The first impression I had when I watched Vanar Chain was a combination of worn-out elements of blockchain and innovative marketing of AI. However, in 2026 it is not only the hype itself but the fact that the platform connects the real use to the continuing economic need. This paper articulates that change with new thoughts: how Vanar constructs its stack, how it gradually trains AI tools to money, what new on-chain products are and why that is important to the future of a smart Web3.

Getting Past the Hype: The Development of Vanar into practice Utility.

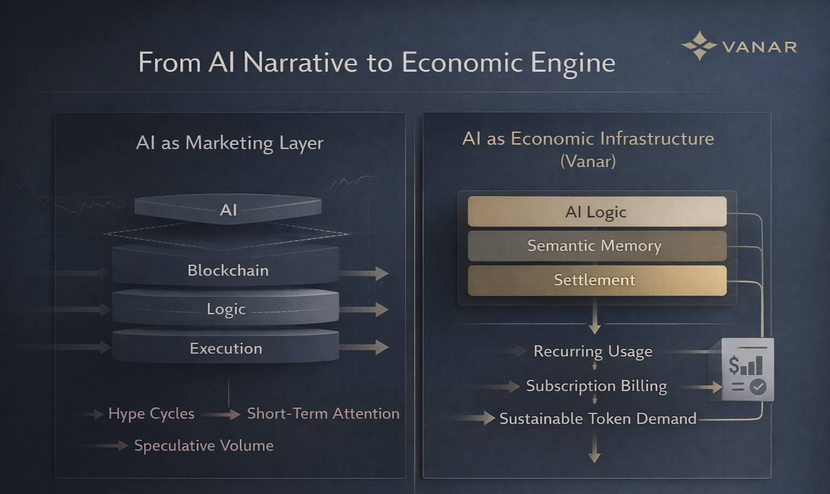

During previous years, a lot of blockchain projects promoted an AI integration as a commercial gimmick on top of regular infrastructure. Vanar instead has attempted to integrate AI into the chain per se, not an add-on but a fundamental aspect of the stack. This is what the official project description describes as one of the major distinctions to this day, which is the ability to combine AI logic, semantic memory, and reasoning into a single blockchain environment.

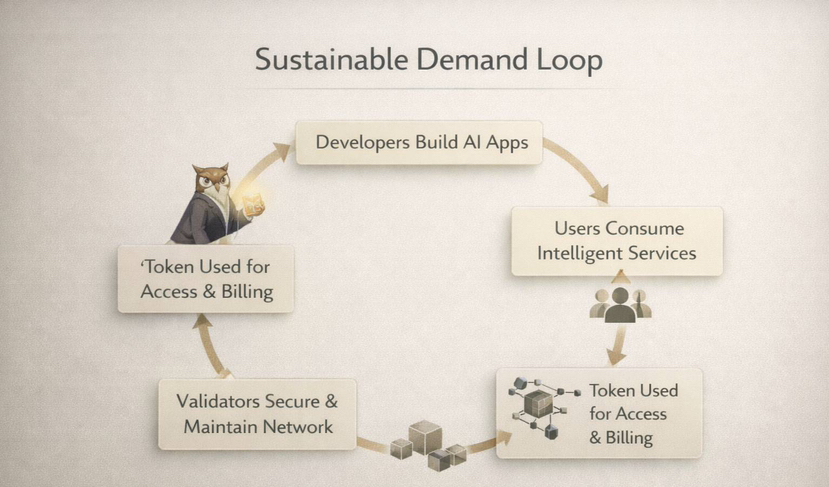

The point is that this stack is not a demonstration of rad ATC in 2026 but practical products that require constant usage. That is important since blockchain networks do not remain alive simply due to their novelty. They require constant action that generates economic need-- and Vanar is establishing means by which that can be accomplished.

Intelligence Monetization: Subscription Model and Token Utility.

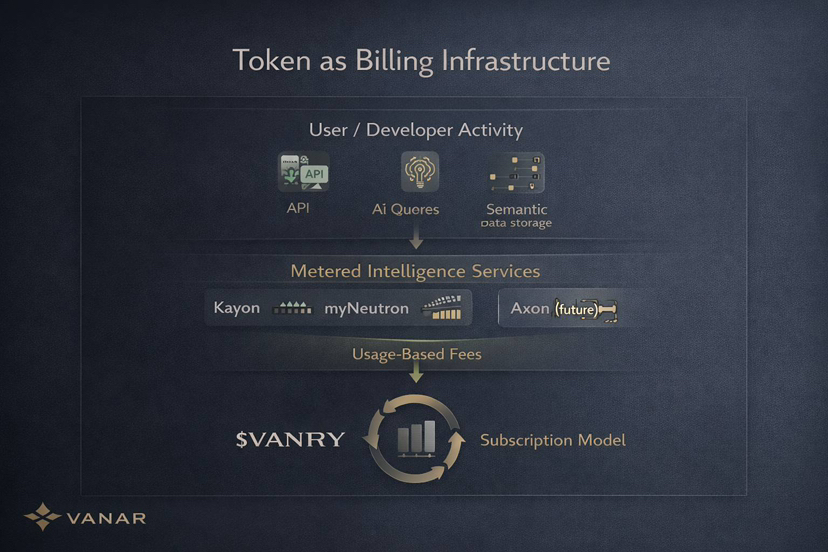

One of the major transformations that I observe in the ecosystem is the shift of free to paid, subscription-based or usage-based AI features. Semantic data storage and reasoning and natural-language querying tools such as myNeutron and Kayon are becoming a value-added service to use with $VANRY.

This is important since it begins to equate token demand to real product utilization rather than speculations. The token is used when users or developers need to buy tokens on a regular basis to get a more advanced use of AI the same way businesses pay to use APIs or cloud computing. This transformation seems more of a software economy than an archetypal blockchain gas model.

When you link token demand to paid AI services, you are not demanding the market to pay for network potential and nothing more. You are requesting actual users to pay the actual use. That is one good economic cycle- and I believe this transformation is among the stories Vanar tells us all the time.

Axon and Flows: On-Chain Logic Next Wave

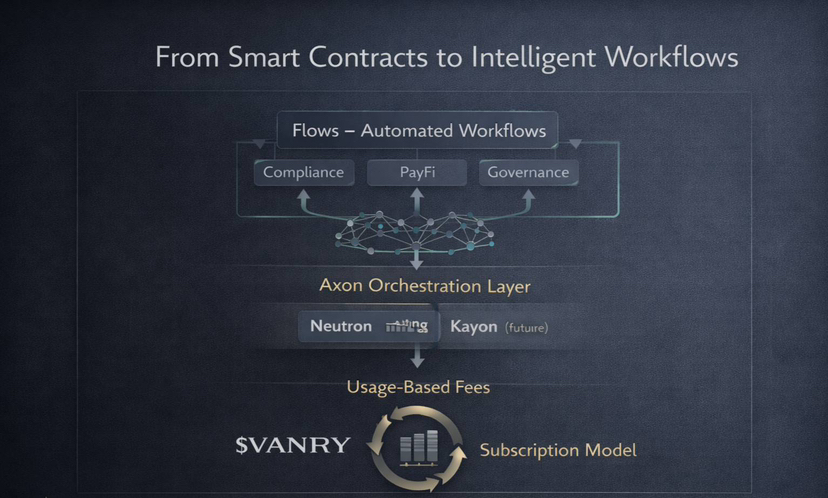

In addition to Neutron and Kayon, Vanar has indicated other new products in its roadmap like Axon and Flows. The information is still scarce, but their positioning next to the AI stack indicates they will not be some new features as such: they will make the ecosystem accept a new sort of on-chain logic and automation.

Axon resembles a connector or orchestration layer something capable of combining decentralized data and reasoning outputs and automated actions between apps. Provided that it adheres to the core intelligence concept, Axon can turn into the foundation of on-chain workflow automation, which allows smart contracts and agents to interlink reasoning tasks without human intervention.

Instead, flows appears to be prepared to connect high-level logic to programmable duties, which makes Vanar a place where workflows can be as natural as transactions. The notable fact is that Vanar is not simply infusing the chain with AI, it is automating the whole Web3 system.

The Reality of the Market and the Reality of the Utility.

There is something interesting in the recent market data: despite technical advancement, $VANRY remains humble in value and cap and is subject to highs and lows. Such disparity between technological utility and token market dynamics indicates the emergence of a rift in crypto: only useful tech cannot produce stable economic movement when users and network use is not transparent. Numerous projects make robust stacks, and demand must come. Vanar is beginning to make that right by transforming deeper utility into paid utility. In case those features fail to take off, the utility of the token might fail to maintain demand at least in the short term.

Story wise this is not unfamiliar. I have observed projects that had great technology fail since they never connected their token to everyday use. Vanar appears to know that, and that is why such a critical development is the subscription shift.

Competitive Position Foundational AI vs Specialized AI Marketplaces.

One can think of Vanar in the company of other AI-blockchain hybrids. Bittensor is a project that aims at decentralized markets of ML models, and Fetch.ai is a project that hopes to serve the tools of autonomous agents.

Vanar is differentiated by being the infrastructure base- the place where AI logic, data memory and automated work flows reside. Vanar does not want to compete with specialised marketplaces or model markets but, rather, the place where those apps execute with native intelligence. It feels like being the operating system rather than an application.

This base role is intelligent in that the infrastructure that can be used by many use cases tends to receive more diversity in demand. In case Vanar is successful, it will not be a niche chain but a foundation of AI-native decentralized applications, including smart payment finance, automated governance and compliance.

Biometric and Naming Tools Integration With Real-World UX.

User experience integration is another frontier that is increasing in the ecosystem. To be adopted by a broad audience, i.e. not just devs and token speculators, apps need to be comfortable and secure.

A recent addition to the wider stack is biometric sybil resistance and name-like tools which can be read by humans (wallet names, rather than long hex numbers) that make it easier to interact. The trend will fill the gap between the typical complexity of crypto and consumer expectation.

With Vanar being able to integrate AI as a smooth component of daily processes, without compelling users to interact with the traditional pain points of crypto (long addresses, manual keys, frustrating onboarding occupying the whole interface), it will position itself as a utility layer rather than a subculture chain.

The Long Road:Real Adoption Is Slack,But Structural Models Count

I do not believe that mainstream adoption is achieved in one jump. It is an incremental move, a successive infrastructure stability, a cyclical developer triumph, cyclical economic demand, and the elimination of user experience frictions. Vanar is projecting all these forces on its new path, though not taking off blazing on hype.

Rather, it is the creation of a utility platform, where the token has a similar role to the subscription billing, and the blockchain is a dynamic substrate to intelligent application. This is a stark contrast to the antique blockchain system where tokens are being mined in order to become scarce or speculative tokens - here they are being used as a payment system to real AI-enhanced functionality.

In case this model is sustainable, the token demand may be much more sustainable than narrative-based markets.

Personal Reflection: Why This is Important to me.

I have been enjoying blockchain stories rise and fall: NFTs and DeFi and metaverse hype. None of those waves brought a concise economic loop which was sustainable. The way Vanar does it is not flashy and yet more grounded because it is attempting to create a connection between actual product usage and token utility.

In my opinion, the point of transition between donating profound AI capabilities to the open-source and commercializing them through tokens is the silent one. It informs me that the team realizes that tokens will not be abstract economic primitives indefinitely, they will have an application within the ecosystem.

When Vanar can effectively establish a base layer that will constantly drive demand of its AI tools not based on speculation, but because individuals and businesses will require it, it will not be another chain with an AI motto. It will be an infrastructure stack that in fact drives decentralized intelligence.

What to Watch Next

Three things I keep my eyes on, should I be following Vanar this way here on:

Use of Subscription AI Tools: Do people want to pay actual tokens in exchange of intelligence services?

Axon & Flows Rollouts: Are they expanding the ecosystem or just complicating it?

Real-World Integration and UX: Does UX become better than crypto natives?

These are what will ultimately make the difference between the short-term speculative interest in the token and the economical demand.

Summary: Revolution of Vanar in Token Utility.

Vanar is not aiming to be another high-TPS blockchain. It is constructing an entirely new stack that integrates AI into the metabolic layers of the chain, and is currently moving to monetization structures that bind the utility of tokens to repeated usage of products.

This is not ordinary blockchain hype, it is an effort to create a viable economic cycle that can potentially interest developers, business people and ultimately ordinary users.

Adoption and execution will determine whether it succeeds or not. Nevertheless, the movement towards utility-based token demand is, to my mind, among the more developed and fascinating economic stories in Web3 at the moment.