The family gathering in Peshawar carried over more tea, more stories, and this time my cousin pulled out his laptop during a lull. He's been working on an AI tool for small businesses, something about predictive inventory with "on-chain intelligence." The slides were polished: sleek animations, market size charts in billions, promises of seamless integration with existing apps. He talked up decentralized agents, memory layers, real-time decisions. For a moment, it sounded compelling until I asked about the underlying chain handling the payments and data flows. He paused, then admitted it was still "Ethereum-based with some L2 tweaks," but the gas costs and occasional delays were "being optimized." I smiled politely; I've seen enough pitches to know when the infrastructure story gets vague.

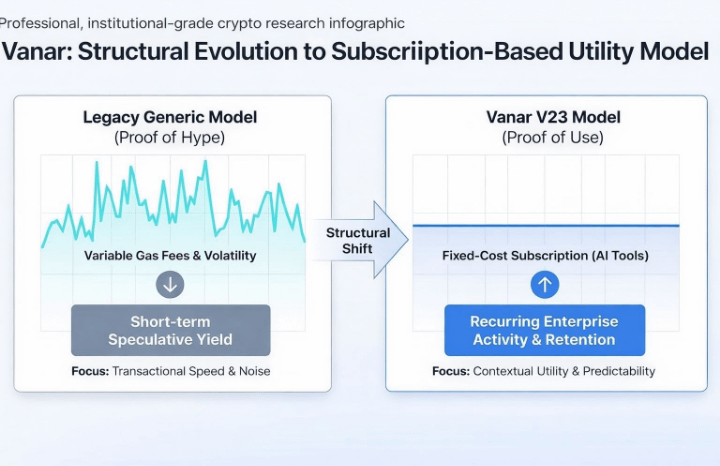

What stands out to me now, reflecting on that conversation, is how VanarChain ($VANRY) approaches these same problems without the gloss. No flashy slides needed when the chain quietly demonstrates it can handle what matters: relentless stablecoin volume that keeps agent-driven transactions moving smoothly. Near-zero fees (often around $0.0005), fiat-fixed costs that don't spike, fast settlements no congestion even when activity picks up. It's pragmatic design for high-frequency, low-value flows, the kind AI agents would generate in real scenarios like automated payments or yield adjustments.

High load is where everything gets exposed. Sequencing needs to stay fair no priority auctions letting whales cut in line. Paymasters must reliably sponsor transactions for seamless user experience. Liquidity routing has to keep funds from fragmenting across pools. I've noticed VanarChain manages these without fanfare no outages or pauses disrupting flow during busy periods.

Recent activity puts this to the test. Massive inflows into savings and lending vaults integrations similar to Aave-style protocols or yield layers pulling in substantial capital quickly processed without breaking stride. Settlements stayed prompt, fees predictable, no cascading issues in bridging or DEX routing. That's production stress-testing in action, far more telling than any audit report on paper.

The Bitcoin anchoring provides a low-key but effective backstop. By anchoring transaction roots to BTC periodically, it adds external finality and economic security during volatility spikes helping prevent the consensus wobbles that hit more isolated chains when things heat up.

Transparency from the team helps too: when volatility or minor issues arise, updates come clear and direct explanations of what happened, fixes deployed, next steps outlined. No vague hype; just facts that build steady confidence.

I've watched other chains struggle when payments dominate—l stablecoin frenzies lead to gas wars, slowdowns, bridges lagging, users paying multiples more or waiting hours. VanarChain sidesteps that by focusing on predictability over theoretical peaks. It feels like reliable infrastructure: you notice it most when it doesn't fail.

Back to my cousin's PPT impressive vision, but without solid plumbing underneath, AI agents risk getting stuck in the same old bottlenecks: high costs, delays, fragmented data. VanarChain seems oriented toward making that layer invisible and dependable, especially as AI workloads demand sustained, payment-heavy activity.

In this post-holiday quiet, when most are winding down, it's worth asking: if your chain is powering AI agents that need to transact reliably at scale, does it hold up under real pressure or does it become the weak link everyone ignores until it breaks?

When volume surges 5x overnight, does your chain still feel like infrastructure or just another bottleneck?