Vanar did not emerge from nothing. It evolved. The transition from Terra Virtua into Vanar Chain was not cosmetic; it was a foundational shift in identity, token structure, and long-term strategy. When a project restructures at that scale, markets react in phases. First confusion. Then revaluation. Then accumulation by those who understand what changed before the crowd does.

That early period of restructuring created the first real trading opportunity. Liquidity reset, narrative reset, tokenomics refinement. Smart capital does not chase announcements it studies positioning. When the migration narrative stabilized and the new Layer-1 identity became clear, VANRY began building its base again. And base-building in crypto is where the real money is positioned.

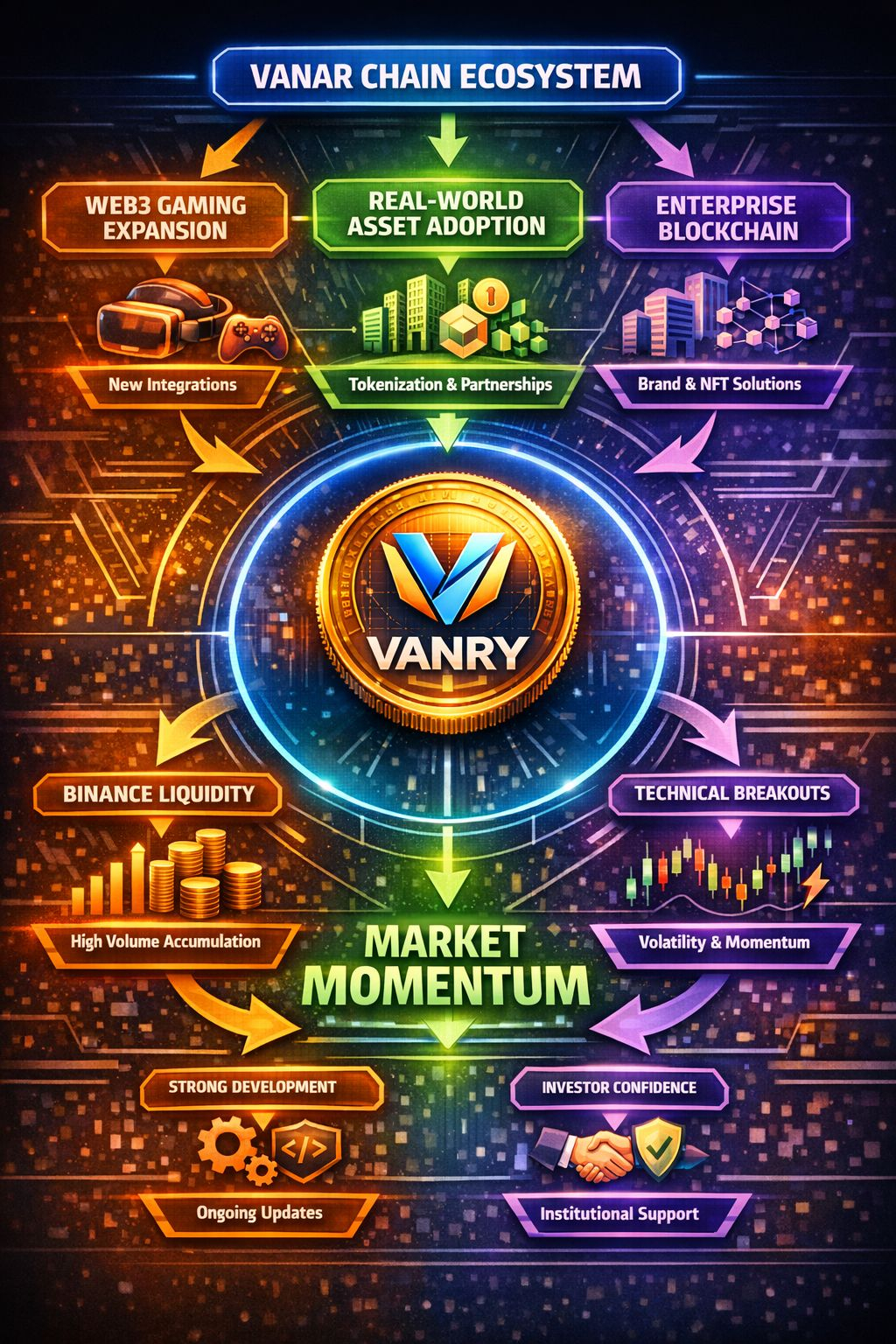

What separates Vanar from dozens of other Layer-1 competitors is its focus. It did not attempt to become everything. It narrowed its attack vector into entertainment, gaming, and real-world brand integration. That clarity of direction matters because capital flows toward conviction.

When ecosystem integrations started rolling out particularly those tied to immersive digital experiences and gaming infrastructure traders began to notice something subtle but powerful. On-chain activity began to climb. Wallet engagement increased. Development updates were not abstract promises; they were measurable expansions.

Markets respond to proof.

Every time Vanar announced ecosystem growth, Binance order books reflected a shift. Large bids appeared during pullbacks. Sell walls thinned gradually instead of collapsing price. This is a textbook sign of controlled absorption. Professional traders recognize this pattern: consolidation under resistance, tightening volatility, declining downside aggression. It is not emotional retail behavior. It is positioning.

Then broader crypto liquidity cycles entered the equation. During risk-on phases led by Bitcoin expansion, VANRY displayed amplified beta behavior. But what made it stand out was not just its upside bursts it was its resilience during corrections. Instead of erasing gains entirely, it formed structured higher lows on higher timeframes. That structural integrity builds trader confidence.

Confidence is capital’s magnet.

Another real-world driver shaping VANRY’s behavior has been the growing demand for Web3 gaming infrastructure. The global gaming industry is massive, and blockchain integration is no longer experimental it is inevitable. Vanar positioned itself as infrastructure rather than a single-game token. That distinction is critical. Infrastructure tokens capture ecosystem growth, not just product success.

As developers onboard and build within an ecosystem, token utility expands organically. More smart contracts. More transaction volume. More staking engagement. Increased demand pressure in subtle but compounding ways. Utility-backed tokens often experience delayed but powerful repricing once ecosystem depth reaches critical mass.

Binance liquidity plays a decisive role in this equation. Deep liquidity pools allow accumulation without dramatic price spikes. This creates compression phases. And in trading, compression precedes expansion. VANRY has historically respected this rhythm: extended range consolidation, volatility contraction, sudden breakout fueled by volume ignition.

This is not a slow-grind token. It behaves like stored energy.

Another dimension influencing Vanar’s trajectory is enterprise blockchain adoption. As global brands explore tokenization, digital identity, immersive engagement, and blockchain-backed assets, infrastructure-ready chains gain speculative tailwinds. Vanar’s positioning within entertainment and brand integration gives it optionality and optionality in markets is priced at a premium during bullish expansions.

Survivability is another underappreciated factor. Many projects disappear during bear markets. Vanar endured. Development continued. Exchange presence remained intact. Community engagement did not evaporate. Survival builds narrative strength because it filters out weak hands and speculative excess.

When markets recover, survivors move first.

Technically, VANRY has shown a tendency to respect major retracement zones during corrections. Liquidity sweeps below support levels often precede aggressive reversals, suggesting algorithmic accumulation rather than panic-driven capitulation. Funding rate resets during derivatives overheating phases have historically created healthier continuation structures.

These are not coincidences. They are behavioral patterns.

Real-world events tied to Vanar ecosystem launches, gaming integrations, developer onboarding, brand partnerships, structural rebranding do not operate in isolation. They feed into liquidity cycles. They influence sentiment. They shift trader psychology. And psychology, in leveraged markets, amplifies price.

The most dangerous mistake traders make is confusing silence with weakness. Vanar’s growth has often unfolded quietly before volatility erupts. Accumulation phases rarely feel exciting. They feel boring. Tight ranges. Low social buzz. Controlled price action. Until suddenly, they do not.

And that is where professionals separate from spectators.

VANRY is not priced purely on what it is today. It is priced on what its infrastructure could support tomorrow. If broader market liquidity expands and narrative rotation flows back into Web3 gaming and real-world blockchain integration, Vanar stands positioned to absorb that capital efficiently.

In crypto, narratives ignite moves. Infrastructure sustains them.

Vanar has spent its time building infrastructure. And when liquidity returns in force, infrastructure-backed assets do not beg for attention they command it.

For the pro-trader watching Binance depth charts, volume shifts, funding metrics, and ecosystem growth side by side, VANRY is not just another altcoin ticker. It is a coiled mechanism waiting for the right macro trigger.

And when compression finally releases, markets rarely move quietly.