It's early 2026 in Peshawar, dust swirling outside my window as I stare at my screen. My trading bot just executed a flawless arb on Fogo sub-40ms block, ~1.3s finality, no reorg drama, spreads so tight I could shave with them. I felt like I'd cracked the code. The tech? Elite. But then I pulled up the token distribution chart, and that high turned into a cold sweat. 38% circulating. 62% locked in vesting cliffs and schedules. The chain runs like a dream, but who really owns the upside when the unlocks hit?

This isn't FUD. It's the full picture every serious $FOGO holder needs. I've synthesized everything we've covered physics realities, trader edges, SVM ease, builder appeal, market design into one honest assessment. Tech wins battles; tokenomics win wars.

The Tech That Hooks You: Why Fogo Feels Different

Start with what draws you in. Most L1s chase TPS fireworks while ignoring physics. Speed-of-light is 300,000 km/s distant validators mean 100-200ms round-trips, jitter under load. Fogo's Multi-Local Consensus clusters validators in co-located zones (Tokyo lead, London/NY rotation, follow-the-sun). Blocks ~40ms, stable even at peak. Curated set (performance-vetted) trades broad geo-decentralization for reliable speed no theater, just execution.

Firedancer pure-client squeezes SVM: high throughput, low latency, MEV mitigation. ~1.3s sub-second finality crushes reorg/inventory risk, enables HFT-style arb, liquidations, tight spreads. Team ex-Jump/Citadel/Morgan Stanley/Pyth knows tradfi pain speed isn't feature; it's product for microsecond DeFi.

SVM compatibility seals migration: same .so binaries, Anchor/CLI, wallets. RPC fogo.io deploy fast. Metaplex/Squads/Wormhole carry over. PDAs/identities shift (new chain), composability gaps need bridges, but Sessions fix UX: gasless, session-signed trading one approval for scoped keys, no pop-ups, apps pay gas. CEX feel, self-custody.

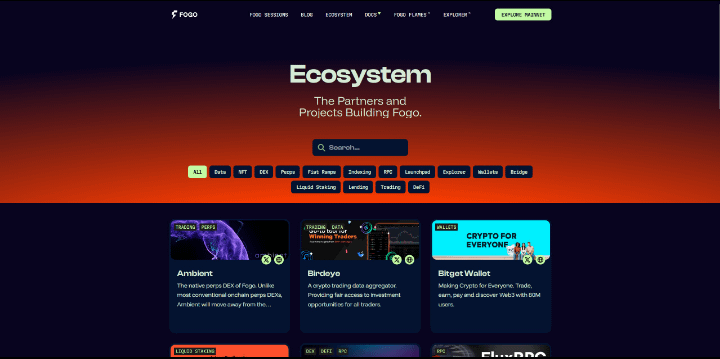

Structurally, enshrined primitives (native oracles like Pyth ties, colocated liquidity, batch auctions) make chain the exchange, not host. Ambient perps, Valiant DEX, early gravity trading infrastructure first.

After weeks testing, the performance dashboard glows: uptime flawless, latency deterministic, execution visceral. This is why enthusiasts overlook token risks.

The Tokenomics Reality Check: The Overhang Countdown

But zoom out. Total supply ~10B $FOGO (genesis fixed, 2% burned permanently effective ~9.8B). Circulating supply mid-Feb 2026 ~37-38% (~3.75-3.8B tokens, per Tokenomist/DropsTab/CryptoRank trackers). That leaves 62% locked/vesting core contributors, foundation, investors, advisors hold majority long-term.

Allocation snapshot (aggregated from DropsTab, Tokenomist, CryptoRank, official echoes):

- Core Contributors ~34% 4-year vesting, 12-month cliff (expires ~Jan 2027, then linear). Aligns team, but big unlock wave post-2027.

- Foundation ~27-30% partial TGE unlock for ecosystem/ops, rest controlled release.

- Institutional Investors/Echo Raises ~8-9% (Distributed Global, CMS Holdings) 8-12 month cliff (many start Sep 26, 2026), then 36-month linear.

- Advisors ~7% similar cliff/linear, first unlocks Sep 2026.

- Community/Airdrop/Launch ~15-16% (airdrops unlocked TGE, Binance Prime Sale 2%, liquidity 6.5%).

- Burned 2% permanent reduction.

Key dates: Sep 26, 2026 advisors/investor unlocks begin (~several % potential in waves). Jan 2027 core cliff ends, linear starts. Full vesting to 2029.

Transparent? Absolutely docs.fogo.io, trackers show clearly. Comfortable? Not if growth stalls. Retail trades small slice now; incoming supply pressures if TVL/volume doesn't absorb.

Staking? Yields paid reliably (epoch-tested), but inflationary new emissions for rewards. Without fee burn/activity absorbing, real yield dilutes (earn more tokens worth less). Interface complex: epochs, weights, delegation pro-level, retail intimidating.

Governance? DAO elements, but weighted to large stakers/validators. $100 holder votes? Echo in wind. Power concentrates early.

Compare: Ethereum dispersed via years trading/mining; Solana insider-heavy early but natural spread. Fogo (mainnet Jan 15, 2026) young concentrated launch norm. Team mitigated: canceled presale, expanded airdrops (testnet/users), burned 2%, community focus.

Nuanced: Early concentration isn't death sentence. Solana/Ethereum started similar; value dispersed as adoption grew. Fogo bets tech pulls volume low-latency DeFi attracts traders, Sessions onboard, SVM ports dApps. If TVL/fees explode pre-unlocks, overhang absorbs, dilution fades. If not? Volatility, downward pressure.

The Balanced Bet: What I'm Doing & Why

I'm not dumping I'm positioned. Staking selectively for yields/security. Trading edges (arb/liquidations) on-chain. Monitoring unlocks like hawk: TVL growth, daily actives, fee revenue, staking participation. Performance dashboard stellar unlocks countdown real.

Smart move: Tech deserves praise; tokenomics demand caution. One builds chain; other decides profit share. Watch both. If ecosystem hits escape velocity (perps volume, builder migration, trader influx), unlocks become fuel. If hype fades, risk materializes.

Fam, this is grind season campaign ends Feb 27, 2026. What's your stance? All-in on tech absorbing supply, or hedging unlocks? Drop honest takes below. Let's build informed community.

@Fogo Official $FOGO #Fogo #FOGO #Tokenomics #defi #CryptoRealityCheck