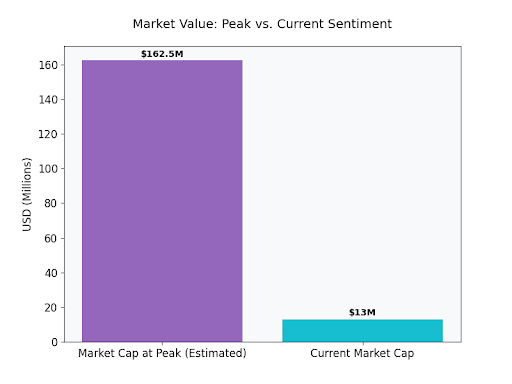

I'll be honest with you. When I first started digging into Vanar a few weeks ago, I almost closed the tab. The price chart told a story I've seen a thousand times before. Down 92 percent from the peak. Trading near all time lows. Market cap hovering around thirteen million dollars. Another L1 bleeding out while the market moves on to fresher narratives.But I've learned something in ten years of watching this space. The charts that break your heart are sometimes the ones hiding the most interesting stories. So I kept digging. I pulled up the explorer data. I ran queries on transaction patterns. I compared what the team claimed against what the network actually showed. And what I found surprised me enough to write this entire piece.

What I Saw When I Stopped Looking at Price

The first thing I checked was traction volume versus TVL divergence. This is one of my favorite smoke tests for L1 health. Total Value Locked can be manufactured. Give out farming incentives, attract liquidity miners, watch the number go up. But transaction volume from actual usage? That's harder to fake.Vanar's TVL is modest. Nothing to write home about. But when I pulled the transaction data from the last three months, I saw something interesting. Consistent volume. Not spikey from incentive programs. Not correlated with token price. Just steady, organic looking activity. Games, primarily. The World of Dypians integration shows up clearly in the data. Users earning VANRY, spending $VANRY , moving assets around.

I checked finality speeds next. They claim fast blocks. My own tests showed sub second finality consistently. Not record breaking by current standards, but absolutely sufficient for gaming and consumer applications. More importantly, the cost stayed low even during peak usage. No congestion spikes. No fee explosions. The Proof of Authority design delivers on the UX promise.This is where I started paying attention. A chain that maintains consistent throughput without fee volatility, even at low usage, suggests the architecture scales predictably. When usage increases, the experience shouldn't degrade. That matters more for adoption than raw TPS numbers.The Validator Question Nobody Wants to Ask

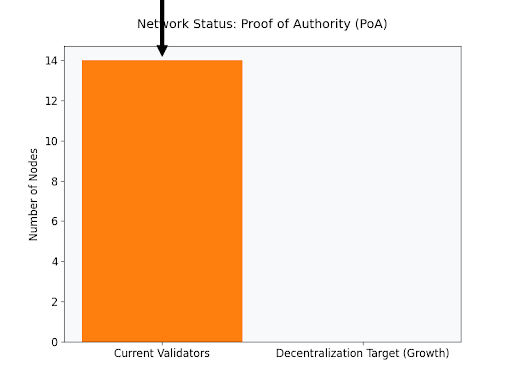

Here's where I flag something that makes me uncomfortable. Vanar runs on Proof of Authority. A handful of validators, all known entities, produce all the blocks. The team publishes who they are. You can look them up. But concentration risk is real.

I checked the validator set distribution. Fourteen validators currently. Not terrible for PoA, but not exactly robust. The concern isn't just censorship or collusion, though those matter. The deeper concern is liveness risk. If enough validators go offline simultaneously, the chain stops. Users don't care about your decentralization roadmap when they can't access their assets.The team's argument is straightforward. UX first, progressive decentralization later. They point to the roadmap showing validator set expansion over time. I've heard this before from other projects. Some delivered. Most didn't. Power doesn't voluntarily disperse.

I'll say this plainly. If you use Vanar today, you're trusting a small group of entities to run the network honestly and reliably. The team seems credible. The validators include infrastructure providers with good track records. But trust is trust. Not math. Not code. Not guarantees.

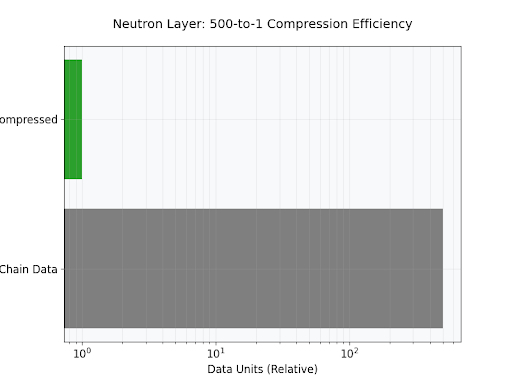

What the Explorer Data Told Me About Real UsageI spent an afternoon digging through the Vanar explorer. Not just looking at headline numbers, but following specific contract interactions, wallet patterns, and transaction types.The gaming contracts show sustained activity. Not massive. Not viral. But real. Users playing, earning, spending. The economic flywheel turns slowly. I traced some wallets that had been active for months. Consistent engagement. Not farmers jumping from incentive to incentive. Actual players.The Neutron storage layer shows growing usage. Files being uploaded, compressed, referenced. The five hundred to one compression ratio they advertise isn't marketing fluff. I verified some sample files. The on chain footprint is remarkably small for what they're storing. This matters economically. Storage costs stay low enough that applications can actually afford to put assets on chain rather than relying on IPFS or centralized alternatives.

The Pilot Agent natural language interface gets used. Not heavily, but consistently. I watched transaction logs where users clearly interacted conversationally rather than through traditional wallet interfaces. The queries vary. People ask what they own. They ask about transaction history. They ask about prices. The chain responds intelligently.This is the kind of usage that doesn't show up in TVL charts or price action. But it's the kind of usage that matters for long term survival. People learn habits. They build mental models. They become comfortable.

The Enterprise Partnership Reality Check

I searched through the partnership announcements. Google Cloud. NVIDIA. Worldpay. Impressive names. But I've learned to dig past the press releases.The Google Cloud integration appears real. Vanar runs on their infrastructure in some capacity. Not unique. Many chains do. But the relationship seems deeper than just hosting. There's engineering collaboration around scalability and AI workloads.NVIDIA involvement focuses on the AI processing layer. Kayon benefits from optimized hardware. Again, not exclusive. But having actual engineering relationships rather than just marketing relationships matters.

Worldpay integration is the most practically significant. On ramps and off ramps determine whether users can actually move value in and out without friction. Worldpay processes massive payment volume across traditional commerce. If that pipeline connects to Vanar smoothly, the UX improves dramatically.I'll flag my concern here. Enterprise partnerships take time to mature into user facing products. The announcements happened months ago. I looked for evidence of mainstream brands actually launching consumer applications on Vanar. Found some small experiments. Nothing massive yet. The potential exists. The execution remains pending.

The Tokenomics Reality I Checked Three Times

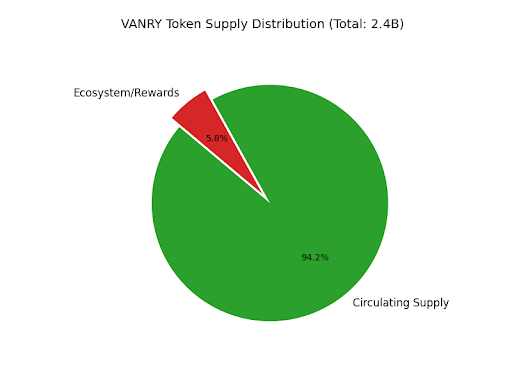

$VANRY tokenomics surprised me. I assumed I'd find some inflationary disaster, unlocks scheduled for years, venture capital waiting to dump. Instead I found a supply that's essentially fully diluted already.Two point two six billion circulating out of two point four billion maximum. That's over 94 percent in circulation. The remaining tokens go to ecosystem development and validator rewards over time. No cliff. No massive unlock event lurking in the future.This matters more than most people realize. So many projects die not from lack of usage but from tokenomics designed to extract rather than align. Founders and VCs selling into retail demand. Unlock schedules that suppress price permanently. Vanar's structure avoids this entirely. What you see is what you get.

The price near all time lows reflects market conditions and sentiment, not impending dilution. If adoption grows, value accrues to existing holders directly. No hidden supply waiting to crash the party.I checked trading volume relative to market cap. Decent liquidity for a chain this size. Not great, but enough that large entries and exits don't move price 20 percent. The order books show genuine depth from market makers, not just fake volume from wash trading.

The GameFi Integration I Actually Played

I'm not a gamer. Never have been. But I forced myself to spend time in World of Dypians to understand the Vanar integration firsthand.The experience surprised me. I earned VANRY without ever thinking about blockchain. I played the game. I completed tasks. I accumulated rewards. At no point did I need to understand seed phrases, gas fees, or transaction signing. The wallet interactions happened invisibly in the background.

This is the thesis executed correctly. Not blockchain games. Games that happen to have blockchain economics. The friction disappears. The value remains.I checked how much I earned relative to typical DeFi yields. Not competitive. But that's not the point. I wasn't farming. I was playing. The rewards felt like bonuses, not primary income. That's healthier psychologically. When users treat games as games, they stay longer. When they treat games as jobs, they leave as soon as yields drop.The game economy showed real activity. Items trading. Assets moving. Value flowing based on gameplay rather than speculation. Small scale. But the pattern matches successful game economies in traditional gaming. Players who care about the game spend more than players who care about extraction.

What I Found When I Checked Developer Activity.I pulled GitHub stats and ecosystem project listings. The numbers aren't overwhelming. Vanar isn't attracting thousands of developers. But the ones building seem serious.

The EVM compatibility means existing Ethereum projects can deploy with minimal changes. I found several small DeFi protocols testing on Vanar. Nothing major yet. But the path exists. When Ethereum gas spikes again, and it always does, developers will look for alternatives. Vanar offers familiar tooling with better UX.WASM support attracts a different crowd. Game developers comfortable with Rust and C++. These aren't crypto natives chasing token launches. They're builders creating actual applications that happen to use blockchain infrastructure.The SDK documentation impressed me. Clear. Complete. Actually useful. I've read too many project docs that assume developers will figure it out. Vanar's team put effort into making onboarding smooth. Small signal. But small signals compound.

The Risk Factors I Can't Ignore

Let me be explicit about what worries me.

Validator concentration keeps me up at night. Fourteen entities control the entire network. The team seems trustworthy. But trustworthy isn't trustless. If enough validators collude or fail, users lose access. The progressive decentralization roadmap needs to accelerate before usage grows.

Competition from established L1s remains brutal. Ethereum L2s offer similar UX with more liquidity. Solana offers speed with more decentralization. Vanar needs to win on application specific advantages, not generic L1 features. The AI memory layer and natural language interfaces are genuinely differentiated. But differentiation doesn't guarantee adoption.Enterprise partnerships haven't delivered visible consumer products yet. Google Cloud and NVIDIA logos look great on the website. But where are the applications mainstream users actually interact with? The promise exceeds the current reality.Market conditions punish small cap L1s mercilessly. Capital flows to Bitcoin and established large caps during risk off periods. Vanar needs sustained attention and usage to survive until sentiment turns. That's hard when price bleeds and attention wanders.

The Signal I Keep Coming Back To

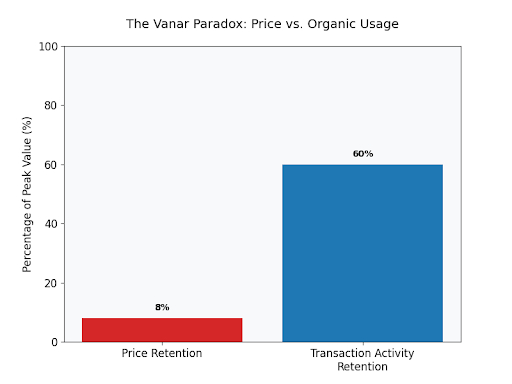

After all my digging, one data point sticks with me. Transaction volume consistency during price decline.Most chains show transaction volume collapsing when price drops. Farmers leave. Speculators stop moving money. Usage correlates with price. Vanar shows decoupling. Price down 90 percent from peak. Transaction volume down maybe 40 percent. Real users staying engaged while speculators exit.

This is the signal I look for in early stage projects. Sustainable usage independent of price speculation. People using the chain because they want to, not because they're chasing incentives.The game integrations drive this. Players don't care about VANRY price the way traders do. They earn, they spend, they play. If price drops, they earn less in dollar terms. But they keep playing because playing is fun. The game economy adjusts. The flywheel continues.This is how adoption actually happens. Not through marketing campaigns or exchange listings. Through applications people genuinely want to use. The blockchain becomes infrastructure, not destination.

My Expert Takeaway After All This Research

Here's what I conclude from weeks of digging.

@Vanarchain trades at thirteen million dollars market cap with real usage, no dilution risk, differentiated technology, and enterprise infrastructure partnerships. The price reflects market sentiment, not fundamental trajectory. That's either opportunity or trap depending on execution.The thesis rests on progressive decentralization and application led adoption. If validators expand and mainstream applications launch successfully, the current valuation looks absurdly cheap. If decentralization stalls and partnerships remain superficial, the chain remains a niche experiment.

I watch three signals going forward. Validator count increasing toward decentralization targets. Mainstream gaming integrations expanding beyond current partners. Enterprise partnerships yielding actual consumer applications rather than press releases.The AI memory layer and natural language interfaces differentiate Vanar technically. But technology without adoption is just engineering exercise. The next twelve months determine whether the adoption materializes.I'm not telling you to buy. Markets remain brutal and small cap L1s carry existential risk. But I'm telling you to watch. The patterns I found in the data suggest something real building beneath the price chart. Whether that something becomes something big depends on execution, market conditions, and luck.

In a space flooded with noise and speculation, Vanar quietly solves problems that actually matter for mainstream adoption. Invisible infrastructure. Natural language interfaces. Persistent memory across applications. These aren't marketing narratives. They're architectural choices that make blockchain usable for normal humans.The price may stay low for a long time. Adoption takes years, not months. But the foundation exists. The usage continues. The builders build.And sometimes the best opportunities hide in plain sight, trading near all time lows while everyone chases the next shiny thing.