When I look at Fogo, I don’t see another Layer-1 chasing TPS headlines. I see a deliberate narrowing of ambition. And in infrastructure, narrowing is often strength.

Fogo is not trying to be a universal settlement layer for games, NFTs, identity, and every experimental app category. It is designed around a single question:

Can on-chain trading match the execution certainty of centralized exchanges without giving up self-custody?

That framing changes everything — architecture, validator design, liquidity model, and ultimately tokenomics.

Built on Proven Rails, Optimized for Execution

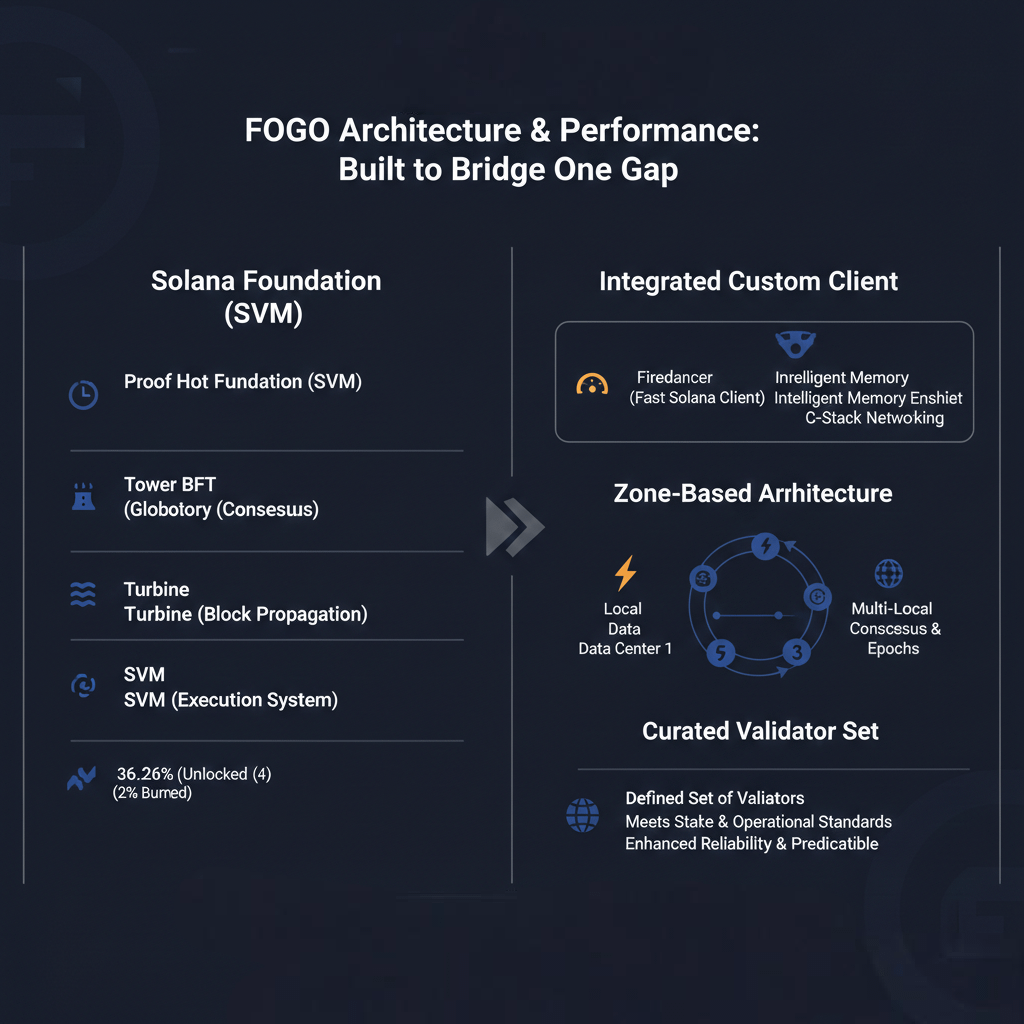

Technically, Fogo does not reinvent the foundations laid by Solana. It retains Proof of History as a global clock, Tower BFT for consensus, Turbine for block propagation, the Solana Virtual Machine for execution, and rotating leader architecture.

Instead of rewriting the rulebook, Fogo tightens it.

Its bespoke client is built around Firedancer, originally developed by Jump Crypto. Firedancer’s parallelized execution model, optimized networking stack, and hardware-aware design make it one of the fastest blockchain clients ever engineered. Fogo standardizes around that philosophy: performance is not optional — it is the product.

This matters because most chains degrade under load. As validator heterogeneity increases, latency becomes unpredictable. Fogo’s answer is controversial but coherent: curate the validator environment, normalize performance expectations, and reduce latency variance.

That is not maximal decentralization. It is deterministic infrastructure.

Multi-Local Consensus: Reducing Geography, Not Sovereignty

One of Fogo’s most interesting innovations is its zone-based, multi-local consensus model.

Validators cluster geographically, often within the same data center region, to reduce physical signal latency. These regions rotate epochs to preserve diversity and reduce capture risk.

The result is reduced geographical delay, preserved jurisdictional spread, and predictable block propagation.

In capital markets, microseconds matter. In DeFi, unpredictability is more damaging than raw slowness. Fogo optimizes for predictability.

That makes it resemble financial market infrastructure more than a general blockchain.

Enshrined Market Structure

Most DeFi trading today is fragmented. Liquidity sits across multiple DEXs, with external oracle dependencies introducing latency and risk.

Fogo’s model includes an enshrined central limit order book at protocol level, native price feeds maintained by validators, high-performance hardware expectations, and unified liquidity pools.

This is a structural decision. Instead of letting dozens of exchanges compete for liquidity, the protocol embeds market structure directly.

That is not ideological decentralization. It is execution engineering.

Community Distribution Without Venture Dominance

Where the architecture optimizes for speed and certainty, the token distribution optimizes for ownership breadth.

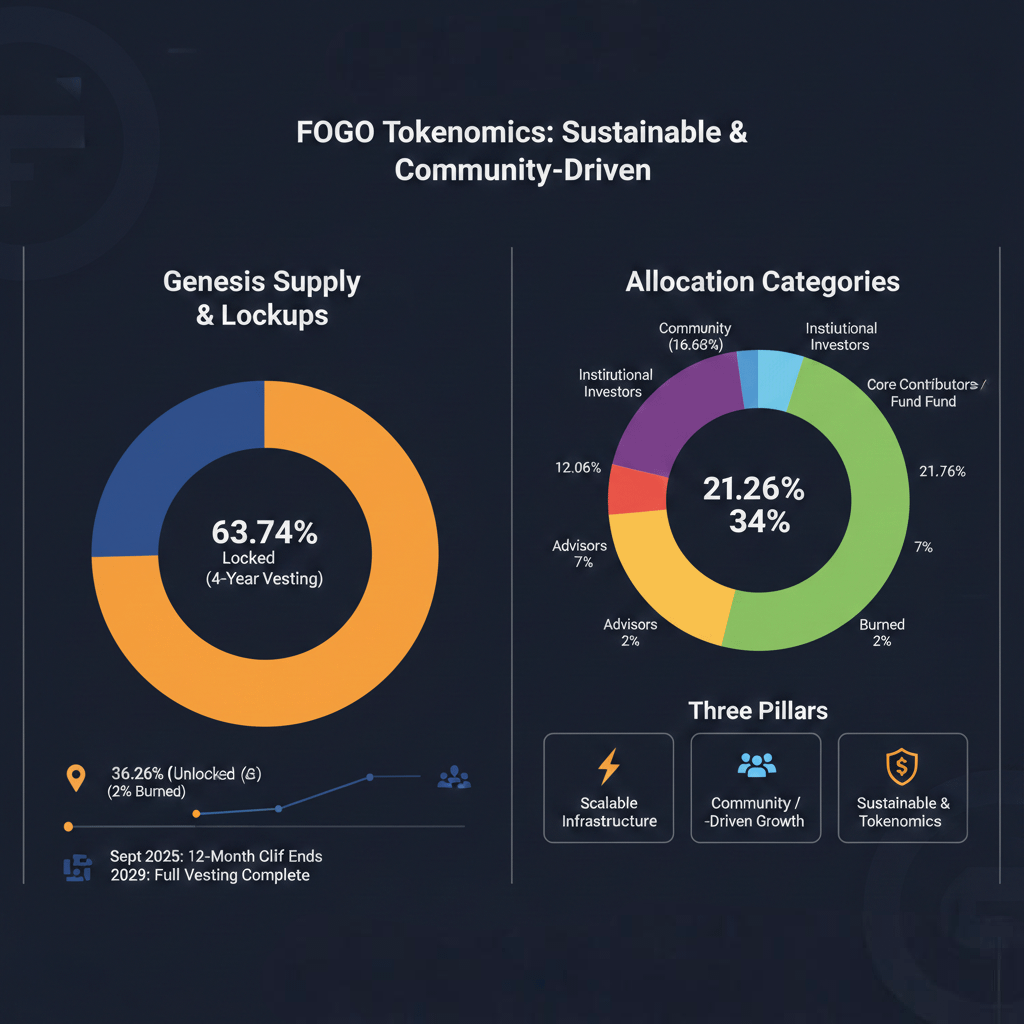

Rather than relying heavily on concentrated venture allocations, Fogo distributed tokens through Echo raises, a Binance Prime Sale, and broad community participation. Community allocation stands at 16.68% of total supply, with structured vesting and unlocked portions for early contributors and launch incentives.

Institutional investors hold 12.06%, fully locked until 2026. Core contributors hold 34%, vested over four years with a 12-month cliff. Advisors follow a similar long-term schedule. Over 63% of supply was locked at genesis, reducing early sell pressure.

This structure signals something important.

Fogo is not optimized for a fast token cycle. It is optimized for a multi-year build phase.

Vesting extending to 2029 aligns technical contributors with protocol survival, not short-term price performance.

Utility: Gas, Security, and Governance Flywheel

The $FOGO token functions across three layers.

It is required for transaction execution, with Sessions enabling dApps to sponsor fees. It secures the network through staking, allowing validators and delegators to earn rewards. It also governs protocol parameters, validator regions, and strategic direction.

If the chain succeeds in attracting serious trading volume, token demand becomes structurally tied to execution rather than speculation.

That is a subtle but important distinction.

The Real Competitor Is Not Another L1

Most people compare Fogo to Solana or other SVM chains. That comparison misses the point.

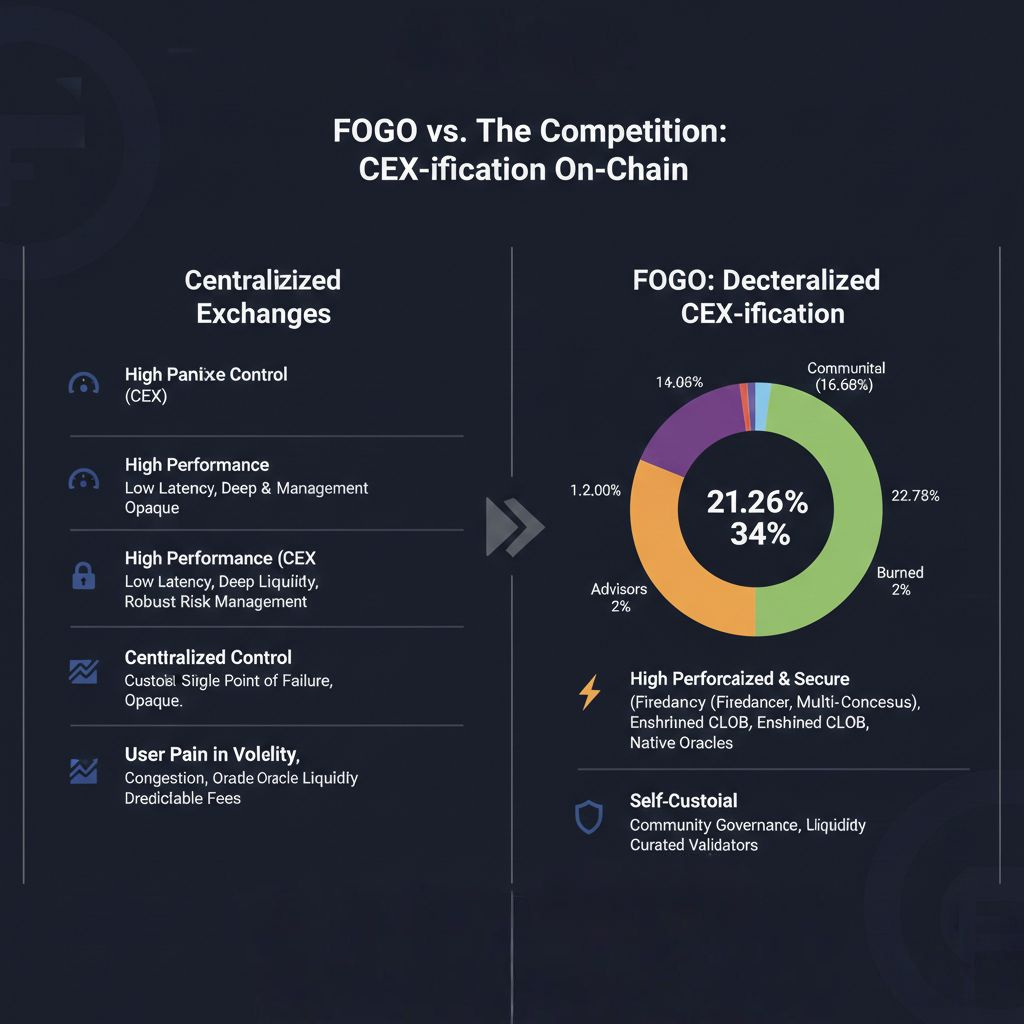

The true competitor is centralized exchanges.

Centralized venues dominate because they offer near-instant matching engines, deep liquidity, mature risk management systems, and predictable execution under stress.

Professional capital does not optimize for ideology. It optimizes for certainty.

Even today, during volatility events, liquidity often migrates back to platforms like Binance. Not because users prefer custody risk, but because execution reliability wins during chaos.

Fogo’s strategy can be described as CEX-ification on-chain.

It attempts to replicate matching speed, liquidity aggregation, and risk predictability while retaining self-custody and programmable transparency.

If successful, that shifts the battlefield from which Layer-1 is faster to whether on-chain infrastructure can replace centralized trading rails.

That is a much bigger question.

Why This Is an Unpopular Opinion

The industry narrative often rewards maximal decentralization, experimental architecture, or novel virtual machines.

Fogo takes a more pragmatic stance.

It uses proven SVM infrastructure, optimizes the execution client, curates validator performance, embeds market structure, and locks supply to reduce short-term volatility.

It sacrifices ideological purity for performance determinism.

That trade-off will not please everyone.

But capital markets rarely reward purity. They reward reliability.

Can It Work?

The real test will not be marketing cycles or token price spikes.

It will be whether latency remains stable under peak load, whether liquidity consolidates rather than fragments, whether execution remains consistent during volatility, and whether professional traders stay on-chain during crashes.

If Fogo proves resilient when markets stress, the narrative shifts. The debate moves away from TPS comparisons and toward structural competition between decentralized infrastructure and centralized exchanges.

That would be a far more consequential battle.

Final Thought

Fogo is not trying to win the Layer-1 race.

It is trying to win the execution war.

If it can deliver CEX-level reliability with DeFi-level custody, it will not just be another high-performance chain. It will become financial market infrastructure.

And infrastructure, unlike hype, compounds quietly until it becomes indispensable.

@Fogo Official #fogo #FOGO $FOGO