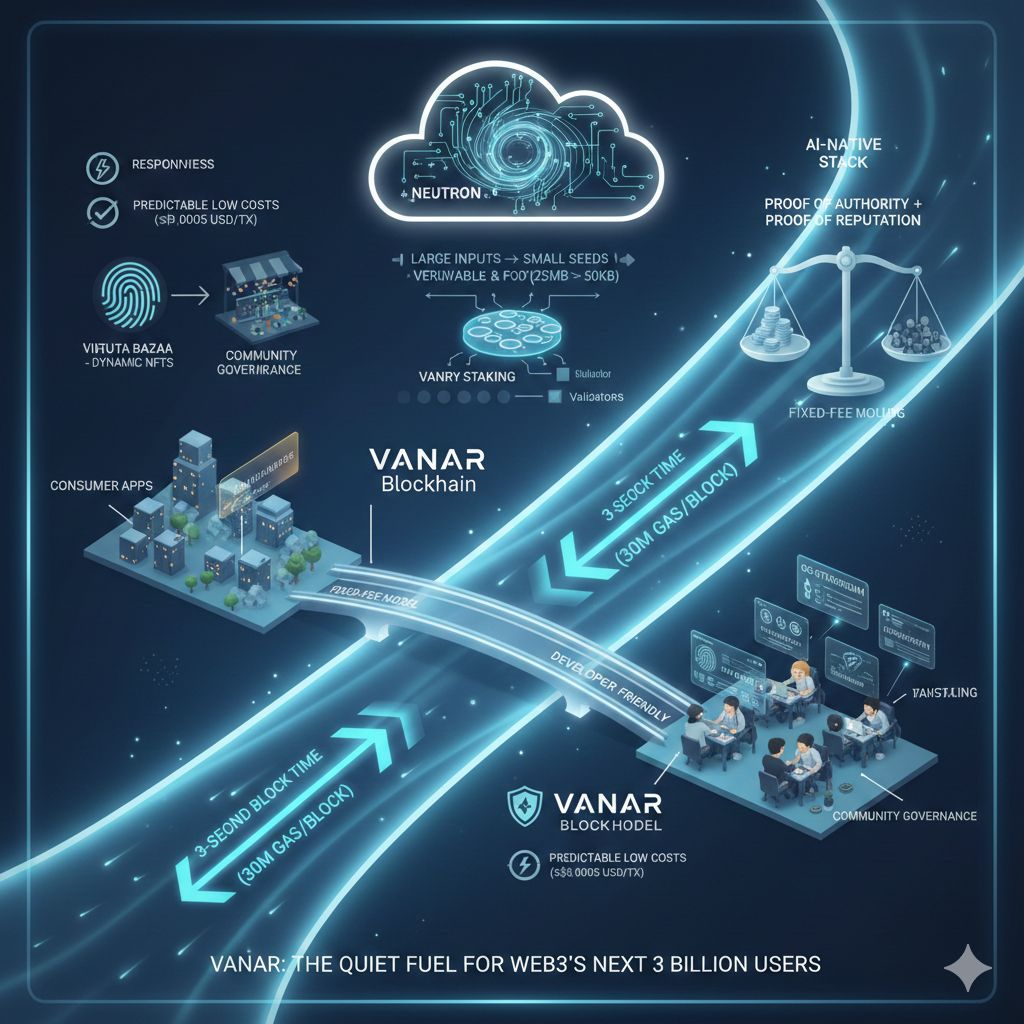

Vanar is built around a simple premise that most “general-purpose” chains only talk about: if you want mainstream adoption, blockchain has to behave like infrastructure, not like a market. That shows up in the two areas users feel immediately—cost and responsiveness—and in the two areas builders care about most—developer familiarity and predictable operations at scale. In its own technical framing, Vanar is engineered for fast confirmations (a maximum 3-second block time is explicitly stated) and high throughput via a high per-block gas limit (30 million), because consumer apps don’t survive latency the way speculative protocols sometimes can.

The architecture choices reinforce that “boring reliability” goal. Vanar describes its execution layer as based on Go-Ethereum (geth), which is a pragmatic way to inherit battle-tested EVM behavior rather than inventing a new runtime and hoping the ecosystem follows. Practically, that means developers can reuse the mental model, tooling, and deployment patterns they already trust from the EVM world, and Vanar’s own documentation explicitly leans into that compatibility strategy rather than treating it as an afterthought.

Where Vanar gets more opinionated is how it secures and governs performance. The chain describes a hybrid approach: primarily Proof of Authority, with validator onboarding governed through Proof of Reputation, and the foundation initially running validators before expanding participation. That choice is controversial in crypto culture but coherent in a consumer-first design: it prioritizes consistent block production early, then tries to broaden validator inclusion through reputation rather than pure capital. On the staking side, Vanar documents a delegated model where the foundation selects validators and the community delegates VANRY to them—so token holders can participate in security and rewards without having to operate infrastructure.

The clearest “Vanar move” is its fee design, because it targets the exact failure mode that breaks consumer products: unpredictable costs. Vanar’s whitepaper describes a fixed-fee model expressed in dollar terms, including a commitment that ordinary transactions remain extremely cheap even if the token price rises materially. It also explicitly ties this fee model to transaction ordering: with fixed fees, Vanar frames transaction inclusion as first-come, first-served rather than an auction for priority, aiming for fairness and predictability in high-traffic moments. In the docs, that fixed-fee concept is operationalized as tiers: a broad “normal usage” band is priced around $0.0005, while larger transactions are priced higher to make spam and block-filling attacks economically painful. To keep “fixed in USD” from becoming “floating in practice,” Vanar documents a protocol-level mechanism that updates the VANRY reference price using multiple market sources so the user sees stable fiat-denominated fees even as token markets move.

All of that matters because Vanar’s token, VANRY, is intended to be used constantly, not occasionally. At the base layer, VANRY is the gas token for transactions and smart-contract execution and is used in staking, as described in a UK crypto asset statement produced for Kraken. That same statement provides the cleanest snapshot of VANRY’s supply structure: a total supply of 2.4 billion, with a large genesis allocation tied to the 1:1 swap from the legacy TVK token (1.5B, 50%), plus validator rewards (996M, 41.5%), development rewards (156M, 6.5%), and airdrops/community incentives (48M, 2%). Vanar’s own swap announcement also states the 1:1 conversion explicitly, and exchange notices from the period corroborate the same ratio, reinforcing that the migration mechanics were designed to be straightforward for holders.

Economically, Vanar’s design links the token’s long-term role to network activity and security rather than to perpetual inflation narratives. The whitepaper describes two minting paths—genesis issuance and ongoing issuance via block rewards—while reiterating the hard cap at 2.4B tokens. The protocol docs align with that, describing block rewards as the incentive mechanism for validators and the tool for gradual issuance rather than abrupt supply shocks. From a market-structure perspective, CoinMarketCap currently reports a circulating supply of 2,291,370,559 VANRY against the 2.4B max, which implies a high circulation ratio relative to many newer networks (and therefore a different risk profile: less “future unlock overhang,” more dependence on real usage to drive value).

Vanar’s ecosystem strategy is where the “next 3 billion consumers” thesis either becomes real or stays theoretical. The project doesn’t only promise gaming and digital worlds; it points to consumer surfaces that already exist. Virtua, for example, positions its Bazaa marketplace as a decentralized marketplace built on Vanar, with dynamic NFTs meant to be used across experiences rather than treated as idle collectibles. That matters because it gives VANRY a natural sink—users need the token (directly or abstracted by the product) to transact, mint, trade, and interact—while giving developers a reason to deploy where fees won’t destroy retention loops.

The more forward-leaning part of Vanar’s roadmap is its AI-native stack narrative, and it’s not just marketing language on the homepage. Vanar describes the chain as “built for AI from day one,” emphasizing AI workloads and semantic operations as first-class design goals. Neutron is presented as a data layer that compresses large inputs into much smaller “Seeds” (the public claim is 25MB into 50KB) and frames those outputs as verifiable and programmable rather than merely stored. In the technical docs, Neutron is described with a hybrid posture—seeds stored off-chain for performance, optionally anchored on-chain for verification and ownership—suggesting the team is trying to balance “AI-scale data” with blockchain constraints instead of pretending everything belongs directly in blocks. Whether Neutron becomes a genuine differentiator will depend on developer uptake and whether “semantic memory” features translate into measurable product outcomes (search, personalization, compliance logic, fraud reduction) that consumers actually feel.

Trust and user quality is another axis Vanar seems to be leaning into, especially where marketplaces, PayFi flows, and incentive systems attract bots. A notable integration here is Humanode’s Biomapper C1 deployment on Vanar (dated July 17, 2025), described as privacy-preserving biometric Sybil resistance that can be added with minimal integration effort, positioned for AI marketplaces and dynamic payment systems. In consumer ecosystems, “real users vs. farms” is not a side problem; it’s the difference between growth and collapse, so integrations like this are strategically aligned with Vanar’s broader adoption narrative.

If you zoom out, Vanar’s core bet is not that it can out-hype other L1s, but that it can out-operationalize them for consumer contexts: EVM familiarity to reduce builder friction, fast blocks for responsive UX, fixed and tiered USD-denominated fees to make cost predictable, and product-linked ecosystems so the chain isn’t waiting for demand to appear. The hard test is also clear: a consumer-first chain only earns its narrative if daily usage becomes routine and durable—transactions that happen because users are playing, trading, earning, and verifying, not because they’re speculating. If Vanar keeps pushing its stack in that direction—where VANRY is the quiet fuel for an experience that feels stable, fast, and human-scaled—then the most interesting outcome isn’t that it becomes “another L1,” but that it proves a different success pattern: blockchains win adoption when they stop asking users to care that they’re using one.