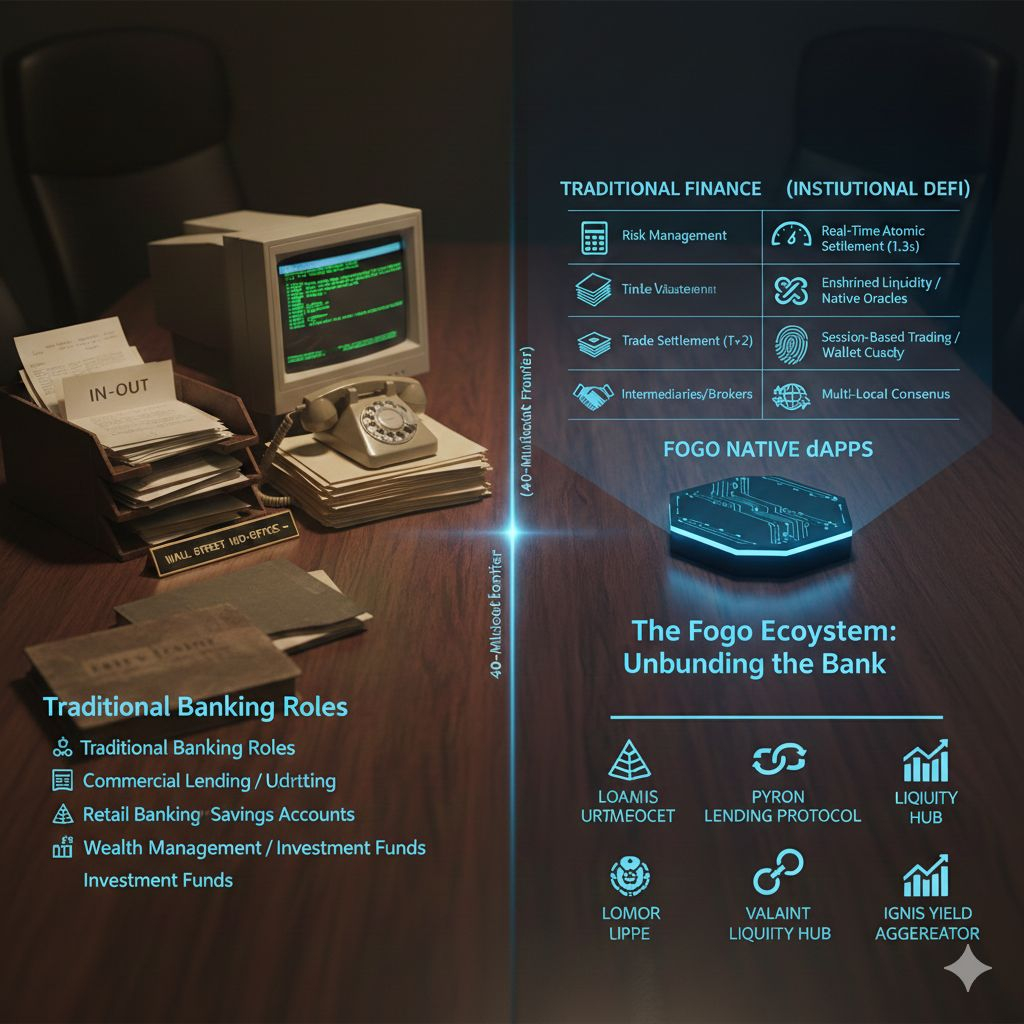

When you look at the plumbing of Wall Street, it’s remarkably dusty. We are living in an era of AI-driven high-frequency trading, yet our settlement systems still run on "T+2"—a fancy way of saying it takes two days for the paperwork to catch up with the trade. In that 48-hour window, billions of dollars are trapped in "capital purgatory," held as collateral just in case someone defaults.

The Fogo mainnet launch in January 2026 wasn't just another crypto event; it was a stress test for a new kind of financial architecture. By porting the Solana Virtual Machine (SVM) onto a hyper-optimized Firedancer core, Fogo isn't trying to build a better "internet money." It’s trying to build a better clearing house.

Here is how Fogo is actually positioned to dismantle the traditional mid-office.

The 40-Millisecond Settlement

In a traditional bank, the "mid-office" exists largely to reconcile differences between what the front office sold and what the back office can deliver. Fogo collapses this entire department into a single line of code.

With 40-millisecond block times, execution and settlement become simultaneous. There is no "reconciliation" because the ledger is the source of truth in real-time. For a hedge fund, moving from a 48-hour settlement to a sub-second one means they can recycle their capital dozens of times a day instead of waiting for a bank’s legacy software to refresh.

"Enshrinement" vs. App Fragmentation

One of the biggest headaches for institutional DeFi has always been "middleware risk." If you trade on a standard chain, you’re relying on a bridge, an external oracle (like Chainlink), and a third-party DEX. If any of those break, the trade fails.

Fogo’s approach is Enshrinement. They’ve built the Central Limit Order Book (CLOB) and price oracles directly into the blockchain’s "operating system."

The Result: The liquidity is unified. You don't have fragmented pools of money scattered across ten different apps.

The "Pure" Advantage: This mirrors the structure of the New York Stock Exchange but does it without the centralized gatekeepers.

The Death of the "Confirm" Button

If you’ve ever used a crypto wallet, you know the friction of signing a digital pop-up for every single move. It’s clunky, slow, and—frankly—unprofessional.

Fogo’s "Sessions" protocol is the human-centric solution to this. It allows a trader to open a secure "window" of activity. You sign once, and for the next hour (or day), your high-frequency algorithms or manual trades execute instantly, without the "click-to-confirm" fatigue. It makes a decentralized chain feel as smooth as a Bloomberg Terminal or a Coinbase Pro interface.

The Skeptic’s Corner: Can it actually scale?

Wall Street won't move its trillions onto a network run from someone’s basement. Fogo knows this. That’s why they’ve pioneered Multi-Local Consensus. Instead of having validators spread randomly, they use a "Follow-the-Sun" model, co-locating high-performance nodes in global financial hubs like Tokyo and New York.

This isn't about being "decentralized" in the hobbyist sense; it’s about Institutional Decentralization. It provides the uptime and regulatory transparency that a mid-office manager needs to sleep at night.

The Bottom Line

The mid-office of the future won't be a room full of people checking spreadsheets. It will be a high-speed, parallel-processing engine that treats every trade as its own settlement.

Fogo is currently the only L1 that has successfully married the "move fast" culture of the SVM with the "don't break" requirements of institutional finance. We aren't just looking at a faster blockchain; we’re looking at the first real candidate to replace the aging heart of the global financial system.