$XRP The adoption of digital assets at the state level is moving from theoretical discussion to actionable policy, signaling a shift in how U.S. governments perceive cryptocurrencies. Lawmakers increasingly see blockchain not just as a speculative tool but as a strategic component of financial infrastructure.

Integrating digital assets into official reserves reflects broader confidence in their utility, liquidity, and role in modern treasury management, reshaping how states approach asset diversification.

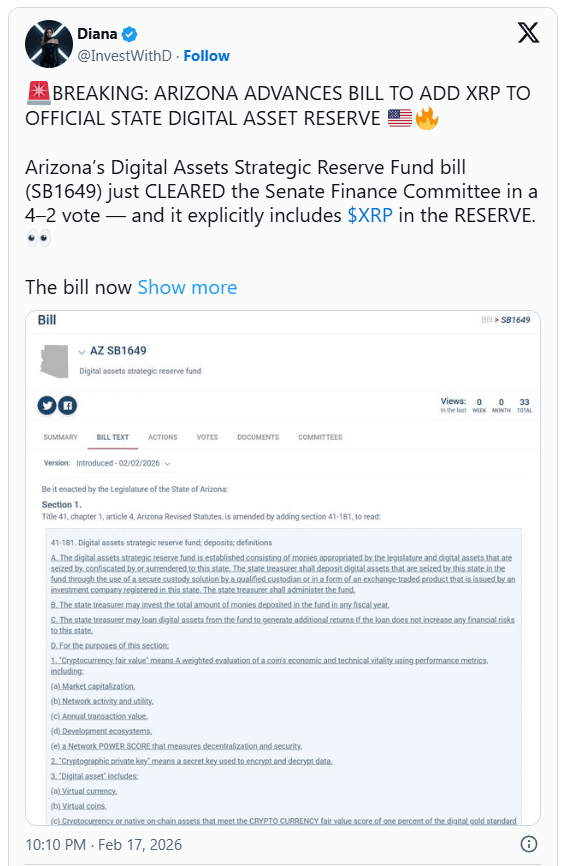

Crypto analyst Diana recently highlighted a major step in this evolution: Arizona’s Digital Assets Strategic Reserve Fund bill (SB1649) cleared the Senate Finance Committee in a 4–2 vote. Importantly, the legislation explicitly includes XRP as an eligible asset for the state’s reserve.

According to Diana, this vote advances the bill toward the Rules Committee, moving it one step closer to becoming law. The development marks one of the first instances where a U.S. state has formally considered allocating cryptocurrency to its treasury beyond widely recognized tokens like Bitcoin or Ethereum.

💥The Strategic Reserve Fund

Arizona’s bill proposes a Digital Assets Strategic Reserve Fund to complement existing state-managed finances. By explicitly recognizing XRP, the legislation frames the token as a functional asset rather than a speculative instrument. Analysts interpret this move as a formal acknowledgment of blockchain’s potential to enhance liquidity, streamline payments, and diversify state portfolios.

The committee’s vote illustrates the balance between innovation and caution. While supporters see an opportunity to modernize fiscal strategy, skeptics remain wary of volatility, technological risk, and compliance requirements. Successfully navigating these concerns is essential for establishing credibility in state-level digital asset integration.

💥Implications for XRP and Institutional Adoption

Including XRP in a state reserve carries symbolic and practical weight. Beyond market sentiment, it strengthens institutional confidence and validates XRP’s use case as a liquidity and settlement tool. Arizona’s approach could inspire other states to consider similar initiatives, potentially setting a precedent for regional adoption strategies.

Institutional observers note that this development positions XRP as more than a market-traded token. It signals its emergence as a recognized medium of exchange within structured financial frameworks. For investors, the move highlights the growing legitimacy of XRP in both public and private financial contexts.

💥Next Steps and Outlook

SB1649 now heads to the Rules Committee, where lawmakers will review details, address risk mitigation, and consider stakeholder feedback. While passage is not guaranteed, the bill’s progress underscores a broader trend: U.S. states are increasingly experimenting with digital assets as part of a formal financial strategy.

For XRP holders, Arizona’s initiative demonstrates the token’s evolving role in mainstream finance and its potential to shape future adoption and regulatory landscapes across the country.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.