➤ The Hidden Edge Most Traders Overlook

In crypto, information is everywhere — charts flashing, influencers tweeting, indicators firing signals every minute. Yet most traders still struggle.

Why?

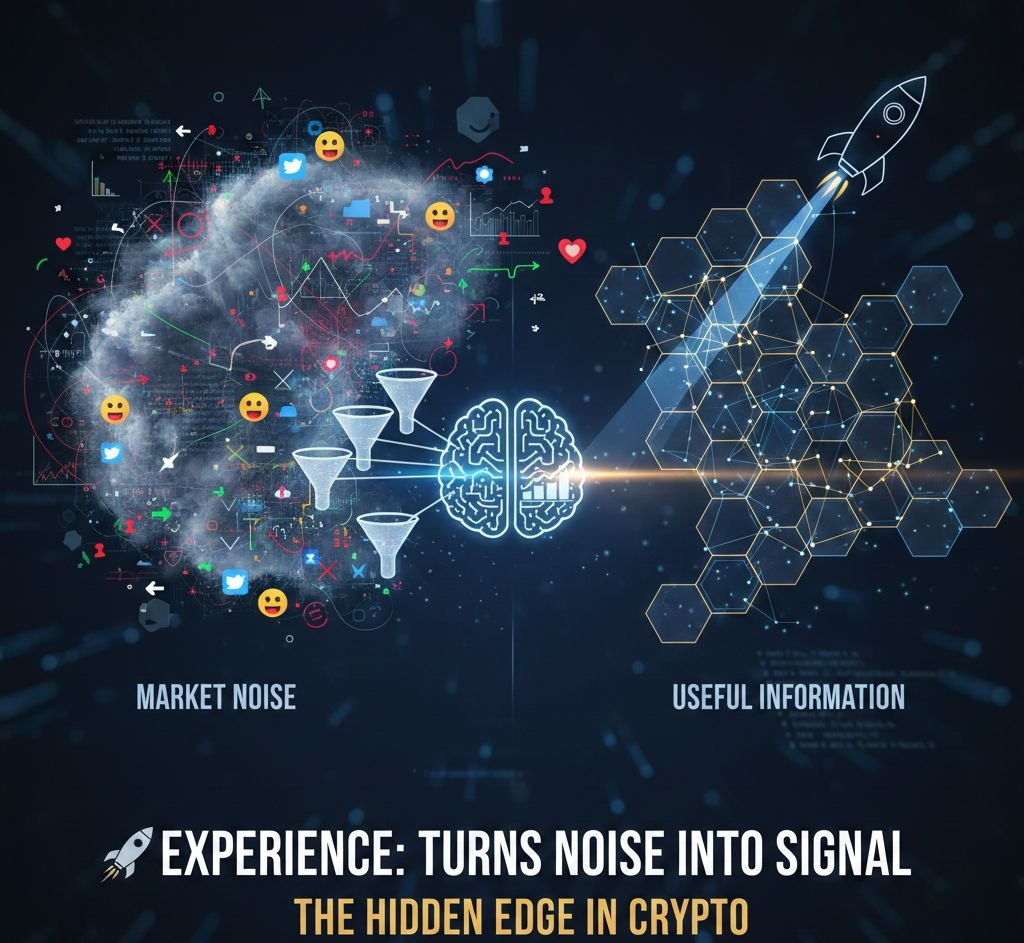

Because they confuse noise with signal.

✔︎ News headlines create panic.

✔︎ Social media amplifies fear and greed.

✔︎ Indicators contradict each other.

✔︎ Price spikes trigger emotional decisions.

But here’s the truth most beginners don’t realize:

> Experience doesn’t give you more information — it teaches you how to filter it.

That’s the real edge.

◆ What Is “Market Noise” in Crypto?

Market noise is random short-term movement or emotional reaction that doesn’t reflect real structural change.

Examples:

➜ A sudden 3% drop after a rumor

➜ An influencer calling for a “100x” coin

➜ A breakout that fails within hours

➜ Panic selling after minor liquidation cascades

In volatile markets like crypto, noise is constant. The inexperienced trader reacts.

The experienced trader observes.

◆ How Experience Changes Everything

Experience rewires how you interpret price action.

Instead of reacting emotionally, you begin to think probabilistically.

① You Recognize Patterns, Not Headlines

Experienced traders don’t chase every news event.

They ask:

✔︎ Is this aligned with higher timeframe structure?

✔︎ Is volume confirming the move?

✔︎ Is this liquidity hunting or genuine momentum?

They understand that price often moves to seek liquidity, not to follow narratives.

② You Understand Context Over Emotion

Beginners see a red candle and think: “It’s crashing.”

Experienced traders see:

➜ Support zone

➜ Oversold conditions

➜ Funding imbalance

➜ Weak hands exiting

Same chart. Different interpretation.

Experience transforms fear into analysis.

③ You Filter Social Media Influence

Crypto Twitter, Telegram, YouTube — information overload.

But experience teaches you:

✔︎ Most viral opinions are late

✔︎ Strong trends rarely need loud promotion

✔︎ Crowded trades increase risk

When you’ve lived through multiple cycles, hype becomes predictable.

④ You Develop a Structured Framework

Noise affects traders without a plan.

Experienced traders rely on:

➜ Defined risk per trade

➜ Clear invalidation levels

➜ Position sizing discipline

➜ Data-backed strategies

Structure turns chaos into opportunity.

◆ The Psychology Shift

The biggest transformation isn’t technical — it’s mental.

✔︎ You stop trying to predict every move.

✔︎ You accept uncertainty.

✔︎ You focus on execution, not perfection.

✔︎ You think in long-term probabilities, not single trades.

Experience doesn’t eliminate losses.

It eliminates emotional damage from losses.

◆ Why This Matters in 2026’s Crypto Landscape

With AI-driven trading, algorithmic liquidity sweeps, and 24/7 volatility, raw information is no longer scarce — it’s overwhelming.

The winners aren’t the most informed.

They’re the most filtered.

In modern crypto markets:

➤ Reaction is expensive

➤ Patience is profitable

➤ Experience compounds

◆ How to Build This Experience Faster

You don’t need 10 years — you need intentional practice:

① Journal every trade (reason, emotion, result)

② Review losing setups weekly

③ Focus on one or two strategies only

④ Reduce overtrading

⑤ Study past market cycles

Consistency builds pattern recognition.

Pattern recognition builds conviction.

Conviction builds edge.

Final Thoughts

Market noise will never disappear.

Volatility will always test your discipline.

But over time, if you stay consistent and analytical, something powerful happens:

What once looked chaotic becomes structured.

What once felt random becomes readable.

That’s when trading shifts from gambling… to skill.

Have you noticed how your interpretation of charts has changed over time?

What was your biggest lesson from experience in crypto?

✔︎ Drop your thoughts in the comments

✔︎ Share this with a trader who needs clarity

✔︎ Follow for more structured crypto insights

The market rewards discipline — not noise.

#StrategyBTCPurchase #PredictionMarketsCFTCBacking #OpenClawFounderJoinsOpenAI #PEPEBrokeThroughDowntrendLine