there. Now it’s about adoption.