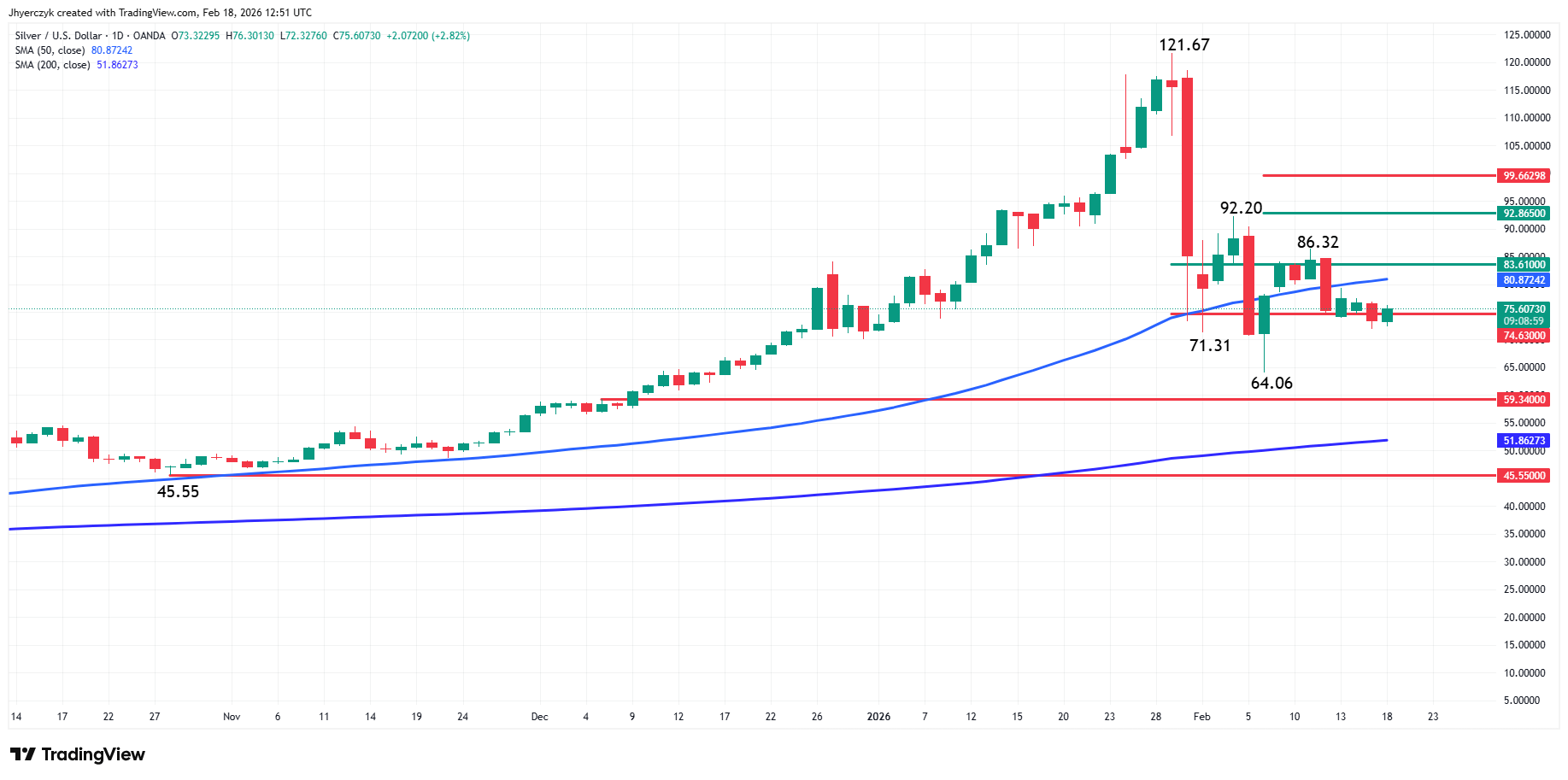

Silver is in a cooling-off/consolidation phase after its strong January rally. Right now, price is trading below the 50-day moving average ($80.87), which was a key support for most of 2025. As long as silver stays under this level, more downside pressure is possible.

Traders are no longer chasing higher prices. Instead, they are looking for “value” lower down, which increases attention on the 200-day moving average ($51.86) as the next major support zone.

A key date is April 10, when the 50-day moving average is expected to start declining, because the January spike will begin to drop out of the 50-day calculation. This could make the chart reflect the real trend more clearly.

Two outcomes to watch:

Bullish: Silver reclaims the 50-day MA, holds above it, and then needs a catalyst to push higher.

Bearish: Silver continues to reject the 50-day MA and slowly grinds down toward the 200-day MA. Later, a catalyst like lower interest rates could support a fresh rally after the “digesting” phase is complete.