When I sit with a project Fogo I try to strip away the noise and ask a simple q usestion ? spent enough time watching markets and digital systems to know that most failures don’t happen because something is obviously broken. They happen because a system behaves just well enough to survive, but not well enough to be trusted under pressure. When activity is light, almost everything looks functional. When volume increases, when timing matters, when users are tired or stressed or making decisions quickly, weaknesses surface. Latency shows up as hesitation. Unclear execution shows up as smaller position sizes. Inconsistent settlement shows up as people quietly leaving. Over time, behavior changes long before opinions do.

That observation is where I start when I look at infrastructure like Fogo. Not with what it promises to be, but with what problem it seems to acknowledge. The problem is not that blockchains are slow in an abstract sense. It’s that systems which handle value are judged minute by minute on whether they respect human intent. If I act, I expect a response. If I commit capital, I expect clarity. Any delay, ambiguity, or inconsistency creates psychological drag. People don’t articulate this in whitepapers, but they react to it instinctively.

Fogo exists because there is a gap between theoretical performance and lived experience. Many systems claim high throughput or low fees, but those claims often flatten under real usage. What matters is not peak numbers, but whether execution feels predictable when it matters most. From the outside, Fogo’s decision to utilize the Solana Virtual Machine reads like a technical choice. From the inside, it looks more like a behavioral one. It suggests an emphasis on fast, deterministic execution as a baseline expectation, not a luxury.

I’ve learned to interpret design choices as signals. When a team builds around a particular execution environment, they’re revealing what kind of failure they’re least willing to tolerate. In this case, the intolerance seems aimed at latency and inconsistency. Markets are environments where delays don’t just slow things down; they change outcomes. A trade filled late is not the same trade. A settlement confirmed seconds later can shift risk. Over time, these small mismatches train users to distrust the system, even if they can’t explain why.

I’ve learned to interpret design choices as signals. When a team builds around a particular execution environment, they’re revealing what kind of failure they’re least willing to tolerate. In this case, the intolerance seems aimed at latency and inconsistency. Markets are environments where delays don’t just slow things down; they change outcomes. A trade filled late is not the same trade. A settlement confirmed seconds later can shift risk. Over time, these small mismatches train users to distrust the system, even if they can’t explain why.

What interests me about Fogo is not speed as a headline, but speed as a form of emotional stability. When execution is consistently fast, users stop thinking about the system and start thinking about their decisions. That sounds trivial, but it’s rare. Most infrastructures demand attention at the wrong moments. You find yourself watching confirmations, refreshing dashboards, second-guessing whether an action went through. That cognitive load accumulates. Systems that reduce it create a different kind of relationship with their users.

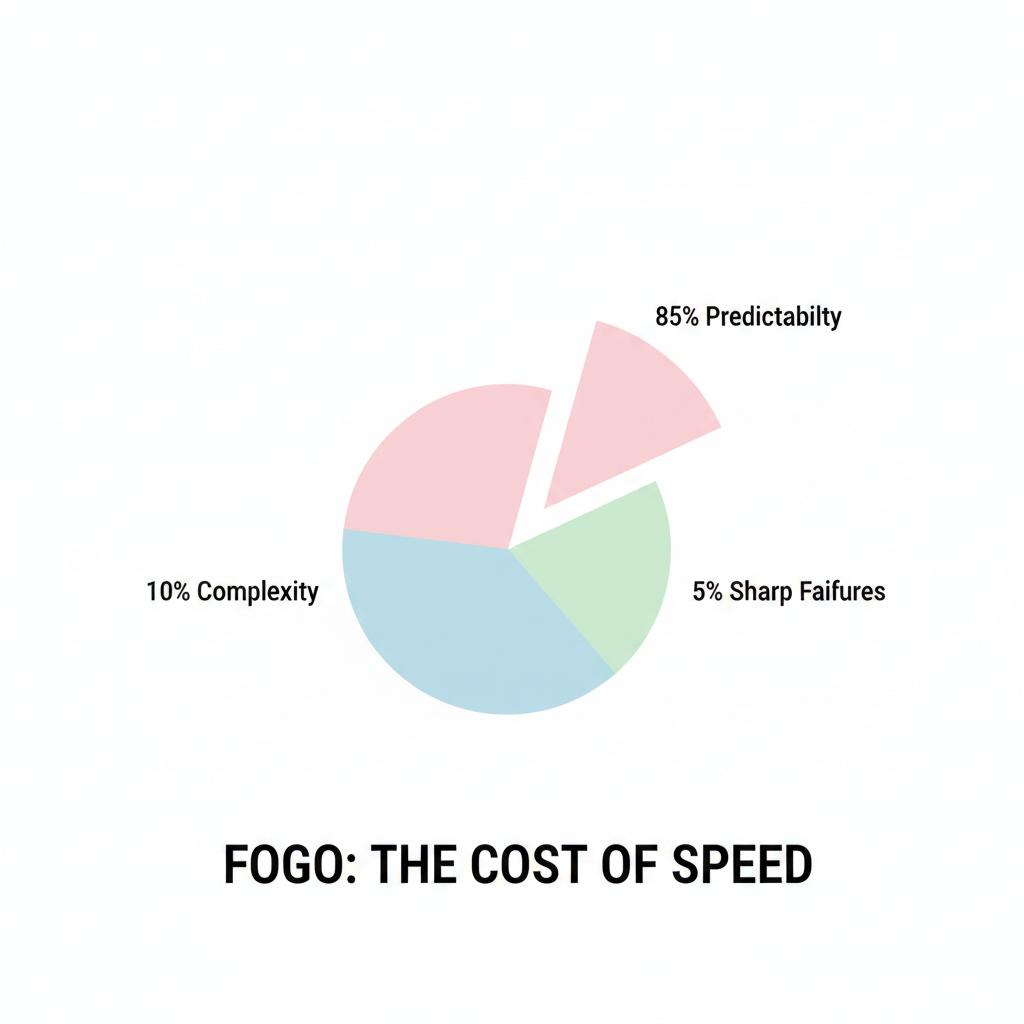

The Solana Virtual Machine, in this context, isn’t just an engine. It’s a constraint. It enforces a certain execution model that prioritizes parallelism and throughput. But constraints always come with trade-offs. Designing for speed means accepting complexity elsewhere. It means developers and operators have to be more disciplined. It means failures, when they happen, can be sharp rather than gradual. I don’t see that as a flaw so much as an honest exchange. You’re choosing predictability in one dimension over comfort in another.

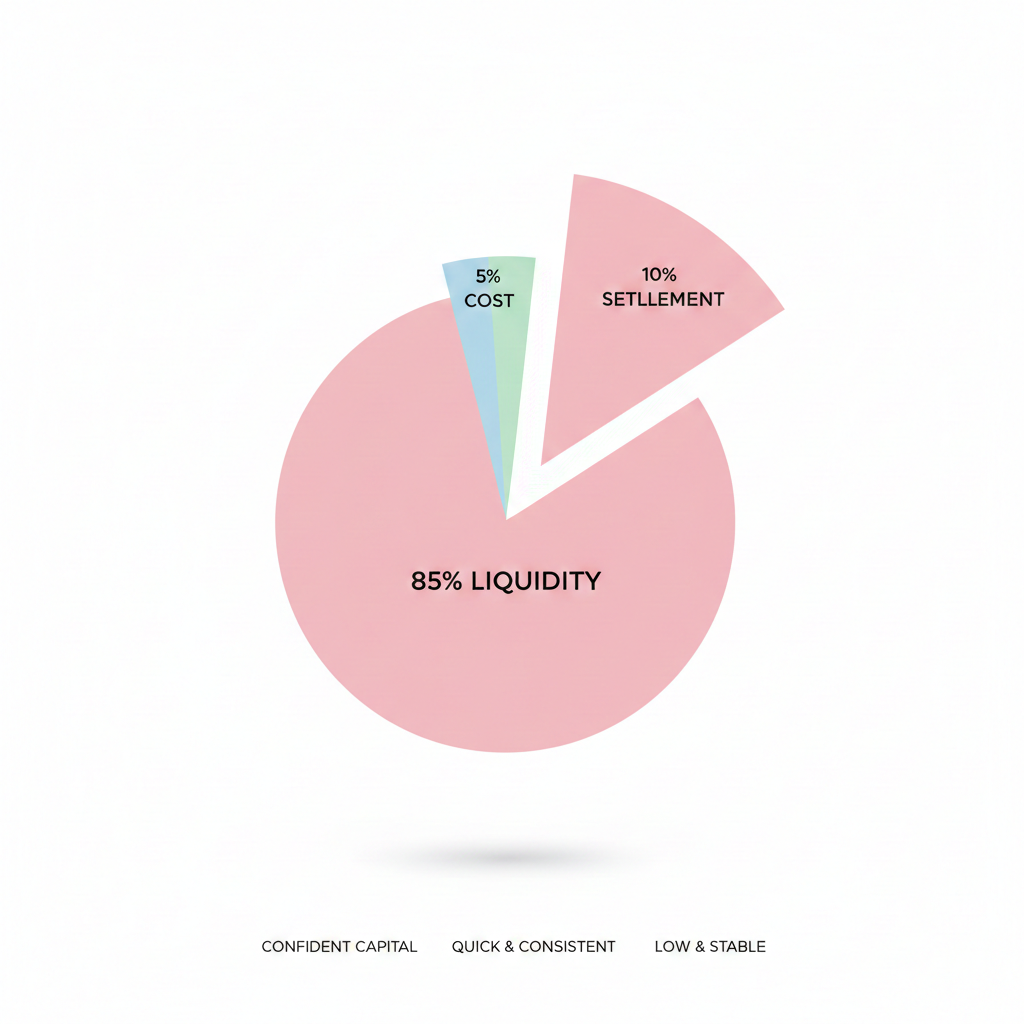

From a liquidity perspective, this matters more than people admit. Liquidity is not just about capital being present; it’s about capital being confident. When participants believe they can enter and exit positions without friction, they behave differently. They quote tighter spreads. They size up rather than down. They engage more frequently. You can often see this indirectly in charts, in how price responds to volume spikes, or in how order books behave during stress. Infrastructure that executes cleanly encourages participation without needing to persuade anyone.

From a liquidity perspective, this matters more than people admit. Liquidity is not just about capital being present; it’s about capital being confident. When participants believe they can enter and exit positions without friction, they behave differently. They quote tighter spreads. They size up rather than down. They engage more frequently. You can often see this indirectly in charts, in how price responds to volume spikes, or in how order books behave during stress. Infrastructure that executes cleanly encourages participation without needing to persuade anyone.

Settlement is another area where design reveals intent. Slow or uncertain settlement doesn’t just increase risk; it reshapes incentives. People build workarounds. They delay actions. They demand buffers. Over time, the system fills with defensive behavior. A chain designed to settle quickly and consistently reduces the need for those behaviors. It doesn’t eliminate risk, but it localizes it. Users know where uncertainty ends, and that clarity is valuable.

Cost is often discussed as a number, but in practice it’s a signal. Low, stable costs tell users that the system won’t punish them for being active. Volatile or unpredictable costs tell them to be cautious. Even when fees are technically low, unpredictability creates hesitation. An infrastructure that keeps costs boring creates room for experimentation and iteration. People try things because the penalty for failure is small and known.

Latency ties all of this together. I don’t think of latency as a performance metric; I think of it as a trust metric. When outcomes arrive quickly, users learn to associate action with result. When they don’t, users decouple the two and start protecting themselves. That protection shows up as reduced engagement, not complaints. Systems that feel immediate foster a sense of agency. Systems that feel delayed foster passivity.

Latency ties all of this together. I don’t think of latency as a performance metric; I think of it as a trust metric. When outcomes arrive quickly, users learn to associate action with result. When they don’t, users decouple the two and start protecting themselves. That protection shows up as reduced engagement, not complaints. Systems that feel immediate foster a sense of agency. Systems that feel delayed foster passivity.

Privacy and coordination are subtler, but no less important. Even in transparent systems, users care about how much of their behavior is exposed and when. Infrastructure that manages these boundaries thoughtfully allows coordination without overexposure. It lets participants act without feeling watched in every moment. That balance affects how comfortable people feel operating at scale. Too much opacity breeds suspicion. Too much transparency breeds caution. Finding the middle ground is a design challenge, not a moral one.

I don’t assume Fogo solves all of this perfectly. No system does. High-performance environments often face challenges around complexity, resilience, and developer ergonomics. Fast execution can magnify errors. Parallelism can introduce edge cases. These are real trade-offs, and they matter. What I look for instead is whether the system seems aware of them, and whether its choices align with the kind of behavior it wants to encourage.

When I imagine Fogo under sustained use, I think less about benchmarks and more about habits. Do users stop checking confirmations obsessively? Do developers build assuming the system will respond as expected? Do participants treat it as a reliable layer rather than an experiment? These are questions that can’t be answered by documentation alone. They show up in usage patterns, in retention, in how people talk about the system when they’re not trying to sell it.

When I imagine Fogo under sustained use, I think less about benchmarks and more about habits. Do users stop checking confirmations obsessively? Do developers build assuming the system will respond as expected? Do participants treat it as a reliable layer rather than an experiment? These are questions that can’t be answered by documentation alone. They show up in usage patterns, in retention, in how people talk about the system when they’re not trying to sell it.

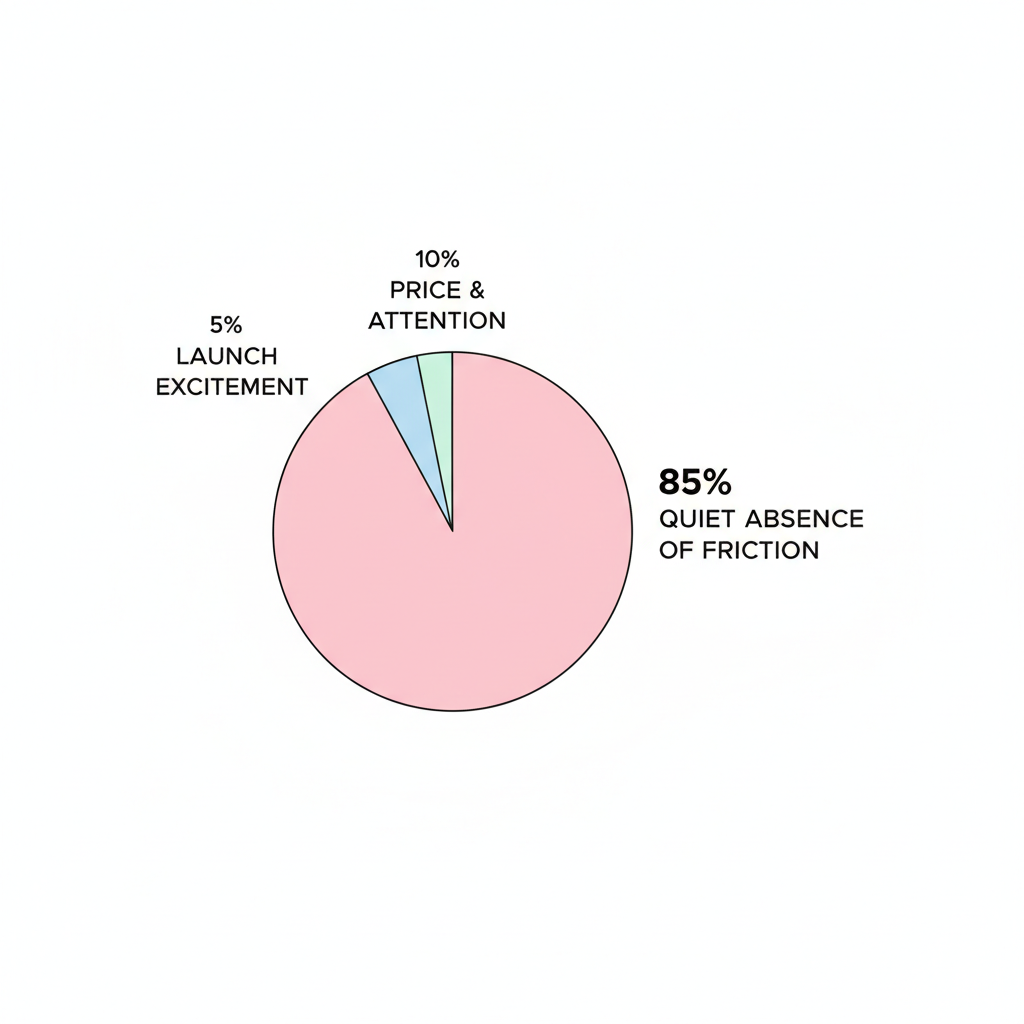

Over time, infrastructure either fades into the background or becomes a constant topic of conversation. The best systems are rarely discussed because they don’t demand attention. They just work. That’s not glamorous, but it’s durable. If Fogo succeeds, I suspect it won’t be because it convinced people with narratives, but because it trained them through experience. Quietly, repeatedly, it would show that action leads to outcome without drama.

I value systems that respect time. Not in a philosophical sense, but in a practical one. Time is the one input users never get back. Infrastructure that wastes it erodes trust, even if everything else looks impressive. Infrastructure that preserves it earns loyalty without asking. Fogo’s design choices suggest an understanding of this dynamic. Whether that understanding translates into long-term usefulness will depend on how consistently the system behaves when it’s no longer being watched closely.

In the end, I don’t judge infrastructure by how exciting it feels at launch. I judge it by how invisible it becomes once people rely on it. If, years from now, users interact with Fogo without thinking about it, without adjusting their behavior defensively, without needing to explain why it works, that will be the real measure. Not price, not attention, but the quiet absence of friction.