@Vanarchain $VANRY #Vanar #vanar

In a market where noise often moves faster than substance, I have learned to look for ecosystems that focus on infrastructure before hype. That is exactly why I keep returning to VanarChain and its native asset VANRY. What fascinates me most is not short term volatility but the structural design choices that quietly position this ecosystem for long term relevance.

VanarChain is not trying to be just another Layer 1 promising speed alone. What stands out to me is its deliberate focus on real digital ownership, scalable infrastructure, and practical integration for creators and developers. Instead of chasing trends, it seems to be building rails that allow applications to grow without constant friction. That foundation matters more than momentary price action.

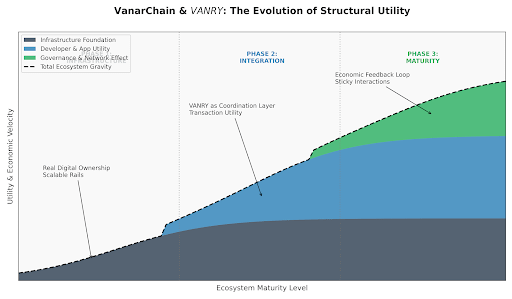

When I analyze VANRY, I do not see it as a speculative ticker. I see it as a coordination layer within the network. Every blockchain needs an internal economic engine. VANRY plays that role through transaction utility, ecosystem incentives, governance participation, and application level integrations. As more activity flows through the chain, the demand logic becomes clearer. Utility drives velocity, and velocity strengthens ecosystem gravity.

What truly interests me is how network activity compounds over time. In the early stage, adoption feels slow and fragmented. But once infrastructure stabilizes, developers gain confidence. Applications begin to interconnect. Liquidity becomes more efficient. User onboarding improves. That is the phase where ecosystems quietly transition from experimental to sustainable.

VanarChain appears to be moving toward that structural maturity. The emphasis on scalable architecture and creator economy tools signals a strategy that goes beyond speculation cycles. Instead of asking how high price can go this week, I find it more productive to ask how many real interactions are occurring on chain and how sticky those interactions are.

VANRY becomes more interesting when seen through that lens. If the ecosystem expands, the token becomes more than a medium of exchange. It becomes a mechanism for governance alignment, staking participation, and value routing across decentralized applications. The stronger the network effect, the stronger the economic feedback loop.

Below is a simplified growth model that helps me visualize how ecosystem expansion can influence token dynamics over time.

In the early phase, infrastructure development dominates. Transaction volume remains modest while builders experiment. In the expansion phase, user growth accelerates as applications mature. During the network effect phase, interactions multiply because users, developers, and liquidity reinforce one another. That is the stage where tokens often shift from narrative driven to utility reinforced.

Another angle I consider is resilience. Many chains can perform well in bullish conditions. The real test comes during consolidation periods. Does developer activity remain steady. Do applications continue shipping updates. Does the community maintain engagement. Sustainable ecosystems survive quiet markets because they are not dependent on external momentum alone.

VanarChain’s positioning within digital ownership and interactive ecosystems creates room for differentiated growth. If creators find better monetization rails and users experience smoother interaction layers, retention improves. Retention is the invisible metric that long term investors watch closely. Without retention, growth becomes cyclical. With retention, growth compounds.

VANRY sits at the center of that equation. Staking mechanisms, transaction requirements, and governance pathways tie user participation directly to token demand. The more applications integrate VANRY at a core level rather than as an optional feature, the stronger the intrinsic utility becomes.

I also reflect on competitive positioning. The Layer 1 space is crowded. But differentiation does not always come from raw throughput alone. It often emerges from ecosystem culture, tooling simplicity, and targeted industry integration. If VanarChain continues refining developer experience and onboarding flows, it may attract builders who prioritize stability and clarity over trend chasing.

From an investment perspective, I try to separate narrative spikes from structural evolution. Short term volatility will always exist. But if on chain metrics show rising wallet activity, consistent transaction growth, and increasing developer deployment, that signals deeper adoption. Tokens backed by active ecosystems tend to demonstrate stronger recovery patterns over full market cycles.

What keeps me optimistic is the alignment between infrastructure focus and token design. VANRY is not positioned as a decorative asset. It is woven into the mechanics of participation. That alignment reduces dependency on external hype because internal activity itself generates relevance.

In the end, I see VanarChain as a long horizon infrastructure play rather than a fast cycle trade. The real story may not be written in a single quarter. It may unfold through steady expansion of applications, creators, and communities who find genuine utility within the network. If that trajectory continues, VANRY becomes not just a token within an ecosystem but a measurable reflection of its growth.

And that is the kind of foundation I prefer to watch closely.