The market does not price throughput; it prices the credible expectation of exit. Most infrastructure debates begin from a laboratory condition in which performance is measured as an average across cooperative demand, but real flows arrive in bursts, under stress, and with asymmetric information. In those moments the system is not judged by how many transactions it can process in equilibrium but by whether large participants can change state without moving the market against themselves. Tail latency, not mean latency, becomes the economically relevant variable, because it determines whether capital treats the venue as a coordination layer or as inventory risk. Any serious discussion of tokenomics must therefore begin from the observation that infrastructure tokens derive value not from activity alone but from their position in the path of irreversible settlement under adversarial conditions.

In those moments the system is not judged by how many transactions it can process in equilibrium but by whether large participants can change state without moving the market against themselves. Tail latency, not mean latency, becomes the economically relevant variable, because it determines whether capital treats the venue as a coordination layer or as inventory risk. Any serious discussion of tokenomics must therefore begin from the observation that infrastructure tokens derive value not from activity alone but from their position in the path of irreversible settlement under adversarial conditions.

The separation between execution and settlement is the first structural fault line. Execution environments compete for order flow by optimizing for immediacy and developer ergonomics, while settlement layers compete for credibility and finality. When a system collapses these functions into a single domain, it inherits the full volatility of both. The token becomes simultaneously a fee instrument, a security budget, a governance weight, and a liquidity surface. That compression is not neutral.  It creates reflexivity in which demand for blockspace is indistinguishable from demand for collateral, and short-term activity directly perturbs the cost of long-term safety. FOGO’s tokenomic design, in attempting to align usage with security provisioning, implicitly takes a position in this debate: that economic bandwidth and consensus bandwidth should be priced through the same asset. The advantage is internal coherence in value flow; the risk is that execution volatility leaks into the settlement guarantee.

It creates reflexivity in which demand for blockspace is indistinguishable from demand for collateral, and short-term activity directly perturbs the cost of long-term safety. FOGO’s tokenomic design, in attempting to align usage with security provisioning, implicitly takes a position in this debate: that economic bandwidth and consensus bandwidth should be priced through the same asset. The advantage is internal coherence in value flow; the risk is that execution volatility leaks into the settlement guarantee.

This choice only makes sense if the system is optimized for predictable state transitions rather than for peak synthetic throughput. The relevant question is not how many transactions can be included in a block but whether the cost of inclusion remains bounded when the system is congested by actors who are indifferent to user experience. If the token is required for both transaction inclusion and validator incentives, then congestion is not merely a technical condition but a monetary tightening. Under those conditions, the elasticity of supply—whether through emissions, fee redistribution, or liquidity design—becomes the primary stabilizer of the user experience.  Tokenomics here is monetary policy under load. If issuance expands to subsidize inclusion, long-term holders pay for short-term usability. If it does not, the system preserves its security budget at the expense of becoming economically exclusionary precisely when it is most needed.

Tokenomics here is monetary policy under load. If issuance expands to subsidize inclusion, long-term holders pay for short-term usability. If it does not, the system preserves its security budget at the expense of becoming economically exclusionary precisely when it is most needed.

Developer experience and trader experience diverge in ways that are often treated as cosmetic but are in fact architectural. Developers require determinism, composability, and stable cost surfaces to build systems that can be reasoned about. Traders require predictable exit under volatility. A design that privileges parallel execution and localized state access may improve developer throughput while introducing non-deterministic ordering effects that only manifest during contention. The second-order effect is that applications appear reliable in testing conditions yet fragment liquidity when exposed to real markets. FOGO’s positioning, if it is to be taken seriously, depends on whether its execution model produces stable ordering guarantees under adversarial demand. Without that, the token captures application activity without capturing the high-value flows that define settlement relevance.

Validator economics sits at the center of this structure. The distribution of rewards defines not only who participates but how they behave. If rewards are predominantly activity-driven, validators become short-term maximizers of inclusion revenue, favoring flow that increases fee density even if it degrades long-term state quality. If rewards are predominantly time-weighted or stake-weighted, the system privileges capital persistence over operational performance, creating a class of passive security providers whose incentives are orthogonal to user experience. FOGO’s token design, by tying security provisioning to economic usage, attempts to collapse this distinction. The critical variable is whether validator profitability remains positive without requiring a continuous expansion of nominal activity. A system whose security budget is endogenous to speculative demand is secure only in bull markets.

Decentralization in this context is not a moral property but a latency distribution. When validator participation requires specialized hardware, continuous uptime, or privileged access to order flow, the network’s geographic and operational diversity narrows. That narrowing reduces the variance of performance under normal conditions while increasing the probability of correlated failure under stress. Tokenomics can either subsidize this diversity or accelerate its erosion. If the marginal validator cannot cover costs without external revenue, stake concentrates in entities that can internalize losses for strategic reasons. The token then ceases to represent a broad security base and instead becomes a claim on a small number of balance sheets. The appearance of decentralization persists in the staking interface while the effective control of ordering power becomes localized.

Governance enters as the mechanism through which these economic tensions are renegotiated over time. Architecture defines the initial constraint set, but token-weighted governance determines whether those constraints are binding. If governance can alter emission schedules, fee routing, or validator requirements in response to short-term market pressure, then the token’s long-term credibility is a function of its voter composition. Capital that allocates on multi-year horizons discounts systems in which security parameters are politically adjustable. The unpopular implication for FOGO is that flexibility in tokenomics is not unambiguously positive. The more responsive the system is to activity cycles, the less it can credibly commit to a stable settlement policy.

Short-term incentives and long-term sustainability are therefore not opposing goals but different time horizons of the same cash flow. Emissions that bootstrap participation must eventually be replaced by endogenous demand for blockspace and finality. The transition point is observable not in the level of activity but in the composition of fees. When a majority of validator revenue comes from economically necessary transactions rather than from subsidized inclusion or speculative churn, the system has crossed from promotional phase to infrastructural phase. For FOGO, the signal is not total value locked or transaction count but the persistence of fee revenue through periods of market contraction. If validator income remains stable when leverage leaves the system, the token has become a security instrument rather than a growth coupon.

Competitive positioning emerges from these structural choices rather than from feature comparison. Systems that separate execution from settlement externalize volatility and create markets for blockspace as a service. Systems that integrate them internalize volatility and attempt to capture the full value flow. The former compete on credibility and neutrality; the latter compete on coherence and capital efficiency. FOGO’s design implicitly rejects the modular thesis in favor of a tightly coupled value loop. Its success depends on whether that loop can remain solvent under conditions in which activity migrates elsewhere for execution while still requiring its settlement. If it cannot, then integrated design becomes a liability, as the token is exposed to both the loss of order flow and the fixed cost of security.

Failure modes follow directly from this. Capture occurs when a small set of validators or liquidity providers can influence governance to redirect value flow toward themselves. Monetary instability occurs when the token’s role as fee asset and collateral produces procyclical security. Liquidity illusion occurs when staking derivatives or internal leverage create the appearance of depth without providing real exit capacity. Each of these is measurable in market data long before it becomes visible in governance discourse. Rising correlation between staking yield and token price, declining participation of independent validators, and widening spreads during volatility are not cosmetic metrics; they are structural diagnostics.

What must go right for the thesis to hold is not an increase in usage but the emergence of inelastic demand for finality. That demand comes from applications that cannot tolerate probabilistic settlement: large-scale financial coordination, cross-domain collateral management, and systems in which rollback risk is economically catastrophic. When such applications choose a settlement layer, they do so for its monetary policy and validator distribution, not for its developer tooling. FOGO’s architecture must therefore produce a cost of reorganization that is economically irrational for any coalition of validators. Only then does the token become a required asset rather than an optional medium.

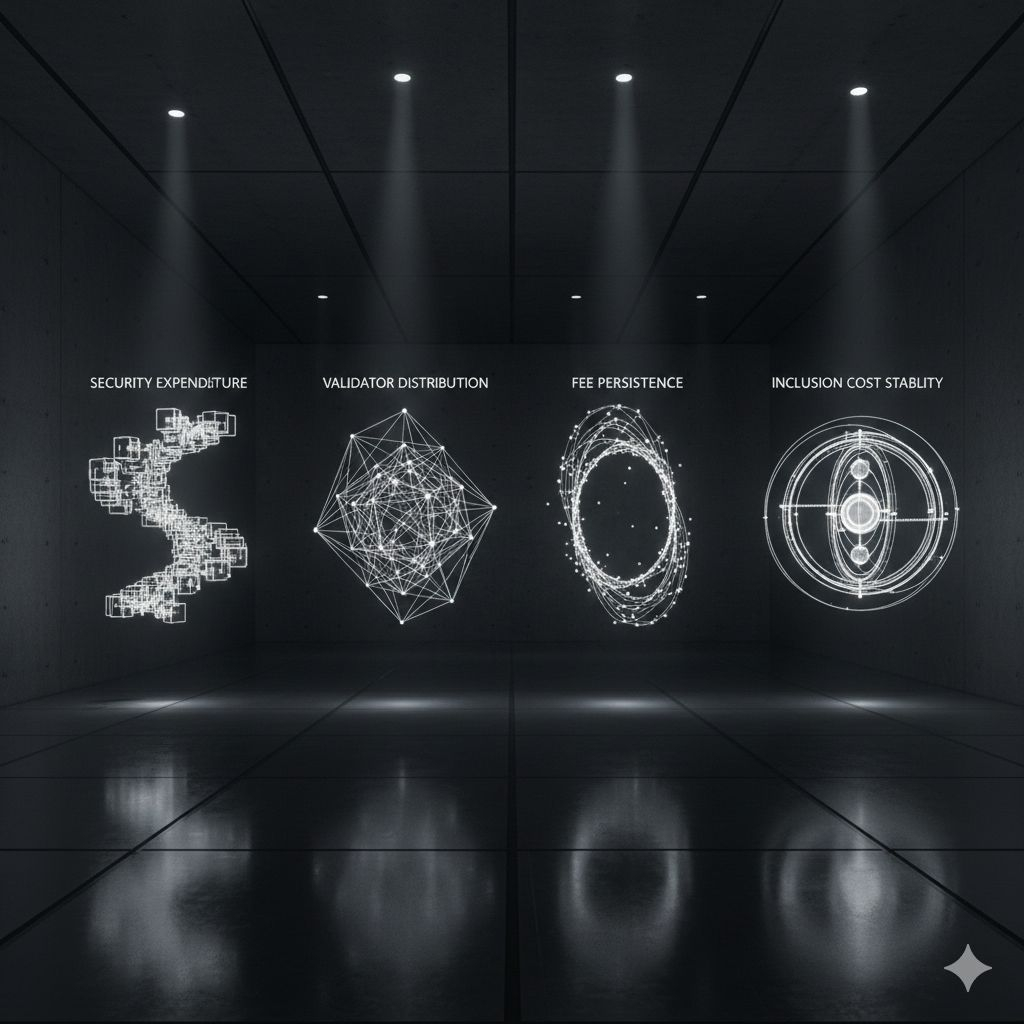

Serious observers should evaluate the system as they would a clearinghouse rather than a software platform. The relevant framework is to track the ratio of security expenditure to economically necessary fees, the dispersion of validator revenue across participants, the stability of inclusion costs during volatility, and the persistence of state commitments when speculative activity disappears. Governance proposals should be read as monetary policy decisions. Liquidity conditions in the staking and lending markets should be treated as indicators of latent leverage in the security model. The question is not whether the system grows but whether it can refuse to change its core guarantees when growth slows.

Under this lens, tokenomics is revealed as institutional design. It defines who bears the cost of stability, who captures the value of coordination, and who has the authority to rewrite those rules. FOGO’s competitive position is therefore not a function of narrative dominance but of whether its constraints are credible to capital that measures risk in decades. The market will eventually converge on that distinction, because the only infrastructure that matters is the one that remains predictable when everything else becomes variable.