When I try to explain Fogo to a friend without slipping into crypto slogans, I end up talking about waiting.

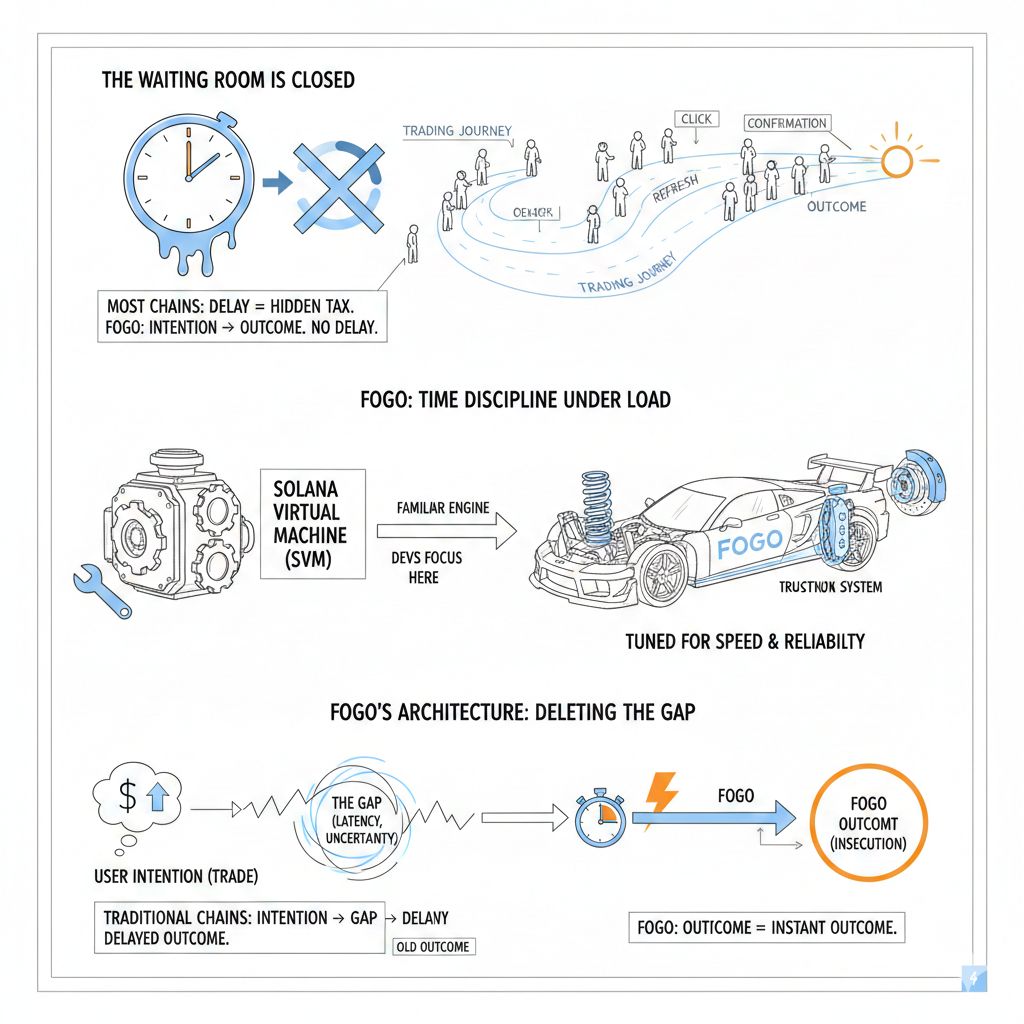

Most chains make you wait in ways you don’t notice at first. You click, the spinner shows up, you refresh a tab, you wonder if it landed, and by the time it settles the market has already moved a little. That delay becomes a hidden tax on everything that looks like trading, especially when price is changing fast. Fogo’s whole personality feels like an attempt to delete that waiting room. Not “faster on a chart,” but faster in the only place that matters: the gap between intention and outcome.

That’s why the Solana Virtual Machine angle isn’t just a trendy technical choice. Picking SVM is like choosing a familiar engine block so you can spend your energy tuning the suspension, brakes, and traction control. The developer world already knows a lot of the SVM “grammar,” so Fogo can focus on what it’s actually selling: time discipline under load.

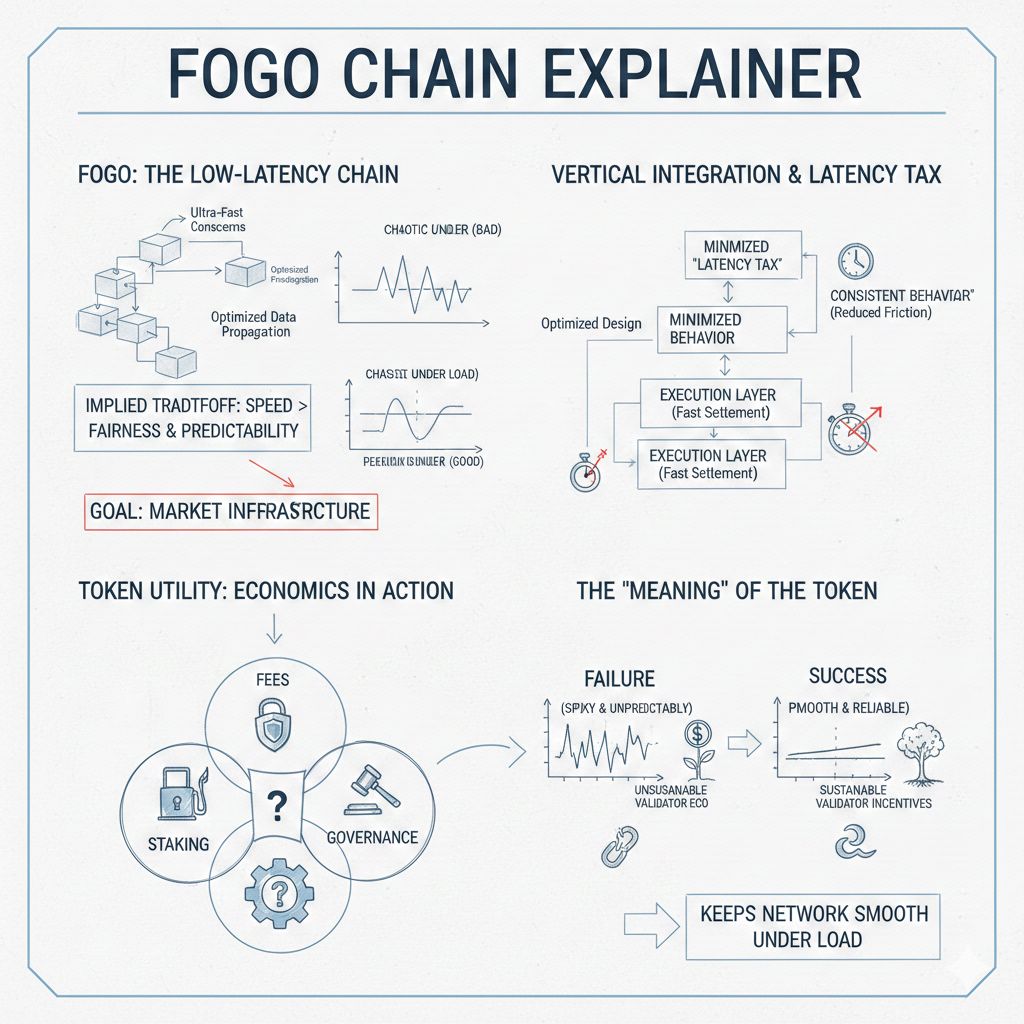

The interesting part is that Fogo isn’t shy about putting numbers on the table. Multiple writeups consistently reference sub-40ms block times and about ~1.3s finality as the target experience. Those aren’t just benchmark brag lines; they’re an attempt to shrink the window where traders get punished by delay, stale pricing, or simply not knowing whether their transaction is already obsolete.

What makes this feel more “real” than a typical performance narrative is the timing of the network’s life cycle. Fogo’s public mainnet launched on January 15, 2026. Once you cross that line, the world stops being polite. Bots show up. Bad assumptions get exposed. Tooling breaks in embarrassing ways. And a chain that claims it’s built for on-chain trading basically volunteers to be stress-tested by the most impatient users on the internet.

I also like to sanity-check any chain’s story with a simple question: does it look like a system that is continuously doing work? Explorers aren’t perfect truth machines, but they do show whether a network has constant motion. Fogoscan’s public dashboard (for its testnet cluster view) displays a very large cumulative transaction count and live TPS readouts—one snapshot shows 40,828,163,529 transactions and 100.21 TPS. That doesn’t automatically mean “organic demand,” because testnets can be scripted, spammed, and artificially loaded. But it does suggest the chain is measurable and running as a machine rather than existing only as a narrative.

There’s also a historical thread that helps anchor the performance claims. Messari previously reported devnet benchmarking around ~46,000 TPS with ~20ms block times, while noting testnet averages closer to ~40ms. I don’t treat those numbers as guarantees for mainnet conditions, but they do tell you what the architecture is trying to accomplish: shrinking time slices so the network behaves more like a responsive execution venue and less like a slow settlement layer.

Where it gets genuinely interesting is the implied tradeoff. If you optimize a chain for low latency trading, you’re not just chasing speed—you’re committing to a tighter standard of fairness and predictability. A fast chain that becomes chaotic under load is worse than a slower chain that behaves consistently. Some ecosystem explainers describe Fogo’s approach as vertically integrating trading primitives and designing around minimizing “latency tax” and execution friction. Whether every specific mechanism works exactly as advertised is something the market will judge over time, but the intent is clear: Fogo wants the chain itself to feel closer to “market infrastructure” than to a general-purpose playground.

Token utility is where this stops being philosophy and starts being economics. The token can have the usual roles—fees, staking, governance—but on a chain that’s trying to feel real-time, the fee market and validator incentives can’t be an afterthought. If fees become spiky or unpredictable during volatility, you lose the entire point of the system. If validator economics require constant subsidization, you lose sustainability. So the token’s “meaning” isn’t in a list of utilities; it’s in whether those utilities keep the network smooth when the crowd shows up.

My honest read is this: Fogo is competing on a single ruthless axis—how quickly and reliably it can turn user intent into final settlement. Mainnet being live since January 15, 2026 means it’s now in the phase where outcomes matter more than claims. If it succeeds, it won’t be because the story is louder. It’ll be because people stop thinking about the chain at all and just notice that trading feels less like waiting and more like acting.