There’s a small repair shop near my house that only fixes one thing: motorcycle engines. Not tires. Not paint. Just engines. At first I thought it was limiting. Why turn away business? But over time I noticed something. Riders trust that place more than the bigger workshops. When your focus narrows, your thinking sharpens. You stop pretending to be universal.

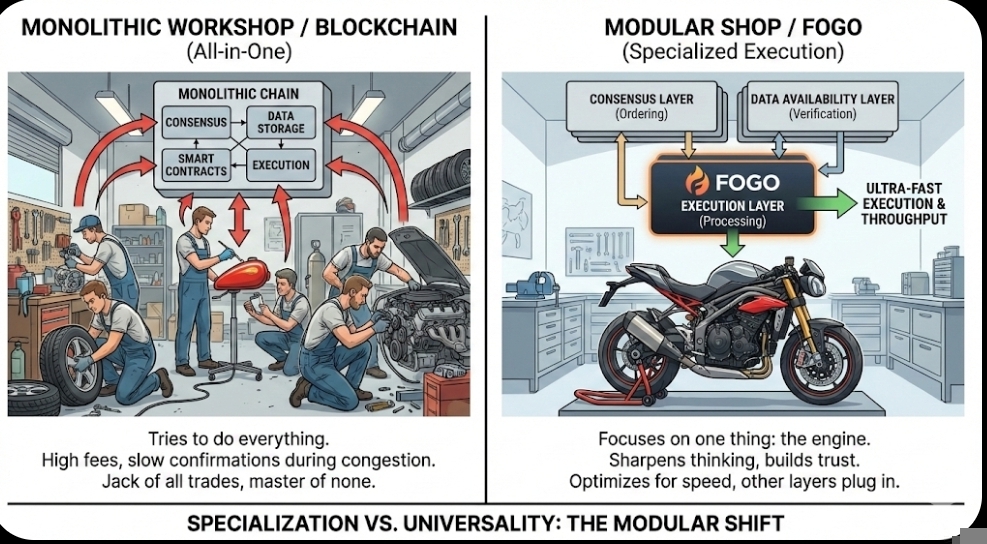

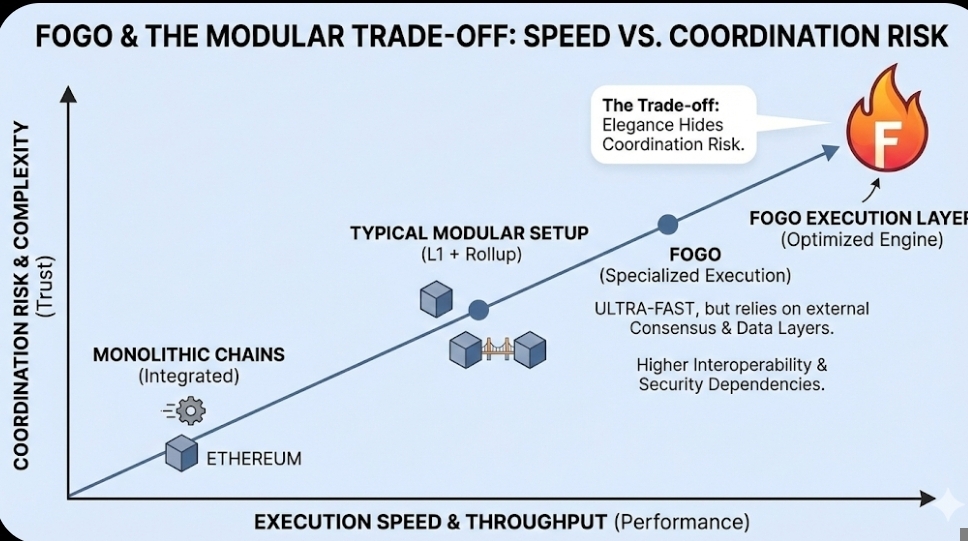

I’ve been thinking about that while watching the shift toward modular blockchains. For years, most chains tried to be complete systems. They handled consensus, which is just the process of agreeing on transaction order. They stored data. They executed smart contracts, meaning they ran the code that actually moves assets or updates state. It was tidy on paper. In practice, everything competed for the same bandwidth. When markets got busy, fees spiked. Confirmation times stretched. You could feel it.

Fogo steps into this picture with a different posture. It leans into execution as its main job. Execution sounds abstract, but it’s the part where transactions are actually processed. The engine room, basically. In a modular setup, consensus might live elsewhere. Data availability , which just means making transaction data accessible for verification that might also be handled by another layer. Fogo’s bet is that if you optimize the engine hard enough, the rest of the system can plug into it.

I don’t think this is about speed alone, even though speed is the headline metric everyone likes to quote. Latency of the time between sending a transaction and seeing it confirmed and shapes behavior. Traders widen slippage settings when networks are slow. Developers overcompensate with extra safeguards. You can see it in DeFi contracts that assume congestion as a default state. Infrastructure changes psychology before it changes code.

But here’s the part people don’t say out loud. Specialization creates dependency. If execution is separate from consensus, you’re trusting another layer to order transactions fairly. You’re trusting data layers to make information available and verifiable. Modular design sounds elegant, and sometimes it is, but elegance hides coordination risk. If one layer stumbles, the whole stack feels unstable. It’s like a racing engine bolted into a weak chassis.

And still, there’s something refreshing about a project that doesn’t claim to be the entire future of finance. Fogo focusing on execution feels… disciplined. It suggests a design philosophy that accepts trade-offs instead of pretending they don’t exist. That alone sets a different tone in a space where “all-in-one” used to be the selling point.

I’ve also noticed how performance metrics travel socially. On platforms like Binance Square, visibility isn’t random. Dashboards highlight engagement. AI systems rank posts based on interaction patterns. The numbers start to define credibility. Blockchains experience something similar. If a network consistently shows low confirmation times and stable throughput, throughput meaning how many transactions it can handle per second, that data becomes narrative fuel. It gets repeated. It builds momentum. Even before most users understand the architecture, they internalize the perception.

But raw metrics are slippery. Throughput under light demand doesn’t tell you much. A chain processing thousands of simple transactions in a lab is not the same as surviving volatile market conditions with complex smart contracts firing simultaneously. Execution layers need stress, not just benchmarks. Otherwise, speed is cosmetic.

There’s another angle that keeps nagging at me. Faster execution lowers friction. Lower friction invites activity. More activity isn’t automatically healthier. Traditional markets learned this the hard way. High-frequency trading improved liquidity in some contexts, yes, but it also amplified short-term volatility. If Fogo or any execution-focused layer succeeds, it won’t just enable better apps. It might also intensify speculative behavior. Infrastructure doesn’t judge intent.

Then there’s liquidity gravity. Capital clusters. Developers follows the users. Users follows the liquidity. Modular systems assume components can mix and match easily, but migration in crypto is rarely seamless. Bridges tools that move assets between chains and have historically been weak points. Every new integration expands the attack surface. Specialization works beautifully when interoperability is secure. When it isn’t, specialization becomes fragmentation.

Still, I can’t shake the intuition that modular architecture reflects maturity. Early blockchains tried to prove they could exist. Now the question is different. Can they perform under real economic pressure without collapsing under their own complexity? Specializing execution feels like an answer to that, even if it’s not the only one.

What interests me most is how this shapes developer culture. When infrastructure is predictable, builders take different risks. They design tighter systems. They experiment with features that assume consistency rather than congestion. That subtle shift might matter more than raw speed numbers. Architecture influences imagination.

I don’t see Fogo as a guaranteed winner or as a passing experiment. It feels more like a stress test of a broader idea, that blockchains don’t need to be monoliths to be coherent. Maybe coherence comes from coordination instead of consolidation. Or maybe we’ll discover that too much separation creates fragility. Both outcomes are plausible.

For now, the motorcycle shop down the street keeps fixing engines. Riders keep lining up. Not because it promises everything, but because it promises one thing done carefully. In a modular future, that kind of focus might turn out to be less limiting than it first appears.

Άρθρο

Fogo as a Specialized Execution Layer in a Modular Future

Αποποίηση ευθυνών: Περιλαμβάνει γνώμες τρίτων. Δεν είναι οικονομική συμβουλή. Ενδέχεται να περιλαμβάνει χορηγούμενο περιεχόμενο. Δείτε τους Όρους και προϋποθέσεις.

0

7

85

Εξερευνήστε τα τελευταία νέα για τα κρύπτο

⚡️ Συμμετέχετε στις πιο πρόσφατες συζητήσεις για τα κρύπτο

💬 Αλληλεπιδράστε με τους αγαπημένους σας δημιουργούς

👍 Απολαύστε περιεχόμενο που σας ενδιαφέρει

Διεύθυνση email/αριθμός τηλεφώνου