In an industry often obsessed with theoretical "TPS" (transactions per second) and marketing-driven benchmarks, @Fogo Official is taking a different path. Rather than chasing abstract performance metrics, Fogo is being engineered for real trading conditions from day one.The project’s philosophy is simple: for decentralized finance (DeFi) to truly compete with centralized exchanges (CEXs), the underlying infrastructure must deliver the same reliability, speed, and deterministic execution that professional traders demand.

1. The Core Engine: A Custom Firedancer-Based Client

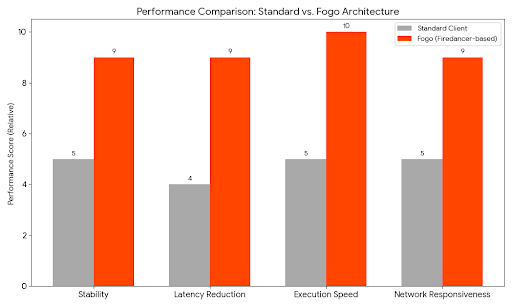

Fogo doesn’t just run on standard code. Its core is a custom Firedancer-based client, adapted from high-performance Agave code and specifically optimized for operational stability.

Why it matters: Most networks struggle during periods of high volatility. By utilizing a Firedancer-based architecture, Fogo targets the "latency tax" that often plagues traders.

The Result: Execution speed and network responsiveness that affect actual trading outcomes, not just benchmark tests.

2. Strategic Validator Architecture: Colocation for Speed

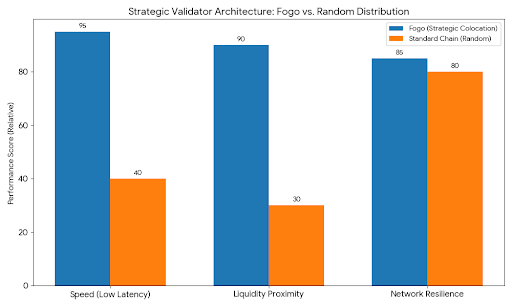

A major design choice that sets Fogo apart is its validator architecture. While many chains distribute validators randomly at launch, Fogo has strategically colocated its initial set in a high-performance data center in Asia.

Proximity to Liquidity: By positioning validators close to major exchange infrastructure, Fogo significantly reduces physical latency.

Resilience: This isn't a trade-off for security; backup full nodes operate in alternate global locations, allowing for rapid rotation if a primary site faces issues.

3. A Performance-First Selection Model

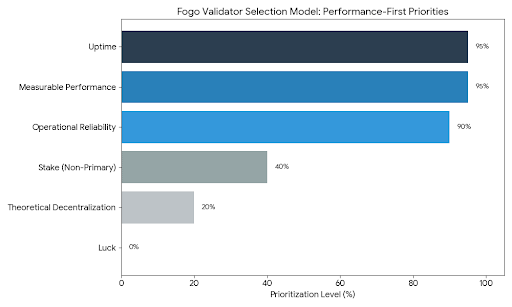

The active validator set isn't chosen by luck or purely by stake. Fogo prioritizes measurable performance and uptime.

The network prioritizes operational reliability over theoretical decentralization at the early stage—a move common among performance-focused chains that need stable execution before scaling."

4. A Fully Permissionless, Builder-Centric Environment

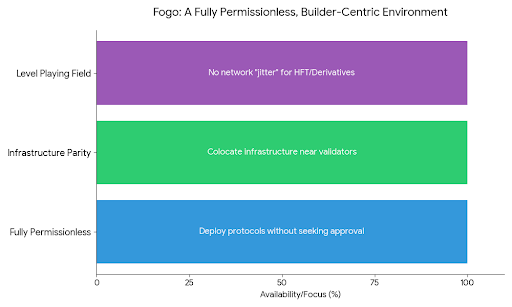

Despite its high-performance focus, Fogo remains fully permissionless. Any developer can deploy protocols without seeking approval.

Infrastructure Parity: Builders can even colocate their own infrastructure near validators.

Level Playing Field: This creates an environment where high-frequency strategies and derivatives trading can thrive without being disadvantaged by network "jitter."

The Outlook: Real Value Over Short-Term Hype

The architectural decisions behind $FOGO suggest a long-term strategy built around real economic activity. By providing low latency, high uptime, and a stable environment for liquidity providers, Fogo is positioning itself as the "backbone" for the next generation of on-chain finance.While the ecosystem is still in its early stages, the technical foundation described in the official blog suggests that Fogo is built to survive multiple market cycles by focusing on what actually matters: utility.