Introduction

When I look at Fogo, I don’t see “another Layer-1.” I see a deliberate design choice.

Fogo is a decentralized Layer-1 blockchain built specifically for traders and professional capital markets. It runs a bespoke Firedancer client on top of the Solana architecture (Solana Virtual Machine, SVM) and pushes latency down using multi-local consensus.

Fogo is not trying to be everything. It is not optimizing for gaming, NFTs, or experimental social apps. It is focused on one thing: high-performance on-chain trading that feels as reliable as a centralized exchange—without giving up self-custody.

That focus defines everything: the architecture, the validator model, and the tokenomics.

Architecture: Built for Execution, Not Ideology

Fogo doesn’t reinvent Solana’s foundations. It keeps:

Proof of History (global clock)

Tower BFT (consensus)

Turbine (block propagation)

SVM (execution engine)

Leader rotation

Instead of redesigning the stack, it optimizes it. Compatibility with Solana tooling remains intact, allowing developers to migrate without rewriting applications.

Where Fogo differentiates is in performance discipline.

1. Integrated Client Execution (Firedancer Standardization)

Rather than allowing multiple validator clients with uneven performance, Fogo standardizes around a high-performance Firedancer-based client (originally developed by Jump Crypto).

Parallel execution, optimized memory handling, and a C-based networking stack reduce bottlenecks.

This avoids the “lowest common denominator” problem seen in heterogeneous validator networks.

2. Zone-Based, Multi-Local Consensus

Validators are grouped into geographic zones—often within the same data center—to reduce physical latency.

Zones rotate across epochs to preserve resilience and jurisdictional diversity.

Result:

Sub-100ms target block times

Sub-second finality

Lower variance under load

This matters most when volatility spikes.

3. Curated Validator Set

Fogo prioritizes operational standards. Validators must meet hardware and performance requirements.

Low-performance nodes and abusive MEV actors are filtered out.

This does reduce permissionless access at the margins—but in practice, most PoS networks are already dominated by high-stake operators. Fogo makes that trade-off explicit in favor of predictability.

The Three Strategic Pillars

Fogo’s positioning rests on three interconnected pillars:

1. Scalable infrastructure

2. Community-driven growth

3. Sustainable tokenomics

They reinforce each other rather than compete.

Scalable Infrastructure

Fogo looks less like a typical blockchain and more like financial market infrastructure.

Enshrined Central Limit Order Book (CLOB)

Instead of fragmented DEX liquidity, the order book is integrated at the protocol layer.

This reduces:

Liquidity fragmentation

Slippage

Latency between matching and settlement

It mirrors centralized exchange mechanics—without custody risk.

Native Oracles

Price feeds are integrated into the protocol. Validators maintain timely pricing data, reducing external oracle lag and dependency risks.

Hardware Standardization

Validators are encouraged to deploy similar high-performance hardware in optimized environments.

The objective is consistency under stress—not just average speed.

Community-Driven Growth

Fogo adopted a broader distribution model through:

Echo raises

Binance Prime Sale

Community airdrops

This spreads ownership beyond a small VC circle.

Governance participation and gas-sponsored Sessions (where dApps cover user transaction fees) improve usability and encourage adoption.

Distribution aligns users, builders, and token holders.

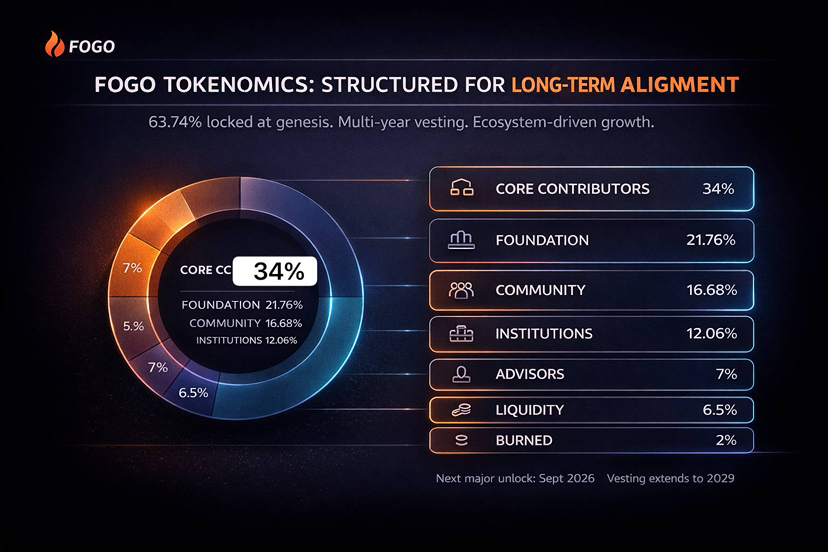

Tokenomics: Structured for Longevity

Fogo’s token design emphasizes long-term alignment over short-term liquidity.

Genesis Structure

63.74% of supply locked at genesis

36.26% initially unlocked

2% permanently burned

Most major allocations begin unlocking on 26 September 2025 after a 12-month cliff.

Institutional investors begin vesting on 26 September 2026.

Vesting extends through 2029.

This reduces early sell pressure and signals multi-year commitment.

Allocation Overview

Community – 16.68%

8.68% Echo raises (12-month cliff, 4-year vesting)

2% Binance Prime (fully unlocked)

6% Airdrops (mixed unlocked/allocated)

Institutional Investors – 12.06%

Fully locked, vesting from Sept 2026

Core Contributors – 34%

12-month cliff, 4-year vesting

Foundation / Ecosystem – 21.76%

Allocated for grants, incentives, expansion

Advisors – 7%

4-year vesting with cliff

Launch Liquidity – 6.5%

Fully unlocked

With over 63% locked post-genesis, supply shock risk is moderated.

Token Utility

The $FOGO token has three primary functions:

1. Gas – Transaction fees

2. Staking – Validators and delegators secure the network

3. Governance & Ecosystem Participation – Voting, fee discounts, ecosystem incentives

There is also a revenue flywheel mechanism where ecosystem activity can reinforce value back into the network.

The Real Competition: CEX, Not Other L1s

Comparing Fogo directly to Solana or other SVM chains misses the point.

The real trade-off for traders is:

On-chain vs Centralized Exchange.

Centralized exchanges dominate because they offer:

Near-instant matching

Deep liquidity

Tight spreads

Mature risk engines

In times of stress, capital returns to reliability. That’s why exchanges like Binance capture volume during volatility spikes.

Traders value certainty more than ideology.

Fogo’s Strategy: CEX-Grade Performance On-Chain

Fogo attempts “CEX-ification” of DeFi:

Sub-100ms blocks

Unified order book

Native oracles

Hardware-standardized validators

Reduced latency variance

The focus is not maximal decentralization experimentation. It is execution certainty.

If Fogo can match centralized exchange performance while preserving self-custody, the competitive battlefield shifts.

Not chain vs chain.

Infrastructure vs centralized custody.

Why Capital Still Returns to CEX

During volatility, on-chain trading often suffers from:

Confirmation delays

Fragmented liquidity

Oracle lag

Congestion

Professional capital moves where execution is predictable.

If Fogo maintains uptime, liquidity depth, and low variance during real stress events, that behavior could change.

Final Thoughts

Fogo is a focused bet:

Performance over generalization.

Execution reliability over experimentation.

Structured tokenomics over short-term hype.

Built on Solana’s architecture but optimized through Firedancer standardization, zone-based consensus, and validator curation, it aims to make on-chain trading competitive with centralized exchanges.

Its token supply remains largely locked, vesting extends to 2029, and incentives are structured around long-term alignment.

Ultimately, the outcome depends on one thing:

Can it stay fast and liquid when markets break?

If it can, the narrative shifts.

The future battle won’t be L1 vs L1.

It will be decentralized execution vs centralized custody.