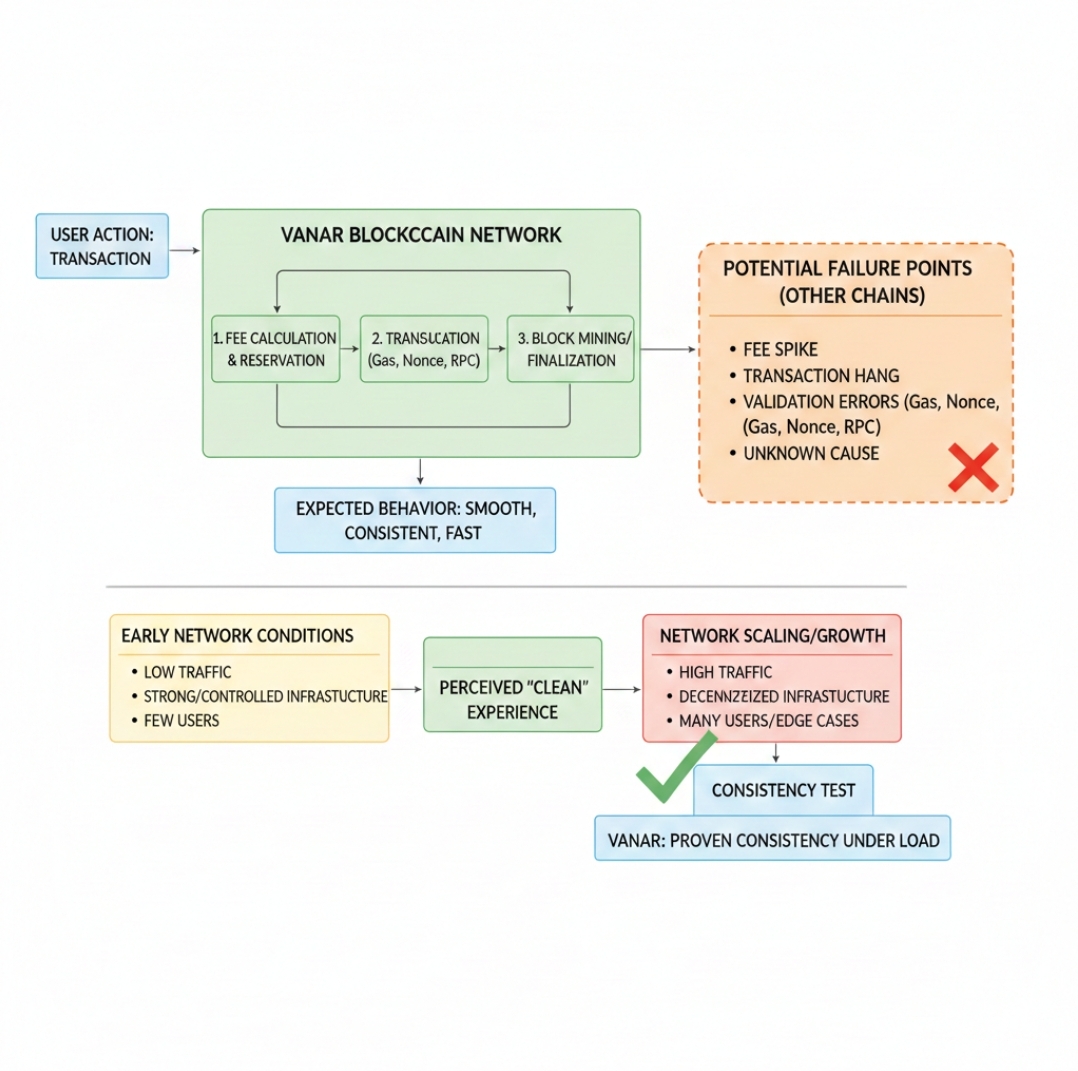

I’m going to start with the part that most crypto writeups skip. Using Web3 often feels stressful. Not because people hate new tech. But because the experience can feel unpredictable. Fees can spike. Confirmations can lag. A single wrong click can feel like a permanent mistake. Vanar Chain positions itself as an L1 designed for real world adoption with a focus on consumer experiences like gaming and entertainment where users expect things to simply work.

The core idea is practical. Make the chain fast enough for interactive apps. Make costs predictable enough that teams can plan. Make the developer path familiar enough that products can ship without years of relearning. Vanar’s architecture documentation describes building on the Geth implementation and pairing it with a hybrid consensus approach. That choice signals a preference for established execution foundations while tuning the network for its specific adoption goals.

Vanar’s whitepaper proposes a three second block time and a thirty million gas limit per block. In plain terms it is aiming for quick confirmations and higher throughput so apps feel responsive. This matters most in environments like games where users do not wait politely. They tap again. They refresh. They leave. When a chain is slow it does not just fail technically. It fails emotionally. It breaks the feeling of flow.

One of Vanar’s most distinctive claims is the fixed fee model. The whitepaper explains that with fixed fees transactions can be processed on a first come first serve basis rather than users bidding higher gas to win priority. The documentation expands on this by describing fixed fees in terms of dollar value to improve predictability for users and for teams running apps. If it becomes reliable under real load then the chain removes one of the biggest sources of user anxiety which is the fear of surprise costs.

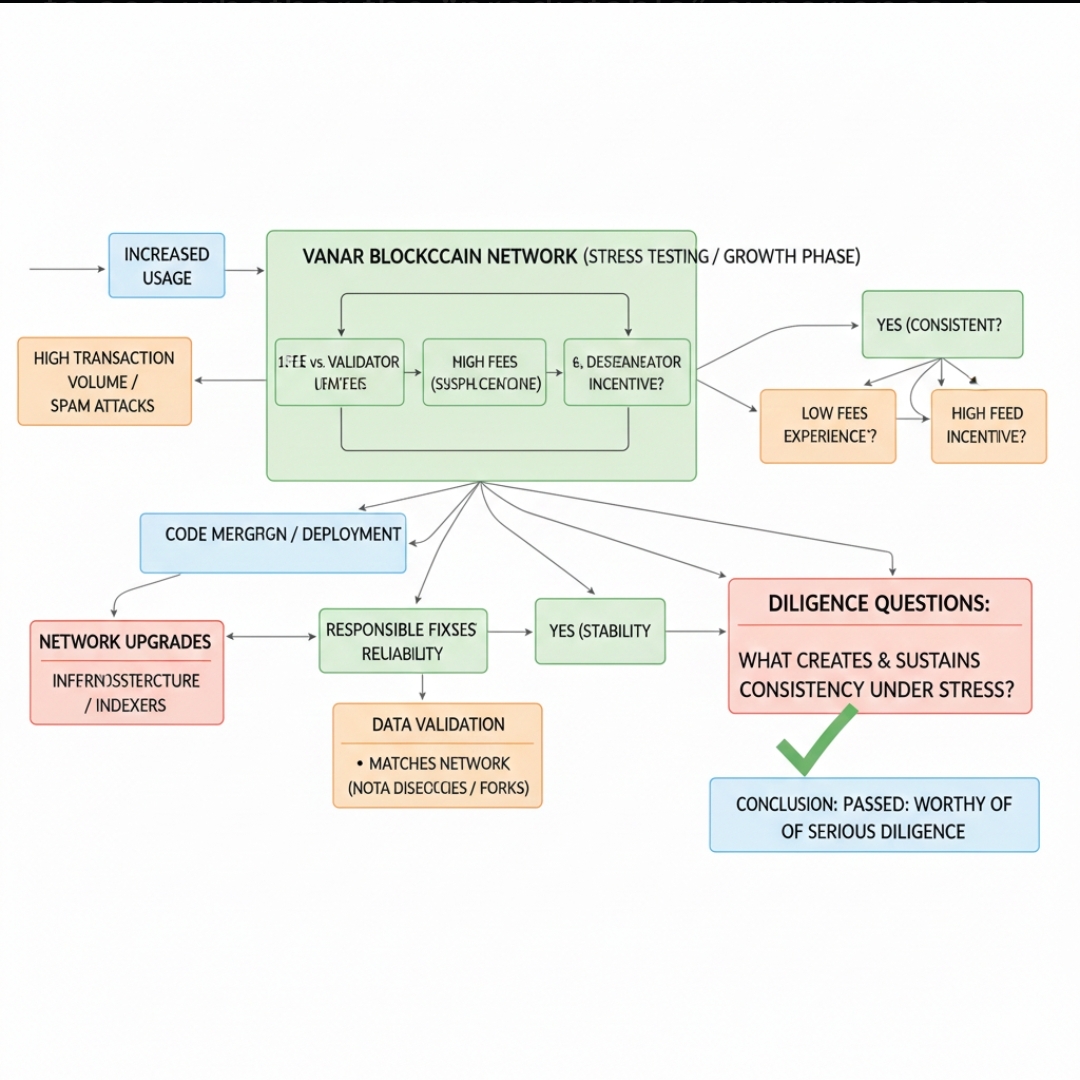

Low fees create a second problem though. They can invite spam. Vanar addresses that with fee tiers. The gas fee tiers page lists ranges where typical transactions fall into a very low fixed USD fee tier and larger more resource heavy transactions face much higher fixed fees. It also notes that the charged amount can vary slightly due to changes in the market value of the gas token. That is an important detail because it admits the system aims for predictability rather than absolute perfection. It also reveals the tradeoff. Predictable pricing is a policy choice and policy must be maintained.

Then there is the consensus story. Vanar documentation states it plans to use a hybrid approach that primarily relies on Proof of Authority and is governed by a Proof of Reputation mechanism. It also says that initially the Vanar Foundation will run validator nodes and will onboard external participants through the Proof of Reputation process. This is the kind of decision that can produce stability early. It can also raise trust questions if decentralization expands too slowly. Both truths can exist at once.

Proof of Reputation in their docs is framed around credibility and trustworthiness determining validator eligibility rather than only compute power or financial stake. That is a meaningful framing for a network that wants brands and consumer products. Brands often care about operational reliability and reputational risk. They’re more comfortable when validators are known entities at first. But the long term credibility of this approach depends on transparency. Who gets onboarded. Why they qualify. How disputes are handled. And how quickly power spreads beyond the initial operators.

Vanar also markets itself as more than a base chain. It presents a stack where the blockchain layer is paired with data and intelligence oriented layers. One of the boldest parts of that story is Neutron. The Neutron page claims it compresses and restructures data into programmable Seeds that are fully onchain and verifiable. It uses the example of compressing twenty five megabytes into fifty kilobytes using semantic heuristic and algorithmic layers. That is a huge claim. If it becomes real in practice then it changes what ownership can feel like. Instead of owning a token that points to something elsewhere you own a verifiable object that can remain present and usable inside the system.

This focus on data is not a small detail. A lot of Web3 breaks at the content layer. People mint something meaningful then later discover the media is unavailable or the reference is fragile. Vanar is explicitly calling out that problem by telling people to forget IPFS and hashes and files that go dark and by positioning Neutron as a new approach to permanence and usability. That language is emotional for a reason. It is aimed at the fear of losing what you thought you owned.

Vanar also has a myNeutron product page that frames a different kind of problem. The AI platform switching problem. It describes creating a secure universal knowledge base across major AI tools and anchoring permanence on Vanar when needed. That connects Vanar’s messaging about onchain memory with a mainstream pain point. People want their context to survive across tools and across time. It becomes less about crypto and more about continuity.

On token economics the network token is VANRY. Public trackers list a maximum supply of 2.4 billion and circulating supply around 2.29 billion at the time of viewing. Numbers like that matter because they shape expectations around supply and distribution. But they do not tell you whether the chain is healthy. What matters more is whether the network earns repeat usage from real applications.

So what are the right progress metrics. First is stability of user experience. Do confirmations remain quick when demand rises. The three second block time target and the thirty million gas limit design are intended to support that. Second is predictability of costs. The fixed fee model and tiering are intended to protect small users while discouraging abuse. Third is decentralization trajectory. We’re seeing many networks start with stronger control. The question is whether Vanar can widen validator participation in a way that is visible and trusted. Fourth is developer reality. Are teams shipping apps that normal people can use without needing a guide. That is the real signal that an L1 is becoming infrastructure.

Now the hard part. Risks. One risk is governance trust in the early phase. If validators are initially run by the foundation then users must trust that the rules are applied fairly and that expansion is not just promised but delivered. Another risk is the maintenance burden of predictability. Fixed fees in dollar terms sound comforting but they require careful management and clear communication when conditions change. The docs themselves acknowledge nominal variation due to market value shifts which is honest but still a reminder that predictability is a moving target. A third risk is execution risk on the data layer. Neutron makes strong claims. Those claims must hold up under real developer scrutiny with reproducible verifiability and reliable tooling.

If It becomes what Vanar describes then the future roadmap reads like a human story more than a technical roadmap. First the chain must feel stable. Fast. Predictable. Familiar enough to build on. Then the data layer must prove it can keep important information alive and verifiable. Then the intelligence narrative must become practical so apps can use stored context in ways that are auditable and safe. This is where the project either becomes a dependable platform or remains an ambitious concept.

They’re aiming at the place where adoption truly happens. Not inside trader circles. Inside everyday experiences. A game reward. A community collectible. A proof that something is yours. A memory that stays with you. When those moments work smoothly people do not talk about the chain. They just feel the product. They feel included rather than intimidated.

I’m left with a simple standard. Trust is built when nothing surprises you. When fees do not shock you. When confirmation does not make you wait too long. When content does not disappear. When governance feels predictable and not personal. Vanar’s design choices around fast blocks fixed fee tiers and a staged validator approach are all trying to reduce surprise and increase calm.

And the conclusion is the quiet kind that lasts. We’re seeing Web3 slowly shift away from systems that demand constant attention and toward systems that feel like normal infrastructure. If Vanar succeeds it will not be because it shouted louder. It will be because it removed fear from the moments that matter. The first time a new user joins through a game or a community and everything works the feeling they will remember is not excitement alone. It is relief. That relief is the seed of trust. And trust is what turns a technology into a place people return to.