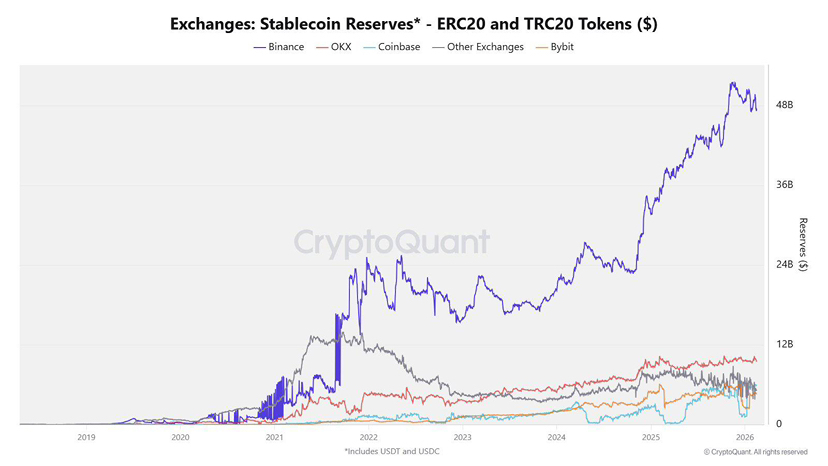

Binance is not only larger in stablecoins, but its market is where the market is storing its idle cash.

The quantity of USDT and USDC that is on the major centralized exchanges throughout time. The key idea is that the line of Binance continues to increase towards 2025-2026, whereas the other exchanges remain small and flat.

CryptoQuant currently indicates approximately 47.5billion of USDT and USDC on Binance, or approximately 65 per cent of all USDT+USDC on centralized exchanges. And not a small lead at that, it demonstrates that Binance is the primary liquidity location.

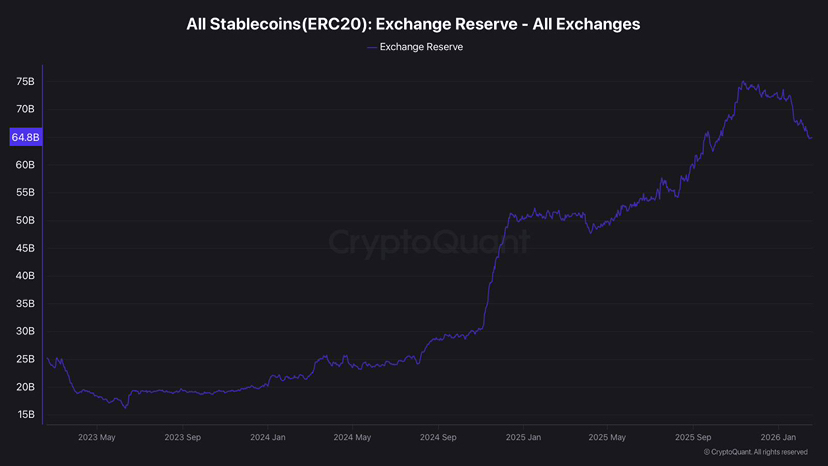

The importance of stablecoin reserves is not as insignificant as it may seem.

Stablecoins in an exchange are equivalent to pre-cooked purchasing power. Increase in reserves is normally an indication that people are preparing trades, hedges, or quick moves without having to transfer fiat or wait. CryptoQuant reports that reserves in exchange stablecoins are an indication of the quantity of stablecoins available to purchase crypto.

It is not just a popularity contest. It is on who is capable of giving the most liquidity in a minute when there is a shift in markets.

The actual action taken in the line: fear, speed, and convenience.

The thing that most people fail to understand is that when the market is bearish, people do not flock to a platform due to its brand. They will proceed to the place where the business is least endangered.

During down markets, traders would desire tight spreads, quick fill, and assurance that liquidity will remain even when everyone is panicking. In cases where the needs are spiking, liquidity naturally clung together rather than diffusing. It is that clustering and that is what is depicted by the chart.

The lead of Binance is not even distributed evenly, USDT does most of the work.

One more detail: the stablecoin assets of Binance consist mostly of USDT. According to CryptoQuant, Binance stores approximately 42.3 billion USDt as compared to approximately 5.2 billion USDc. That is important since USDT continues to be the primary pathway of numerous high-frequency trades and derivative flows.

To the point, Binance is not merely holding stablecoins. It is the type of liquidity traders are holding in stablecoins when they have to get something fast.

ERC20 vs TRC20: why the name is not important as much as the networks.

There is a reason why you have included ERC20 and TRC20 in your chart title. These are the two major networks that stablecoins operate on, Ethereum (ERC20) and Tron (TRC20).

CryptoQuant observes that Binance exhibits large variations in the distribution of stablecoin reserves on these networks across time, even when an ERC-20 USDT burst or network-network balance partition. It is important because users do not simply use an exchange, but the cheapest and quickest path that will suit what they are doing at that time.

Brand dominance is not everything that Binance enjoys. It is concerned with being the place where the routes of preferred stablecoins of the market meet.

Liquidity always gathers in the time of stress, a brief history lesson.

The trend is observed not only in the crypto market. During good times liquidity can be dispersed in the venues. During crises, it is gathered in the place which seems to be the greatest one, as the reliability turns out to be the most important issue.

This is the reason why this is not a random data display. It is an indicator of the market structure: Binance is the primary liquidity provider of the biggest stablecoins on exchanges at the moment.

What I deduce out of this chart

I do not view any marketing win when I view this chart. I see a behavioral win.

The largest share of USDT+USDC on exchanges is held on a platform since users continue to prefer: “Where I want to store unused cash on a CEX this is where I would keep it. That decision self-perpetuates - further liquidity leads to further liquidity and the distance increases.

Conclusion: Binance continues to topple the stablecoin liquidity.

Assuming that stablecoins are fuel, the largest fuel depot is Binance.

Holding approximately 47.5billion USDT and USDC on the exchange, and approximately 65per cent of CEX stablecoin reserves, Binance is not competing to get notices. It has its way at the right time: the spot capital decides when the conditions are uncertain.