$XRP Crypto markets rarely move on price targets alone. They move on narratives that reshape how investors interpret time, risk, and expansion potential. In 2026, XRP has returned to the center of that narrative as analysts reassess long-term positioning after regulatory clarity, renewed institutional engagement, and strengthening multi-year technical structure. These converging forces have shifted the conversation away from survival and toward scale.

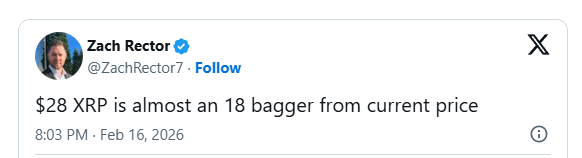

Crypto commentator Zach Rector recently emphasized this shift by describing a possible $28 valuation as nearly an eighteen-fold increase from current levels. His framing focuses on proportional growth rather than headline shock, encouraging investors to evaluate XRP through the lens of historical crypto cycle expansion.

That perspective aligns with broader analyst thinking that views XRP’s prolonged consolidation as a preparatory phase rather than a completed move.

💥Cycle Dynamics and Exponential Growth

Major digital assets often experience nonlinear appreciation once liquidity, sentiment, and structural breakout conditions align. Historical market cycles show that the strongest percentage rallies usually emerge after extended compression periods.

XRP’s multi-year range following its previous peak, combined with clearer regulatory standing since 2025, strengthens the argument that the asset may still operate in an early expansion stage.

Viewing upside through return multiples helps investors compare XRP’s trajectory with earlier crypto leaders that delivered exponential gains during late-cycle momentum. This analytical lens reframes bold projections as mathematical possibilities rooted in cycle behavior rather than speculation alone.

💥Institutional Forecasts and Evolving Narratives

Independent commentary increasingly overlaps with institutional modeling. Analysts frequently reference long-range projections from Standard Chartered that outline a pathway toward $28 XRP price by 2030. This convergence suggests that bullish expectations stem from structural assumptions about adoption, liquidity, and infrastructure relevance rather than isolated enthusiasm.

A recent TimesTabloid’s report also highlighted Rector reiterating his optimism around the $28 XRP price figure. That nuance reflects the fluid nature of crypto discourse, where analytical scenarios evolve alongside market data and sentiment.

💥Interpreting the Bigger Picture

The meaning behind an eighteen-fold projection extends beyond the number itself. Such growth would require sustained capital inflows, deeper institutional integration of blockchain finance, and confirmed long-term technical breakouts. Without those elements, extreme upside scenarios remain theoretical.

Still, the persistence of these discussions reveals a psychological transition within the market. Investors increasingly debate how far XRP can move rather than whether it can endure. In past crypto cycles, that shift in mindset often preceded powerful bullish phases.

No projection guarantees an outcome. Yet the structure of today’s conversation shows clear maturation. Analysts now ground optimism in historical precedent, institutional context, and measurable cycle dynamics—turning bold price targets into reflections of rebuilding conviction rather than mere hype.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.